The global Dipropylene Glycol Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Fragrance Grade, Industrial Grade), By Application (Polyester Resins, Functional Fluids, Pharmaceutical, Personal Care, Liquid Detergents, Others).

Dipropylene glycol (DPG) is a colorless, odorless liquid solvent commonly used in various industrial and consumer applications in 2024. It is a member of the glycol ether family and is produced by the hydrolysis of propylene oxide. Dipropylene glycol is prized for its excellent solvency, low volatility, and low toxicity, making it suitable for use in a wide range of formulations, including paints, coatings, cleaners, and personal care products. In the paint and coatings industry, DPG serves as a solvent, coalescing agent, and viscosity modifier, improving film formation, flow properties, and stability. In cleaning products, it acts as a solvent for grease, oils, and other soils, enhancing cleaning efficiency and performance. Dipropylene glycol is also used as a humectant and solvent in personal care products such as lotions, creams, and antiperspirants, where it helps retain moisture and improve product texture. Additionally, DPG finds applications in industrial processes such as hydraulic fluids, cutting fluids, and antifreeze formulations, where its properties contribute to lubrication, heat transfer, and corrosion protection. With its versatility and favorable toxicological profile, dipropylene glycol s to be a preferred solvent and additive in numerous industrial and consumer products.

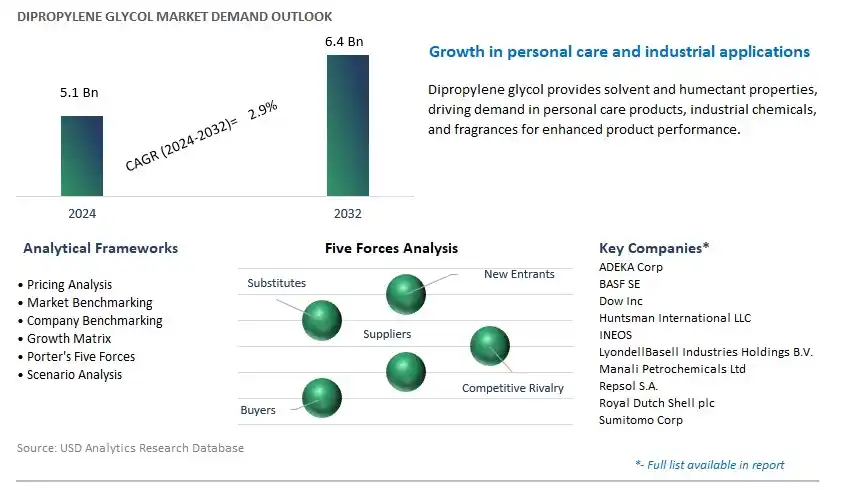

The market report analyses the leading companies in the industry including ADEKA Corp, BASF SE, Dow Inc, Huntsman International LLC, INEOS, LyondellBasell Industries Holdings B.V., Manali Petrochemicals Ltd, Repsol S.A., Royal Dutch Shell plc, Sumitomo Corp, and others.

A prominent trend in the dipropylene glycol market is the increasing demand for personal care products, driven by changing consumer lifestyles, rising disposable incomes, and growing awareness of health and hygiene. Dipropylene glycol, a versatile solvent and humectant, finds extensive use in the formulation of cosmetics, skincare, haircare, and fragrance products due to its excellent solubility, moisturizing properties, and ability to enhance product texture and stability. As consumers prioritize self-care routines and seek high-quality, innovative personal care products, there is a rising demand for formulations that offer hydration, nourishment, and sensory appeal. This trend is driving market growth and innovation, with manufacturers developing new formulations, product lines, and packaging designs to meet evolving consumer preferences and market trends in the global beauty and personal care industry.

The primary driver fueling the demand for dipropylene glycol is its widespread use in industrial applications across various sectors, including paints and coatings, automotive, textiles, and pharmaceuticals. Dipropylene glycol serves as a solvent, coupling agent, and chemical intermediate in these industries, where it contributes to the formulation of coatings, adhesives, antifreeze, hydraulic fluids, and pharmaceutical formulations. With the growth of end-user industries and the increasing need for high-performance materials and formulations, there is a continuous demand for dipropylene glycol as a key raw material and process additive. Additionally, the versatility and compatibility of dipropylene glycol with other chemicals make it a preferred choice for formulators seeking efficient solutions for their specific application requirements. As industrial activities expand globally and technological advancements drive innovation in product development and manufacturing processes, the demand for dipropylene glycol is expected to remain robust, supporting market growth and investment in production capacity, technology upgrades, and application development.

An emerging opportunity within the dipropylene glycol market lies in the development of sustainable solutions and eco-friendly formulations that align with growing consumer and industry demand for environmentally responsible products. Manufacturers can capitalize on this opportunity by exploring bio-based sources, renewable feedstocks, and green chemistry processes for dipropylene glycol production, as well as by enhancing the sustainability of downstream applications and end products. Opportunities exist for formulating eco-friendly personal care products, paints and coatings, and industrial fluids using dipropylene glycol derived from renewable resources or produced through environmentally friendly processes. Additionally, manufacturers can leverage certifications, labels, and marketing initiatives to communicate the sustainability attributes of their products and differentiate themselves in the marketplace. By embracing sustainability principles, adopting circular economy practices, and addressing environmental concerns throughout the value chain, manufacturers can enhance their brand reputation, meet regulatory requirements, and capture market share in the growing market for sustainable chemicals and products.

Within the dipropylene glycol market segmented by type, the Industrial Grade segment is the largest, driven by its extensive applications across various industries. Industrial grade dipropylene glycol is utilized as a solvent, humectant, and plasticizer in industries such as paints and coatings, plastics, textiles, and personal care products. Its hygroscopic properties make it an effective humectant in products such as moisturizers, while its solvent capabilities make it valuable in paint formulations and printing inks. Additionally, dipropylene glycol serves as a plasticizer in plastics manufacturing, enhancing flexibility and durability. The industrial grade variant offers a cost-effective solution for industrial applications, making it the preferred choice for manufacturers seeking reliable performance and versatility in their products. As industries continue to innovate and expand, the demand for industrial grade dipropylene glycol remains robust, solidifying its position as the largest segment in the market.

Among the segments categorized by application in the dipropylene glycol market, the Pharmaceutical sector is the fastest-growing, propelled by its increasing utilization in pharmaceutical formulations and drug delivery systems. Dipropylene glycol serves as a versatile solvent and carrier in pharmaceutical applications, facilitating the dissolution of active pharmaceutical ingredients (APIs) and enhancing their bioavailability. Additionally, it finds use as a stabilizer in oral and topical medications, ensuring product efficacy and shelf-life stability. With the continual advancements in medical science and the expanding pharmaceutical industry, the demand for dipropylene glycol in pharmaceutical applications is expected to surge. Furthermore, the rising prevalence of chronic diseases and the development of new drug formulations further contribute to the growth of the Pharmaceutical segment in the dipropylene glycol market. As healthcare demands escalate and pharmaceutical innovations continue to evolve, the Pharmaceutical sector is poised for rapid expansion, driven by the indispensable role of dipropylene glycol in pharmaceutical formulations.

By Type

Fragrance Grade

Industrial Grade

By Application

Polyester Resins

Functional Fluids

Pharmaceutical

Personal Care

Liquid Detergents

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

ADEKA Corp

BASF SE

Dow Inc

Huntsman International LLC

INEOS

LyondellBasell Industries Holdings B.V.

Manali Petrochemicals Ltd

Repsol S.A.

Royal Dutch Shell plc

Sumitomo Corp

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Dipropylene Glycol Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Dipropylene Glycol Market Size Outlook, $ Million, 2021 to 2032

3.2 Dipropylene Glycol Market Outlook by Type, $ Million, 2021 to 2032

3.3 Dipropylene Glycol Market Outlook by Product, $ Million, 2021 to 2032

3.4 Dipropylene Glycol Market Outlook by Application, $ Million, 2021 to 2032

3.5 Dipropylene Glycol Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Dipropylene Glycol Industry

4.2 Key Market Trends in Dipropylene Glycol Industry

4.3 Potential Opportunities in Dipropylene Glycol Industry

4.4 Key Challenges in Dipropylene Glycol Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Dipropylene Glycol Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Dipropylene Glycol Market Outlook by Segments

7.1 Dipropylene Glycol Market Outlook by Segments, $ Million, 2021- 2032

By Type

Fragrance Grade

Industrial Grade

By Application

Polyester Resins

Functional Fluids

Pharmaceutical

Personal Care

Liquid Detergents

Others

8 North America Dipropylene Glycol Market Analysis and Outlook To 2032

8.1 Introduction to North America Dipropylene Glycol Markets in 2024

8.2 North America Dipropylene Glycol Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Dipropylene Glycol Market size Outlook by Segments, 2021-2032

By Type

Fragrance Grade

Industrial Grade

By Application

Polyester Resins

Functional Fluids

Pharmaceutical

Personal Care

Liquid Detergents

Others

9 Europe Dipropylene Glycol Market Analysis and Outlook To 2032

9.1 Introduction to Europe Dipropylene Glycol Markets in 2024

9.2 Europe Dipropylene Glycol Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Dipropylene Glycol Market Size Outlook by Segments, 2021-2032

By Type

Fragrance Grade

Industrial Grade

By Application

Polyester Resins

Functional Fluids

Pharmaceutical

Personal Care

Liquid Detergents

Others

10 Asia Pacific Dipropylene Glycol Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Dipropylene Glycol Markets in 2024

10.2 Asia Pacific Dipropylene Glycol Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Dipropylene Glycol Market size Outlook by Segments, 2021-2032

By Type

Fragrance Grade

Industrial Grade

By Application

Polyester Resins

Functional Fluids

Pharmaceutical

Personal Care

Liquid Detergents

Others

11 South America Dipropylene Glycol Market Analysis and Outlook To 2032

11.1 Introduction to South America Dipropylene Glycol Markets in 2024

11.2 South America Dipropylene Glycol Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Dipropylene Glycol Market size Outlook by Segments, 2021-2032

By Type

Fragrance Grade

Industrial Grade

By Application

Polyester Resins

Functional Fluids

Pharmaceutical

Personal Care

Liquid Detergents

Others

12 Middle East and Africa Dipropylene Glycol Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Dipropylene Glycol Markets in 2024

12.2 Middle East and Africa Dipropylene Glycol Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Dipropylene Glycol Market size Outlook by Segments, 2021-2032

By Type

Fragrance Grade

Industrial Grade

By Application

Polyester Resins

Functional Fluids

Pharmaceutical

Personal Care

Liquid Detergents

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

ADEKA Corp

BASF SE

Dow Inc

Huntsman International LLC

INEOS

LyondellBasell Industries Holdings B.V.

Manali Petrochemicals Ltd

Repsol S.A.

Royal Dutch Shell plc

Sumitomo Corp

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Fragrance Grade

Industrial Grade

By Application

Polyester Resins

Functional Fluids

Pharmaceutical

Personal Care

Liquid Detergents

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Dipropylene Glycol Market Size is valued at $5.1 Billion in 2024 and is forecast to register a growth rate (CAGR) of 2.9% to reach $6.4 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

ADEKA Corp, BASF SE, Dow Inc, Huntsman International LLC, INEOS, LyondellBasell Industries Holdings B.V., Manali Petrochemicals Ltd, Repsol S.A., Royal Dutch Shell plc, Sumitomo Corp

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume