The global Drag Reducing Agents Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Polymer, Surfactant, Suspended Solids), By Application (Crude Oil, Multi-phase Liquid, Refined Products, Heavy, Asphaltic Crude, Water Transportation), By End-User (Oil & Gas, Chemicals & Petrochemicals, Power & Energy, Agriculture, Others).

Drag reducing agents (DRAs), also known as flow improvers or pipeline additives, are chemicals used to reduce frictional resistance and turbulence in fluid flow systems such as pipelines, pumps, and conduits in 2024. DRAs are particularly beneficial in industries such as oil and gas transportation, water distribution, and chemical processing, where minimizing energy consumption, enhancing flow efficiency, and reducing maintenance costs are paramount. These agents work by modifying the flow characteristics of fluids, reducing the drag force exerted on the pipeline walls and improving flow rates. Common types of drag reducing agents include long-chain polymers, surfactants, and nanoparticles, which are added to the fluid in small concentrations to achieve significant reductions in frictional losses. DRAs are typically injected into the fluid stream upstream of pumps or along the pipeline route, where they disperse and form a thin, slippery layer along the pipe wall, reducing friction and turbulence. By reducing drag and increasing flow efficiency, drag reducing agents can lead to substantial energy savings, reduced pumping costs, and extended equipment life. However, proper selection, dosing, and monitoring of DRAs are essential to ensure optimal performance and avoid unintended consequences such as flow instability or product degradation. With advancements in polymer chemistry and fluid dynamics, drag reducing agents to evolve, offering innovative solutions for enhancing flow efficiency and reducing energy consumption in fluid transport systems.

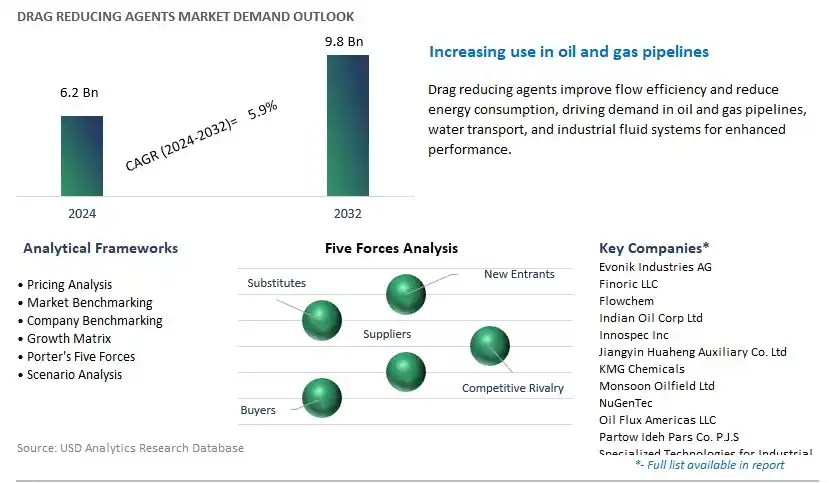

The market report analyses the leading companies in the industry including Evonik Industries AG, Finoric LLC, Flowchem, Indian Oil Corp Ltd, Innospec Inc, Jiangyin Huaheng Auxiliary Co. Ltd, KMG Chemicals, Monsoon Oilfield Ltd, NuGenTec, Oil Flux Americas LLC, Partow Ideh Pars Co. P.J.S, Specialized Technologies for Industrial Services Co., The Lubrizol Corp, The Zoranoc Oilfield Chemical, Weifang Xinchang Chemical Co. Ltd, and others.

A prominent trend in the drag reducing agents market is the heightened focus on energy efficiency across various industries, including oil and gas transportation, water distribution, and industrial fluid systems. Drag reducing agents (DRAs) are additives designed to reduce frictional resistance and turbulence in fluid flow, thereby improving the efficiency of pipelines, pumps, and other hydraulic systems. With a growing emphasis on optimizing energy consumption, reducing operational costs, and minimizing environmental impact, there is a rising demand for DRAs as a cost-effective solution to enhance fluid flow performance and maximize throughput while reducing pumping requirements and energy consumption. This trend is driving market growth as industries seek innovative ways to improve operational efficiency, mitigate pressure drop, and optimize fluid transportation systems to meet increasing demand and regulatory standards.

The primary driver fueling the demand for drag reducing agents is the increasing need for efficient oil and gas transportation infrastructure to meet global energy demand. DRAs play a vital role in the oil and gas industry by facilitating the efficient and cost-effective transportation of hydrocarbons through pipelines over long distances. As exploration and production activities expand to remote and challenging environments, there is a growing reliance on pipeline networks to transport crude oil, natural gas, and refined products from production sites to refineries and distribution centers. DRAs help operators overcome flow challenges such as turbulent flow, pressure drop, and pipeline constraints, enabling higher flow rates, increased throughput, and reduced energy consumption. With the continuous expansion of oil and gas production and the need for reliable, safe, and efficient transportation infrastructure, the demand for drag reducing agents is expected to grow, driving market expansion and investment in DRA technologies, applications, and services to support the energy industry's evolving needs.

An emerging opportunity within the drag reducing agents market lies in the innovation and development of green DRAs that offer improved environmental performance and sustainability compared to conventional formulations. With growing concerns about the environmental impact of chemical additives and their potential effects on ecosystems, there is increasing demand for eco-friendly alternatives that minimize toxicity, biodegradeability, and environmental persistence while maintaining or enhancing performance characteristics. Manufacturers can capitalize on this opportunity by investing in research and development of bio-based, biodegradable, and environmentally friendly drag reducing agents derived from renewable resources or produced through green chemistry processes. Opportunities exist for formulating eco-friendly DRAs with reduced environmental footprint, lower toxicity, and improved compatibility with various fluid systems, providing operators with sustainable solutions for optimizing fluid flow efficiency while minimizing environmental risks. By leveraging sustainability as a key differentiator and addressing the growing demand for green solutions, manufacturers can position themselves as leaders in the DRA market, meet evolving regulatory requirements, and capture market share in the growing segment of environmentally conscious customers and industries.

Within the drag reducing agents market segmented by product, the Polymer segment is the largest, driven by its widespread use and effectiveness in reducing frictional drag in fluid flow systems. Polymers, such as polyacrylamides and polyethylene oxide, are extensively utilized as drag reducing agents in industries such as oil and gas, water treatment, and transportation. These polymers are capable of altering the flow behavior of fluids by modifying the boundary layer and reducing turbulence, resulting in significant energy savings and improved flow efficiency. The Polymer segment benefits from the versatility of polymer-based drag reducing agents, which can be tailored to suit specific fluid compositions and operating conditions. Additionally, polymers offer long-lasting drag reduction effects and are compatible with a wide range of fluids, making them the preferred choice for industries seeking efficient and cost-effective solutions to minimize frictional losses in fluid transport systems. As industries continue to prioritize energy efficiency and operational cost savings, the demand for polymer-based drag reducing agents remains robust, solidifying the Polymer segment's position as the largest in the market.

Among the segments categorized by application in the drag reducing agents market, the Water Transportation sector is the fastest-growing, fuelled by the increasing need for efficiency and cost-effectiveness in maritime operations. Drag reducing agents play a crucial role in water transportation by reducing frictional resistance and improving the flow efficiency of vessels, resulting in significant fuel savings and reduced operating costs. As the maritime industry faces pressure to reduce emissions and comply with stringent environmental regulations, there is a growing demand for drag reducing agents to optimize vessel performance and minimize fuel consumption. Additionally, the expansion of global trade and the growing demand for energy resources drive the need for efficient water transportation solutions, further boosting the demand for drag reducing agents in this sector. As maritime operators seek to enhance operational efficiency and environmental sustainability, the Water Transportation segment is poised for rapid growth in the drag reducing agents market, driven by its indispensable role in optimizing vessel performance and reducing fuel consumption.

Within the drag reducing agents market segmented by end-user, the Oil & Gas sector is the largest, driven by its extensive applications in enhancing pipeline efficiency and reducing operational costs. Drag reducing agents play a critical role in the oil and gas industry by minimizing frictional losses in pipelines, thereby increasing the flow rate and throughput capacity of hydrocarbon fluids such as crude oil, natural gas, and refined products. The Oil & Gas sector benefits significantly from drag reducing agents' ability to optimize pipeline performance, mitigate flow assurance issues such as turbulence and pressure drop, and extend the operational lifespan of pipelines. Additionally, as the oil and gas industry continue to explore and exploit unconventional resources, such as shale gas and tight oil, the demand for drag reducing agents to enhance the efficiency of hydraulic fracturing operations and transportation of these resources further fuels the growth of the Oil & Gas segment in the drag reducing agents market. As pipeline operators seek to improve operational efficiency, maximize throughput, and minimize energy consumption, the Oil & Gas sector remains at the forefront of demand for drag reducing agents, solidifying its position as the largest segment in the market.

By Product

Polymer

Surfactant

Suspended Solids

By Application

Crude Oil

Multi-phase Liquid

Refined Products

Heavy

Asphaltic Crude

Water Transportation

By End-User

Oil & Gas

Chemicals & Petrochemicals

Power & Energy

Agriculture

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Evonik Industries AG

Finoric LLC

Flowchem

Indian Oil Corp Ltd

Innospec Inc

Jiangyin Huaheng Auxiliary Co. Ltd

KMG Chemicals

Monsoon Oilfield Ltd

NuGenTec

Oil Flux Americas LLC

Partow Ideh Pars Co. P.J.S

Specialized Technologies for Industrial Services Co.

The Lubrizol Corp

The Zoranoc Oilfield Chemical

Weifang Xinchang Chemical Co. Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Drag Reducing Agents Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Drag Reducing Agents Market Size Outlook, $ Million, 2021 to 2032

3.2 Drag Reducing Agents Market Outlook by Type, $ Million, 2021 to 2032

3.3 Drag Reducing Agents Market Outlook by Product, $ Million, 2021 to 2032

3.4 Drag Reducing Agents Market Outlook by Application, $ Million, 2021 to 2032

3.5 Drag Reducing Agents Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Drag Reducing Agents Industry

4.2 Key Market Trends in Drag Reducing Agents Industry

4.3 Potential Opportunities in Drag Reducing Agents Industry

4.4 Key Challenges in Drag Reducing Agents Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Drag Reducing Agents Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Drag Reducing Agents Market Outlook by Segments

7.1 Drag Reducing Agents Market Outlook by Segments, $ Million, 2021- 2032

By Product

Polymer

Surfactant

Suspended Solids

By Application

Crude Oil

Multi-phase Liquid

Refined Products

Heavy

Asphaltic Crude

Water Transportation

By End-User

Oil & Gas

Chemicals & Petrochemicals

Power & Energy

Agriculture

Others

8 North America Drag Reducing Agents Market Analysis and Outlook To 2032

8.1 Introduction to North America Drag Reducing Agents Markets in 2024

8.2 North America Drag Reducing Agents Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Drag Reducing Agents Market size Outlook by Segments, 2021-2032

By Product

Polymer

Surfactant

Suspended Solids

By Application

Crude Oil

Multi-phase Liquid

Refined Products

Heavy

Asphaltic Crude

Water Transportation

By End-User

Oil & Gas

Chemicals & Petrochemicals

Power & Energy

Agriculture

Others

9 Europe Drag Reducing Agents Market Analysis and Outlook To 2032

9.1 Introduction to Europe Drag Reducing Agents Markets in 2024

9.2 Europe Drag Reducing Agents Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Drag Reducing Agents Market Size Outlook by Segments, 2021-2032

By Product

Polymer

Surfactant

Suspended Solids

By Application

Crude Oil

Multi-phase Liquid

Refined Products

Heavy

Asphaltic Crude

Water Transportation

By End-User

Oil & Gas

Chemicals & Petrochemicals

Power & Energy

Agriculture

Others

10 Asia Pacific Drag Reducing Agents Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Drag Reducing Agents Markets in 2024

10.2 Asia Pacific Drag Reducing Agents Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Drag Reducing Agents Market size Outlook by Segments, 2021-2032

By Product

Polymer

Surfactant

Suspended Solids

By Application

Crude Oil

Multi-phase Liquid

Refined Products

Heavy

Asphaltic Crude

Water Transportation

By End-User

Oil & Gas

Chemicals & Petrochemicals

Power & Energy

Agriculture

Others

11 South America Drag Reducing Agents Market Analysis and Outlook To 2032

11.1 Introduction to South America Drag Reducing Agents Markets in 2024

11.2 South America Drag Reducing Agents Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Drag Reducing Agents Market size Outlook by Segments, 2021-2032

By Product

Polymer

Surfactant

Suspended Solids

By Application

Crude Oil

Multi-phase Liquid

Refined Products

Heavy

Asphaltic Crude

Water Transportation

By End-User

Oil & Gas

Chemicals & Petrochemicals

Power & Energy

Agriculture

Others

12 Middle East and Africa Drag Reducing Agents Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Drag Reducing Agents Markets in 2024

12.2 Middle East and Africa Drag Reducing Agents Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Drag Reducing Agents Market size Outlook by Segments, 2021-2032

By Product

Polymer

Surfactant

Suspended Solids

By Application

Crude Oil

Multi-phase Liquid

Refined Products

Heavy

Asphaltic Crude

Water Transportation

By End-User

Oil & Gas

Chemicals & Petrochemicals

Power & Energy

Agriculture

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Evonik Industries AG

Finoric LLC

Flowchem

Indian Oil Corp Ltd

Innospec Inc

Jiangyin Huaheng Auxiliary Co. Ltd

KMG Chemicals

Monsoon Oilfield Ltd

NuGenTec

Oil Flux Americas LLC

Partow Ideh Pars Co. P.J.S

Specialized Technologies for Industrial Services Co.

The Lubrizol Corp

The Zoranoc Oilfield Chemical

Weifang Xinchang Chemical Co. Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Polymer

Surfactant

Suspended Solids

By Application

Crude Oil

Multi-phase Liquid

Refined Products

Heavy

Asphaltic Crude

Water Transportation

By End-User

Oil & Gas

Chemicals & Petrochemicals

Power & Energy

Agriculture

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Drag Reducing Agents Market Size is valued at $6.2 Billion in 2024 and is forecast to register a growth rate (CAGR) of 5.9% to reach $9.8 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Evonik Industries AG, Finoric LLC, Flowchem, Indian Oil Corp Ltd, Innospec Inc, Jiangyin Huaheng Auxiliary Co. Ltd, KMG Chemicals, Monsoon Oilfield Ltd, NuGenTec, Oil Flux Americas LLC, Partow Ideh Pars Co. P.J.S, Specialized Technologies for Industrial Services Co., The Lubrizol Corp, The Zoranoc Oilfield Chemical, Weifang Xinchang Chemical Co. Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume