The global Contact Adhesives Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Technology (Water-Based, Solvent-Based), By Resin (Neoprene, Polyurethane, Acrylic, SBC, Others), By End-User (Construction, Automotive, Woodworking, Leather, Others).

Contact adhesives, also known as contact cement or contact bond adhesives, are versatile adhesives commonly used in woodworking, construction, automotive, and manufacturing industries to bond materials together in 2024. Unlike traditional adhesives that require clamping or curing, contact adhesives form an instant bond when the adhesive-coated surfaces are brought into contact with each other, providing a strong and permanent bond without the need for additional fixtures or drying time. Contact adhesives are typically applied to both mating surfaces using a brush, roller, or spray gun and allowed to dry until tacky before joining the surfaces together. Once the surfaces are pressed firmly together, the adhesive forms a strong bond that resists shear, peel, and impact forces. Contact adhesives are commonly used for bonding laminates, veneers, countertops, upholstery, and automotive trim, as well as for assembly and repair applications where traditional adhesives can be impractical or ineffective. They are available in various formulations, including solvent-based, water-based, and low-VOC formulations, each offering different characteristics such as bonding strength, temperature resistance, and open time. With their ease of use, versatility, and rapid bonding capabilities, contact adhesives are indispensable products in a wide range of industries, enabling efficient and reliable bonding solutions for diverse applications.

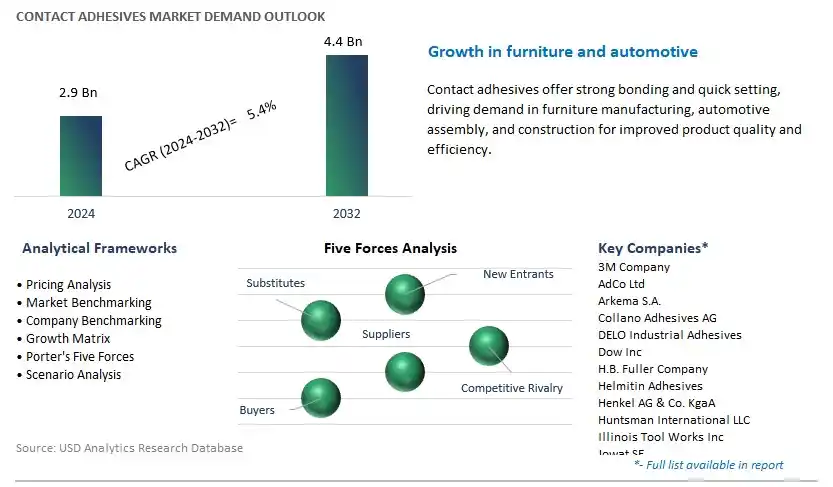

The market report analyses the leading companies in the industry including 3M Company, AdCo Ltd, Arkema S.A., Collano Adhesives AG, DELO Industrial Adhesives, Dow Inc, H.B. Fuller Company, Helmitin Adhesives, Henkel AG & Co. KgaA, Huntsman International LLC, Illinois Tool Works Inc, Jowat SE, KMS Adhesives Ltd, Mapei SpA, Pyrotek Inc, Sika AG, and others.

A prominent trend in the market for contact adhesives is the increasing demand for instant bonding solutions driven by the need for quick and efficient assembly processes in various industries. Contact adhesives, known for their ability to create strong and permanent bonds upon contact, are seeing heightened interest due to their suitability for applications requiring immediate adhesion, such as furniture manufacturing, automotive interiors, and construction. As manufacturers seek to streamline production, reduce assembly times, and improve operational efficiency, there is a growing preference for contact adhesives that offer rapid curing times and high initial tack, allowing for instant bonding without the need for clamping or curing fixtures. This trend is reshaping the adhesive industry, with manufacturers focusing on the development of fast-acting formulations and application methods to meet the increasing demand for instant bonding solutions across various sectors.

The primary driver fueling the demand for contact adhesives is the growth in the construction and building materials industry, driven by urbanization, infrastructure development, and renovation projects. Contact adhesives play a crucial role in construction applications such as laminate flooring installation, countertop fabrication, wall paneling, and ceiling tile assembly, where they provide strong and durable bonds between materials such as wood, laminate, metal, and plastic. With the expansion of residential, commercial, and industrial construction activities worldwide, there is a significant demand for contact adhesives as construction professionals and contractors seek reliable and efficient bonding solutions to meet project deadlines and quality standards. As the construction sector continues to grow, the demand for contact adhesives is expected to rise, driving market expansion and investment in product innovation, distribution channels, and application technologies tailored to the needs of the construction industry.

An emerging opportunity within the market for contact adhesives lies in the development of low volatile organic compound (VOC) formulations that meet stringent environmental regulations and sustainability requirements. With increasing awareness of indoor air quality concerns and environmental health hazards associated with VOC emissions from adhesives and other construction materials, there is a growing demand for low VOC or VOC-free contact adhesives that minimize harmful emissions and contribute to healthier indoor environments. Manufacturers can capitalize on this opportunity by investing in research and development of eco-friendly formulations that offer low VOC content without compromising on bonding strength, durability, or application performance. Additionally, opportunities exist for partnering with green building certification programs, architects, and construction firms to promote the adoption of low VOC contact adhesives in sustainable building projects, offering competitive advantages in the marketplace and driving market differentiation in the adhesive industry.

Among the segments listed, the water-based contact adhesives market is the largest segment, and its dominance can be attributed to water-based adhesives align with the growing global emphasis on sustainability and environmental responsibility. With increasing regulations aimed at reducing volatile organic compound (VOC) emissions, industries are actively seeking greener alternatives, and water-based adhesives fit the bill perfectly. These adhesives have lower VOC content compared to their solvent-based counterparts, making them preferred choices for environmentally conscious consumers and manufacturers alike. Additionally, water-based adhesives offer excellent bonding performance across various substrates, ranging from wood and paper to plastics and metals, making them versatile solutions for a wide array of applications. Moreover, advancements in formulation technology have led to improved properties such as enhanced durability and faster curing times, further bolstering the market demand for water-based contact adhesives. As sustainability continues to drive purchasing decisions and regulatory frameworks, the water-based contact adhesives market is poised to maintain its leadership position in the foreseeable future.

In the contact adhesives market segmented by resin type, polyurethane resin is the fastest-growing segment, driven by its exceptional versatility and performance characteristics. Polyurethane adhesives offer a unique combination of strength, flexibility, and durability, making them ideal for a wide range of applications across various industries. From automotive and construction to electronics and footwear, polyurethane adhesives find extensive use due to their ability to bond diverse substrates effectively. Moreover, they exhibit excellent resistance to temperature extremes, moisture, and chemicals, ensuring reliable performance even in challenging environments. Additionally, advancements in polyurethane chemistry have led to the development of low-VOC formulations, aligning with the growing demand for environmentally friendly adhesive solutions. As industries continue to prioritize efficiency, durability, and sustainability, the demand for polyurethane adhesives is expected to escalate rapidly, driving robust growth in this segment for the foreseeable future.

Among the segments delineated by end-users in the contact adhesives market, the automotive sector stands out as the largest segment, fuelled by a combination of innovation and sustained demand. The automotive industry's reliance on contact adhesives is multifaceted, ranging from interior trim assembly to structural bonding in vehicle construction. With the shift towards lightweight materials and advanced manufacturing techniques, the demand for high-performance adhesives has soared. Contact adhesives offer potential advantages for automotive applications, including excellent bond strength, vibration resistance, and the ability to join dissimilar materials efficiently. Moreover, these adhesives facilitate streamlined production processes, contributing to cost savings and enhanced productivity for automotive manufacturers. As the automotive sector continues to evolve, driven by factors such as electric vehicle adoption and stringent regulatory standards, the demand for advanced contact adhesives is expected to remain robust, consolidating the automotive segment's position as a key driver of growth in the market.

By Technology

Water-Based

Solvent-Based

By Resin

Neoprene

Polyurethane

Acrylic

SBC

Others

By End-User

Construction

Automotive

Woodworking

Leather

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

3M Company

AdCo Ltd

Arkema S.A.

Collano Adhesives AG

DELO Industrial Adhesives

Dow Inc

H.B. Fuller Company

Helmitin Adhesives

Henkel AG & Co. KgaA

Huntsman International LLC

Illinois Tool Works Inc

Jowat SE

KMS Adhesives Ltd

Mapei SpA

Pyrotek Inc

Sika AG

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Contact Adhesives Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Contact Adhesives Market Size Outlook, $ Million, 2021 to 2032

3.2 Contact Adhesives Market Outlook by Type, $ Million, 2021 to 2032

3.3 Contact Adhesives Market Outlook by Product, $ Million, 2021 to 2032

3.4 Contact Adhesives Market Outlook by Application, $ Million, 2021 to 2032

3.5 Contact Adhesives Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Contact Adhesives Industry

4.2 Key Market Trends in Contact Adhesives Industry

4.3 Potential Opportunities in Contact Adhesives Industry

4.4 Key Challenges in Contact Adhesives Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Contact Adhesives Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Contact Adhesives Market Outlook by Segments

7.1 Contact Adhesives Market Outlook by Segments, $ Million, 2021- 2032

By Technology

Water-Based

Solvent-Based

By Resin

Neoprene

Polyurethane

Acrylic

SBC

Others

By End-User

Construction

Automotive

Woodworking

Leather

Others

8 North America Contact Adhesives Market Analysis and Outlook To 2032

8.1 Introduction to North America Contact Adhesives Markets in 2024

8.2 North America Contact Adhesives Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Contact Adhesives Market size Outlook by Segments, 2021-2032

By Technology

Water-Based

Solvent-Based

By Resin

Neoprene

Polyurethane

Acrylic

SBC

Others

By End-User

Construction

Automotive

Woodworking

Leather

Others

9 Europe Contact Adhesives Market Analysis and Outlook To 2032

9.1 Introduction to Europe Contact Adhesives Markets in 2024

9.2 Europe Contact Adhesives Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Contact Adhesives Market Size Outlook by Segments, 2021-2032

By Technology

Water-Based

Solvent-Based

By Resin

Neoprene

Polyurethane

Acrylic

SBC

Others

By End-User

Construction

Automotive

Woodworking

Leather

Others

10 Asia Pacific Contact Adhesives Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Contact Adhesives Markets in 2024

10.2 Asia Pacific Contact Adhesives Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Contact Adhesives Market size Outlook by Segments, 2021-2032

By Technology

Water-Based

Solvent-Based

By Resin

Neoprene

Polyurethane

Acrylic

SBC

Others

By End-User

Construction

Automotive

Woodworking

Leather

Others

11 South America Contact Adhesives Market Analysis and Outlook To 2032

11.1 Introduction to South America Contact Adhesives Markets in 2024

11.2 South America Contact Adhesives Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Contact Adhesives Market size Outlook by Segments, 2021-2032

By Technology

Water-Based

Solvent-Based

By Resin

Neoprene

Polyurethane

Acrylic

SBC

Others

By End-User

Construction

Automotive

Woodworking

Leather

Others

12 Middle East and Africa Contact Adhesives Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Contact Adhesives Markets in 2024

12.2 Middle East and Africa Contact Adhesives Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Contact Adhesives Market size Outlook by Segments, 2021-2032

By Technology

Water-Based

Solvent-Based

By Resin

Neoprene

Polyurethane

Acrylic

SBC

Others

By End-User

Construction

Automotive

Woodworking

Leather

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

3M Company

AdCo Ltd

Arkema S.A.

Collano Adhesives AG

DELO Industrial Adhesives

Dow Inc

H.B. Fuller Company

Helmitin Adhesives

Henkel AG & Co. KgaA

Huntsman International LLC

Illinois Tool Works Inc

Jowat SE

KMS Adhesives Ltd

Mapei SpA

Pyrotek Inc

Sika AG

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Technology

Water-Based

Solvent-Based

By Resin

Neoprene

Polyurethane

Acrylic

SBC

Others

By End-User

Construction

Automotive

Woodworking

Leather

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Contact Adhesives Market Size is valued at $2.9 Billion in 2024 and is forecast to register a growth rate (CAGR) of 5.4% to reach $4.4 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

3M Company, AdCo Ltd, Arkema S.A., Collano Adhesives AG, DELO Industrial Adhesives, Dow Inc, H.B. Fuller Company, Helmitin Adhesives, Henkel AG & Co. KgaA, Huntsman International LLC, Illinois Tool Works Inc, Jowat SE, KMS Adhesives Ltd, Mapei SpA, Pyrotek Inc, Sika AG

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume