The global Cryogenic Valves Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Application (Tanks & Cold Boxes, Liquefiers, Transfer lines, Manifolds & Gas Trains), By Type (Globe Valve, Gate Valve, Check Valve, Ball Valve, Others), By Gas (LNG, Oxygen, Nitrogen, Others), By End-User (Energy & Power, Chemicals, Food & Beverage, Healthcare, Others).

Cryogenic valves are specialized valves designed to control the flow of cryogenic fluids, such as liquid nitrogen, liquid oxygen, and liquefied natural gas (LNG), at extremely low temperatures in 2024. These valves are essential components in cryogenic systems used in industries such as aerospace, energy, healthcare, and research, where cryogenic fluids are stored, transported, and used for various applications. Cryogenic valves must withstand the extreme cold temperatures and high pressures associated with handling cryogenic fluids while maintaining tight sealing and precise flow control. They are constructed from materials such as stainless steel, brass, or nickel alloys that exhibit excellent low-temperature properties, including toughness, ductility, and corrosion resistance. Additionally, cryogenic valves are equipped with special seals, packing materials, and lubricants that remain flexible and functional at cryogenic temperatures to prevent leakage and ensure reliable operation. Common types of cryogenic valves include ball valves, gate valves, globe valves, and check valves, each offering specific advantages depending on the application requirements. Cryogenic valves are subject to rigorous testing and certification standards to ensure safety, reliability, and compliance with industry regulations. With the increasing demand for cryogenic fluids in applications such as liquefied natural gas (LNG) transportation, medical imaging, and superconducting technologies, cryogenic valves play a critical role in enabling the efficient and safe handling of cryogenic fluids across various industries.

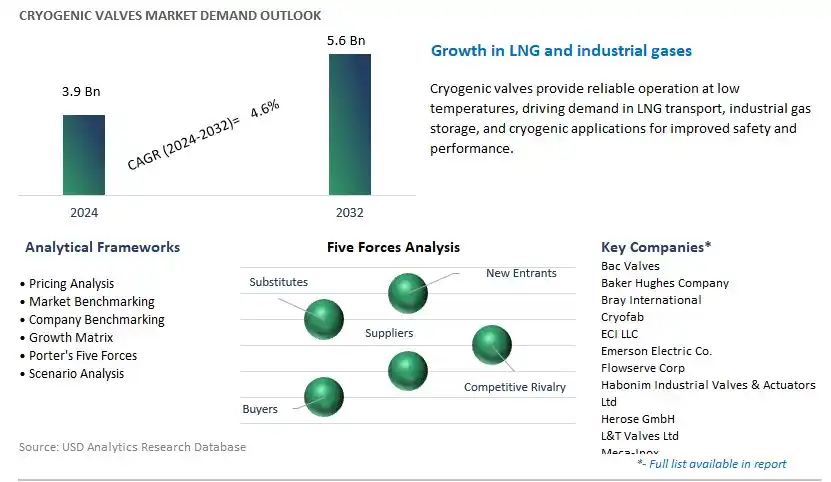

The market report analyses the leading companies in the industry including Bac Valves, Baker Hughes Company, Bray International, Cryofab, ECI LLC, Emerson Electric Co., Flowserve Corp, Habonim Industrial Valves & Actuators Ltd, Herose GmbH, L&T Valves Ltd, Meca-Inox, Parker Hannifin Corp, Powell Valves, Samson AG, Velan Inc, and others.

A prominent trend in the market for cryogenic valves is the ongoing advancements in cryogenic technology, driven by the increasing demand for liquefied natural gas (LNG), industrial gases, and cryogenic applications in healthcare, aerospace, and research. As industries continue to explore and utilize extreme low-temperature environments for storage, transportation, and processing of gases and fluids, there is a growing need for cryogenic valves capable of withstanding ultra-low temperatures and maintaining reliable performance under challenging conditions. Manufacturers are investing in research and development to enhance the design, materials, and sealing technologies of cryogenic valves, enabling them to operate efficiently at temperatures below -150°C (-238°F) and meet the stringent safety and reliability requirements of cryogenic systems. This trend is driving market growth and innovation, with a focus on improving valve performance, durability, and compatibility with diverse cryogenic applications.

The primary driver fueling the demand for cryogenic valves is the expansion of liquefied natural gas (LNG) infrastructure worldwide, driven by the growing demand for cleaner energy sources, energy security, and geopolitical factors. LNG plays a critical role in meeting global energy needs, particularly in regions where access to natural gas pipelines is limited or economically unfeasible. As countries invest in LNG liquefaction plants, storage terminals, marine terminals, and regasification facilities to facilitate the import, export, and distribution of LNG, there is a significant need for cryogenic valves for controlling the flow, pressure, and isolation of LNG and cryogenic fluids throughout the LNG value chain. Cryogenic valves are essential components in LNG processing facilities, storage tanks, LNG carriers, and LNG fueling stations, ensuring safe and efficient operation of cryogenic systems while minimizing the risk of leaks, spills, and equipment failures. With the expansion of LNG infrastructure projects worldwide, the demand for cryogenic valves is expected to rise, driving market growth and investment in valve manufacturing, testing, and certification to meet industry standards and specifications.

An emerging opportunity within the market for cryogenic valves lies in the development of smart valve technologies that offer enhanced monitoring, control, and predictive maintenance capabilities for cryogenic systems. Manufacturers can capitalize on this opportunity by integrating sensors, actuators, and communication technologies into cryogenic valves to enable real-time monitoring of valve performance, flow conditions, and environmental parameters such as temperature, pressure, and fluid composition. By leveraging data analytics, machine learning, and internet of things (IoT) connectivity, smart cryogenic valves can provide valuable insights into system health, operational efficiency, and potential failure risks, allowing operators to optimize valve performance, prevent unplanned downtime, and minimize maintenance costs. Additionally, opportunities exist for developing remote monitoring and control systems that enable operators to remotely operate and diagnose cryogenic valves from a central control center or mobile device, enhancing operational flexibility, safety, and productivity in cryogenic applications. By offering smart valve solutions, manufacturers can meet the evolving needs of cryogenic industry stakeholders, differentiate themselves in the marketplace, and drive adoption of advanced valve technologies in LNG, industrial gases, and cryogenic research applications.

Within the cryogenic valves market segmented by application, the Tanks & Cold Boxes segment is the largest, driven by the critical role these components play in the storage and transportation of liquefied gases at extremely low temperatures. Cryogenic tanks and cold boxes are essential infrastructure components in industries such as healthcare, food processing, and energy, where the storage and handling of liquefied gases like oxygen, nitrogen, and LNG are paramount. These tanks and boxes require robust valves to maintain the integrity of the cryogenic systems, ensuring safe and efficient operations. The demand for cryogenic valves in Tanks & Cold Boxes is further fuelled by the increasing need for cryogenic storage solutions due to the expanding applications of liquefied gases in various sectors. As industries continue to leverage the benefits of cryogenic technology for storage and transportation purposes, the Tanks & Cold Boxes segment maintains its dominance as the largest segment in the cryogenic valves market.

Among the types of cryogenic valves, the Check Valve segment is the fastest-growing, propelled by its crucial role in ensuring safety and reliability in cryogenic systems. Check valves are essential components that permit flow in one direction while preventing reverse flow, crucial for maintaining the integrity of cryogenic pipelines and equipment. In cryogenic applications, where temperatures plunge to extremely low levels, ensuring the prevention of backflow is paramount to avoid potential hazards such as equipment damage or catastrophic failures. As industries increasingly adopt cryogenic technologies for various applications, including medical gases, industrial gases, and liquefied natural gas (LNG), the demand for check valves to safeguard these systems against backflow surges. Moreover, advancements in check valve design and materials have enhanced their performance in cryogenic environments, further driving their adoption. As safety and reliability remain top priorities in cryogenic operations, the Check Valve segment is poised for rapid growth in the cryogenic valves market.

Within the cryogenic valves market segmented by gas type, LNG is the largest segment, driven by the rapid expansion of liquefied natural gas (LNG) infrastructure globally. LNG has emerged as a crucial alternative energy source due to its lower environmental impact and increased availability compared to traditional fossil fuels. Cryogenic valves play a pivotal role in LNG processing, storage, and transportation, ensuring the safe and efficient handling of liquefied natural gas at extremely low temperatures. With the growing demand for cleaner energy sources and the ongoing development of LNG export terminals and liquefaction plants worldwide, the demand for cryogenic valves tailored for LNG applications continues to surge. Moreover, the versatility of LNG in various sectors, including power generation, transportation, and industrial applications, further bolsters the dominance of the LNG segment in the cryogenic valves market. As nations strive to reduce carbon emissions and transition towards cleaner energy solutions, the LNG segment is poised to maintain its position as the largest and most significant segment in the cryogenic valves market.

Among the segments categorized by end-users in the cryogenic valves market, the Healthcare sector is the fastest-growing segment, fuelled by advancements in medical technology and the expanding applications of cryogenic systems in healthcare settings. Cryogenic valves play a vital role in medical gas delivery systems, cryosurgery equipment, and cryopreservation applications, ensuring precise control and safe handling of extremely low-temperature gases such as liquid oxygen and nitrogen. With the growing demand for medical gases in hospitals, research laboratories, and biotechnology facilities, there is an increasing need for reliable and efficient cryogenic valves to support these critical applications. Additionally, the rise in demand for cryogenic storage solutions for biological samples, vaccines, and pharmaceuticals further drives the growth of cryogenic valves in the healthcare sector. As medical advancements continue to drive innovation and demand for cryogenic applications in healthcare, the Healthcare segment is poised for rapid expansion in the cryogenic valves market.

By Application

Tanks & Cold Boxes

Liquefiers

Transfer lines

Manifolds & Gas Trains

By Type

Globe Valve

Gate Valve

Check Valve

Ball Valve

Others

By Gas

LNG

Oxygen

Nitrogen

Others

By End-User

Energy & Power

Chemicals

Food & Beverage

Healthcare

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Bac Valves

Baker Hughes Company

Bray International

Cryofab

ECI LLC

Emerson Electric Co.

Flowserve Corp

Habonim Industrial Valves & Actuators Ltd

Herose GmbH

L&T Valves Ltd

Meca-Inox

Parker Hannifin Corp

Powell Valves

Samson AG

Velan Inc

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Cryogenic Valves Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Cryogenic Valves Market Size Outlook, $ Million, 2021 to 2032

3.2 Cryogenic Valves Market Outlook by Type, $ Million, 2021 to 2032

3.3 Cryogenic Valves Market Outlook by Product, $ Million, 2021 to 2032

3.4 Cryogenic Valves Market Outlook by Application, $ Million, 2021 to 2032

3.5 Cryogenic Valves Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Cryogenic Valves Industry

4.2 Key Market Trends in Cryogenic Valves Industry

4.3 Potential Opportunities in Cryogenic Valves Industry

4.4 Key Challenges in Cryogenic Valves Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Cryogenic Valves Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Cryogenic Valves Market Outlook by Segments

7.1 Cryogenic Valves Market Outlook by Segments, $ Million, 2021- 2032

By Application

Tanks & Cold Boxes

Liquefiers

Transfer lines

Manifolds & Gas Trains

By Type

Globe Valve

Gate Valve

Check Valve

Ball Valve

Others

By Gas

LNG

Oxygen

Nitrogen

Others

By End-User

Energy & Power

Chemicals

Food & Beverage

Healthcare

Others

8 North America Cryogenic Valves Market Analysis and Outlook To 2032

8.1 Introduction to North America Cryogenic Valves Markets in 2024

8.2 North America Cryogenic Valves Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Cryogenic Valves Market size Outlook by Segments, 2021-2032

By Application

Tanks & Cold Boxes

Liquefiers

Transfer lines

Manifolds & Gas Trains

By Type

Globe Valve

Gate Valve

Check Valve

Ball Valve

Others

By Gas

LNG

Oxygen

Nitrogen

Others

By End-User

Energy & Power

Chemicals

Food & Beverage

Healthcare

Others

9 Europe Cryogenic Valves Market Analysis and Outlook To 2032

9.1 Introduction to Europe Cryogenic Valves Markets in 2024

9.2 Europe Cryogenic Valves Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Cryogenic Valves Market Size Outlook by Segments, 2021-2032

By Application

Tanks & Cold Boxes

Liquefiers

Transfer lines

Manifolds & Gas Trains

By Type

Globe Valve

Gate Valve

Check Valve

Ball Valve

Others

By Gas

LNG

Oxygen

Nitrogen

Others

By End-User

Energy & Power

Chemicals

Food & Beverage

Healthcare

Others

10 Asia Pacific Cryogenic Valves Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Cryogenic Valves Markets in 2024

10.2 Asia Pacific Cryogenic Valves Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Cryogenic Valves Market size Outlook by Segments, 2021-2032

By Application

Tanks & Cold Boxes

Liquefiers

Transfer lines

Manifolds & Gas Trains

By Type

Globe Valve

Gate Valve

Check Valve

Ball Valve

Others

By Gas

LNG

Oxygen

Nitrogen

Others

By End-User

Energy & Power

Chemicals

Food & Beverage

Healthcare

Others

11 South America Cryogenic Valves Market Analysis and Outlook To 2032

11.1 Introduction to South America Cryogenic Valves Markets in 2024

11.2 South America Cryogenic Valves Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Cryogenic Valves Market size Outlook by Segments, 2021-2032

By Application

Tanks & Cold Boxes

Liquefiers

Transfer lines

Manifolds & Gas Trains

By Type

Globe Valve

Gate Valve

Check Valve

Ball Valve

Others

By Gas

LNG

Oxygen

Nitrogen

Others

By End-User

Energy & Power

Chemicals

Food & Beverage

Healthcare

Others

12 Middle East and Africa Cryogenic Valves Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Cryogenic Valves Markets in 2024

12.2 Middle East and Africa Cryogenic Valves Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Cryogenic Valves Market size Outlook by Segments, 2021-2032

By Application

Tanks & Cold Boxes

Liquefiers

Transfer lines

Manifolds & Gas Trains

By Type

Globe Valve

Gate Valve

Check Valve

Ball Valve

Others

By Gas

LNG

Oxygen

Nitrogen

Others

By End-User

Energy & Power

Chemicals

Food & Beverage

Healthcare

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Bac Valves

Baker Hughes Company

Bray International

Cryofab

ECI LLC

Emerson Electric Co.

Flowserve Corp

Habonim Industrial Valves & Actuators Ltd

Herose GmbH

L&T Valves Ltd

Meca-Inox

Parker Hannifin Corp

Powell Valves

Samson AG

Velan Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Application

Tanks & Cold Boxes

Liquefiers

Transfer lines

Manifolds & Gas Trains

By Type

Globe Valve

Gate Valve

Check Valve

Ball Valve

Others

By Gas

LNG

Oxygen

Nitrogen

Others

By End-User

Energy & Power

Chemicals

Food & Beverage

Healthcare

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Cryogenic Valves Market Size is valued at $3.9 Billion in 2024 and is forecast to register a growth rate (CAGR) of 4.6% to reach $5.6 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Bac Valves, Baker Hughes Company, Bray International, Cryofab, ECI LLC, Emerson Electric Co., Flowserve Corp, Habonim Industrial Valves & Actuators Ltd, Herose GmbH, L&T Valves Ltd, Meca-Inox, Parker Hannifin Corp, Powell Valves, Samson AG, Velan Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume