The global Copper In Electric Vehicle Charging Infrastructure Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Charge Ports (Level 1, Level 2), By End-User (Commercial Charging Station, Private Charging Station).

In the market for copper in electric vehicle (EV) charging infrastructure, the future is marked by the rapid expansion of EV adoption, technological advancements, and regulatory initiatives driving demand for efficient and reliable charging solutions. Copper is a critical component in EV charging infrastructure, including charging cables, connectors, and charging stations, due to its excellent electrical conductivity, thermal performance, and durability. Key trends shaping this industry include the development of high-power charging systems to reduce charging time and improve convenience for EV owners, the deployment of smart charging networks with advanced communication and control capabilities to optimize grid integration and energy management, and the integration of renewable energy sources such as solar and wind to power EV charging stations sustainably. As governments and utilities invest in expanding EV charging infrastructure to support electrification goals and enhance transportation sustainability, the demand for copper in EV charging systems is expected to grow significantly, driving market growth and innovation.

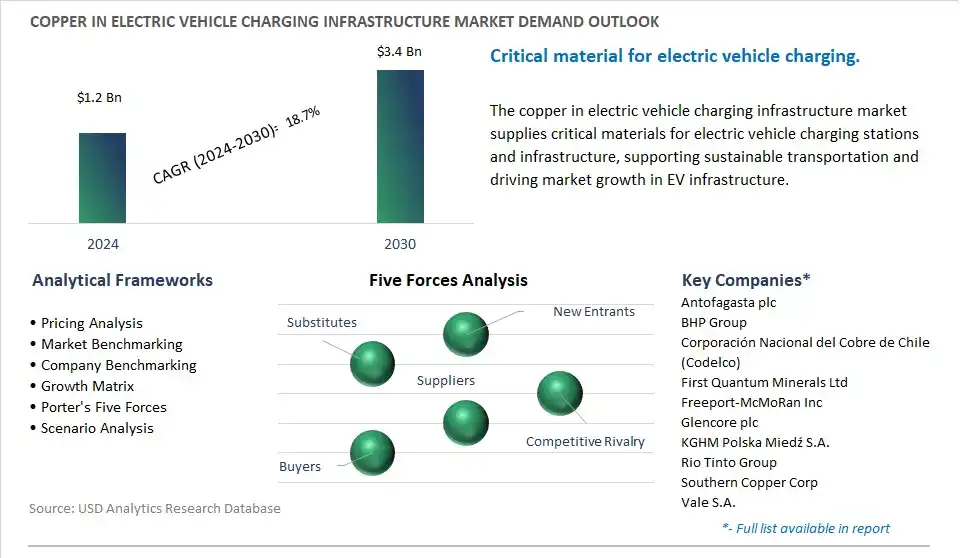

The market report analyses the leading companies in the industry including Antofagasta plc, BHP Group, Corporación Nacional del Cobre de Chile (Codelco), First Quantum Minerals Ltd, Freeport-McMoRan Inc, Glencore plc, KGHM Polska Miedź S.A., Rio Tinto Group, Southern Copper Corp, Vale S.A..

One prominent market trend in the copper in electric vehicle charging infrastructure industry is the expansion of electric vehicle charging infrastructure worldwide. With the increasing adoption of electric vehicles and government initiatives to support sustainable transportation, there is a growing need for robust and efficient charging infrastructure to accommodate the growing number of electric vehicles on the road. Copper plays a critical role in electric vehicle charging infrastructure, as it is used in conductors, connectors, and components of charging stations to ensure reliable power transmission and efficient charging. As governments, utilities, and private companies invest in the deployment of charging stations in urban areas, highways, and public spaces, the demand for copper in electric vehicle charging infrastructure is expected to rise, driving market growth and opportunities for copper suppliers and manufacturers.

A key driver in the copper in electric vehicle charging infrastructure market is government funding and incentives aimed at promoting electric vehicle adoption and supporting the development of charging infrastructure. Governments around the world are implementing policies, grants, tax incentives, and subsidies to accelerate the deployment of electric vehicle charging stations and facilitate the transition to electric mobility. Funding programs such as the Volkswagen Electrify America initiative in the United States and the European Union's Clean Vehicles Directive provide financial support for the installation of charging infrastructure, including fast chargers and ultra-fast chargers, in key locations. Government support creates a favorable environment for the expansion of electric vehicle charging infrastructure, driving the demand for copper components and materials used in charging stations.

One potential opportunity in the copper in electric vehicle charging infrastructure market lies in innovation in high-power charging technologies. As electric vehicle technology advances and battery capacities increase, there is a growing demand for fast and ultra-fast charging solutions that reduce charging time and improve convenience for electric vehicle drivers. Copper's excellent conductivity and heat dissipation properties make it ideal for high-power charging applications, enabling efficient power transmission and minimizing energy loss during charging. Innovations such as liquid-cooled cables, high-power connectors, and smart charging systems offer opportunities to enhance the performance and reliability of electric vehicle charging infrastructure while optimizing the use of copper materials. By investing in research and development of high-power charging technologies, manufacturers can capitalize on the growing demand for fast charging solutions and position themselves as leaders in the electric vehicle charging infrastructure market.

Copper's significance in the Electric Vehicle (EV) charging infrastructure market is evident throughout its Market Ecosystem. It commences with Copper Mining and Refining by entities including Freeport-McMoRan Inc. and BHP Group Ltd., which extract and refine copper ore into usable forms. Optionally, Copper Mills including Wieland Werke AG and Aurubis AG convert refined copper into semi-finished products including rods and wires. Component Manufacturing involves Cable Manufacturers including Prysmian Group S.p.A. and Transformer Manufacturers including ABB Ltd, which utilize copper in cables and transformers crucial for power transmission and voltage adjustment in charging stations. Additionally, Other Component Manufacturers produce copper-containing components including busbars and connectors, while Charging Station Manufacturers including ABB Ltd and ChargePoint Holdings Inc. integrate these components into complete charging stations.

By Charge Ports

Level 1

Level 2

By End-User

Commercial Charging Station

Private Charging Station

Antofagasta plc

BHP Group

Corporación Nacional del Cobre de Chile (Codelco)

First Quantum Minerals Ltd

Freeport-McMoRan Inc

Glencore plc

KGHM Polska Miedź S.A.

Rio Tinto Group

Southern Copper Corp

Vale S.A.

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Copper In Electric Vehicle Charging Infrastructure Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Copper In Electric Vehicle Charging Infrastructure Market Size Outlook, $ Million, 2021 to 2030

3.2 Copper In Electric Vehicle Charging Infrastructure Market Outlook by Type, $ Million, 2021 to 2030

3.3 Copper In Electric Vehicle Charging Infrastructure Market Outlook by Product, $ Million, 2021 to 2030

3.4 Copper In Electric Vehicle Charging Infrastructure Market Outlook by Application, $ Million, 2021 to 2030

3.5 Copper In Electric Vehicle Charging Infrastructure Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Copper In Electric Vehicle Charging Infrastructure Industry

4.2 Key Market Trends in Copper In Electric Vehicle Charging Infrastructure Industry

4.3 Potential Opportunities in Copper In Electric Vehicle Charging Infrastructure Industry

4.4 Key Challenges in Copper In Electric Vehicle Charging Infrastructure Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Copper In Electric Vehicle Charging Infrastructure Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Copper In Electric Vehicle Charging Infrastructure Market Outlook by Segments

7.1 Copper In Electric Vehicle Charging Infrastructure Market Outlook by Segments, $ Million, 2021- 2030

By Charge Ports

Level 1

Level 2

By End-User

Commercial Charging Station

Private Charging Station

8 North America Copper In Electric Vehicle Charging Infrastructure Market Analysis and Outlook To 2030

8.1 Introduction to North America Copper In Electric Vehicle Charging Infrastructure Markets in 2024

8.2 North America Copper In Electric Vehicle Charging Infrastructure Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Copper In Electric Vehicle Charging Infrastructure Market size Outlook by Segments, 2021-2030

By Charge Ports

Level 1

Level 2

By End-User

Commercial Charging Station

Private Charging Station

9 Europe Copper In Electric Vehicle Charging Infrastructure Market Analysis and Outlook To 2030

9.1 Introduction to Europe Copper In Electric Vehicle Charging Infrastructure Markets in 2024

9.2 Europe Copper In Electric Vehicle Charging Infrastructure Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Copper In Electric Vehicle Charging Infrastructure Market Size Outlook by Segments, 2021-2030

By Charge Ports

Level 1

Level 2

By End-User

Commercial Charging Station

Private Charging Station

10 Asia Pacific Copper In Electric Vehicle Charging Infrastructure Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Copper In Electric Vehicle Charging Infrastructure Markets in 2024

10.2 Asia Pacific Copper In Electric Vehicle Charging Infrastructure Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Copper In Electric Vehicle Charging Infrastructure Market size Outlook by Segments, 2021-2030

By Charge Ports

Level 1

Level 2

By End-User

Commercial Charging Station

Private Charging Station

11 South America Copper In Electric Vehicle Charging Infrastructure Market Analysis and Outlook To 2030

11.1 Introduction to South America Copper In Electric Vehicle Charging Infrastructure Markets in 2024

11.2 South America Copper In Electric Vehicle Charging Infrastructure Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Copper In Electric Vehicle Charging Infrastructure Market size Outlook by Segments, 2021-2030

By Charge Ports

Level 1

Level 2

By End-User

Commercial Charging Station

Private Charging Station

12 Middle East and Africa Copper In Electric Vehicle Charging Infrastructure Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Copper In Electric Vehicle Charging Infrastructure Markets in 2024

12.2 Middle East and Africa Copper In Electric Vehicle Charging Infrastructure Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Copper In Electric Vehicle Charging Infrastructure Market size Outlook by Segments, 2021-2030

By Charge Ports

Level 1

Level 2

By End-User

Commercial Charging Station

Private Charging Station

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Antofagasta plc

BHP Group

Corporación Nacional del Cobre de Chile (Codelco)

First Quantum Minerals Ltd

Freeport-McMoRan Inc

Glencore plc

KGHM Polska Miedź S.A.

Rio Tinto Group

Southern Copper Corp

Vale S.A.

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Charge Ports

Level 1

Level 2

By End-User

Commercial Charging Station

Private Charging Station

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Copper In Electric Vehicle Charging Infrastructure is forecast to reach $3.4 Billion in 2030 from $1.2 Billion in 2024, registering a CAGR of 18.7% over the outlook period

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Antofagasta plc, BHP Group, Corporación Nacional del Cobre de Chile (Codelco), First Quantum Minerals Ltd, Freeport-McMoRan Inc, Glencore plc, KGHM Polska Miedź S.A., Rio Tinto Group, Southern Copper Corp, Vale S.A.

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume