The global Dimer Acid Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Application (Nonreactive Polyamide Resins, Reactive Polyamide Resins, Oilfield Chemicals, Others), By Product (Standard, Distilled, Distilled and Hydrogenated).

The dimer acid market is experiencing significant growth driven by its applications in various industries such as adhesives, coatings, lubricants, and personal care products. Key trends shaping the future of the industry include the increasing demand for dimer acids as sustainable alternatives to petrochemical-derived products, driven by regulatory pressures, environmental concerns, and consumer preferences for eco-friendly materials. As industries seek bio-based solutions that offer high performance, versatility, and biodegradability, there's a growing need for dimer acids derived from renewable feedstocks such as vegetable oils and tall oil. Moreover, advancements in dimer acid production methods, catalysis, and purification techniques are driving market expansion by improving yield, purity, and consistency of dimer acid products. Additionally, the growing applications of dimer acids in specialty chemicals, polymer additives, and industrial formulations are fueling demand for customized dimer acid derivatives with tailored properties and functionalities. Furthermore, the integration of sustainable sourcing practices, green chemistry principles, and circular economy initiatives is driving innovation and market growth in the dimer acid industry, enabling the development of environmentally friendly and cost-effective solutions to meet evolving market demands.

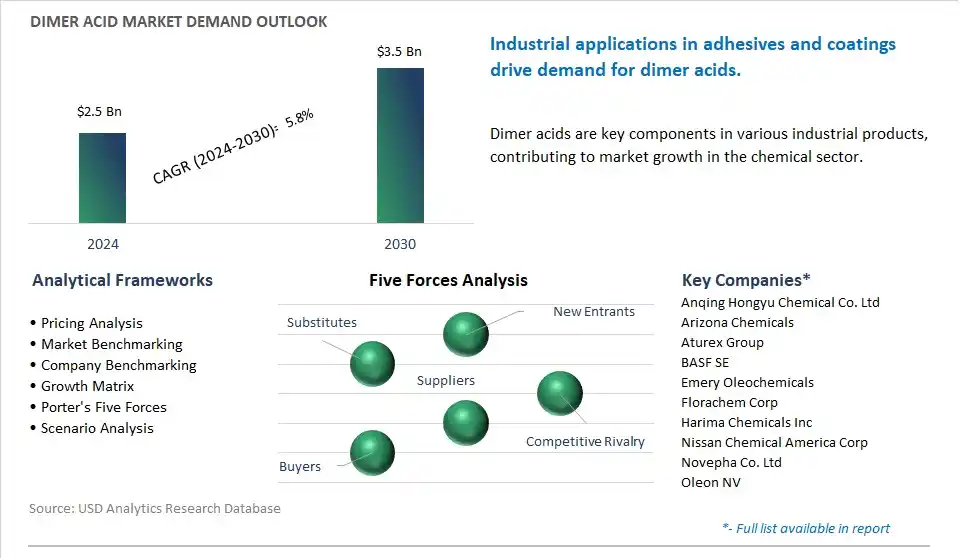

The market report analyses the leading companies in the industry including Anqing Hongyu Chemical Co. Ltd, Arizona Chemicals, Aturex Group, BASF SE, Emery Oleochemicals, Florachem Corp, Harima Chemicals Inc, Nissan Chemical America Corp, Novepha Co. Ltd, Oleon NV.

One prominent trend in the dimer acid market is the rising demand for bio-based and sustainable chemicals. Dimer acids, derived from natural oils such as tall oil or soybean oil, are gaining popularity as environmentally friendly alternatives to traditional petroleum-based acids. With increasing awareness of environmental concerns and regulations promoting sustainability, industries are shifting towards bio-based chemicals in various applications including adhesives, coatings, lubricants, and personal care products. The trend towards bio-based and sustainable chemicals drives market demand for dimer acids as key raw materials in green formulations.

A primary driver shaping the dimer acid market is the growth in end-user industries and emerging markets. As economies continue to develop and consumer preferences evolve, there is a growing demand for dimer acids across diverse sectors such as adhesives, paints and coatings, and cosmetics. Additionally, emerging markets present significant opportunities for market expansion, driven by urbanization, infrastructure development, and increasing disposable incomes. The driver behind the growth in end-user industries and emerging markets stimulates market demand for dimer acids as essential components in a wide range of products and applications.

An opportunity within the dimer acid market lies in the development of specialty dimer acid derivatives to address specific industry needs and niche applications. By modifying the chemical structure of dimer acids or synthesizing derivatives with unique properties, companies can create value-added products tailored to customer requirements. Specialty dimer acid derivatives can find applications in areas such as corrosion inhibitors, plasticizers, surfactants, and pharmaceutical intermediates, offering enhanced performance, functionality, and versatility. Additionally, there is potential to explore novel formulations and applications for specialty dimer acid derivatives in emerging industries such as renewable energy, biotechnology, and advanced materials. By embracing opportunities in specialty dimer acid derivatives, companies can expand their product portfolios, penetrate new market segments, and differentiate themselves in the competitive landscape of the dimer acid market.

The nonreactive polyamide resins segment is the largest in the dimer acid market, primarily due to diverse key factors. The nonreactive polyamide resins find extensive application in various industries, including coatings, adhesives, printing inks, and textiles, among others. These resins exhibit excellent properties such as flexibility, adhesion, and chemical resistance, making them ideal for formulating coatings and adhesives for diverse substrates and applications. In addition, nonreactive polyamide resins are preferred for their versatility and compatibility with a wide range of additives and pigments, allowing formulators to tailor formulations to meet specific performance requirements. Additionally, the growing demand for eco-friendly and sustainable coatings and adhesives drives the adoption of nonreactive polyamide resins, as they are derived from renewable sources such as natural oils and exhibit low volatility and emissions. With their widespread use across industries and versatile performance characteristics, nonreactive polyamide resins maintain their position as the largest segment in the dimer acid market.

The "Distilled and Hydrogenated" segment is the fastest-growing segment in the dimer acid market due to diverse key factors. The the distillation and hydrogenation process enhances the purity and performance characteristics of dimer acids, resulting in products with superior quality and functionality compared to standard or distilled dimer acids. The hydrogenation process involves the saturation of double bonds in the dimer acid molecule, leading to improved thermal stability, color stability, and resistance to oxidation, which are highly desirable properties in many applications such as coatings, adhesives, and lubricants. In addition, distilled and hydrogenated dimer acids exhibit reduced levels of impurities and contaminants, making them suitable for high-performance and specialty applications that require stringent quality standards. Additionally, advancements in process technology and manufacturing techniques have enabled the production of distilled and hydrogenated dimer acids with tailored properties to meet specific customer requirements, further driving their adoption in niche markets. With their enhanced performance attributes and increasing demand for high-quality, sustainable chemical solutions, the distilled and hydrogenated segment experiences rapid growth in the dimer acid market.

By Application

Nonreactive Polyamide Resins

Reactive Polyamide Resins

Oilfield Chemicals

Others

By Product

Standard

Distilled

Distilled and Hydrogenated

Regions Included

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Anqing Hongyu Chemical Co. Ltd

Arizona Chemicals

Aturex Group

BASF SE

Emery Oleochemicals

Florachem Corp

Harima Chemicals Inc

Nissan Chemical America Corp

Novepha Co. Ltd

Oleon NV

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Dimer Acid Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Dimer Acid Market Size Outlook, $ Million, 2021 to 2030

3.2 Dimer Acid Market Outlook by Type, $ Million, 2021 to 2030

3.3 Dimer Acid Market Outlook by Product, $ Million, 2021 to 2030

3.4 Dimer Acid Market Outlook by Application, $ Million, 2021 to 2030

3.5 Dimer Acid Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Dimer Acid Industry

4.2 Key Market Trends in Dimer Acid Industry

4.3 Potential Opportunities in Dimer Acid Industry

4.4 Key Challenges in Dimer Acid Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Dimer Acid Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Dimer Acid Market Outlook by Segments

7.1 Dimer Acid Market Outlook by Segments, $ Million, 2021- 2030

By Application

Nonreactive Polyamide Resins

Reactive Polyamide Resins

Oilfield Chemicals

Others

By Product

Standard

Distilled

Distilled and Hydrogenated

8 North America Dimer Acid Market Analysis and Outlook To 2030

8.1 Introduction to North America Dimer Acid Markets in 2024

8.2 North America Dimer Acid Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Dimer Acid Market size Outlook by Segments, 2021-2030

By Application

Nonreactive Polyamide Resins

Reactive Polyamide Resins

Oilfield Chemicals

Others

By Product

Standard

Distilled

Distilled and Hydrogenated

9 Europe Dimer Acid Market Analysis and Outlook To 2030

9.1 Introduction to Europe Dimer Acid Markets in 2024

9.2 Europe Dimer Acid Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Dimer Acid Market Size Outlook by Segments, 2021-2030

By Application

Nonreactive Polyamide Resins

Reactive Polyamide Resins

Oilfield Chemicals

Others

By Product

Standard

Distilled

Distilled and Hydrogenated

10 Asia Pacific Dimer Acid Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Dimer Acid Markets in 2024

10.2 Asia Pacific Dimer Acid Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Dimer Acid Market size Outlook by Segments, 2021-2030

By Application

Nonreactive Polyamide Resins

Reactive Polyamide Resins

Oilfield Chemicals

Others

By Product

Standard

Distilled

Distilled and Hydrogenated

11 South America Dimer Acid Market Analysis and Outlook To 2030

11.1 Introduction to South America Dimer Acid Markets in 2024

11.2 South America Dimer Acid Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Dimer Acid Market size Outlook by Segments, 2021-2030

By Application

Nonreactive Polyamide Resins

Reactive Polyamide Resins

Oilfield Chemicals

Others

By Product

Standard

Distilled

Distilled and Hydrogenated

12 Middle East and Africa Dimer Acid Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Dimer Acid Markets in 2024

12.2 Middle East and Africa Dimer Acid Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Dimer Acid Market size Outlook by Segments, 2021-2030

By Application

Nonreactive Polyamide Resins

Reactive Polyamide Resins

Oilfield Chemicals

Others

By Product

Standard

Distilled

Distilled and Hydrogenated

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Anqing Hongyu Chemical Co. Ltd

Arizona Chemicals

Aturex Group

BASF SE

Emery Oleochemicals

Florachem Corp

Harima Chemicals Inc

Nissan Chemical America Corp

Novepha Co. Ltd

Oleon NV

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Application

Nonreactive Polyamide Resins

Reactive Polyamide Resins

Oilfield Chemicals

Others

By Product

Standard

Distilled

Distilled and Hydrogenated

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Dimer Acid is forecast to reach $3.5 Billion in 2030 from $2.5 Billion in 2024, registering a CAGR of 5.8%

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Anqing Hongyu Chemical Co. Ltd, Arizona Chemicals, Aturex Group, BASF SE, Emery Oleochemicals, Florachem Corp, Harima Chemicals Inc, Nissan Chemical America Corp, Novepha Co. Ltd, Oleon NV

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume