The global Connected Health Market Comprehensive Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (M-Health Services, M-Health Devices), By Application (Monitoring Applications, Education and Awareness, Wellness and Prevention, Healthcare Management, Others), By End-User (Hospitals and Clinics, Home Monitoring, Others)

In 2024, the connected health market is experiencing rapid growth driven by advancements in digital health technologies, the proliferation of connected devices and wearables, and the increasing adoption of telemedicine and remote monitoring solutions. Connected health, also known as digital health or eHealth, encompasses a broad spectrum of technologies and services that leverage connectivity, data analytics, and artificial intelligence to improve healthcare delivery, patient outcomes, and population health management. From wearable fitness trackers and smart scales to remote patient monitoring systems and virtual care platforms, connected health solutions empower individuals to take a proactive approach to their health and well-being, enabling them to monitor vital signs, track health metrics, and access personalized healthcare services from the comfort of their homes. The market is driven by the growing prevalence of chronic diseases, aging populations, and the need for more efficient and cost-effective healthcare solutions that can address the challenges of access, affordability, and quality of care. Moreover, the COVID-19 pandemic has accelerated the adoption of telehealth and remote monitoring technologies, transforming the way healthcare is delivered and experienced by patients and providers alike. As the connected health ecosystem continues to evolve and expand, fueled by innovation, investment, and regulatory support, the market presents opportunities for stakeholders to collaborate, innovate, and create value in a rapidly evolving and interconnected healthcare landscape.

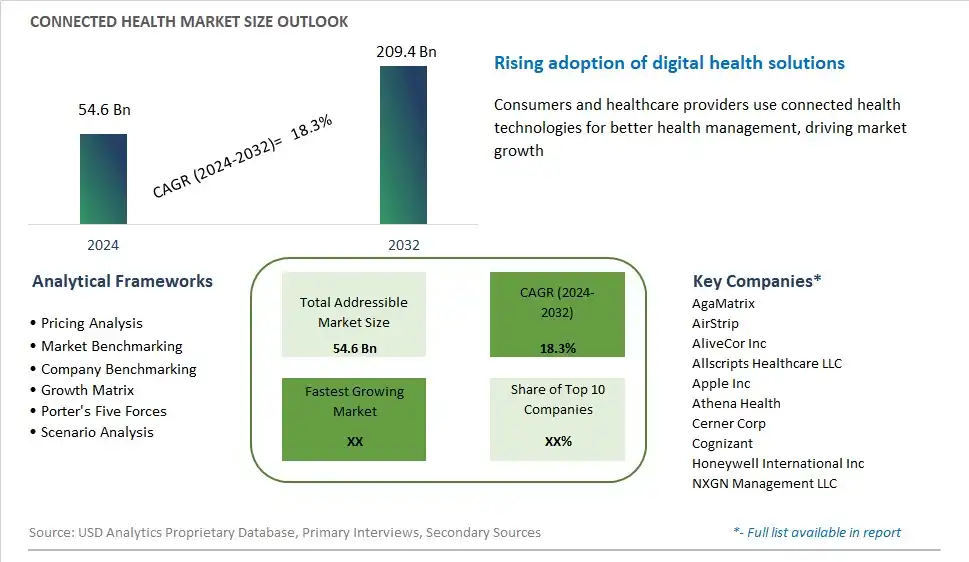

The market report analyses the leading companies in the industry including AgaMatrix, AirStrip, AliveCor Inc, Allscripts Healthcare LLC, Apple Inc, Athena Health, Cerner Corp, Cognizant, Honeywell International Inc, NXGN Management LLC, and Others.

The most prominent market trend for Connected Health is the widespread adoption of wearable health technologies, driven by advancements in sensor technology, data analytics, and consumer demand for personalized healthcare solutions. Wearable devices such as fitness trackers, smartwatches, and health monitoring patches enable individuals to track various health metrics in real-time, including heart rate, activity levels, sleep patterns, and vital signs. This trend reflects a growing emphasis on proactive health management, preventive care, and lifestyle interventions, as consumers seek to take control of their health and well-being. With the increasing integration of connectivity features and health monitoring capabilities, connected health devices are becoming indispensable tools for empowering individuals to make informed decisions about their health and lifestyle choices.

A significant market driver for Connected Health is the shift towards remote patient monitoring and telehealth services, fueled by factors such as aging populations, rising healthcare costs, and the need for improved access to healthcare services. Telehealth technologies, including virtual consultations, remote monitoring platforms, and mobile health apps, enable healthcare providers to remotely monitor patients' health status, deliver timely interventions, and facilitate continuity of care outside traditional clinical settings. This driver is particularly relevant in the context of chronic disease management, post-acute care, and ongoing health surveillance, as remote monitoring solutions offer convenience, flexibility, and cost-effectiveness for both patients and healthcare providers.

An opportunity in the Connected Health market lies in the expansion of personalized health management solutions that leverage data-driven insights, artificial intelligence, and machine learning algorithms to deliver tailored interventions and predictive analytics. By harnessing the power of big data and digital health technologies, companies can develop sophisticated platforms that provide personalized recommendations for disease prevention, health promotion, and behavior modification. Additionally, there's potential to integrate connected health devices with electronic health records (EHRs), patient portals, and population health management systems to facilitate seamless data exchange and collaboration across healthcare ecosystems. By offering comprehensive and integrated solutions for personalized health management, connected health providers can address the evolving needs of patients, caregivers, and healthcare organizations in an increasingly connected world.

Within the Connected Health Market, the M-Health Services segment is the largest, overshadowing M-Health Devices. This dominance can be attributed to several factors. Firstly, M-Health Services encompass a wide range of offerings, including telemedicine, remote patient monitoring, and health information services, catering to diverse healthcare needs and preferences. The convenience and accessibility offered by these services resonate strongly with both healthcare providers and patients, driving adoption across various demographics. Additionally, the rapid proliferation of smartphones and internet connectivity has facilitated the widespread adoption of M-Health Services, enabling seamless communication and data exchange between patients and healthcare professionals. Further, the evolving regulatory landscape and reimbursement policies further support the growth of M-Health Services, incentivizing healthcare providers to integrate digital health solutions into their practice. As a result, the M-Health Services segment not only commands the largest market share but also presents significant opportunities for innovation and expansion, as technological advancements continue to reshape the healthcare landscape.

Monitoring applications represent the fastest growing segment in the connected health market. This growth is driven by several key factors, including the increasing prevalence of chronic diseases, the rising aging population, and the ongoing advancements in wearable technology. Monitoring applications enable continuous health tracking, allowing for real-time data collection and analysis. This capability is crucial for managing chronic conditions such as diabetes, cardiovascular diseases, and respiratory disorders, which require constant monitoring to prevent complications. Furthermore, the integration of artificial intelligence and machine learning in these applications enhances their predictive capabilities, leading to better patient outcomes and personalized care. The convenience and accessibility of monitoring applications also contribute to their rapid adoption, as they empower patients to take an active role in their health management. Additionally, the COVID-19 pandemic has accelerated the adoption of remote monitoring solutions, highlighting their importance in reducing the burden on healthcare systems and minimizing the risk of virus transmission. Overall, the increasing demand for efficient, cost-effective, and proactive healthcare solutions is propelling the growth of monitoring applications in the connected health market.

Hospitals and clinics represent the largest segment in the connected health market, primarily due to their central role in providing comprehensive healthcare services. These facilities are equipped with advanced medical technologies and have the necessary infrastructure to support a wide range of connected health applications. The adoption of electronic health records (EHRs), telemedicine services, and remote patient monitoring systems has significantly enhanced the efficiency and effectiveness of patient care in hospitals and clinics. These institutions benefit from integrated healthcare solutions that enable seamless communication and data sharing among healthcare providers, leading to improved diagnosis, treatment, and patient outcomes. Furthermore, the increasing prevalence of chronic diseases and the rising demand for specialized healthcare services have driven hospitals and clinics to invest heavily in connected health technologies. The ability to monitor patients remotely and provide timely interventions is particularly valuable in managing chronic conditions and reducing hospital readmissions. Additionally, the COVID-19 pandemic has underscored the importance of telehealth and remote monitoring, further accelerating the adoption of connected health solutions in hospitals and clinics. This segment's growth is also supported by favorable government policies and initiatives aimed at promoting digital health and telemedicine. As healthcare providers continue to prioritize patient-centered care and leverage technology to enhance service delivery, hospitals and clinics are expected to maintain their dominant position in the connected health market.

By Type

M-Health Services

M-Health Devices

By Application

Monitoring Applications

Education and Awareness

Wellness and Prevention

Healthcare Management

Others

By End-User

Hospitals and Clinics

Home Monitoring

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

AgaMatrix

AirStrip

AliveCor Inc

Allscripts Healthcare LLC

Apple Inc

Athena Health

Cerner Corp

Cognizant

Honeywell International Inc

NXGN Management LLC

*- List Not Exhaustive

Chapter 1. TABLE OF CONTENTS

Chapter 2. Introduction to Connected Health Market

2.1. Market Overview

2.2. Key Statistics and Report Highlights

2.3. Scope of the Comprehensive Study

2.3.1. Market Definition

2.3.2 Countries and Regions Covered

2.3.3 Research Objective

2.3.4 Units, Currency, and Conversions

2.3.5 Industry Value Chain

2.4. Key Market Segments

2.5. Key Companies

2.6. Study Period

Chapter 3. Strategic Analysis Review

3.1. Connected Health Pricing Analysis and Forecast

3.2. Porter’s Five Forces

3.3. Market Ecosystem

3.4. SWOT Analysis

3.5. Regulatory Scenario

3.3. Effects of Inflation, Russia-Ukraine War, moderating economic growth, and other macroeconomic factors

Chapter 4. Competitive Landscape

4.1. Market Share Analysis

4.1.1. Global Connected Health Market Share by Company, 2023

4.1.2. Product Offerings of Leading Connected Health Companies

4.2. Market Entropy

4.2.1. New Product Launches in the Industry

4.2.2. Mergers, Acquisitions, Joint ventures, and Partnerships

4.3. Key Strategies and Best Practices

Chapter 5. Global Market Projections: Best, Reference, and Low Case Scenarios

5.1. Growth Analysis- Case Scenario Definitions

5.2. Low Growth Case Scenario Forecasts

5.3. Reference Growth Case Scenario Forecasts

5.4. High Growth Case Scenario Forecasts

Chapter 6. Market Dynamics

6.1. Connected Health Market Drivers

6.2. Connected Health Market Challenges

6.6. Connected Health Market Opportunities

6.4. Connected Health Market Trends

Chapter 7. Global Connected Health Market Outlook Trends

7.1. Global Connected Health Revenue (USD Million) and CAGR (%) by Type (2021-2032)

7.2. Global Connected Health Revenue (USD Million) and CAGR (%) by Application (2021-2032)

7.3. Global Connected Health Revenue (USD Million) and CAGR (%) by Product (2021-2032)

By Type

M-Health Services

M-Health Devices

By Application

Monitoring Applications

Education and Awareness

Wellness and Prevention

Healthcare Management

Others

By End-User

Hospitals and Clinics

Home Monitoring

Others

Chapter 8. Global Connected Health Regional Analysis and Outlook

8.1. Global Connected Health Revenue (USD Million) By Regions (2021- 2032)

8.2. North America Connected Health Revenue (USD Million) by Country (2021-2032)

8.2.1. United States Connected Health Regional Analysis and Outlook

8.2.2. Canada Connected Health Regional Analysis and Outlook

8.2.3. Mexico Connected Health Regional Analysis and Outlook

8.3. Europe Connected Health Revenue (USD Million), by Country (2021-2032)

8.3.1. Germany Connected Health Regional Analysis and Outlook

8.3.2. France Connected Health Regional Analysis and Outlook

8.3.3. United Kingdom Connected Health Regional Analysis and Outlook

8.3.4. Spain Connected Health Regional Analysis and Outlook

8.3.5. Italy Connected Health Regional Analysis and Outlook

8.3.6. Russia Connected Health Regional Analysis and Outlook

8.3.7. Rest of Europe Connected Health Regional Analysis and Outlook

8.4. Asia Pacific Connected Health Revenue (USD Million) by Country (2021-2032)

8.4.1. China Connected Health Regional Analysis and Outlook

8.4.2. Japan Connected Health Regional Analysis and Outlook

8.4.3. India Connected Health Regional Analysis and Outlook

8.4.4. South Korea Connected Health Regional Analysis and Outlook

8.4.5. Australia Connected Health Regional Analysis and Outlook

8.4.6. South East Asia Connected Health Regional Analysis and Outlook

8.4.7. Rest of Asia Pacific Connected Health Regional Analysis and Outlook

8.5. South America Connected Health Revenue (USD Million), by Country (2021-2032)

8.5.1. Brazil Connected Health Regional Analysis and Outlook

8.5.2. Argentina Connected Health Regional Analysis and Outlook

8.5.3. Rest of South America Connected Health Regional Analysis and Outlook

8.6. Middle East and Africa Connected Health Revenue (USD Million) by Country (2021-2032)

8.6.1. Middle East Connected Health Regional Analysis and Outlook

8.6.2. Africa Connected Health Regional Analysis and Outlook

Chapter 9. North America Connected Health Analysis and Outlook

9.1. North America Connected Health Revenue (USD Million) by Segments (2021-2032)

9.1.1. North America Connected Health Revenue (USD Million) by Type (2021-2032)

9.1.2. North America Connected Health Revenue (USD Million) by Application (2021-2032)

9.1.3. North America Connected Health Revenue (USD Million) by Product (2021-2032)

By Type

M-Health Services

M-Health Devices

By Application

Monitoring Applications

Education and Awareness

Wellness and Prevention

Healthcare Management

Others

By End-User

Hospitals and Clinics

Home Monitoring

Others

Chapter 10. Europe Connected Health Analysis and Outlook

10.1. Europe Connected Health Revenue (USD Million), by Segments (USD Million) (2021-2032)

10.1.1. Europe Connected Health Revenue (USD Million) by Type (2021-2032)

10.1.2. Europe Connected Health Revenue (USD Million) by Application (2021-2032)

10.1.3. Europe Connected Health Revenue (USD Million) by Product (2021-2032)

By Type

M-Health Services

M-Health Devices

By Application

Monitoring Applications

Education and Awareness

Wellness and Prevention

Healthcare Management

Others

By End-User

Hospitals and Clinics

Home Monitoring

Others

Chapter 11. Asia Pacific Connected Health Analysis and Outlook

11.1. Asia Pacific Connected Health Revenue (USD Million), and Revenue (USD Million) by Segments (2021-2032)

11.1.1. Asia Pacific Connected Health Revenue (USD Million) by Type (2021-2032)

11.1.2. Asia Pacific Connected Health Revenue (USD Million) by Application (2021-2032)

11.1.3. Asia Pacific Connected Health Revenue (USD Million) by Product (2021-2032)

By Type

M-Health Services

M-Health Devices

By Application

Monitoring Applications

Education and Awareness

Wellness and Prevention

Healthcare Management

Others

By End-User

Hospitals and Clinics

Home Monitoring

Others

Chapter 12. South America Connected Health Analysis and Outlook

12.1. South America Connected Health Revenue (USD Million), by Segments (2021-2032)

12.1.1. South America Connected Health Revenue (USD Million) by Type (2021-2032)

12.1.2. South America Connected Health Revenue (USD Million) by Application (2021-2032)

12.1.3. South America Connected Health Revenue (USD Million) by Product (2021-2032)

By Type

M-Health Services

M-Health Devices

By Application

Monitoring Applications

Education and Awareness

Wellness and Prevention

Healthcare Management

Others

By End-User

Hospitals and Clinics

Home Monitoring

Others

Chapter 13. Middle East and Africa Connected Health Analysis and Outlook

13.1. Middle East and Africa Connected Health Revenue (USD Million), by Segments (2021-2032)

13.1.1. Middle East and Africa Connected Health Revenue (USD Million) by Type (2021-2032)

13.1.2. Middle East and Africa Connected Health Revenue (USD Million) by Application (2021-2032)

13.1.3. Middle East and Africa Connected Health Revenue (USD Million) by Product (2021-2032)

By Type

M-Health Services

M-Health Devices

By Application

Monitoring Applications

Education and Awareness

Wellness and Prevention

Healthcare Management

Others

By End-User

Hospitals and Clinics

Home Monitoring

Others

Chapter 14. Connected Health Company Profiles

14.1 Business Overview

14.2 Product Profiles

14.3 SWOT Profiles

14.5 Recent Developments

14.6 Financial Profile

List of Companies

AgaMatrix

AirStrip

AliveCor Inc

Allscripts Healthcare LLC

Apple Inc

Athena Health

Cerner Corp

Cognizant

Honeywell International Inc

NXGN Management LLC

15. Methodology and Data Sources

15.1 Customization Offerings

15.2 Subscription Services

15.3 Related Reports

15.4 Publisher Expertise

LIST OF TABLES

Table 1 Market Segmentation Analysis

Table 2 Global Connected Health Market Share of Leading Companies, 2023

Table 3 Product Offerings of Leading Companies

Table 4 Low Growth Scenario Forecasts

Table 5 Reference Case Growth Scenario

Table 6 High Growth Case Scenario

Table 7 Global Connected Health Revenue (USD Million) And CAGR (%) By Type (2021-2032)

Table 8 Global Connected Health Revenue (USD Million) And CAGR (%) By Application (2021-2032)

Table 9 Global Connected Health Revenue (USD Million) And CAGR (%) By Product (2021-2032)

Table 10 Global Connected Health Market Revenue (USD Million) By Regions (2021-2032)

Table 11 Global Connected Health Market Share (%) By Regions (2021-2032)

Table 12 North America Connected Health Revenue (USD Million) By Country (2021-2032)

Table 13 Europe Connected Health Revenue (USD Million) By Country (2021-2032)

Table 14 Asia Pacific Connected Health Revenue (USD Million) By Country (2021-2032)

Table 15 South America Connected Health Revenue (USD Million) By Country (2021-2032)

Table 16 Middle East and Africa Connected Health Revenue (USD Million) By Region (2021-2032)

Table 17 North America Connected Health Revenue (USD Million) By Type (2021-2032)

Table 18 North America Connected Health Revenue (USD Million) By Application (2021-2032)

Table 19 North America Connected Health Revenue (USD Million) By Product (2021-2032)

Table 20 Europe Connected Health Revenue (USD Million) By Type (2021-2032)

Table 21 Europe Connected Health Revenue (USD Million) By Application (2021-2032)

Table 22 Europe Connected Health Revenue (USD Million) By Product (2021-2032)

Table 23 Asia Pacific Connected Health Revenue (USD Million) By Type (2021-2032)

Table 24 Asia Pacific Connected Health Revenue (USD Million) By Application (2021-2032)

Table 25 Asia Pacific Connected Health Revenue (USD Million) By Product (2021-2032)

Table 26 South America Connected Health Revenue (USD Million) By Type (2021-2032)

Table 27 South America Connected Health Revenue (USD Million) By Application (2021-2032)

Table 28 South America Connected Health Revenue (USD Million) By Product (2021-2032)

Table 29 Middle East and Africa Connected Health Revenue (USD Million) By Type (2021-2032)

Table 30 Middle East and Africa Connected Health Revenue (USD Million) By Application (2021-2032)

Table 31 Middle East and Africa Connected Health Revenue (USD Million) By Product (2021-2032)

LIST OF FIGURES

Figure 1. Market Scope

Figure 2. Pricing Forecasts Per Unit, 2023- 2032

Figure 3. Porter’s Five Forces

Figure 4. Global Connected Health Market Revenue (USD Million) By Regions (2021-2032)

Figure 5. Global Connected Health Market Share (%) By Regions (2023)

Figure 6. North America Connected Health Revenue (USD Million) By Country (2021-2032)

Figure 7. United States Connected Health Revenue (USD Million) By Country (2021-2032)

Figure 8. Canada Connected Health Revenue (USD Million) By Country (2021-2032)

Figure 9. Mexico Connected Health Revenue (USD Million) By Country (2021-2032)

Figure 10. Europe Connected Health Revenue (USD Million) By Country (2021-2032)

Figure 11. Germany Connected Health Revenue (USD Million) By Country (2021-2032)

Figure 12. France Connected Health Revenue (USD Million) By Country (2021-2032)

Figure 13. United Kingdom Connected Health Revenue (USD Million) By Country (2021-2032)

Figure 14. Spain Connected Health Revenue (USD Million) By Country (2021-2032)

Figure 15. Italy Connected Health Revenue (USD Million) By Country (2021-2032)

Figure 16. Russia Connected Health Revenue (USD Million) By Country (2021-2032)

Figure 17. Rest of Europe Connected Health Revenue (USD Million) By Country (2021-2032)

Figure 11. Asia Pacific Connected Health Revenue (USD Million) By Country (2021-2032)

Figure 12. China Connected Health Revenue (USD Million) By Country (2021-2032)

Figure 13. Japan Connected Health Revenue (USD Million) By Country (2021-2032)

Figure 14. India Connected Health Revenue (USD Million) By Country (2021-2032)

Figure 15. South Korea Connected Health Revenue (USD Million) By Country (2021-2032)

Figure 16. Australia Connected Health Revenue (USD Million) By Country (2021-2032)

Figure 17. South East Asia Connected Health Revenue (USD Million) By Country (2021-2032)

Figure 18. South America Connected Health Revenue (USD Million) By Country (2021-2032)

Figure 19. Brazil Connected Health Revenue (USD Million) By Country (2021-2032)

Figure 20. Argentina Connected Health Revenue (USD Million) By Country (2021-2032)

Figure 21. Rest of Asia Pacific Connected Health Revenue (USD Million) By Country (2021-2032)

Figure 22. Middle East and Africa Connected Health Revenue (USD Million) By Region (2021-2032)

Figure 23. Saudi Arabia Connected Health Revenue (USD Million) By Region (2021-2032)

Figure 24. The UAE Connected Health Revenue (USD Million) By Region (2021-2032)

Figure 25. Rest of Middle East Connected Health Revenue (USD Million) By Region (2021-2032)

Figure 26. South Africa Connected Health Revenue (USD Million) By Region (2021-2032)

Figure 27. Africa Connected Health Revenue (USD Million) By Region (2021-2032)

Figure 28. North America Connected Health Revenue (USD Million) By Type (2021-2032)

Figure 29. North America Connected Health Revenue (USD Million) By Application (2021-2032)

Figure 30. North America Connected Health Revenue (USD Million) By Product (2021-2032)

Figure 31. Europe Connected Health Revenue (USD Million) By Type (2021-2032)

Figure 32. Europe Connected Health Revenue (USD Million) By Application (2021-2032)

Figure 33. Europe Connected Health Revenue (USD Million) By Product (2021-2032)

Figure 34. Asia Pacific Connected Health Revenue (USD Million) By Type (2021-2032)

Figure 35. Asia Pacific Connected Health Revenue (USD Million) By Application (2021-2032)

Figure 36. Asia Pacific Connected Health Revenue (USD Million) By Product (2021-2032)

Figure 37. South America Connected Health Revenue (USD Million) By Type (2021-2032)

Figure 38. South America Connected Health Revenue (USD Million) By Application (2021-2032)

Figure 39. South America Connected Health Revenue (USD Million) By Product (2021-2032)

Figure 40. Middle East and Africa Connected Health Revenue (USD Million) By Type (2021-2032)

Figure 41. Middle East and Africa Connected Health Revenue (USD Million) By Application (2021-2032)

Figure 42. Middle East and Africa Connected Health Revenue (USD Million) By Product (2021-2032)

By Type

M-Health Services

M-Health Devices

By Application

Monitoring Applications

Education and Awareness

Wellness and Prevention

Healthcare Management

Others

By End-User

Hospitals and Clinics

Home Monitoring

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Connected Health Market Size is valued at $54.6 Billion in 2024 and is forecast to register a growth rate (CAGR) of 18.3% to reach $209.4 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

AgaMatrix, AirStrip, AliveCor Inc, Allscripts Healthcare LLC, Apple Inc, Athena Health, Cerner Corp, Cognizant, Honeywell International Inc, NXGN Management LLC

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume