The global Cosmetic Preservatives Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Paraben Esters, Formaldehyde Donors, Phenol Derivatives, Alcohols, Inorganics, Quaternary Compounds, Organic Acids & Their Salts, Others), By Application (Lotions, Facemasks, Sunscreens, Shampoos, Soaps, Shower Cleansers, Face Powders, Mouthwashes, Others).

Cosmetic preservatives are additives used in cosmetic and personal care products to prevent microbial growth, spoilage, and contamination, thereby ensuring product safety, stability, and shelf-life. The market for cosmetic preservatives is driven by regulatory requirements, consumer safety concerns, and the need to maintain product integrity throughout its lifecycle. Cosmetic products, including creams, lotions, shampoos, and makeup, contain water and other ingredients that can support microbial growth, making preservatives essential to prevent bacterial, fungal, and mold contamination. Common types of cosmetic preservatives include parabens, formaldehyde-releasing agents, phenols, and organic acids, each offering specific antimicrobial properties and compatibility with different formulations. These preservatives are used at varying concentrations depending on the product's pH, water content, and intended use. Further, advancements in preservative technology, such as natural and eco-friendly alternatives, preservative blends, and multifunctional additives, are driving innovation and market growth within the cosmetic preservatives industry. As consumers demand safer and more natural cosmetic formulations, preservative manufacturers to develop effective and regulatory-compliant solutions that meet industry standards and consumer expectations for product safety and quality.

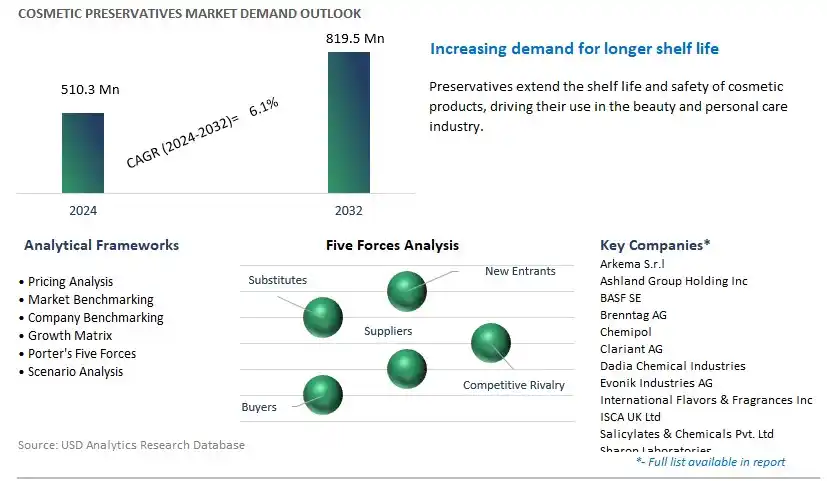

The market report analyses the leading companies in the industry including Arkema S.r.l, Ashland Group Holding Inc, BASF SE, Brenntag AG, Chemipol, Clariant AG, Dadia Chemical Industries, Evonik Industries AG, International Flavors & Fragrances Inc, ISCA UK Ltd, Salicylates & Chemicals Pvt. Ltd, Sharon Laboratories, Symrise AG, The Dow Chemical Company, Thor Group Ltd, and others.

A significant trend in the cosmetic preservatives market is the rising demand for natural and clean label cosmetic preservatives. With increasing consumer awareness of ingredient safety and transparency, there is a growing preference for cosmetic products formulated with natural, plant-based, and environmentally-friendly preservatives. Consumers are seeking products free from synthetic chemicals such as parabens, formaldehyde-releasing agents, and phenoxyethanol, leading cosmetic brands to reformulate their products with alternative preservative systems derived from botanical extracts, essential oils, and fermentation technologies. This trend is reshaping the cosmetic preservatives market, driving manufacturers to innovate and develop natural preservative solutions that offer effective antimicrobial properties while meeting the safety and regulatory requirements of the beauty and personal care industry.

The market for cosmetic preservatives is driven by stringent regulatory requirements and consumer safety concerns regarding microbial contamination and product stability. Regulatory agencies such as the FDA (Food and Drug Administration) and the European Commission impose strict guidelines and standards for cosmetic product safety, including the use of preservatives to prevent microbial growth and ensure product efficacy and stability throughout shelf life. Additionally, consumer safety concerns regarding the potential health risks associated with microbial contamination, such as bacterial growth and mold formation, drive the demand for effective preservative systems in cosmetic formulations. Manufacturers are under pressure to comply with regulatory requirements and address consumer safety concerns by incorporating safe and efficacious preservatives into their cosmetic products, driving the growth of the cosmetic preservatives market as brands prioritize product quality and consumer protection.

An opportunity for market expansion in the cosmetic preservatives industry lies in the development of multifunctional and synergistic preservative systems. While traditional preservatives primarily focus on antimicrobial protection, there is potential to innovate and enhance preservative formulations to offer additional functional benefits and synergistic effects. For example, there is an opportunity to develop preservative systems that not only provide broad-spectrum antimicrobial activity but also offer antioxidant, anti-inflammatory, and skin conditioning properties to enhance the overall performance and consumer appeal of cosmetic products. Additionally, there is potential to explore synergistic combinations of preservatives and natural antimicrobial agents, as well as preservative boosters and stabilizers, to improve preservative efficacy, reduce reliance on single active ingredients, and minimize the risk of microbial resistance. By investing in research and development and collaborating with industry partners, manufacturers of cosmetic preservatives can capitalize on the growing demand for multifunctional and synergistic preservative solutions, differentiate their products in the market, and meet the evolving needs of cosmetic formulators and brands for safe, effective, and multifaceted preservation of beauty and personal care products.

In the cosmetic preservatives market, the paraben esters segment is the largest segment, commanding a significant share of the market. In particular, paraben esters, such as methylparaben and propylparaben, have been widely used as preservatives in cosmetics and personal care products for decades due to their effective antimicrobial properties and broad-spectrum activity against bacteria, yeast, and mold. Additionally, paraben esters are cost-effective, readily available, and compatible with a wide range of cosmetic formulations, including creams, lotions, shampoos, and makeup products. Moreover, paraben esters exhibit excellent stability and solubility in water and oil phases, making them suitable for use in various cosmetic formulations without affecting product texture or performance. Furthermore, the safety profile of paraben esters has been extensively studied and approved by regulatory authorities worldwide, further contributing to their widespread acceptance and use in the cosmetics industry. As cosmetic manufacturers continue to prioritize product safety, efficacy, and regulatory compliance, the paraben esters segment is expected to maintain its leading position in the cosmetic preservatives market.

In the cosmetic preservatives market, the sunscreens segment is the fastest-growing segment. In particular, sunscreens are essential skincare products designed to protect the skin from harmful UV radiation, including UVA and UVB rays, which can cause sunburn, premature aging, and skin cancer. As awareness of the damaging effects of UV exposure increases and the importance of sun protection becomes ingrained in skincare routines, the demand for sunscreens continues to rise globally. Additionally, sunscreens often contain water-based or oil-based formulations with complex ingredient compositions, making them susceptible to microbial contamination and degradation over time. Therefore, the inclusion of effective preservatives in sunscreen formulations is crucial to ensure product stability, shelf-life, and safety for consumers. Moreover, the trend towards multifunctional sunscreens, incorporating additional skincare benefits such as moisturization, antioxidant protection, and anti-aging properties, further drives the need for robust preservative systems to maintain product integrity and efficacy. Furthermore, the regulatory requirements for sunscreen products, including compliance with sunscreen monograph standards and SPF (Sun Protection Factor) testing, necessitate the use of preservatives to ensure product safety and regulatory compliance. As consumers prioritize sun protection and demand innovative sunscreen formulations with enhanced performance and stability, the sunscreens segment is expected to experience rapid growth and adoption in the cosmetic preservatives market.

By Type

Paraben Esters

Formaldehyde Donors

Phenol Derivatives

Alcohols

Inorganics

Quaternary Compounds

Organic Acids & Their Salts

Others

By Application

Lotions

Facemasks

Sunscreens

Shampoos

Soaps

Shower Cleansers

Face Powders

Mouthwashes

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Arkema S.r.l

Ashland Group Holding Inc

BASF SE

Brenntag AG

Chemipol

Clariant AG

Dadia Chemical Industries

Evonik Industries AG

International Flavors & Fragrances Inc

ISCA UK Ltd

Salicylates & Chemicals Pvt. Ltd

Sharon Laboratories

Symrise AG

The Dow Chemical Company

Thor Group Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Cosmetic Preservatives Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Cosmetic Preservatives Market Size Outlook, $ Million, 2021 to 2032

3.2 Cosmetic Preservatives Market Outlook by Type, $ Million, 2021 to 2032

3.3 Cosmetic Preservatives Market Outlook by Product, $ Million, 2021 to 2032

3.4 Cosmetic Preservatives Market Outlook by Application, $ Million, 2021 to 2032

3.5 Cosmetic Preservatives Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Cosmetic Preservatives Industry

4.2 Key Market Trends in Cosmetic Preservatives Industry

4.3 Potential Opportunities in Cosmetic Preservatives Industry

4.4 Key Challenges in Cosmetic Preservatives Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Cosmetic Preservatives Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Cosmetic Preservatives Market Outlook by Segments

7.1 Cosmetic Preservatives Market Outlook by Segments, $ Million, 2021- 2032

By Type

Paraben Esters

Formaldehyde Donors

Phenol Derivatives

Alcohols

Inorganics

Quaternary Compounds

Organic Acids & Their Salts

Others

By Application

Lotions

Facemasks

Sunscreens

Shampoos

Soaps

Shower Cleansers

Face Powders

Mouthwashes

Others

8 North America Cosmetic Preservatives Market Analysis and Outlook To 2032

8.1 Introduction to North America Cosmetic Preservatives Markets in 2024

8.2 North America Cosmetic Preservatives Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Cosmetic Preservatives Market size Outlook by Segments, 2021-2032

By Type

Paraben Esters

Formaldehyde Donors

Phenol Derivatives

Alcohols

Inorganics

Quaternary Compounds

Organic Acids & Their Salts

Others

By Application

Lotions

Facemasks

Sunscreens

Shampoos

Soaps

Shower Cleansers

Face Powders

Mouthwashes

Others

9 Europe Cosmetic Preservatives Market Analysis and Outlook To 2032

9.1 Introduction to Europe Cosmetic Preservatives Markets in 2024

9.2 Europe Cosmetic Preservatives Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Cosmetic Preservatives Market Size Outlook by Segments, 2021-2032

By Type

Paraben Esters

Formaldehyde Donors

Phenol Derivatives

Alcohols

Inorganics

Quaternary Compounds

Organic Acids & Their Salts

Others

By Application

Lotions

Facemasks

Sunscreens

Shampoos

Soaps

Shower Cleansers

Face Powders

Mouthwashes

Others

10 Asia Pacific Cosmetic Preservatives Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Cosmetic Preservatives Markets in 2024

10.2 Asia Pacific Cosmetic Preservatives Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Cosmetic Preservatives Market size Outlook by Segments, 2021-2032

By Type

Paraben Esters

Formaldehyde Donors

Phenol Derivatives

Alcohols

Inorganics

Quaternary Compounds

Organic Acids & Their Salts

Others

By Application

Lotions

Facemasks

Sunscreens

Shampoos

Soaps

Shower Cleansers

Face Powders

Mouthwashes

Others

11 South America Cosmetic Preservatives Market Analysis and Outlook To 2032

11.1 Introduction to South America Cosmetic Preservatives Markets in 2024

11.2 South America Cosmetic Preservatives Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Cosmetic Preservatives Market size Outlook by Segments, 2021-2032

By Type

Paraben Esters

Formaldehyde Donors

Phenol Derivatives

Alcohols

Inorganics

Quaternary Compounds

Organic Acids & Their Salts

Others

By Application

Lotions

Facemasks

Sunscreens

Shampoos

Soaps

Shower Cleansers

Face Powders

Mouthwashes

Others

12 Middle East and Africa Cosmetic Preservatives Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Cosmetic Preservatives Markets in 2024

12.2 Middle East and Africa Cosmetic Preservatives Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Cosmetic Preservatives Market size Outlook by Segments, 2021-2032

By Type

Paraben Esters

Formaldehyde Donors

Phenol Derivatives

Alcohols

Inorganics

Quaternary Compounds

Organic Acids & Their Salts

Others

By Application

Lotions

Facemasks

Sunscreens

Shampoos

Soaps

Shower Cleansers

Face Powders

Mouthwashes

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Arkema S.r.l

Ashland Group Holding Inc

BASF SE

Brenntag AG

Chemipol

Clariant AG

Dadia Chemical Industries

Evonik Industries AG

International Flavors & Fragrances Inc

ISCA UK Ltd

Salicylates & Chemicals Pvt. Ltd

Sharon Laboratories

Symrise AG

The Dow Chemical Company

Thor Group Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Paraben Esters

Formaldehyde Donors

Phenol Derivatives

Alcohols

Inorganics

Quaternary Compounds

Organic Acids & Their Salts

Others

By Application

Lotions

Facemasks

Sunscreens

Shampoos

Soaps

Shower Cleansers

Face Powders

Mouthwashes

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Cosmetic Preservatives Market Size is valued at $510.3 Million in 2024 and is forecast to register a growth rate (CAGR) of 6.1% to reach $819.5 Million by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Arkema S.r.l, Ashland Group Holding Inc, BASF SE, Brenntag AG, Chemipol, Clariant AG, Dadia Chemical Industries, Evonik Industries AG, International Flavors & Fragrances Inc, ISCA UK Ltd, Salicylates & Chemicals Pvt. Ltd, Sharon Laboratories, Symrise AG, The Dow Chemical Company, Thor Group Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume