The Critical Illness Insurance Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Premium (Monthly, Quarterly, Half Yearly, Yearly), By Disease (Cancer, Heart Attack, Stroke, Major Organ Transplant, Others), By Type (Individual Insurance, Family Insurance).

The Critical Illness Insurance market in 2024 addresses the demand for financial protection and risk management solutions against the financial impact of serious illnesses and medical emergencies. Critical illness insurance policies provide lump-sum payments to policyholders diagnosed with covered conditions such as cancer, heart attack, stroke, organ failure, or major injuries, offering financial support for medical expenses, lost income, and other related costs. Market dynamics are driven by factors such as the increasing prevalence of chronic diseases, rising healthcare costs, and the need for supplemental insurance coverage beyond traditional health insurance. Collaboration between insurance companies, healthcare providers, and policyholders drives innovation and market growth in critical illness insurance, providing individuals and families with peace of mind and financial security in the face of unforeseen health crises.

A significant trend in the Critical Illness Insurance market is the rising awareness and adoption of critical illness insurance policies. With growing concerns about the financial burden associated with medical emergencies, more individuals are recognizing the importance of having comprehensive insurance coverage. Critical illness insurance provides policyholders with a lump-sum payment upon diagnosis of a covered illness, offering financial support to cover medical expenses, loss of income, and other related costs. As people become more aware of the benefits of critical illness insurance in safeguarding their financial well-being, the demand for such policies is expected to continue increasing.

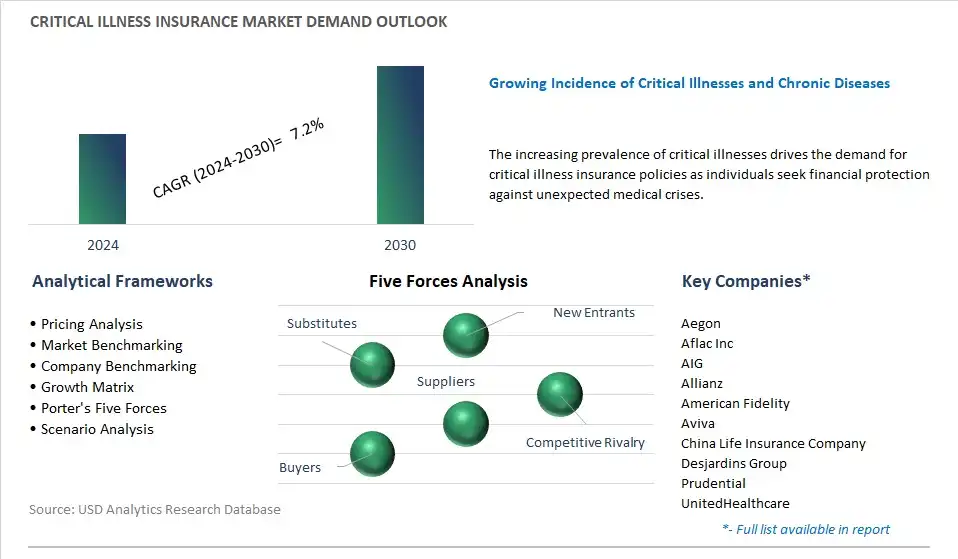

The primary driver for the Critical Illness Insurance market is the escalating incidence of critical illnesses and chronic diseases worldwide. Factors such as aging populations, changing lifestyles, and environmental factors contribute to the rising prevalence of conditions like cancer, heart disease, stroke, and diabetes. As these diseases impose significant financial burdens on individuals and families due to high treatment costs and long-term care needs, there is a growing recognition of the importance of having adequate insurance coverage. The increasing prevalence of critical illnesses drives the demand for critical illness insurance policies as individuals seek financial protection against unexpected medical crises.

An opportunity in the Critical Illness Insurance market lies in the development of customized and innovative insurance products tailored to specific demographics and healthcare needs. Insurers can differentiate themselves by offering policies with unique features such as coverage for rare diseases, personalized risk assessments, and wellness programs aimed at disease prevention and early detection. Additionally, leveraging advancements in technology, such as wearable devices and telemedicine services, can enable insurers to enhance the value proposition of their critical illness insurance offerings. By innovating and adapting to evolving consumer preferences and healthcare trends, insurers can tap into new market segments and strengthen their competitive position in the critical illness insurance market.

By Premium Type

Monthly

Quarterly

Half Yearly

Yearly

By Disease

Cancer

Heart Attack

Stroke

Major Organ Transplant

Others

By Type

Individual Insurance

Family Insurance

Geographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Aegon

Aflac Inc

AIG

Allianz

American Fidelity

Aviva

China Life Insurance Company

Desjardins Group

Prudential

UnitedHealthcare

• Deepen your industry insights and navigate uncertainties for strategy formulation, CAPEX, and Operational decisions

• Gain access to detailed insights on the Critical Illness Insurance Market, encompassing current market size, growth trends, and forecasts till 2030.

• Access detailed competitor analysis, enabling competitive advantage through a thorough understanding of market players, strategies, and potential differentiation opportunities

• Stay ahead of the curve with insights on technological advancements, innovations, and upcoming trends

• Identify lucrative investment avenues and expansion opportunities within the Critical Illness Insurance Market industry, guided by robust, data-backed analysis.

• Understand regional and global markets through country-wise analysis, regional market potential, regulatory nuances, and dynamics

• Execute strategies with confidence and speed through information, analytics, and insights on the industry value chain

• Corporate leaders, strategists, financial experts, shareholders, asset managers, and governmental representatives can make long-term planning scenarios and build an integrated and timely understanding of market dynamics

• Benefit from tailored solutions and expert consultation based on report insights, providing personalized strategies aligned with specific business needs.

TABLE OF CONTENTS

1 Introduction to 2024 Critical Illness Insurance Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Critical Illness Insurance Market Size Outlook, $ Million, 2021 to 2030

3.2 Critical Illness Insurance Market Outlook by Type, $ Million, 2021 to 2030

3.3 Critical Illness Insurance Market Outlook by Product, $ Million, 2021 to 2030

3.4 Critical Illness Insurance Market Outlook by Application, $ Million, 2021 to 2030

3.5 Critical Illness Insurance Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Critical Illness Insurance Market Industry

4.2 Key Market Trends in Critical Illness Insurance Market Industry

4.3 Potential Opportunities in Critical Illness Insurance Market Industry

4.4 Key Challenges in Critical Illness Insurance Market Industry

5 Market Factor Analysis

5.1 Competitive Landscape

5.1.1 Global Critical Illness Insurance Market Share by Company (%), 2023

5.1.2 Product Offerings by Company

5.2 Porter’s Five Forces Analysis

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Critical Illness Insurance Market Outlook By Segments

7.1 Critical Illness Insurance Market Outlook by Segments

By Premium Type

Monthly

Quarterly

Half Yearly

Yearly

By Disease

Cancer

Heart Attack

Stroke

Major Organ Transplant

Others

By Type

Individual Insurance

Family Insurance

8 North America Critical Illness Insurance Market Analysis And Outlook To 2030

8.1 Introduction to North America Critical Illness Insurance Markets in 2024

8.2 North America Critical Illness Insurance Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Critical Illness Insurance Market size Outlook by Segments, 2021-2030

By Premium Type

Monthly

Quarterly

Half Yearly

Yearly

By Disease

Cancer

Heart Attack

Stroke

Major Organ Transplant

Others

By Type

Individual Insurance

Family Insurance

9 Europe Critical Illness Insurance Market Analysis And Outlook To 2030

9.1 Introduction to Europe Critical Illness Insurance Markets in 2024

9.2 Europe Critical Illness Insurance Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Critical Illness Insurance Market Size Outlook By Segments, 2021-2030

By Premium Type

Monthly

Quarterly

Half Yearly

Yearly

By Disease

Cancer

Heart Attack

Stroke

Major Organ Transplant

Others

By Type

Individual Insurance

Family Insurance

10 Asia Pacific Critical Illness Insurance Market Analysis And Outlook To 2030

10.1 Introduction to Asia Pacific Critical Illness Insurance Markets in 2024

10.2 Asia Pacific Critical Illness Insurance Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Critical Illness Insurance Market size Outlook by Segments, 2021-2030

By Premium Type

Monthly

Quarterly

Half Yearly

Yearly

By Disease

Cancer

Heart Attack

Stroke

Major Organ Transplant

Others

By Type

Individual Insurance

Family Insurance

11 South America Critical Illness Insurance Market Analysis And Outlook To 2030

11.1 Introduction to South America Critical Illness Insurance Markets in 2024

11.2 South America Critical Illness Insurance Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Critical Illness Insurance Market size Outlook by Segments, 2021-2030

By Premium Type

Monthly

Quarterly

Half Yearly

Yearly

By Disease

Cancer

Heart Attack

Stroke

Major Organ Transplant

Others

By Type

Individual Insurance

Family Insurance

12 Middle East And Africa Critical Illness Insurance Market Analysis And Outlook To 2030

12.1 Introduction to Middle East and Africa Critical Illness Insurance Markets in 2024

12.2 Middle East and Africa Critical Illness Insurance Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Critical Illness Insurance Market size Outlook by Segments, 2021-2030

By Premium Type

Monthly

Quarterly

Half Yearly

Yearly

By Disease

Cancer

Heart Attack

Stroke

Major Organ Transplant

Others

By Type

Individual Insurance

Family Insurance

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

Aegon

Aflac Inc

AIG

Allianz

American Fidelity

Aviva

China Life Insurance Company

Desjardins Group

Prudential

UnitedHealthcare

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Premium Type

Monthly

Quarterly

Half Yearly

Yearly

By Disease

Cancer

Heart Attack

Stroke

Major Organ Transplant

Others

By Type

Individual Insurance

Family Insurance

The global Critical Illness Insurance Market is one of the lucrative growth markets, poised to register a 7.2% growth (CAGR) between 2024 and 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Aegon, Aflac Inc, AIG, Allianz, American Fidelity, Aviva, China Life Insurance Company, Desjardins Group, Prudential, UnitedHealthcare

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume