The global Container Glass Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Bottles, Jars, Vials & Ampoules, Others), By End-User (Pharmaceutical, Food & Beverage, Cosmetics, Personal Care, Chemical, Others).

The future of the container glass market is influenced by trends such as sustainability, premiumization, and technological advancements in glass manufacturing and recycling. Container glass, used for packaging beverages, food, pharmaceuticals, and cosmetics, plays a crucial role in preserving product integrity, enhancing shelf appeal, and minimizing environmental impact. Key trends shaping this industry include the development of lightweight and eco-friendly glass formulations to reduce material usage and transportation costs, innovations in glass design to meet evolving consumer preferences for convenience and aesthetics, and the implementation of closed-loop recycling systems to increase glass recycling rates and reduce raw material consumption. As consumers and brand owners prioritize sustainable packaging solutions and regulatory pressure mounts to reduce plastic waste, the demand for container glass that offers recyclability, purity, and premium branding opportunities will continue to drive market growth and innovation.

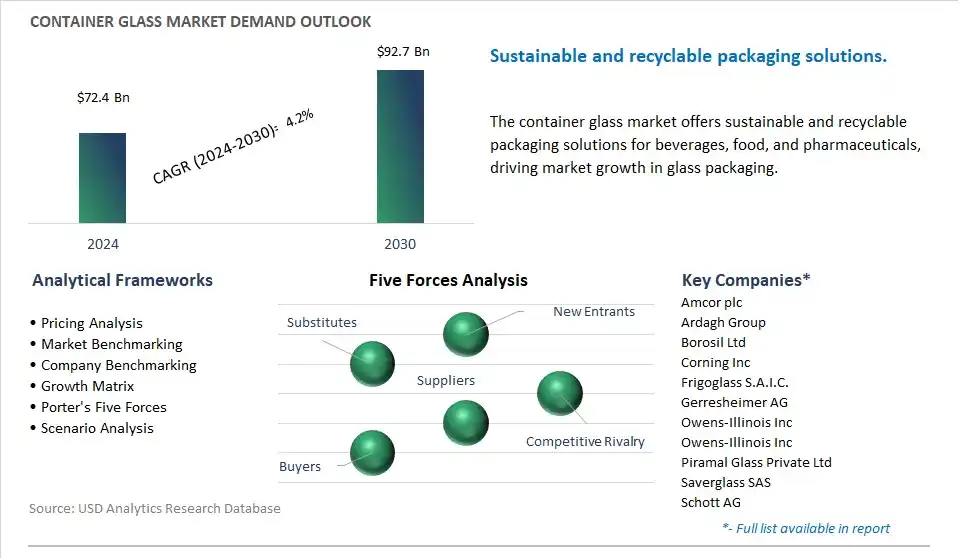

The market report analyses the leading companies in the industry including Amcor plc, Ardagh Group, Borosil Ltd, Corning Inc, Frigoglass S.A.I.C., Gerresheimer AG, Owens-Illinois Inc, Owens-Illinois Inc, Piramal Glass Private Ltd, Saverglass SAS, Schott AG, SGD S.A., Stevanato Group, Unitrade FZE, Vitro, S.A.B. de C.V..

One prominent market trend in the container glass industry is the growing demand for sustainable packaging solutions. With increasing awareness of environmental issues and a shift towards eco-friendly practices, consumers and businesses alike are seeking packaging materials that minimize environmental impact and promote recycling. Container glass offers a sustainable packaging option as it is 100% recyclable, inert, and preserves the integrity and freshness of products. The trend is driving manufacturers to invest in container glass production and innovation, catering to the rising demand for environmentally friendly packaging solutions across various industries, including food and beverage, pharmaceuticals, and cosmetics.

A key driver in the container glass market is the expansion of the food and beverage industry. As consumer preferences shift towards healthier lifestyles and premium products, there is a growing demand for packaged food and beverages. Glass containers are preferred for packaging food and beverages due to their ability to preserve taste, freshness, and quality while providing a transparent and aesthetically pleasing packaging solution. The expansion of the food and beverage industry, coupled with the increasing popularity of glass packaging, is driving the demand for container glass, prompting manufacturers to ramp up production capacity and invest in technological advancements to meet market requirements.

One potential opportunity in the container glass market lies in innovation in customized packaging solutions. As brands seek to differentiate themselves and attract consumers' attention in a crowded marketplace, there is a growing demand for unique and customized packaging designs. Container glass offers versatility in shape, color, and decoration options, allowing manufacturers to create bespoke packaging solutions tailored to individual brand identities and product offerings. By investing in innovative manufacturing techniques, such as embossing, labeling, and printing, manufacturers aim to capitalize on this opportunity to provide customized container glass solutions that enhance brand visibility, consumer engagement, and product differentiation in the market.

In the Container Glass market, the Market Ecosystem initiates with Raw Material Acquisition where Sand Suppliers including U.S. Silica Holdings, Inc., and Soda Ash Suppliers including Solvay SA provide essential ingredients for glass production. Additionally, Limestone Suppliers including Martin Marietta Materials, Inc. contribute calcium carbonate for structural stability. Batch House and Furnace Operations are managed by Container Glass Manufacturers including O-I Glass, Inc. and Owens Corning, where raw materials are mixed and melted in furnaces to form molten glass. Following this, Glass Forming processes are executed by these manufacturers, shaping molten glass into containers through methods including blow molding or press and blow molding. Annealing and Lehr's processes then ensure controlled cooling for improved strength.

The decoration involves specialized Glass Decorators employing techniques including screen printing or decal application for enhanced visual appeal. Distribution and Sales are facilitated by Glass Distributors including Berlin Packaging, supplying container glass to end-user industries including Food and Beverage Companies, Pharmaceutical Companies, and Cosmetics Companies, which utilize container glass for packaging various products due to its functionality and aesthetic properties, marking the final stage of the Market Ecosystem.

The largest segment in the Container Glass Market is the "Bottles" segment. This dominance is driven by bottles are one of the most common and widely used types of container glass products across various industries, including beverage, food, pharmaceuticals, cosmetics, and household products. Bottles serve as primary packaging for a wide range of liquid and solid products, offering protection, preservation, and convenience for consumers. Additionally, bottles come in various shapes, sizes, and colors to meet the specific requirements and branding preferences of different products and manufacturers. In addition, bottles made of glass are preferred over other packaging materials, such as plastic or metal, due to their inertness, impermeability, and recyclability, which help maintain product quality, extend shelf life, and minimize environmental impact. Further, the beverage industry, including alcoholic and non-alcoholic beverages, is a significant consumer of bottled glass products, driving the demand for bottles in the container glass market. As a result, the "Bottles" segment is the largest segment in the Container Glass Market due to its widespread use, versatility, and importance in various packaging applications across industries.

The fastest-growing segment in the Container Glass Market is the "Pharmaceutical" segment. This trend is driven by there is an increasing demand for pharmaceutical packaging made of glass due to its superior properties, including inertness, non-reactivity, and impermeability, which help maintain the integrity and stability of pharmaceutical products. Glass containers are widely used for storing and packaging pharmaceutical drugs, medications, and healthcare products, ensuring product safety, efficacy, and compliance with regulatory standards. Additionally, the pharmaceutical industry is experiencing rapid growth worldwide, driven by factors such as population growth, aging demographics, increasing healthcare expenditure, and rising prevalence of chronic diseases. As a result, there is a corresponding increase in the demand for pharmaceutical packaging solutions, including glass containers, to meet the needs of the expanding pharmaceutical market. In addition, advancements in pharmaceutical formulations, drug delivery systems, and biopharmaceuticals drive the development of specialized glass packaging solutions, such as vials, ampoules, and syringes, tailored to the specific requirements of modern pharmaceutical products and manufacturing processes. Further, regulatory requirements and quality standards for pharmaceutical packaging, including USP (United States Pharmacopeia) and EP (European Pharmacopoeia) standards, emphasize the importance of using high-quality and reliable packaging materials, such as glass, to ensure product safety and integrity. As a result, the "Pharmaceutical" segment is the fastest-growing segment in the Container Glass Market, propelled by the increasing demand for pharmaceutical packaging solutions, the growth of the pharmaceutical industry, and the importance of glass packaging in ensuring product quality, safety, and compliance with regulatory requirements.

By Product

Bottles

Jars

Vials & Ampoules

Others

By End-User

Pharmaceutical

Food & Beverage

Cosmetics

Personal Care

Chemical

Others

Amcor plc

Ardagh Group

Borosil Ltd

Corning Inc

Frigoglass S.A.I.C.

Gerresheimer AG

Owens-Illinois Inc

Owens-Illinois Inc

Piramal Glass Private Ltd

Saverglass SAS

Schott AG

SGD S.A.

Stevanato Group

Unitrade FZE

Vitro, S.A.B. de C.V.

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Container Glass Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Container Glass Market Size Outlook, $ Million, 2021 to 2030

3.2 Container Glass Market Outlook by Type, $ Million, 2021 to 2030

3.3 Container Glass Market Outlook by Product, $ Million, 2021 to 2030

3.4 Container Glass Market Outlook by Application, $ Million, 2021 to 2030

3.5 Container Glass Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Container Glass Industry

4.2 Key Market Trends in Container Glass Industry

4.3 Potential Opportunities in Container Glass Industry

4.4 Key Challenges in Container Glass Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Container Glass Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Container Glass Market Outlook by Segments

7.1 Container Glass Market Outlook by Segments, $ Million, 2021- 2030

By Product

Bottles

Jars

Vials & Ampoules

Others

By End-User

Pharmaceutical

Food & Beverage

Cosmetics

Personal Care

Chemical

Others

8 North America Container Glass Market Analysis and Outlook To 2030

8.1 Introduction to North America Container Glass Markets in 2024

8.2 North America Container Glass Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Container Glass Market size Outlook by Segments, 2021-2030

By Product

Bottles

Jars

Vials & Ampoules

Others

By End-User

Pharmaceutical

Food & Beverage

Cosmetics

Personal Care

Chemical

Others

9 Europe Container Glass Market Analysis and Outlook To 2030

9.1 Introduction to Europe Container Glass Markets in 2024

9.2 Europe Container Glass Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Container Glass Market Size Outlook by Segments, 2021-2030

By Product

Bottles

Jars

Vials & Ampoules

Others

By End-User

Pharmaceutical

Food & Beverage

Cosmetics

Personal Care

Chemical

Others

10 Asia Pacific Container Glass Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Container Glass Markets in 2024

10.2 Asia Pacific Container Glass Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Container Glass Market size Outlook by Segments, 2021-2030

By Product

Bottles

Jars

Vials & Ampoules

Others

By End-User

Pharmaceutical

Food & Beverage

Cosmetics

Personal Care

Chemical

Others

11 South America Container Glass Market Analysis and Outlook To 2030

11.1 Introduction to South America Container Glass Markets in 2024

11.2 South America Container Glass Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Container Glass Market size Outlook by Segments, 2021-2030

By Product

Bottles

Jars

Vials & Ampoules

Others

By End-User

Pharmaceutical

Food & Beverage

Cosmetics

Personal Care

Chemical

Others

12 Middle East and Africa Container Glass Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Container Glass Markets in 2024

12.2 Middle East and Africa Container Glass Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Container Glass Market size Outlook by Segments, 2021-2030

By Product

Bottles

Jars

Vials & Ampoules

Others

By End-User

Pharmaceutical

Food & Beverage

Cosmetics

Personal Care

Chemical

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Amcor plc

Ardagh Group

Borosil Ltd

Corning Inc

Frigoglass S.A.I.C.

Gerresheimer AG

Owens-Illinois Inc

Owens-Illinois Inc

Piramal Glass Private Ltd

Saverglass SAS

Schott AG

SGD S.A.

Stevanato Group

Unitrade FZE

Vitro, S.A.B. de C.V.

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Bottles

Jars

Vials & Ampoules

Others

By End-User

Pharmaceutical

Food & Beverage

Cosmetics

Personal Care

Chemical

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Container Glass is forecast to reach $92.7 Billion in 2030 from $72.4 Billion in 2024, registering a CAGR of 4.2% over the outlook period

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Amcor plc, Ardagh Group, Borosil Ltd, Corning Inc, Frigoglass S.A.I.C., Gerresheimer AG, Owens-Illinois Inc, Owens-Illinois Inc, Piramal Glass Private Ltd, Saverglass SAS, Schott AG, SGD S.A., Stevanato Group, Unitrade FZE, Vitro, S.A.B. de C.V.

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume