The global Diesel Exhaust Fluid Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Component (SCR Catalysts, DEF Tanks, DEF Injectors, DEF Supply Modules, DEF Sensors, NOx Sensors), By Vehicle (Passenger Cars, LCVs, HCVs), By Application (Construction Equipment, Agricultural Tractors, Diesel Exhaust Fluid Aftermarket), By Supply Mode (Cans & Bottles, IBCs, Bulk, Pumps).

Diesel exhaust fluid (DEF) plays a crucial role in reducing harmful emissions from diesel-powered vehicles by neutralizing nitrogen oxides (NOx) in the exhaust stream. In 2024, the DEF market continues to expand in response to stringent emissions regulations, environmental sustainability initiatives, and the widespread adoption of diesel engines across various industries. Manufacturers are investing in DEF production facilities and distribution networks to meet growing demand from commercial fleets, heavy-duty trucks, agricultural machinery, and off-road equipment. Moreover, advancements in DEF formulations, packaging technologies, and dispensing systems enhance product purity, handling convenience, and regulatory compliance. Additionally, the integration of telematics and onboard DEF monitoring systems enables fleet operators to track fluid consumption, optimize refueling schedules, and ensure compliance with emissions regulations, underscoring the importance of DEF as a critical component in modern diesel engine emissions control strategies.

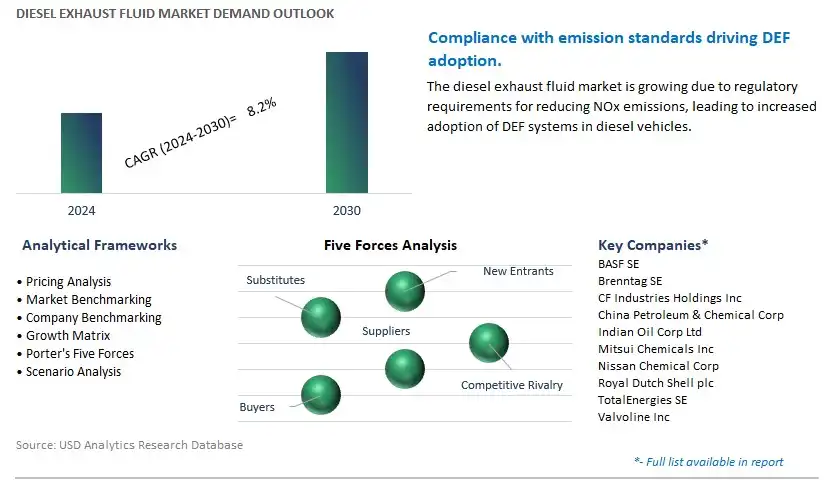

The global Diesel Exhaust Fluid market is highly competitive with a large number of companies focusing on niche market segments. Amidst intense competitive conditions, Diesel Exhaust Fluid Companies are investing in new product launches and strengthening distribution channels. Key companies operating in the Diesel Exhaust Fluid Market Industry include- BASF SE, Brenntag SE, CF Industries Holdings Inc, China Petroleum & Chemical Corp, Indian Oil Corp Ltd, Mitsui Chemicals Inc, Nissan Chemical Corp, Royal Dutch Shell plc, TotalEnergies SE, Valvoline Inc.

A significant trend in the Diesel Exhaust Fluid (DEF) Market is the increasing adoption of emission regulations. Governments worldwide are implementing stringent emissions standards to reduce harmful pollutants from diesel engines, leading to a growing demand for DEF, which is used in Selective Catalytic Reduction (SCR) systems to reduce nitrogen oxide (NOx) emissions. With a focus on environmental sustainability and air quality improvement, the automotive industry is witnessing a surge in DEF usage across various vehicle segments, driving market growth and shaping product innovation to meet evolving regulatory requirements.

A key driver in the Diesel Exhaust Fluid (DEF) Market is the expansion of the diesel-powered vehicle fleet. Diesel engines remain a popular choice for commercial vehicles, trucks, buses, and off-road equipment due to their fuel efficiency, towing capacity, and longevity. As the global economy grows and transportation needs increase, there's a corresponding growth in the diesel-powered vehicle fleet, leading to higher DEF consumption. Additionally, the increasing adoption of diesel engines in passenger cars and light-duty vehicles, particularly in regions with stringent emissions regulations, further drives market demand for DEF, fueling market expansion and investment in DEF production and distribution infrastructure.

An enticing opportunity within the Diesel Exhaust Fluid (DEF) Market lies in the development of eco-friendly packaging solutions. As environmental sustainability gains prominence, there's a growing demand for DEF packaging options that minimize environmental impact and reduce carbon footprint. Manufacturers can capitalize on this opportunity by exploring innovative packaging materials such as biodegradable plastics, recyclable containers, or eco-friendly packaging designs that optimize material usage and minimize waste generation. Additionally, offering refillable or returnable packaging options can further enhance sustainability credentials and appeal to environmentally conscious consumers and businesses. By developing eco-friendly packaging solutions, stakeholders in the DEF market can differentiate their products, enhance brand reputation, and contribute to sustainability initiatives in the automotive industry. This presents a strategic opportunity for market differentiation and growth in the dynamic landscape of diesel exhaust fluid solutions.

By Component

SCR Catalysts

DEF Tanks

DEF Injectors

DEF Supply Modules

DEF Sensors

NOx Sensors

By Vehicle

Passenger Cars

LCVs

HCVs

By Application

Construction Equipment

Agricultural Tractors

Diesel Exhaust Fluid Aftermarket

By Supply Mode

Cans & Bottles

IBCs

Bulk

PumpsGeographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa

BASF SE

Brenntag SE

CF Industries Holdings Inc

China Petroleum & Chemical Corp

Indian Oil Corp Ltd

Mitsui Chemicals Inc

Nissan Chemical Corp

Royal Dutch Shell plc

TotalEnergies SE

Valvoline Inc

*- List not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Diesel Exhaust Fluid Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Diesel Exhaust Fluid Market Size Outlook, $ Million, 2021 to 2030

3.2 Diesel Exhaust Fluid Market Outlook by Type, $ Million, 2021 to 2030

3.3 Diesel Exhaust Fluid Market Outlook by Product, $ Million, 2021 to 2030

3.4 Diesel Exhaust Fluid Market Outlook by Application, $ Million, 2021 to 2030

3.5 Diesel Exhaust Fluid Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Diesel Exhaust Fluid Industry

4.2 Key Market Trends in Diesel Exhaust Fluid Industry

4.3 Potential Opportunities in Diesel Exhaust Fluid Industry

4.4 Key Challenges in Diesel Exhaust Fluid Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Diesel Exhaust Fluid Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Diesel Exhaust Fluid Market Outlook by Segments

7.1 Diesel Exhaust Fluid Market Outlook by Segments, $ Million, 2021- 2030

By Component

SCR Catalysts

DEF Tanks

DEF Injectors

DEF Supply Modules

DEF Sensors

NOx Sensors

By Vehicle

Passenger Cars

LCVs

HCVs

By Application

Construction Equipment

Agricultural Tractors

Diesel Exhaust Fluid Aftermarket

By Supply Mode

Cans & Bottles

IBCs

Bulk

Pumps

8 North America Diesel Exhaust Fluid Market Analysis and Outlook To 2030

8.1 Introduction to North America Diesel Exhaust Fluid Markets in 2024

8.2 North America Diesel Exhaust Fluid Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Diesel Exhaust Fluid Market size Outlook by Segments, 2021-2030

By Component

SCR Catalysts

DEF Tanks

DEF Injectors

DEF Supply Modules

DEF Sensors

NOx Sensors

By Vehicle

Passenger Cars

LCVs

HCVs

By Application

Construction Equipment

Agricultural Tractors

Diesel Exhaust Fluid Aftermarket

By Supply Mode

Cans & Bottles

IBCs

Bulk

Pumps

9 Europe Diesel Exhaust Fluid Market Analysis and Outlook To 2030

9.1 Introduction to Europe Diesel Exhaust Fluid Markets in 2024

9.2 Europe Diesel Exhaust Fluid Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Diesel Exhaust Fluid Market Size Outlook by Segments, 2021-2030

By Component

SCR Catalysts

DEF Tanks

DEF Injectors

DEF Supply Modules

DEF Sensors

NOx Sensors

By Vehicle

Passenger Cars

LCVs

HCVs

By Application

Construction Equipment

Agricultural Tractors

Diesel Exhaust Fluid Aftermarket

By Supply Mode

Cans & Bottles

IBCs

Bulk

Pumps

10 Asia Pacific Diesel Exhaust Fluid Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Diesel Exhaust Fluid Markets in 2024

10.2 Asia Pacific Diesel Exhaust Fluid Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Diesel Exhaust Fluid Market size Outlook by Segments, 2021-2030

By Component

SCR Catalysts

DEF Tanks

DEF Injectors

DEF Supply Modules

DEF Sensors

NOx Sensors

By Vehicle

Passenger Cars

LCVs

HCVs

By Application

Construction Equipment

Agricultural Tractors

Diesel Exhaust Fluid Aftermarket

By Supply Mode

Cans & Bottles

IBCs

Bulk

Pumps

11 South America Diesel Exhaust Fluid Market Analysis and Outlook To 2030

11.1 Introduction to South America Diesel Exhaust Fluid Markets in 2024

11.2 South America Diesel Exhaust Fluid Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Diesel Exhaust Fluid Market size Outlook by Segments, 2021-2030

By Component

SCR Catalysts

DEF Tanks

DEF Injectors

DEF Supply Modules

DEF Sensors

NOx Sensors

By Vehicle

Passenger Cars

LCVs

HCVs

By Application

Construction Equipment

Agricultural Tractors

Diesel Exhaust Fluid Aftermarket

By Supply Mode

Cans & Bottles

IBCs

Bulk

Pumps

12 Middle East and Africa Diesel Exhaust Fluid Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Diesel Exhaust Fluid Markets in 2024

12.2 Middle East and Africa Diesel Exhaust Fluid Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Diesel Exhaust Fluid Market size Outlook by Segments, 2021-2030

By Component

SCR Catalysts

DEF Tanks

DEF Injectors

DEF Supply Modules

DEF Sensors

NOx Sensors

By Vehicle

Passenger Cars

LCVs

HCVs

By Application

Construction Equipment

Agricultural Tractors

Diesel Exhaust Fluid Aftermarket

By Supply Mode

Cans & Bottles

IBCs

Bulk

Pumps

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

BASF SE

Brenntag SE

CF Industries Holdings Inc

China Petroleum & Chemical Corp

Indian Oil Corp Ltd

Mitsui Chemicals Inc

Nissan Chemical Corp

Royal Dutch Shell plc

TotalEnergies SE

Valvoline Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Component

SCR Catalysts

DEF Tanks

DEF Injectors

DEF Supply Modules

DEF Sensors

NOx Sensors

By Vehicle

Passenger Cars

LCVs

HCVs

By Application

Construction Equipment

Agricultural Tractors

Diesel Exhaust Fluid Aftermarket

By Supply Mode

Cans & Bottles

IBCs

Bulk

Pumps

The global Diesel Exhaust Fluid Market is one of the lucrative growth markets, poised to register a 8.2% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

BASF SE, Brenntag SE, CF Industries Holdings Inc, China Petroleum & Chemical Corp, Indian Oil Corp Ltd, Mitsui Chemicals Inc, Nissan Chemical Corp, Royal Dutch Shell plc, TotalEnergies SE, Valvoline Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume