The global Diethyl Ether Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Application (Fuel and Fuel Additives, Propellants, Solvents, Chemical Intermediates, Extractive Mediums, Others), By End-User (Automotive, Plastics, Pharmaceutical, Fragrance, Others).

Diethyl ether, also known simply as ether, is a volatile organic compound commonly used as a solvent, anesthetic, and laboratory reagent in 2024. It is a colorless, highly flammable liquid with a characteristic ether-like odor and is produced by the acid-catalyzed dehydration of ethanol. Diethyl ether has a long history of use as a general anesthetic agent, although its use in medical practice has declined due to its flammability and potential for respiratory depression. However, it remains an important solvent in organic chemistry laboratories for extracting, purifying, and synthesizing organic compounds. Diethyl ether is also used as a starting material in the synthesis of various chemicals, including pharmaceuticals, perfumes, and explosives. Additionally, diethyl ether finds applications as a solvent in industrial processes such as extraction, cleaning, and polymerization, where its low boiling point and solvency properties are advantageous. Despite its versatility, diethyl ether poses safety hazards due to its flammability and potential for forming explosive peroxides upon prolonged storage. Therefore, proper handling, storage, and disposal practices are essential when working with diethyl ether to ensure safety and prevent accidents.

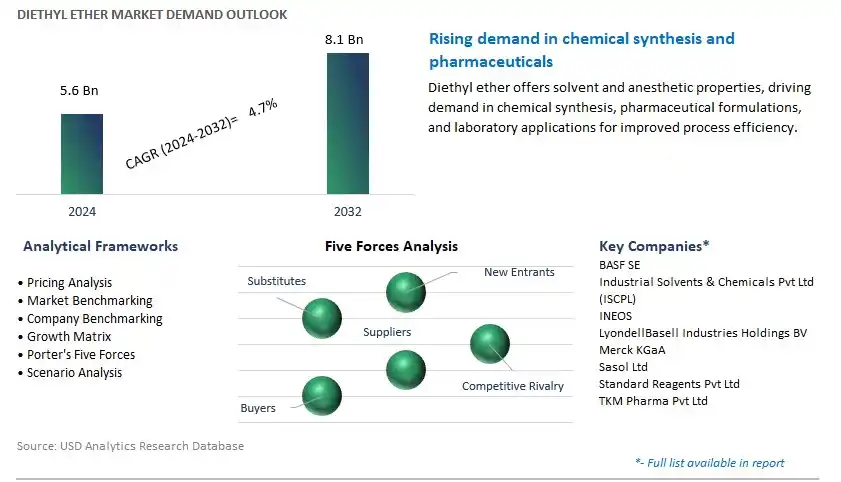

The market report analyses the leading companies in the industry including BASF SE, Industrial Solvents & Chemicals Pvt Ltd (ISCPL), INEOS, LyondellBasell Industries Holdings BV, Merck KGaA, Sasol Ltd, Standard Reagents Pvt Ltd, TKM Pharma Pvt Ltd, and others.

A prominent trend in the diethyl ether market is the resurgence in its use in laboratory and pharmaceutical applications, driven by its unique properties and versatile functionality. Diethyl ether, a highly volatile and flammable solvent, is experiencing renewed interest as a solvent for chemical reactions, extractions, and synthesis processes in research laboratories and pharmaceutical manufacturing facilities. Despite its historical decline due to safety concerns and regulatory restrictions, diethyl ether is being reconsidered as a solvent of choice for certain applications where its low boiling point, solvating power, and compatibility with a wide range of organic compounds offer distinct advantages over alternative solvents. This trend is reflected in increased research activities, academic studies, and pharmaceutical development projects exploring the use of diethyl ether in drug formulation, extraction techniques, and synthesis methodologies, signaling a potential revival of its significance in laboratory and pharmaceutical settings.

The primary driver fueling the demand for diethyl ether is its utilization in various industrial applications, particularly in the production of specialty chemicals, flavors, fragrances, and as a solvent in manufacturing processes. Diethyl ether is valued for its ability to dissolve polar and nonpolar substances, making it an essential solvent for extraction, purification, and separation processes in industries such as pharmaceuticals, cosmetics, food and beverage, and specialty chemicals. Additionally, diethyl ether is used as a starting material in the synthesis of numerous organic compounds, including pharmaceutical intermediates, perfumes, and explosives, where its reactivity and solvating properties play a crucial role in chemical transformations and product development. With the expansion of these industries globally and the growing demand for high-purity solvents and specialty chemicals, there is a consistent need for diethyl ether as a key raw material and process solvent, driving market growth and investment in diethyl ether production, purification, and quality control technologies to meet industry requirements and specifications.

An emerging opportunity within the diethyl ether market lies in the exploration of green solvent alternatives and sustainable manufacturing processes that offer reduced environmental impact and improved safety profiles compared to conventional solvents. As industries increasingly prioritize sustainability, regulatory compliance, and risk mitigation, there is growing interest in developing and adopting eco-friendly solvents derived from renewable resources or produced through green chemistry principles. Manufacturers can capitalize on this opportunity by investing in research and development of novel solvent technologies, such as bio-based solvents, ionic liquids, and supercritical fluids, that offer comparable or superior performance to diethyl ether while minimizing health, safety, and environmental risks. Additionally, opportunities exist for optimizing existing processes, implementing solvent recovery and recycling systems, and adopting green chemistry practices to reduce solvent usage, waste generation, and carbon footprint throughout the product lifecycle. By embracing green solvent innovations and promoting sustainable practices, manufacturers can enhance their competitiveness, meet evolving regulatory requirements, and address customer preferences for environmentally friendly products, positioning themselves as leaders in sustainable chemistry and gaining a competitive edge in the marketplace.

Within the diethyl ether market segmented by application, the Solvents segment is the largest, driven by its wide-ranging use across various industries. Diethyl ether serves as a highly effective solvent due to its ability to dissolve a wide range of organic compounds, making it invaluable in industries such as pharmaceuticals, cosmetics, and chemical manufacturing. As a solvent, diethyl ether finds application in the extraction of natural products, synthesis of pharmaceuticals and fragrances, and as a reaction medium in chemical processes. Its low boiling point and high volatility make it a preferred solvent for certain reactions and extractions. Additionally, diethyl ether is extensively used in laboratory settings as a solvent for chemical reactions and as a solvent for chromatography. Its versatility, coupled with its relatively low cost and favorable properties, solidifies the Solvents segment's position as the largest in the diethyl ether market.

Among the segments categorized by end-users in the diethyl ether market, the Pharmaceutical sector is the fastest-growing, propelled by its critical role in various medical applications. Diethyl ether is widely utilized in the pharmaceutical industry as an anesthetic agent, particularly in the formulation of inhalation anesthetics for surgical procedures. Its rapid onset and offset of action make it an ideal choice for short-duration surgeries and procedures. Additionally, diethyl ether is utilized in the synthesis of various pharmaceutical compounds and as a solvent for drug formulation. With the continual advancements in medical science and the increasing demand for pharmaceutical products, the pharmaceutical sector's reliance on diethyl ether is expected to grow rapidly. Furthermore, the expanding pharmaceutical industry in emerging markets, coupled with the rising prevalence of chronic diseases, further fuels the demand for diethyl ether in pharmaceutical applications. As medical technologies evolve and healthcare demands escalate, the Pharmaceutical segment in the diethyl ether market is poised for significant expansion, driven by its indispensable role in medical applications.

By Application

Fuel and Fuel Additives

Propellants

Solvents

Chemical Intermediates

Extractive Mediums

Others

By End-User

Automotive

Plastics

Pharmaceutical

Fragrance

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

BASF SE

Industrial Solvents & Chemicals Pvt Ltd (ISCPL)

INEOS

LyondellBasell Industries Holdings BV

Merck KGaA

Sasol Ltd

Standard Reagents Pvt Ltd

TKM Pharma Pvt Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Diethyl Ether Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Diethyl Ether Market Size Outlook, $ Million, 2021 to 2032

3.2 Diethyl Ether Market Outlook by Type, $ Million, 2021 to 2032

3.3 Diethyl Ether Market Outlook by Product, $ Million, 2021 to 2032

3.4 Diethyl Ether Market Outlook by Application, $ Million, 2021 to 2032

3.5 Diethyl Ether Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Diethyl Ether Industry

4.2 Key Market Trends in Diethyl Ether Industry

4.3 Potential Opportunities in Diethyl Ether Industry

4.4 Key Challenges in Diethyl Ether Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Diethyl Ether Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Diethyl Ether Market Outlook by Segments

7.1 Diethyl Ether Market Outlook by Segments, $ Million, 2021- 2032

By Application

Fuel and Fuel Additives

Propellants

Solvents

Chemical Intermediates

Extractive Mediums

Others

By End-User

Automotive

Plastics

Pharmaceutical

Fragrance

Others

8 North America Diethyl Ether Market Analysis and Outlook To 2032

8.1 Introduction to North America Diethyl Ether Markets in 2024

8.2 North America Diethyl Ether Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Diethyl Ether Market size Outlook by Segments, 2021-2032

By Application

Fuel and Fuel Additives

Propellants

Solvents

Chemical Intermediates

Extractive Mediums

Others

By End-User

Automotive

Plastics

Pharmaceutical

Fragrance

Others

9 Europe Diethyl Ether Market Analysis and Outlook To 2032

9.1 Introduction to Europe Diethyl Ether Markets in 2024

9.2 Europe Diethyl Ether Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Diethyl Ether Market Size Outlook by Segments, 2021-2032

By Application

Fuel and Fuel Additives

Propellants

Solvents

Chemical Intermediates

Extractive Mediums

Others

By End-User

Automotive

Plastics

Pharmaceutical

Fragrance

Others

10 Asia Pacific Diethyl Ether Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Diethyl Ether Markets in 2024

10.2 Asia Pacific Diethyl Ether Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Diethyl Ether Market size Outlook by Segments, 2021-2032

By Application

Fuel and Fuel Additives

Propellants

Solvents

Chemical Intermediates

Extractive Mediums

Others

By End-User

Automotive

Plastics

Pharmaceutical

Fragrance

Others

11 South America Diethyl Ether Market Analysis and Outlook To 2032

11.1 Introduction to South America Diethyl Ether Markets in 2024

11.2 South America Diethyl Ether Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Diethyl Ether Market size Outlook by Segments, 2021-2032

By Application

Fuel and Fuel Additives

Propellants

Solvents

Chemical Intermediates

Extractive Mediums

Others

By End-User

Automotive

Plastics

Pharmaceutical

Fragrance

Others

12 Middle East and Africa Diethyl Ether Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Diethyl Ether Markets in 2024

12.2 Middle East and Africa Diethyl Ether Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Diethyl Ether Market size Outlook by Segments, 2021-2032

By Application

Fuel and Fuel Additives

Propellants

Solvents

Chemical Intermediates

Extractive Mediums

Others

By End-User

Automotive

Plastics

Pharmaceutical

Fragrance

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

BASF SE

Industrial Solvents & Chemicals Pvt Ltd (ISCPL)

INEOS

LyondellBasell Industries Holdings BV

Merck KGaA

Sasol Ltd

Standard Reagents Pvt Ltd

TKM Pharma Pvt Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Application

Fuel and Fuel Additives

Propellants

Solvents

Chemical Intermediates

Extractive Mediums

Others

By End-User

Automotive

Plastics

Pharmaceutical

Fragrance

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Diethyl Ether Market Size is valued at $5.6 Billion in 2024 and is forecast to register a growth rate (CAGR) of 4.7% to reach $8.1 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

BASF SE, Industrial Solvents & Chemicals Pvt Ltd (ISCPL), INEOS, LyondellBasell Industries Holdings BV, Merck KGaA, Sasol Ltd, Standard Reagents Pvt Ltd, TKM Pharma Pvt Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume