Dimethyl Terephthalate (dimethyl 1, 4-benzene dicarboxylate) market demand is driven by the increasing use of polymer plastics. Increasing demand for DMT as chemical intermediate for polyester fibers across Consumer electronics, Packaging components, non-food contact, Polymer modification, and other applications drives the future consumption of DMT.

In particular, potential cost advantages, superior performance, and wide availability drive the market outlook. On the other hand, penetration of TPA (Terephthalic Acid) poses significant competition to the sales volume of DMT. Plasticizers including Dimethyl terephthalate are increasingly used to modify and improve polymer materials. The growing demand for polyethylene terephthalate for fiber, film, container plastics, specialty plastics, and others fuel the market outlook.

Global production of 1.5 Million tonnes of DMT is largely directed towards the production of plastic polyesters such as polyethylene terephthalate (PET), polybutylene terephthalate (PBT) and polytrimethylene terephthalate (PTT). DMT is produced generally from xylene isomers in a multi-stage process of oxidation and esterification but direct esterification of terephthalic acid with methanol is also used. Asia remains the largest producer and consumer of DMT, predominantly in China. The trade dynamics are also centered around the region with China and Japan leading imports while South Korea leads the exports. The table below details the imports and exports of DMT.

Table- Global Dimethyl Terephthalate Imports and Exports by Country, USD Million, 2023

|

USD Thousand |

Imports |

|

|

Exports |

|

World |

163,867 |

|

World |

162,355 |

|

China |

45,528 |

|

Korea, Republic of |

75,544 |

|

Japan |

21,304 |

|

Türkiye |

44,491 |

|

Luxembourg |

16,940 |

|

Germany |

17,622 |

|

Germany |

16,606 |

|

China |

9,170 |

|

Belgium |

16,553 |

|

United States of America |

7,713 |

|

Italy |

15,899 |

|

Others |

7,815 |

Source: ITC Trademap

Industry- Market Size, Share, Trends, Growth Outlook.webp)

The global demand for polyethylene terephthalate (PET) in the packaging and automotive applications continues to drive DMT sales volume. DMT manufacturers focus on long-term supply agreements with manufacturers of PET products to drive sales. In addition, Polyester fibers made from DMT are increasingly used in the automotive sector for seat belts, airbags, and upholstery. Further, the increasing demand for versatile and low-cost synthetic fibers in fashion, home furnishings, and industrial textiles presents an opportunity for vendors. Amidst widening applications and growing drive towards environmental PET, DMT vendors developing and supplying bio-based DMT are set to gain a competitive edge.

Technological advancements in Dimethyl Terephthalate (DMT) production are primarily driven by innovation in recycling technologies and process optimization. Key manufacturers are marketing new technologies to cater to the increasing preference for polyester recycling. For instance, Eastman markets molecular recycling technology, where rejected PET waste is converted into reusable raw materials for DMT production. Similarly, RePEaT Co., Ltd.'s chemical recycling technology is increasingly licensed for its efficiency in breaking down and repolymerizing polyester products derived from DMT. Further, European DMT companies are focusing on bio-based polymer developments, offering DMT alternatives that reduce dependence on fossil fuels.

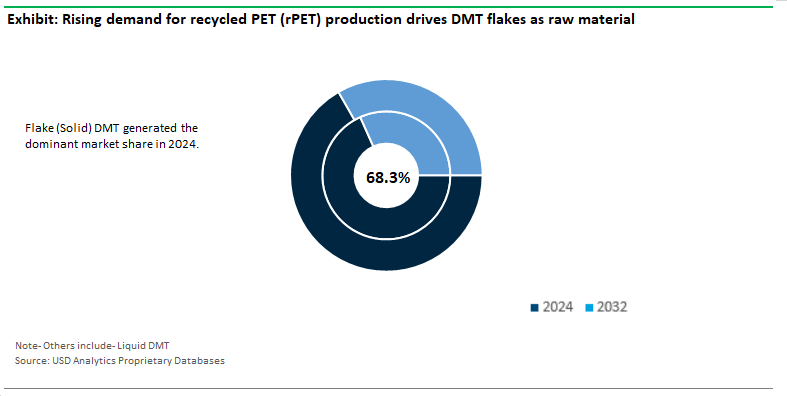

In 2024, Dimethyl Terephthalate (DMT) flakes accounted for 68.3% of the market share due to their predominant use in the polyester and PET production processes. Ease of handling, storage, and integration into automated production systems support the manufacturing and trading of DMT across high-performance polyester fibers used in apparel, home furnishings, and industrial applications.

For instance, Eastman Chemical Company produces DMT flakes with high purity levels for polyester fiber production used in apparel and industrial applications. SK Chemicals also focuses on DMT flakes for applications in high-performance polyethylene terephthalate (PET) bottles. Further, the rising demand for recycled PET (rPET) production is encouraging Indorama Ventures and Alpek Polyester increasingly use DMT flakes as raw material in their recycling processes.

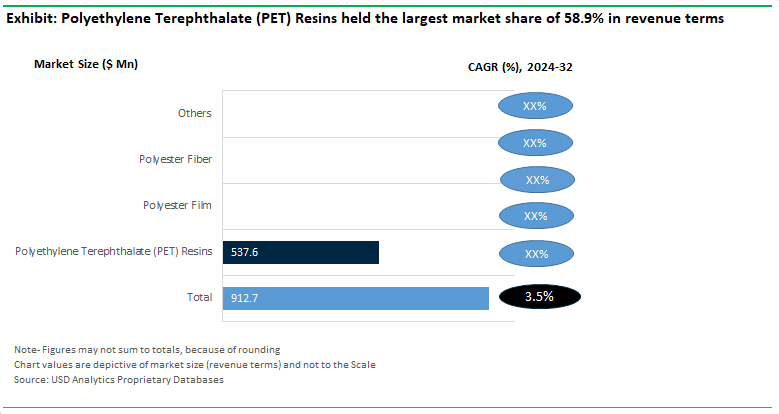

Strong demand for polyethylene terephthalate (PET) resins across consumer and industrial products including plastic bottles, food packaging, and polyester fibers drives the use of DMT. In 2024, the PET segment accounted for 58.9% revenue share in the global Dimethyl Terephthalate. PET derived from DMT generates additional value owing to durability, lightweight properties, and recyclability properties. In addition, DMT-based polyester fibers are witnessing increased demand for clothing, home furnishings, and industrial applications. Alpek Polyester and Reliance Industries are increasingly using DMT to manufacture high-performance materials for synthetic textiles. Further, increasing adoption of recycled PET (rPET) further boosts the revenue generated over the forecast period.

Asia Pacific is the largest end-user of DMT with 78.6% market share and is poised to register a robust 3.7% CAGR over the forecast period to 2032. China is the single largest country in the region and other Asia is the most potential growth market in Asia Pacific. China’s rapidly growing textile industry, along with its substantial packaging and automotive sectors, continues to propel DMT consumption, especially for the production of PET resins and polyester fibers. In addition, increasing demand from Vietnam, Thailand, and Indonesia, where industries related to textiles, packaging, and consumer goods are expanding rapidly present strong import-export opportunities.

The global Dimethyl Terephthalate market is fragmented with the presence of both domestic and global players. Leading companies included in the study are BLD Pharmatech Ltd, Chengdu Sustar Feed Co. Ltd, Connect Chemicals GmbH, Eastman Chemical Co., Fiber Intermediate Products Co., Haihang Industry Co. Ltd, Indorama Ventures Public Co. Ltd, Kanto Chemical Co. Inc, Kishida Chemical Co. Ltd, Merck KGaA, MuBy Chemicals, National Analytical Corp, OAO Mogilevkhimvolokno, OXXYNOVA GmbH, Sarna Chemical Pvt. Ltd, Sasa Polyester Sanayi A.S., Simson Pharma Ltd, SK Chemicals Co. Ltd, Teijin Ltd, Tokyo Chemical Industry Co. Ltd, Vizag Chemical International, and others.

|

Parameter |

Details |

|

Market Size (2024) |

$912.7 Million |

|

Market Size (2032) |

$1.2 Billion |

|

Market Growth Rate |

3.5% |

|

Largest Segment- Application |

PET Segment (58.9% market share) |

|

Fastest Growing Market- Region |

Asia Pacific (3.7% CAGR) |

|

Largest Segment- Type |

Flakes (68.3% Revenue Share) |

|

Segments |

Types, Grades, Applications |

|

Study Period |

2018- 2023 and 2024-2032 |

|

Units |

Revenue (USD) |

|

Qualitative Analysis |

Porter’s Five Forces, SWOT Profile, Market Share, Scenario Forecasts, Market Ecosystem, Company Ranking, Market Dynamics, Industry Benchmarking |

|

Companies |

BLD Pharmatech Ltd, Chengdu Sustar Feed Co. Ltd, Connect Chemicals GmbH, Eastman Chemical Co., Fiber Intermediate Products Co., Haihang Industry Co. Ltd, Indorama Ventures Public Co. Ltd, Kanto Chemical Co. Inc, Kishida Chemical Co. Ltd, Merck KGaA, MuBy Chemicals, National Analytical Corp, OAO Mogilevkhimvolokno, OXXYNOVA GmbH, Sarna Chemical Pvt. Ltd, Sasa Polyester Sanayi A.S., Simson Pharma Ltd, SK Chemicals Co. Ltd, Teijin Ltd, Tokyo Chemical Industry Co. Ltd, Vizag Chemical International |

|

Countries |

US, Canada, Mexico, Germany, France, Spain, Italy, UK, Russia, China, India, Japan, South Korea, Australia, South East Asia, Brazil, Argentina, Middle East, Africa |

Type

Application

Countries Analyzed

Dimethyl Terephthalate Companies Profiled in the Study

*- List Not Exhaustive

About USD Analytics

Table of Contents

1. Executive Summary

What’s New in 2024?

Top 10 Takeaways from the industry

Potential Opportunities for Industry Stakeholders

Strategic Imperatives

Company Market Positioning

Industry Benchmarking Matrix

2. Research Scope and Methodology

Market Definition

Market Segments

Companies Profiled

Research Methodology

Data Sources

Conversion Rates for USD

Abbreviations

3. Strategic Landscape: Key Insights and Implications

Spotlight: Key Strategies opted by Business Leaders

Competitive Landscape

SWOT Analysis

Porter’s Five Force Analysis

Macro-Environmental Analysis

5. Growth Opportunity Analysis

Trends at a Glance

Market Dynamics

Key Industry Stakeholders

Regulatory Landscape

6. Market Size Outlook to 2032

Global Dimethyl Terephthalate Market Size Forecast, USD Million, 2018- 2032

Scenario Analysis

Pricing Analysis and Outlook

7. Historical Dimethyl Terephthalate Market Size by Segments, 2018- 2023

Key Statistics, 2024

Dimethyl Terephthalate Market Size Outlook by Type, USD Million, 2018-2023

Growth Comparison (y-o-y) across Dimethyl Terephthalate Types, 2018-2023

Dimethyl Terephthalate Market Size Outlook by Application, USD Million, 2018-2023

Growth Comparison (y-o-y) across Dimethyl Terephthalate Applications, 2018-2023

8. Dimethyl Terephthalate Market Size Outlook by Segments, 2024- 2032

Dimethyl Terephthalate Market Size Outlook by Type, USD Million, 2024-2032

Growth Comparison (y-o-y) across Dimethyl Terephthalate Types, 2024-2032

Dimethyl Terephthalate Market Size Outlook by End-Users, USD Million, 2024-2032

Growth Comparison (y-o-y) across Dimethyl Terephthalate End-Users, 2024-2032

9. Dimethyl Terephthalate Market Size Outlook by Region

North America

Europe

Asia Pacific

South America

Middle East and Africa

10. United States Dimethyl Terephthalate Market Analysis and Outlook, 2021- 2032

Key Statistics

United States Dimethyl Terephthalate Market Size Outlook by Type, 2021- 2032

United States Dimethyl Terephthalate Market Size Outlook by Application, 2021- 2032

United States Dimethyl Terephthalate Market Size Outlook by End-User, 2021- 2032

11. Canada Dimethyl Terephthalate Market Analysis and Outlook, 2021- 2032

Key Statistics

Canada Dimethyl Terephthalate Market Size Outlook by Type, 2021- 2032

Canada Dimethyl Terephthalate Market Size Outlook by Application, 2021- 2032

Canada Dimethyl Terephthalate Market Size Outlook by End-User, 2021- 2032

12. Mexico Dimethyl Terephthalate Market Analysis and Outlook, 2021- 2032

Key Statistics

Mexico Dimethyl Terephthalate Market Size Outlook by Type, 2021- 2032

Mexico Dimethyl Terephthalate Market Size Outlook by Application, 2021- 2032

Mexico Dimethyl Terephthalate Market Size Outlook by End-User, 2021- 2032

13. Germany Dimethyl Terephthalate Market Analysis and Outlook, 2021- 2032

Key Statistics

Germany Dimethyl Terephthalate Market Size Outlook by Type, 2021- 2032

Germany Dimethyl Terephthalate Market Size Outlook by Application, 2021- 2032

Germany Dimethyl Terephthalate Market Size Outlook by End-User, 2021- 2032

14. France Dimethyl Terephthalate Market Analysis and Outlook, 2021- 2032

Key Statistics

France Dimethyl Terephthalate Market Size Outlook by Type, 2021- 2032

France Dimethyl Terephthalate Market Size Outlook by Application, 2021- 2032

France Dimethyl Terephthalate Market Size Outlook by End-User, 2021- 2032

15. United Kingdom Dimethyl Terephthalate Market Analysis and Outlook, 2021- 2032

Key Statistics

United Kingdom Dimethyl Terephthalate Market Size Outlook by Type, 2021- 2032

United Kingdom Dimethyl Terephthalate Market Size Outlook by Application, 2021- 2032

United Kingdom Dimethyl Terephthalate Market Size Outlook by End-User, 2021- 2032

10. Spain Dimethyl Terephthalate Market Analysis and Outlook, 2021- 2032

Key Statistics

Spain Dimethyl Terephthalate Market Size Outlook by Type, 2021- 2032

Spain Dimethyl Terephthalate Market Size Outlook by Application, 2021- 2032

Spain Dimethyl Terephthalate Market Size Outlook by End-User, 2021- 2032

16. Italy Dimethyl Terephthalate Market Analysis and Outlook, 2021- 2032

Key Statistics

Italy Dimethyl Terephthalate Market Size Outlook by Type, 2021- 2032

Italy Dimethyl Terephthalate Market Size Outlook by Application, 2021- 2032

Italy Dimethyl Terephthalate Market Size Outlook by End-User, 2021- 2032

17. Benelux Dimethyl Terephthalate Market Analysis and Outlook, 2021- 2032

Key Statistics

Benelux Dimethyl Terephthalate Market Size Outlook by Type, 2021- 2032

Benelux Dimethyl Terephthalate Market Size Outlook by Application, 2021- 2032

Benelux Dimethyl Terephthalate Market Size Outlook by End-User, 2021- 2032

18. Nordic Dimethyl Terephthalate Market Analysis and Outlook, 2021- 2032

Key Statistics

Nordic Dimethyl Terephthalate Market Size Outlook by Type, 2021- 2032

Nordic Dimethyl Terephthalate Market Size Outlook by Application, 2021- 2032

Nordic Dimethyl Terephthalate Market Size Outlook by End-User, 2021- 2032

19. Rest of Europe Dimethyl Terephthalate Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Europe Dimethyl Terephthalate Market Size Outlook by Type, 2021- 2032

Rest of Europe Dimethyl Terephthalate Market Size Outlook by Application, 2021- 2032

Rest of Europe Dimethyl Terephthalate Market Size Outlook by End-User, 2021- 2032

20. China Dimethyl Terephthalate Market Analysis and Outlook, 2021- 2032

Key Statistics

China Dimethyl Terephthalate Market Size Outlook by Type, 2021- 2032

China Dimethyl Terephthalate Market Size Outlook by Application, 2021- 2032

China Dimethyl Terephthalate Market Size Outlook by End-User, 2021- 2032

21. India Dimethyl Terephthalate Market Analysis and Outlook, 2021- 2032

Key Statistics

India Dimethyl Terephthalate Market Size Outlook by Type, 2021- 2032

India Dimethyl Terephthalate Market Size Outlook by Application, 2021- 2032

India Dimethyl Terephthalate Market Size Outlook by End-User, 2021- 2032

22. Japan Dimethyl Terephthalate Market Analysis and Outlook, 2021- 2032

Key Statistics

Japan Dimethyl Terephthalate Market Size Outlook by Type, 2021- 2032

Japan Dimethyl Terephthalate Market Size Outlook by Application, 2021- 2032

Japan Dimethyl Terephthalate Market Size Outlook by End-User, 2021- 2032

23. South Korea Dimethyl Terephthalate Market Analysis and Outlook, 2021- 2032

Key Statistics

South Korea Dimethyl Terephthalate Market Size Outlook by Type, 2021- 2032

South Korea Dimethyl Terephthalate Market Size Outlook by Application, 2021- 2032

South Korea Dimethyl Terephthalate Market Size Outlook by End-User, 2021- 2032

24. Australia Dimethyl Terephthalate Market Analysis and Outlook, 2021- 2032

Key Statistics

Australia Dimethyl Terephthalate Market Size Outlook by Type, 2021- 2032

Australia Dimethyl Terephthalate Market Size Outlook by Application, 2021- 2032

Australia Dimethyl Terephthalate Market Size Outlook by End-User, 2021- 2032

25. South East Asia Dimethyl Terephthalate Market Analysis and Outlook, 2021- 2032

Key Statistics

South East Asia Dimethyl Terephthalate Market Size Outlook by Type, 2021- 2032

South East Asia Dimethyl Terephthalate Market Size Outlook by Application, 2021- 2032

South East Asia Dimethyl Terephthalate Market Size Outlook by End-User, 2021- 2032

26. Rest of Asia Pacific Dimethyl Terephthalate Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Asia Pacific Dimethyl Terephthalate Market Size Outlook by Type, 2021- 2032

Rest of Asia Pacific Dimethyl Terephthalate Market Size Outlook by Application, 2021- 2032

Rest of Asia Pacific Dimethyl Terephthalate Market Size Outlook by End-User, 2021- 2032

27. Brazil Dimethyl Terephthalate Market Analysis and Outlook, 2021- 2032

Key Statistics

Brazil Dimethyl Terephthalate Market Size Outlook by Type, 2021- 2032

Brazil Dimethyl Terephthalate Market Size Outlook by Application, 2021- 2032

Brazil Dimethyl Terephthalate Market Size Outlook by End-User, 2021- 2032

28. Argentina Dimethyl Terephthalate Market Analysis and Outlook, 2021- 2032

Key Statistics

Argentina Dimethyl Terephthalate Market Size Outlook by Type, 2021- 2032

Argentina Dimethyl Terephthalate Market Size Outlook by Application, 2021- 2032

Argentina Dimethyl Terephthalate Market Size Outlook by End-User, 2021- 2032

29. Rest of South America Dimethyl Terephthalate Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of South America Dimethyl Terephthalate Market Size Outlook by Type, 2021- 2032

Rest of South America Dimethyl Terephthalate Market Size Outlook by Application, 2021- 2032

Rest of South America Dimethyl Terephthalate Market Size Outlook by End-User, 2021- 2032

30. United Arab Emirates Dimethyl Terephthalate Market Analysis and Outlook, 2021- 2032

Key Statistics

United Arab Emirates Dimethyl Terephthalate Market Size Outlook by Type, 2021- 2032

United Arab Emirates Dimethyl Terephthalate Market Size Outlook by Application, 2021- 2032

United Arab Emirates Dimethyl Terephthalate Market Size Outlook by End-User, 2021- 2032

31. Saudi Arabia Dimethyl Terephthalate Market Analysis and Outlook, 2021- 2032

Key Statistics

Saudi Arabia Dimethyl Terephthalate Market Size Outlook by Type, 2021- 2032

Saudi Arabia Dimethyl Terephthalate Market Size Outlook by Application, 2021- 2032

Saudi Arabia Dimethyl Terephthalate Market Size Outlook by End-User, 2021- 2032

32. Rest of Middle East Dimethyl Terephthalate Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Middle East Dimethyl Terephthalate Market Size Outlook by Type, 2021- 2032

Rest of Middle East Dimethyl Terephthalate Market Size Outlook by Application, 2021- 2032

Rest of Middle East Dimethyl Terephthalate Market Size Outlook by End-User, 2021- 2032

33. South Africa Dimethyl Terephthalate Market Analysis and Outlook, 2021- 2032

Key Statistics

South Africa Dimethyl Terephthalate Market Size Outlook by Type, 2021- 2032

South Africa Dimethyl Terephthalate Market Size Outlook by Application, 2021- 2032

South Africa Dimethyl Terephthalate Market Size Outlook by End-User, 2021- 2032

34. Rest of Africa Dimethyl Terephthalate Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Africa Dimethyl Terephthalate Market Size Outlook by Type, 2021- 2032

Rest of Africa Dimethyl Terephthalate Market Size Outlook by Application, 2021- 2032

Rest of Africa Dimethyl Terephthalate Market Size Outlook by End-User, 2021- 2032

35. Key Companies

Market Share Analysis

Company Benchmarking

Financial Analysis

36. Recent Market Developments

37. Appendix

Looking Ahead

Research Methodology

Legal Disclaimer

Type

Application

Countries Analyzed

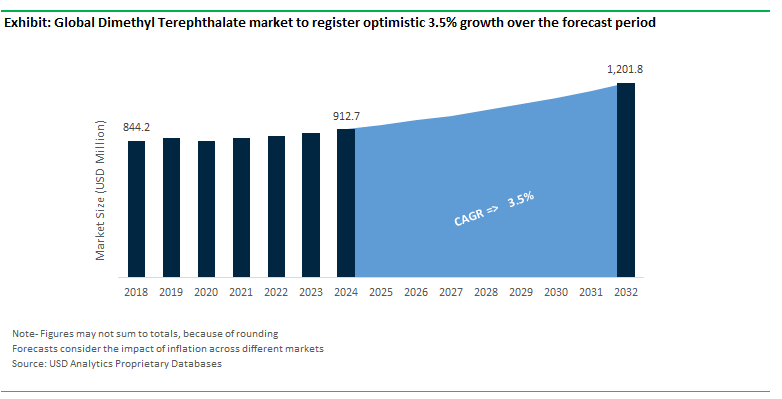

The global Dimethyl Terephthalate market size is set to increase from $912.7 Million in 2024 to $1.2 Billion in 2032, registering a CAGR of 3.5% during the forecast period

PET Segment (58.9% market share), PET Segment (58.9% market share)

BLD Pharmatech Ltd, Chengdu Sustar Feed Co. Ltd, Connect Chemicals GmbH, Eastman Chemical Co., Fiber Intermediate Products Co., Haihang Industry Co. Ltd, Indorama Ventures Public Co. Ltd, Kanto Chemical Co. Inc, Kishida Chemical Co. Ltd, Merck KGaA, MuBy Chemicals, National Analytical Corp, OAO Mogilevkhimvolokno, OXXYNOVA GmbH, Sarna Chemical Pvt. Ltd, Sasa Polyester Sanayi A.S., Simson Pharma Ltd, SK Chemicals Co. Ltd, Teijin Ltd, Tokyo Chemical Industry Co. Ltd, Vizag Chemical International, and others

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume

Asia Pacific (3.7% CAGR)