The global Conductive Polymers Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Polymer (Inherently Conductive Polymers, Inherently Dissipative Polymers, Conductive Plastics, Others), By Class (Conjugated Conducting Polymers, Charge Transfer Polymers, Ionically Conducting Polymers, Conductively Filled Polymers), By Application (Product Components, Antistatic Packaging, Material Handling, Work-Surface and Flooring, Others).

The future of the conductive polymers market is driven by the increasing demand for lightweight, flexible, and electronically functional materials across various industries, including electronics, automotive, healthcare, and energy. Conductive polymers offer unique properties such as electrical conductivity, tunable mechanical flexibility, and chemical stability, making them ideal for applications such as organic electronics, sensors, actuators, and energy storage devices. Key trends shaping this industry include the development of novel synthesis techniques to improve conductivity and processability, the integration of conductive polymers into flexible and stretchable substrates for wearable electronics, and the exploration of hybrid materials for multifunctional applications. As the demand for innovative electronic materials continues to grow, conductive polymers are poised to play a significant role in shaping the future of electronic devices and systems.

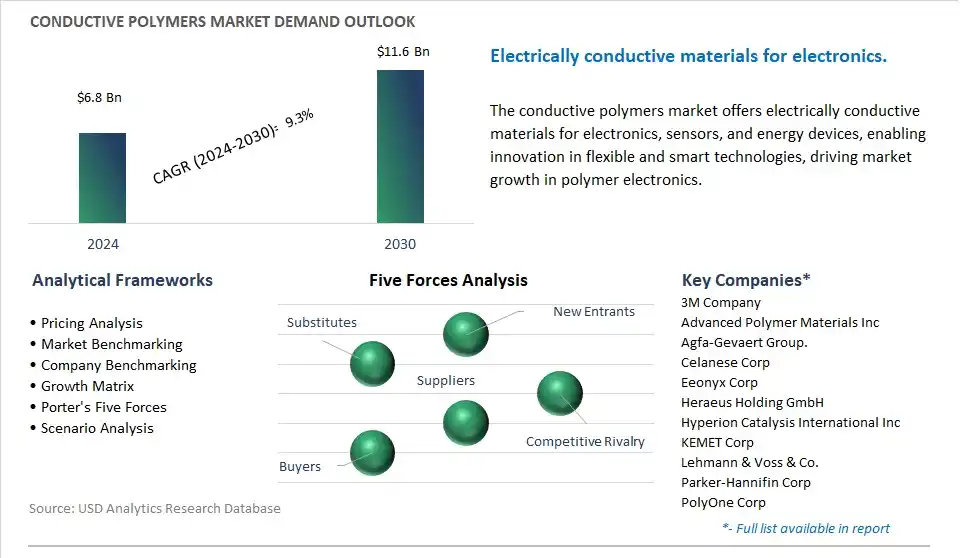

The market report analyses the leading companies in the industry including 3M Company, Advanced Polymer Materials Inc, Agfa-Gevaert Group., Celanese Corp, Eeonyx Corp, Heraeus Holding GmbH, Hyperion Catalysis International Inc, KEMET Corp, Lehmann & Voss & Co., Parker-Hannifin Corp, PolyOne Corp, Premix Oy, RTP Company, Saudi Basic Industries Corp, Solvay S.A., The Lubrizol Corp.

A prominent trend in the market for conductive polymers is the increasing demand for lightweight and flexible electronics. As electronic devices become more integrated into daily life and technology advances, there is a growing need for conductive materials that can provide electrical conductivity while also being lightweight, flexible, and durable. Conductive polymers offer unique properties such as flexibility, stretchability, and processability, making them ideal for applications in wearable electronics, flexible displays, printed electronics, and smart textiles. This is driven by consumer preferences for portable and wearable gadgets, advancements in flexible electronics technology, and the development of novel fabrication techniques for integrating conductive polymers into various electronic devices, leading to increased adoption of conductive polymers in the electronics industry.

A significant driver fueling the demand for conductive polymers is the growing need for energy storage and conversion devices. With the global transition towards renewable energy sources and the increasing demand for portable electronics, there is a rising need for efficient and lightweight materials for energy storage and conversion applications such as batteries, supercapacitors, fuel cells, and solar cells. Conductive polymers offer advantages such as high conductivity, electrochemical stability, and tunable properties, making them promising candidates for enhancing the performance and efficiency of energy storage and conversion devices. This driver is further supported by government initiatives, research funding programs, and industry collaborations aimed at developing sustainable energy solutions, driving the adoption of conductive polymers in the energy sector and renewable energy technologies.

An opportunity within the market for conductive polymers lies in expansion into healthcare and biomedical applications. While conductive polymers are primarily used in electronics and energy storage devices, there is potential for growth in medical devices, bioelectronics, and biomedical sensors. Conductive polymers have unique properties that make them suitable for applications such as neural implants, biosensors, tissue engineering scaffolds, and drug delivery systems. By leveraging the biocompatibility, conductivity, and electroactive properties of conductive polymers, manufacturers can develop innovative solutions for monitoring, diagnosis, and treatment in healthcare and biomedical fields. Moreover, collaborations with research institutions, medical device companies, and healthcare providers can facilitate the development of tailored materials and devices for specific medical applications, offering growth opportunities for manufacturers in the healthcare and life sciences sectors.

In the Conductive Polymers market, the Market Ecosystem begins with Raw Material Acquisition, where companies including BASF supply monomers crucial for polymer creation, alongside optional Catalyst and Dopant Suppliers. Conductive Polymer Manufacturers including Heraeus Holding GmbH then synthesize these polymers using various techniques including chemical oxidative polymerization. Optional purification steps follow to ensure desired purity levels. Compounding Facilities further process polymers by blending them with additives or fillers for specific applications.

Distribution channels involve Chemical Distributors including Avantor, connecting manufacturers with research institutions and electronics companies, while direct sales options exist for large manufacturers targeting major clients in the electronics industry or those requiring customized polymer formulations.

The largest segment in the Conductive Polymers Market is the "Inherently Conductive Polymers" segment. This dominance is driven by inherently conductive polymers (ICPs) possess intrinsic electrical conductivity without requiring the addition of fillers or additives. This property makes them highly desirable for a wide range of applications where electrical conductivity is essential, such as electronic devices, sensors, actuators, batteries, and electromagnetic interference (EMI) shielding materials. Additionally, ICPs offer advantages such as lightweight, flexibility, processability, and compatibility with traditional polymer processing techniques, making them suitable for integration into various manufacturing processes and product designs. In addition, advancements in polymer chemistry and material science have led to the development of new ICP formulations with improved conductivity, stability, and performance characteristics, expanding their application potential and market opportunities. Further, the growing demand for smart and connected devices, wearable electronics, renewable energy technologies, and electric vehicles further drives the adoption of ICPs in emerging markets and high-growth industries. As a result, the "Inherently Conductive Polymers" segment is the largest segment in the Conductive Polymers Market due to its intrinsic conductivity, versatility, and widespread applications across diverse industries.

The fastest-growing segment in the Conductive Polymers Market is the "Conjugated Conducting Polymers" segment. This trend is driven by conjugated conducting polymers (CCPs) exhibit unique electronic properties, including high conductivity, semi-conductivity, and tunable electrical behavior, making them highly desirable for a wide range of advanced electronic and optoelectronic applications. Additionally, CCPs offer advantages such as lightweight, flexibility, processability, and compatibility with solution-based processing techniques, enabling cost-effective fabrication of functional devices such as organic solar cells, organic light-emitting diodes (OLEDs), organic field-effect transistors (OFETs), and sensors. In addition, advancements in polymer chemistry and material science have led to the development of new CCP formulations with enhanced conductivity, stability, and performance characteristics, opening up new opportunities for innovation and product development in emerging markets and high-growth industries. Further, the increasing demand for energy-efficient and environmentally friendly technologies, as well as the rise of the Internet of Things (IoT) and wearable electronics, further drives the adoption of CCPs in next-generation electronics and smart devices. As a result, the "Conjugated Conducting Polymers" segment is the fastest-growing segment in the Conductive Polymers Market due to its unique electronic properties, versatility, and increasing relevance in advanced electronic and optoelectronic applications.

The fastest-growing segment in the Conductive Polymers Market is the "Antistatic Packaging" segment. This trend is driven by antistatic packaging plays a crucial role in protecting electronic components, sensitive devices, and static-sensitive materials from electrostatic discharge (ESD) during storage, transportation, and handling. As the electronics industry continues to grow and evolve, there is an increasing demand for effective ESD protection solutions to prevent damage to electronic products and ensure their reliability and performance. Additionally, antistatic packaging made from conductive polymers offers diverse advantages over traditional materials, including lightweight, flexibility, and durability, as well as superior ESD protection properties. In addition, advancements in polymer technology have led to the development of new antistatic packaging materials with enhanced conductivity, static dissipation, and moisture barrier properties, meeting the stringent requirements of modern electronics manufacturing and assembly processes. Further, regulatory standards and industry certifications for ESD protection drive the adoption of antistatic packaging solutions by electronics manufacturers, distributors, and end-users. As a result, the "Antistatic Packaging" segment is the fastest-growing segment in the Conductive Polymers Market, propelled by the increasing demand for reliable ESD protection solutions and the growing importance of electronics packaging in ensuring product quality and performance.

By Polymer

Inherently Conductive Polymers

Inherently Dissipative Polymers

Conductive Plastics

Others

By Class

Conjugated Conducting Polymers

Charge Transfer Polymers

Ionically Conducting Polymers

Conductively Filled Polymers

By Application

Product Components

Antistatic Packaging

Material Handling

Work-Surface and Flooring

Others

3M Company

Advanced Polymer Materials Inc

Agfa-Gevaert Group.

Celanese Corp

Eeonyx Corp

Heraeus Holding GmbH

Hyperion Catalysis International Inc

KEMET Corp

Lehmann & Voss & Co.

Parker-Hannifin Corp

PolyOne Corp

Premix Oy

RTP Company

Saudi Basic Industries Corp

Solvay S.A.

The Lubrizol Corp

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Conductive Polymers Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Conductive Polymers Market Size Outlook, $ Million, 2021 to 2030

3.2 Conductive Polymers Market Outlook by Type, $ Million, 2021 to 2030

3.3 Conductive Polymers Market Outlook by Product, $ Million, 2021 to 2030

3.4 Conductive Polymers Market Outlook by Application, $ Million, 2021 to 2030

3.5 Conductive Polymers Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Conductive Polymers Industry

4.2 Key Market Trends in Conductive Polymers Industry

4.3 Potential Opportunities in Conductive Polymers Industry

4.4 Key Challenges in Conductive Polymers Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Conductive Polymers Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Conductive Polymers Market Outlook by Segments

7.1 Conductive Polymers Market Outlook by Segments, $ Million, 2021- 2030

By Polymer

Inherently Conductive Polymers

Inherently Dissipative Polymers

Conductive Plastics

Others

By Class

Conjugated Conducting Polymers

Charge Transfer Polymers

Ionically Conducting Polymers

Conductively Filled Polymers

By Application

Product Components

Antistatic Packaging

Material Handling

Work-Surface and Flooring

Others

8 North America Conductive Polymers Market Analysis and Outlook To 2030

8.1 Introduction to North America Conductive Polymers Markets in 2024

8.2 North America Conductive Polymers Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Conductive Polymers Market size Outlook by Segments, 2021-2030

By Polymer

Inherently Conductive Polymers

Inherently Dissipative Polymers

Conductive Plastics

Others

By Class

Conjugated Conducting Polymers

Charge Transfer Polymers

Ionically Conducting Polymers

Conductively Filled Polymers

By Application

Product Components

Antistatic Packaging

Material Handling

Work-Surface and Flooring

Others

9 Europe Conductive Polymers Market Analysis and Outlook To 2030

9.1 Introduction to Europe Conductive Polymers Markets in 2024

9.2 Europe Conductive Polymers Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Conductive Polymers Market Size Outlook by Segments, 2021-2030

By Polymer

Inherently Conductive Polymers

Inherently Dissipative Polymers

Conductive Plastics

Others

By Class

Conjugated Conducting Polymers

Charge Transfer Polymers

Ionically Conducting Polymers

Conductively Filled Polymers

By Application

Product Components

Antistatic Packaging

Material Handling

Work-Surface and Flooring

Others

10 Asia Pacific Conductive Polymers Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Conductive Polymers Markets in 2024

10.2 Asia Pacific Conductive Polymers Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Conductive Polymers Market size Outlook by Segments, 2021-2030

By Polymer

Inherently Conductive Polymers

Inherently Dissipative Polymers

Conductive Plastics

Others

By Class

Conjugated Conducting Polymers

Charge Transfer Polymers

Ionically Conducting Polymers

Conductively Filled Polymers

By Application

Product Components

Antistatic Packaging

Material Handling

Work-Surface and Flooring

Others

11 South America Conductive Polymers Market Analysis and Outlook To 2030

11.1 Introduction to South America Conductive Polymers Markets in 2024

11.2 South America Conductive Polymers Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Conductive Polymers Market size Outlook by Segments, 2021-2030

By Polymer

Inherently Conductive Polymers

Inherently Dissipative Polymers

Conductive Plastics

Others

By Class

Conjugated Conducting Polymers

Charge Transfer Polymers

Ionically Conducting Polymers

Conductively Filled Polymers

By Application

Product Components

Antistatic Packaging

Material Handling

Work-Surface and Flooring

Others

12 Middle East and Africa Conductive Polymers Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Conductive Polymers Markets in 2024

12.2 Middle East and Africa Conductive Polymers Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Conductive Polymers Market size Outlook by Segments, 2021-2030

By Polymer

Inherently Conductive Polymers

Inherently Dissipative Polymers

Conductive Plastics

Others

By Class

Conjugated Conducting Polymers

Charge Transfer Polymers

Ionically Conducting Polymers

Conductively Filled Polymers

By Application

Product Components

Antistatic Packaging

Material Handling

Work-Surface and Flooring

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

3M Company

Advanced Polymer Materials Inc

Agfa-Gevaert Group.

Celanese Corp

Eeonyx Corp

Heraeus Holding GmbH

Hyperion Catalysis International Inc

KEMET Corp

Lehmann & Voss & Co.

Parker-Hannifin Corp

PolyOne Corp

Premix Oy

RTP Company

Saudi Basic Industries Corp

Solvay S.A.

The Lubrizol Corp

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Polymer

Inherently Conductive Polymers

Inherently Dissipative Polymers

Conductive Plastics

Others

By Class

Conjugated Conducting Polymers

Charge Transfer Polymers

Ionically Conducting Polymers

Conductively Filled Polymers

By Application

Product Components

Antistatic Packaging

Material Handling

Work-Surface and Flooring

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Conductive Polymers is forecast to reach $11.6 Billion in 2030 from $6.8 Billion in 2024, registering a CAGR of 9.3% over the outlook period

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

3M Company, Advanced Polymer Materials Inc, Agfa-Gevaert Group., Celanese Corp, Eeonyx Corp, Heraeus Holding GmbH, Hyperion Catalysis International Inc, KEMET Corp, Lehmann & Voss & Co., Parker-Hannifin Corp, PolyOne Corp, Premix Oy, RTP Company, Saudi Basic Industries Corp, Solvay S.A., The Lubrizol Corp

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume