The global Concentrated Milk Market Comprehensive Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Condensed milk, Evaporated Milk), By Application (Beverage Milks, Cheese, Malted Milk, Animal Feeds, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Others), By Packaging (Cans, Bottles)

In 2024, the Concentrated Milk market is witnessing significant growth, driven by the increasing demand for versatile and shelf-stable dairy products. Concentrated milk, which includes products like evaporated milk and sweetened condensed milk, is valued for its rich taste, convenience, and long shelf life. The market is supported by the growing trend towards convenient and ready-to-use ingredients in cooking and baking. Advances in milk concentration and preservation technologies are enhancing the quality, flavor, and nutritional content of concentrated milk products. The market is also benefiting from the trend towards clean-label and fortified dairy products, appealing to consumers seeking high-quality and versatile dairy options.

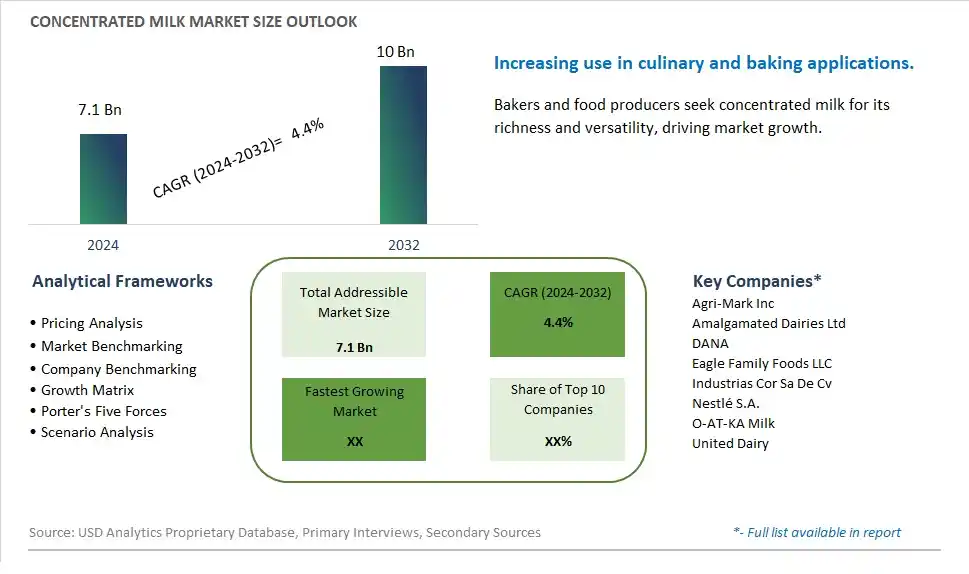

The market report analyses the leading companies in the industry including Agri-Mark Inc, Amalgamated Dairies Ltd, DANA, Eagle Family Foods LLC, Industrias Cor Sa De Cv, Nestlé S.A., O-AT-KA Milk, United Dairy, and Others.

One prominent trend in the Concentrated Milk market is the increasing demand for long shelf-life dairy products. Consumers are seeking convenient and sustainable options that offer extended storage capabilities without compromising on taste and nutritional value. Concentrated milk, known for its longer shelf life compared to regular milk, is gaining popularity among consumers looking for dairy products with extended freshness and usability.

The primary driver for the Concentrated Milk market is the rising preference for convenience and sustainability. Busy lifestyles and the need for products that reduce food waste are driving consumers towards concentrated milk, which can be stored for longer periods without refrigeration. Additionally, the sustainability aspect, including reduced packaging and transportation costs, is attracting environmentally conscious consumers towards concentrated milk products.

An opportunity within the Concentrated Milk market lies in expanding into niche dairy products. Manufacturers can leverage concentrated milk to create innovative dairy products such as condensed milk, evaporated milk, or flavored milk concentrates. These products can cater to specific consumer preferences, such as baking applications, ready-to-drink beverages, or customized flavors, thereby tapping into new market segments and enhancing product offerings.

Condensed milk stands out as the largest segment in the Concentrated Milk market. Its prominence is attributed to several factors contributing to its widespread use and popularity. Firstly, condensed milk offers a convenient and versatile option for various culinary applications, including desserts, beverages, and baking. Its thick and creamy texture, along with its high sugar content, makes it a preferred choice for adding richness and sweetness to a wide range of recipes. Additionally, condensed milk has a longer shelf life compared to fresh milk, making it a convenient pantry staple for consumers and food manufacturers alike. Further, condensed milk is often used in traditional and cultural cuisines worldwide, contributing to its global demand and market dominance. The popularity of condensed milk extends beyond households to foodservice establishments, bakeries, confectionaries, and beverage industries, driving consistent demand and market growth. With its established position in the market and continuous innovation in product formulations and packaging, condensed milk remains a significant contributor to the Concentrated Milk market's overall size and revenue.

The Beverage Milks segment is projected to be the fastest-growing application in the Concentrated Milk Market by 2032. This rapid growth can be attributed to several key factors. Firstly, there is an increasing demand for convenience and ready-to-drink (RTD) milk products among consumers, driven by busy lifestyles and the need for on-the-go nutrition. Additionally, the rise in health consciousness and awareness of the nutritional benefits of milk is boosting the consumption of fortified and enriched milk beverages. Innovations in product formulations, such as lactose-free and plant-based milk alternatives, are also expanding the consumer base. Furthermore, the growing popularity of dairy-based beverages in emerging markets, coupled with advancements in packaging technologies that extend shelf life, is contributing to the segment's robust growth. As a result, beverage milks are becoming a staple in the diet of many, particularly among urban populations, thereby driving substantial market expansion in this segment.

The Supermarkets/Hypermarkets segment is the largest distribution channel in the Concentrated Milk Market. This dominance can be attributed to several significant factors. Firstly, supermarkets and hypermarkets offer a one-stop shopping experience, providing a wide variety of concentrated milk products under one roof, which is highly convenient for consumers. These large retail chains have extensive networks and significant shelf space, allowing them to stock a diverse range of products from multiple brands, thereby catering to varied consumer preferences. Additionally, supermarkets and hypermarkets often run promotional campaigns and discounts, making them an attractive option for cost-conscious buyers. The organized retail sector's growth in emerging economies has also contributed to the segment's prominence, as these stores are increasingly becoming accessible to a broader population. Furthermore, the ability of these large retail formats to maintain product freshness and quality through efficient supply chain management ensures a reliable supply of concentrated milk products. Consequently, the supermarkets/hypermarkets segment continues to attract a significant share of the market, driven by consumer trust and the convenience of bulk purchasing options.

The Bottles segment is projected to be the fastest-growing packaging type in the Concentrated Milk Market by 2032. This rapid growth is driven by several critical factors. Firstly, bottles offer superior convenience and portability compared to traditional cans, making them a popular choice among consumers with busy lifestyles who need easy-to-carry and resealable packaging. The rise in on-the-go consumption of dairy products has significantly contributed to the increased preference for bottled concentrated milk. Additionally, bottles are perceived as more environmentally friendly and easier to recycle, aligning with the growing consumer demand for sustainable packaging solutions. Innovations in bottle design, such as lightweight materials and ergonomic shapes, enhance user experience and appeal. Further, the increasing adoption of plastic and glass bottles in emerging markets, where the demand for dairy products is burgeoning, further propels the segment's growth. As a result, the versatility, convenience, and eco-friendly attributes of bottles make them the preferred choice for both consumers and manufacturers, driving substantial market expansion in this segment.

By Type

Condensed milk

Evaporated Milk

By Application

Beverage Milks

Cheese

Malted Milk

Animal Feeds

Others

By Distribution Channel

Supermarkets/Hypermarkets

Convenience Stores

Online Retail

Others

By Packaging

Cans

Bottles

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Agri-Mark Inc

Amalgamated Dairies Ltd

DANA

Eagle Family Foods LLC

Industrias Cor Sa De Cv

Nestlé S.A.

O-AT-KA Milk

United Dairy

*- List Not Exhaustive

Chapter 1. TABLE OF CONTENTS

Chapter 2. Introduction to Concentrated Milk Market

2.1. Market Overview

2.2. Key Statistics and Report Highlights

2.3. Scope of the Comprehensive Study

2.3.1. Market Definition

2.3.2 Countries and Regions Covered

2.3.3 Research Objective

2.3.4 Units, Currency, and Conversions

2.3.5 Industry Value Chain

2.4. Key Market Segments

2.5. Key Companies

2.6. Study Period

Chapter 3. Strategic Analysis Review

3.1. Concentrated Milk Pricing Analysis and Forecast

3.2. Porter’s Five Forces

3.3. Market Ecosystem

3.4. SWOT Analysis

3.5. Regulatory Scenario

3.3. Effects of Inflation, Russia-Ukraine War, moderating economic growth, and other macroeconomic factors

Chapter 4. Competitive Landscape

4.1. Market Share Analysis

4.1.1. Global Concentrated Milk Market Share by Company, 2023

4.1.2. Product Offerings of Leading Concentrated Milk Companies

4.2. Market Entropy

4.2.1. New Product Launches in the Industry

4.2.2. Mergers, Acquisitions, Joint ventures, and Partnerships

4.3. Key Strategies and Best Practices

Chapter 5. Global Market Projections: Best, Reference, and Low Case Scenarios

5.1. Growth Analysis- Case Scenario Definitions

5.2. Low Growth Case Scenario Forecasts

5.3. Reference Growth Case Scenario Forecasts

5.4. High Growth Case Scenario Forecasts

Chapter 6. Market Dynamics

6.1. Concentrated Milk Market Drivers

6.2. Concentrated Milk Market Challenges

6.6. Concentrated Milk Market Opportunities

6.4. Concentrated Milk Market Trends

Chapter 7. Global Concentrated Milk Market Outlook Trends

7.1. Global Concentrated Milk Revenue (USD Million) and CAGR (%) by Type (2021-2032)

7.2. Global Concentrated Milk Revenue (USD Million) and CAGR (%) by Application (2021-2032)

7.3. Global Concentrated Milk Revenue (USD Million) and CAGR (%) by Product (2021-2032)

By Type

Condensed milk

Evaporated Milk

By Application

Beverage Milks

Cheese

Malted Milk

Animal Feeds

Others

By Distribution Channel

Supermarkets/Hypermarkets

Convenience Stores

Online Retail

Others

By Packaging

Cans

Bottles

Chapter 8. Global Concentrated Milk Regional Analysis and Outlook

8.1. Global Concentrated Milk Revenue (USD Million) By Regions (2021- 2032)

8.2. North America Concentrated Milk Revenue (USD Million) by Country (2021-2032)

8.2.1. United States Concentrated Milk Regional Analysis and Outlook

8.2.2. Canada Concentrated Milk Regional Analysis and Outlook

8.2.3. Mexico Concentrated Milk Regional Analysis and Outlook

8.3. Europe Concentrated Milk Revenue (USD Million), by Country (2021-2032)

8.3.1. Germany Concentrated Milk Regional Analysis and Outlook

8.3.2. France Concentrated Milk Regional Analysis and Outlook

8.3.3. United Kingdom Concentrated Milk Regional Analysis and Outlook

8.3.4. Spain Concentrated Milk Regional Analysis and Outlook

8.3.5. Italy Concentrated Milk Regional Analysis and Outlook

8.3.6. Russia Concentrated Milk Regional Analysis and Outlook

8.3.7. Rest of Europe Concentrated Milk Regional Analysis and Outlook

8.4. Asia Pacific Concentrated Milk Revenue (USD Million) by Country (2021-2032)

8.4.1. China Concentrated Milk Regional Analysis and Outlook

8.4.2. Japan Concentrated Milk Regional Analysis and Outlook

8.4.3. India Concentrated Milk Regional Analysis and Outlook

8.4.4. South Korea Concentrated Milk Regional Analysis and Outlook

8.4.5. Australia Concentrated Milk Regional Analysis and Outlook

8.4.6. South East Asia Concentrated Milk Regional Analysis and Outlook

8.4.7. Rest of Asia Pacific Concentrated Milk Regional Analysis and Outlook

8.5. South America Concentrated Milk Revenue (USD Million), by Country (2021-2032)

8.5.1. Brazil Concentrated Milk Regional Analysis and Outlook

8.5.2. Argentina Concentrated Milk Regional Analysis and Outlook

8.5.3. Rest of South America Concentrated Milk Regional Analysis and Outlook

8.6. Middle East and Africa Concentrated Milk Revenue (USD Million) by Country (2021-2032)

8.6.1. Middle East Concentrated Milk Regional Analysis and Outlook

8.6.2. Africa Concentrated Milk Regional Analysis and Outlook

Chapter 9. North America Concentrated Milk Analysis and Outlook

9.1. North America Concentrated Milk Revenue (USD Million) by Segments (2021-2032)

9.1.1. North America Concentrated Milk Revenue (USD Million) by Type (2021-2032)

9.1.2. North America Concentrated Milk Revenue (USD Million) by Application (2021-2032)

9.1.3. North America Concentrated Milk Revenue (USD Million) by Product (2021-2032)

By Type

Condensed milk

Evaporated Milk

By Application

Beverage Milks

Cheese

Malted Milk

Animal Feeds

Others

By Distribution Channel

Supermarkets/Hypermarkets

Convenience Stores

Online Retail

Others

By Packaging

Cans

Bottles

Chapter 10. Europe Concentrated Milk Analysis and Outlook

10.1. Europe Concentrated Milk Revenue (USD Million), by Segments (USD Million) (2021-2032)

10.1.1. Europe Concentrated Milk Revenue (USD Million) by Type (2021-2032)

10.1.2. Europe Concentrated Milk Revenue (USD Million) by Application (2021-2032)

10.1.3. Europe Concentrated Milk Revenue (USD Million) by Product (2021-2032)

By Type

Condensed milk

Evaporated Milk

By Application

Beverage Milks

Cheese

Malted Milk

Animal Feeds

Others

By Distribution Channel

Supermarkets/Hypermarkets

Convenience Stores

Online Retail

Others

By Packaging

Cans

Bottles

Chapter 11. Asia Pacific Concentrated Milk Analysis and Outlook

11.1. Asia Pacific Concentrated Milk Revenue (USD Million), and Revenue (USD Million) by Segments (2021-2032)

11.1.1. Asia Pacific Concentrated Milk Revenue (USD Million) by Type (2021-2032)

11.1.2. Asia Pacific Concentrated Milk Revenue (USD Million) by Application (2021-2032)

11.1.3. Asia Pacific Concentrated Milk Revenue (USD Million) by Product (2021-2032)

By Type

Condensed milk

Evaporated Milk

By Application

Beverage Milks

Cheese

Malted Milk

Animal Feeds

Others

By Distribution Channel

Supermarkets/Hypermarkets

Convenience Stores

Online Retail

Others

By Packaging

Cans

Bottles

Chapter 12. South America Concentrated Milk Analysis and Outlook

12.1. South America Concentrated Milk Revenue (USD Million), by Segments (2021-2032)

12.1.1. South America Concentrated Milk Revenue (USD Million) by Type (2021-2032)

12.1.2. South America Concentrated Milk Revenue (USD Million) by Application (2021-2032)

12.1.3. South America Concentrated Milk Revenue (USD Million) by Product (2021-2032)

By Type

Condensed milk

Evaporated Milk

By Application

Beverage Milks

Cheese

Malted Milk

Animal Feeds

Others

By Distribution Channel

Supermarkets/Hypermarkets

Convenience Stores

Online Retail

Others

By Packaging

Cans

Bottles

Chapter 13. Middle East and Africa Concentrated Milk Analysis and Outlook

13.1. Middle East and Africa Concentrated Milk Revenue (USD Million), by Segments (2021-2032)

13.1.1. Middle East and Africa Concentrated Milk Revenue (USD Million) by Type (2021-2032)

13.1.2. Middle East and Africa Concentrated Milk Revenue (USD Million) by Application (2021-2032)

13.1.3. Middle East and Africa Concentrated Milk Revenue (USD Million) by Product (2021-2032)

By Type

Condensed milk

Evaporated Milk

By Application

Beverage Milks

Cheese

Malted Milk

Animal Feeds

Others

By Distribution Channel

Supermarkets/Hypermarkets

Convenience Stores

Online Retail

Others

By Packaging

Cans

Bottles

Chapter 14. Concentrated Milk Company Profiles

14.1 Business Overview

14.2 Product Profiles

14.3 SWOT Profiles

14.5 Recent Developments

14.6 Financial Profile

List of Companies

Agri-Mark Inc

Amalgamated Dairies Ltd

DANA

Eagle Family Foods LLC

Industrias Cor Sa De Cv

Nestlé S.A.

O-AT-KA Milk

United Dairy

15. Methodology and Data Sources

15.1 Customization Offerings

15.2 Subscription Services

15.3 Related Reports

15.4 Publisher Expertise

LIST OF TABLES

Table 1 Market Segmentation Analysis

Table 2 Global Concentrated Milk Market Share of Leading Companies, 2023

Table 3 Product Offerings of Leading Companies

Table 4 Low Growth Scenario Forecasts

Table 5 Reference Case Growth Scenario

Table 6 High Growth Case Scenario

Table 7 Global Concentrated Milk Revenue (USD Million) And CAGR (%) By Type (2021-2032)

Table 8 Global Concentrated Milk Revenue (USD Million) And CAGR (%) By Application (2021-2032)

Table 9 Global Concentrated Milk Revenue (USD Million) And CAGR (%) By Product (2021-2032)

Table 10 Global Concentrated Milk Market Revenue (USD Million) By Regions (2021-2032)

Table 11 Global Concentrated Milk Market Share (%) By Regions (2021-2032)

Table 12 North America Concentrated Milk Revenue (USD Million) By Country (2021-2032)

Table 13 Europe Concentrated Milk Revenue (USD Million) By Country (2021-2032)

Table 14 Asia Pacific Concentrated Milk Revenue (USD Million) By Country (2021-2032)

Table 15 South America Concentrated Milk Revenue (USD Million) By Country (2021-2032)

Table 16 Middle East and Africa Concentrated Milk Revenue (USD Million) By Region (2021-2032)

Table 17 North America Concentrated Milk Revenue (USD Million) By Type (2021-2032)

Table 18 North America Concentrated Milk Revenue (USD Million) By Application (2021-2032)

Table 19 North America Concentrated Milk Revenue (USD Million) By Product (2021-2032)

Table 20 Europe Concentrated Milk Revenue (USD Million) By Type (2021-2032)

Table 21 Europe Concentrated Milk Revenue (USD Million) By Application (2021-2032)

Table 22 Europe Concentrated Milk Revenue (USD Million) By Product (2021-2032)

Table 23 Asia Pacific Concentrated Milk Revenue (USD Million) By Type (2021-2032)

Table 24 Asia Pacific Concentrated Milk Revenue (USD Million) By Application (2021-2032)

Table 25 Asia Pacific Concentrated Milk Revenue (USD Million) By Product (2021-2032)

Table 26 South America Concentrated Milk Revenue (USD Million) By Type (2021-2032)

Table 27 South America Concentrated Milk Revenue (USD Million) By Application (2021-2032)

Table 28 South America Concentrated Milk Revenue (USD Million) By Product (2021-2032)

Table 29 Middle East and Africa Concentrated Milk Revenue (USD Million) By Type (2021-2032)

Table 30 Middle East and Africa Concentrated Milk Revenue (USD Million) By Application (2021-2032)

Table 31 Middle East and Africa Concentrated Milk Revenue (USD Million) By Product (2021-2032)

LIST OF FIGURES

Figure 1. Market Scope

Figure 2. Pricing Forecasts Per Unit, 2023- 2032

Figure 3. Porter’s Five Forces

Figure 4. Global Concentrated Milk Market Revenue (USD Million) By Regions (2021-2032)

Figure 5. Global Concentrated Milk Market Share (%) By Regions (2023)

Figure 6. North America Concentrated Milk Revenue (USD Million) By Country (2021-2032)

Figure 7. United States Concentrated Milk Revenue (USD Million) By Country (2021-2032)

Figure 8. Canada Concentrated Milk Revenue (USD Million) By Country (2021-2032)

Figure 9. Mexico Concentrated Milk Revenue (USD Million) By Country (2021-2032)

Figure 10. Europe Concentrated Milk Revenue (USD Million) By Country (2021-2032)

Figure 11. Germany Concentrated Milk Revenue (USD Million) By Country (2021-2032)

Figure 12. France Concentrated Milk Revenue (USD Million) By Country (2021-2032)

Figure 13. United Kingdom Concentrated Milk Revenue (USD Million) By Country (2021-2032)

Figure 14. Spain Concentrated Milk Revenue (USD Million) By Country (2021-2032)

Figure 15. Italy Concentrated Milk Revenue (USD Million) By Country (2021-2032)

Figure 16. Russia Concentrated Milk Revenue (USD Million) By Country (2021-2032)

Figure 17. Rest of Europe Concentrated Milk Revenue (USD Million) By Country (2021-2032)

Figure 11. Asia Pacific Concentrated Milk Revenue (USD Million) By Country (2021-2032)

Figure 12. China Concentrated Milk Revenue (USD Million) By Country (2021-2032)

Figure 13. Japan Concentrated Milk Revenue (USD Million) By Country (2021-2032)

Figure 14. India Concentrated Milk Revenue (USD Million) By Country (2021-2032)

Figure 15. South Korea Concentrated Milk Revenue (USD Million) By Country (2021-2032)

Figure 16. Australia Concentrated Milk Revenue (USD Million) By Country (2021-2032)

Figure 17. South East Asia Concentrated Milk Revenue (USD Million) By Country (2021-2032)

Figure 18. South America Concentrated Milk Revenue (USD Million) By Country (2021-2032)

Figure 19. Brazil Concentrated Milk Revenue (USD Million) By Country (2021-2032)

Figure 20. Argentina Concentrated Milk Revenue (USD Million) By Country (2021-2032)

Figure 21. Rest of Asia Pacific Concentrated Milk Revenue (USD Million) By Country (2021-2032)

Figure 22. Middle East and Africa Concentrated Milk Revenue (USD Million) By Region (2021-2032)

Figure 23. Saudi Arabia Concentrated Milk Revenue (USD Million) By Region (2021-2032)

Figure 24. The UAE Concentrated Milk Revenue (USD Million) By Region (2021-2032)

Figure 25. Rest of Middle East Concentrated Milk Revenue (USD Million) By Region (2021-2032)

Figure 26. South Africa Concentrated Milk Revenue (USD Million) By Region (2021-2032)

Figure 27. Africa Concentrated Milk Revenue (USD Million) By Region (2021-2032)

Figure 28. North America Concentrated Milk Revenue (USD Million) By Type (2021-2032)

Figure 29. North America Concentrated Milk Revenue (USD Million) By Application (2021-2032)

Figure 30. North America Concentrated Milk Revenue (USD Million) By Product (2021-2032)

Figure 31. Europe Concentrated Milk Revenue (USD Million) By Type (2021-2032)

Figure 32. Europe Concentrated Milk Revenue (USD Million) By Application (2021-2032)

Figure 33. Europe Concentrated Milk Revenue (USD Million) By Product (2021-2032)

Figure 34. Asia Pacific Concentrated Milk Revenue (USD Million) By Type (2021-2032)

Figure 35. Asia Pacific Concentrated Milk Revenue (USD Million) By Application (2021-2032)

Figure 36. Asia Pacific Concentrated Milk Revenue (USD Million) By Product (2021-2032)

Figure 37. South America Concentrated Milk Revenue (USD Million) By Type (2021-2032)

Figure 38. South America Concentrated Milk Revenue (USD Million) By Application (2021-2032)

Figure 39. South America Concentrated Milk Revenue (USD Million) By Product (2021-2032)

Figure 40. Middle East and Africa Concentrated Milk Revenue (USD Million) By Type (2021-2032)

Figure 41. Middle East and Africa Concentrated Milk Revenue (USD Million) By Application (2021-2032)

Figure 42. Middle East and Africa Concentrated Milk Revenue (USD Million) By Product (2021-2032)

By Type

Condensed milk

Evaporated Milk

By Application

Beverage Milks

Cheese

Malted Milk

Animal Feeds

Others

By Distribution Channel

Supermarkets/Hypermarkets

Convenience Stores

Online Retail

Others

By Packaging

Cans

Bottles

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Concentrated Milk Market Size is valued at $7.1 Billion in 2024 and is forecast to register a growth rate (CAGR) of 4.4% to reach $10 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Agri-Mark Inc, Amalgamated Dairies Ltd, DANA, Eagle Family Foods LLC, Industrias Cor Sa De Cv, Nestlé S.A., O-AT-KA Milk, United Dairy

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume