The global Composite Insulated Panels Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Expanded Polystyrene (EPS) Panel, Rigid Polyurethane (PUR) and Rigid Polyisocyanurate (PIR) Panel, Glass Wool Panel, Others), By Application (Building Wall, Building Roof, Cold Storage), By Skin Material (Continuous Fiber Reinforced Thermoplastics (CFRT), Fiberglass Reinforced Panel (FRP)).

Composite insulated panels, also known as sandwich panels or structural insulated panels (SIPs), are prefabricated building panels consisting of two outer skins or facings bonded to a core material, typically rigid foam insulation, in 2024. These panels are used in construction applications such as walls, roofs, floors, and partitions, offering advantages such as thermal insulation, structural strength, and rapid installation. Composite insulated panels provide a complete building envelope solution, combining insulation, vapor barrier, and structural support in a single integrated panel system. They are available in various sizes, thicknesses, and configurations to meet specific project requirements and performance criteria. Composite insulated panels offer several benefits over traditional construction methods, including reduced thermal bridging, improved energy efficiency, and enhanced indoor comfort. Additionally, they can be manufactured with customizable facings such as steel, aluminum, fiberglass, or composite materials to meet aesthetic and architectural design requirements. With their ability to provide efficient, cost-effective, and sustainable building solutions, composite insulated panels to be a popular choice for residential, commercial, and industrial construction projects worldwide.

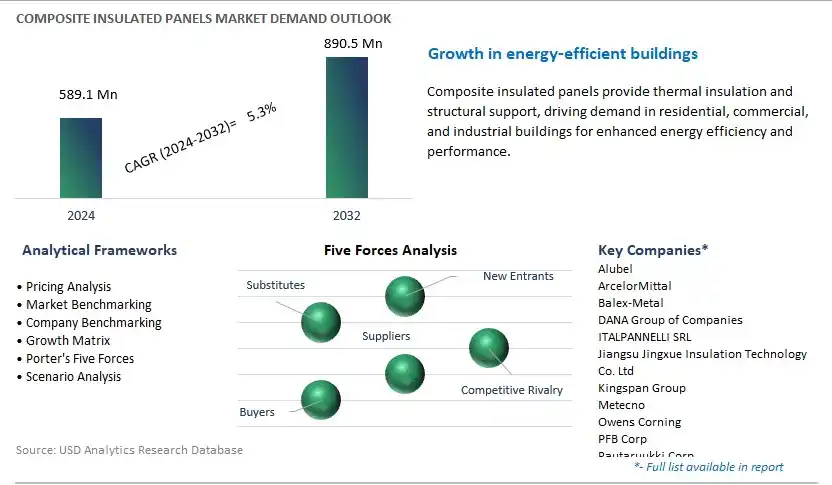

The market report analyses the leading companies in the industry including Alubel, ArcelorMittal, Balex-Metal, DANA Group of Companies, ITALPANNELLI SRL, Jiangsu Jingxue Insulation Technology Co. Ltd, Kingspan Group, Metecno, Owens Corning, PFB Corp, Rautaruukki Corp, Tata Steel, Zamil Steel Pre-Engineered Buildings Company Ltd, and others.

A prominent trend in the market for composite insulated panels is the increasing demand for energy-efficient building solutions driven by sustainability goals, energy regulations, and the need to reduce operational costs. With a growing emphasis on environmental responsibility and energy conservation, building owners and developers are seeking insulated panels that offer superior thermal performance, air tightness, and moisture resistance to enhance building envelope efficiency and indoor comfort. Composite insulated panels, comprising layers of insulation core sandwiched between outer facing materials, provide an effective solution for thermal insulation in walls, roofs, and floors, helping to minimize heat loss or gain and reduce heating, cooling, and ventilation expenses. This trend is reshaping the construction industry, with manufacturers innovating insulated panel designs, materials, and construction methods to meet energy codes, green building standards, and performance criteria for sustainable buildings.

The primary driver fueling the demand for composite insulated panels is the growth in construction of cold storage facilities and controlled environments driven by the expansion of food and beverage industry, pharmaceutical manufacturing, and logistics sectors. With increasing demand for temperature-sensitive products such as perishable goods, vaccines, and pharmaceuticals, there is a rising need for insulated building solutions that provide reliable thermal insulation, temperature control, and hygiene standards. Composite insulated panels offer benefits such as superior insulation properties, seamless construction, and resistance to moisture, mold, and bacteria growth, making them ideal for cold storage warehouses, refrigerated transportation, cleanrooms, and pharmaceutical production facilities. As the cold chain logistics industry expands to meet growing consumer demand for fresh and frozen products, the demand for high-performance insulated panels is expected to rise, driving market growth and investment in advanced panel technologies and solutions for controlled environments.

An emerging opportunity within the market for composite insulated panels lies in the integration of smart building technologies to enhance energy efficiency, occupant comfort, and building performance. Manufacturers can capitalize on this opportunity by incorporating sensors, actuators, and energy management systems into insulated panels to enable real-time monitoring, control, and optimization of building environments. By integrating smart sensors for temperature, humidity, occupancy, and air quality monitoring, insulated panels can contribute to intelligent building systems that adjust heating, cooling, and ventilation operations based on occupancy patterns, weather conditions, and energy demand. Additionally, opportunities exist for the integration of renewable energy technologies such as solar panels and geothermal heating systems with insulated panels to further reduce energy consumption and carbon footprint. By embracing digital transformation and offering integrated solutions that combine insulation performance with smart building capabilities, manufacturers can differentiate themselves in the market, address evolving customer needs, and drive adoption of innovative composite insulated panel solutions for sustainable and efficient buildings of the future.

Within the Composite Insulated Panels market, the Expanded Polystyrene (EPS) Panel Product segment is the largest, primarily due to its versatility, affordability, and wide range of applications. EPS panels are composed of expanded polystyrene foam sandwiched between two rigid facings, typically made of steel, aluminum, or other materials. These panels offer excellent thermal insulation properties, lightweight construction, and ease of installation, making them suitable for various building applications, including walls, roofs, and floors. Moreover, EPS panels are cost-effective compared to other insulation materials like polyurethane and polyisocyanurate, making them a preferred choice for budget-conscious consumers and construction projects. Additionally, EPS panels are highly customizable and can be tailored to meet specific insulation and structural requirements, further enhancing their appeal in the construction industry. Furthermore, the growing emphasis on energy efficiency and sustainable construction practices has led to increased adoption of EPS panels in green building projects and renovations. As construction activities continue to rise globally, especially in the residential and commercial sectors, the demand for EPS panels is expected to remain robust, sustaining the dominance of this segment in the Composite Insulated Panels market.

Within the Composite Insulated Panels market, the Building Wall Application segment is the fastest-growing, propelled by the increasing demand for energy-efficient and sustainable building solutions. Building walls play a crucial role in maintaining thermal comfort and reducing energy consumption in structures, making them a focal point for insulation upgrades and construction innovations. Composite insulated panels offer superior thermal insulation properties compared to traditional building materials, contributing to significant energy savings and operational efficiency in both residential and commercial buildings. Moreover, the ease of installation and modular nature of insulated panels streamline construction processes, reducing labor costs and project timelines. Additionally, the emphasis on green building practices and stringent energy codes and regulations further drive the adoption of composite insulated panels for building walls. As architects, builders, and property owners prioritize environmentally responsible construction methods and seek solutions to combat rising energy costs, the demand for composite insulated panels in the Building Wall Application segment is expected to experience rapid growth, fuelling the overall expansion of the Composite Insulated Panels market.

Within the Composite Insulated Panels market, the Continuous Fiber Reinforced Thermoplastics (CFRT) Skin Material segment is the largest, primarily due to its superior durability and design flexibility. CFRT panels are composed of continuous fibers, such as carbon or glass, embedded in a thermoplastic resin matrix, offering exceptional strength, impact resistance, and weatherability. These panels provide structural integrity and long-term performance, making them suitable for various applications requiring robust building envelopes, such as industrial facilities, cold storage warehouses, and transportation vehicles. Moreover, CFRT panels offer unparalleled design flexibility, allowing architects and designers to create custom shapes, textures, and finishes to meet specific aesthetic and functional requirements. Additionally, CFRT panels can be easily recycled and are inherently resistant to moisture, corrosion, and chemical exposure, enhancing their sustainability and lifecycle value. As construction projects increasingly prioritize durability, sustainability, and design innovation, the demand for CFRT skin materials in composite insulated panels is expected to remain robust, maintaining the dominance of this segment in the market.

By Product

Expanded Polystyrene (EPS) Panel

Rigid Polyurethane (PUR) and Rigid Polyisocyanurate (PIR) Panel

Glass Wool Panel

Others

By Application

Building Wall

Building Roof

Cold Storage

By Skin Material

Continuous Fiber Reinforced Thermoplastics (CFRT)

Fiberglass Reinforced Panel (FRP)Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Alubel

ArcelorMittal

Balex-Metal

DANA Group of Companies

ITALPANNELLI SRL

Jiangsu Jingxue Insulation Technology Co. Ltd

Kingspan Group

Metecno

Owens Corning

PFB Corp

Rautaruukki Corp

Tata Steel

Zamil Steel Pre-Engineered Buildings Company Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Composite Insulated Panels Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Composite Insulated Panels Market Size Outlook, $ Million, 2021 to 2032

3.2 Composite Insulated Panels Market Outlook by Type, $ Million, 2021 to 2032

3.3 Composite Insulated Panels Market Outlook by Product, $ Million, 2021 to 2032

3.4 Composite Insulated Panels Market Outlook by Application, $ Million, 2021 to 2032

3.5 Composite Insulated Panels Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Composite Insulated Panels Industry

4.2 Key Market Trends in Composite Insulated Panels Industry

4.3 Potential Opportunities in Composite Insulated Panels Industry

4.4 Key Challenges in Composite Insulated Panels Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Composite Insulated Panels Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Composite Insulated Panels Market Outlook by Segments

7.1 Composite Insulated Panels Market Outlook by Segments, $ Million, 2021- 2032

By Product

Expanded Polystyrene (EPS) Panel

Rigid Polyurethane (PUR) and Rigid Polyisocyanurate (PIR) Panel

Glass Wool Panel

Others

By Application

Building Wall

Building Roof

Cold Storage

By Skin Material

Continuous Fiber Reinforced Thermoplastics (CFRT)

Fiberglass Reinforced Panel (FRP)

8 North America Composite Insulated Panels Market Analysis and Outlook To 2032

8.1 Introduction to North America Composite Insulated Panels Markets in 2024

8.2 North America Composite Insulated Panels Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Composite Insulated Panels Market size Outlook by Segments, 2021-2032

By Product

Expanded Polystyrene (EPS) Panel

Rigid Polyurethane (PUR) and Rigid Polyisocyanurate (PIR) Panel

Glass Wool Panel

Others

By Application

Building Wall

Building Roof

Cold Storage

By Skin Material

Continuous Fiber Reinforced Thermoplastics (CFRT)

Fiberglass Reinforced Panel (FRP)

9 Europe Composite Insulated Panels Market Analysis and Outlook To 2032

9.1 Introduction to Europe Composite Insulated Panels Markets in 2024

9.2 Europe Composite Insulated Panels Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Composite Insulated Panels Market Size Outlook by Segments, 2021-2032

By Product

Expanded Polystyrene (EPS) Panel

Rigid Polyurethane (PUR) and Rigid Polyisocyanurate (PIR) Panel

Glass Wool Panel

Others

By Application

Building Wall

Building Roof

Cold Storage

By Skin Material

Continuous Fiber Reinforced Thermoplastics (CFRT)

Fiberglass Reinforced Panel (FRP)

10 Asia Pacific Composite Insulated Panels Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Composite Insulated Panels Markets in 2024

10.2 Asia Pacific Composite Insulated Panels Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Composite Insulated Panels Market size Outlook by Segments, 2021-2032

By Product

Expanded Polystyrene (EPS) Panel

Rigid Polyurethane (PUR) and Rigid Polyisocyanurate (PIR) Panel

Glass Wool Panel

Others

By Application

Building Wall

Building Roof

Cold Storage

By Skin Material

Continuous Fiber Reinforced Thermoplastics (CFRT)

Fiberglass Reinforced Panel (FRP)

11 South America Composite Insulated Panels Market Analysis and Outlook To 2032

11.1 Introduction to South America Composite Insulated Panels Markets in 2024

11.2 South America Composite Insulated Panels Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Composite Insulated Panels Market size Outlook by Segments, 2021-2032

By Product

Expanded Polystyrene (EPS) Panel

Rigid Polyurethane (PUR) and Rigid Polyisocyanurate (PIR) Panel

Glass Wool Panel

Others

By Application

Building Wall

Building Roof

Cold Storage

By Skin Material

Continuous Fiber Reinforced Thermoplastics (CFRT)

Fiberglass Reinforced Panel (FRP)

12 Middle East and Africa Composite Insulated Panels Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Composite Insulated Panels Markets in 2024

12.2 Middle East and Africa Composite Insulated Panels Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Composite Insulated Panels Market size Outlook by Segments, 2021-2032

By Product

Expanded Polystyrene (EPS) Panel

Rigid Polyurethane (PUR) and Rigid Polyisocyanurate (PIR) Panel

Glass Wool Panel

Others

By Application

Building Wall

Building Roof

Cold Storage

By Skin Material

Continuous Fiber Reinforced Thermoplastics (CFRT)

Fiberglass Reinforced Panel (FRP)

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Alubel

ArcelorMittal

Balex-Metal

DANA Group of Companies

ITALPANNELLI SRL

Jiangsu Jingxue Insulation Technology Co. Ltd

Kingspan Group

Metecno

Owens Corning

PFB Corp

Rautaruukki Corp

Tata Steel

Zamil Steel Pre-Engineered Buildings Company Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Expanded Polystyrene (EPS) Panel

Rigid Polyurethane (PUR) and Rigid Polyisocyanurate (PIR) Panel

Glass Wool Panel

Others

By Application

Building Wall

Building Roof

Cold Storage

By Skin Material

Continuous Fiber Reinforced Thermoplastics (CFRT)

Fiberglass Reinforced Panel (FRP)

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Composite Insulated Panels Market Size is valued at $589.1 Million in 2024 and is forecast to register a growth rate (CAGR) of 5.3% to reach $890.5 Million by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Alubel, ArcelorMittal, Balex-Metal, DANA Group of Companies, ITALPANNELLI SRL, Jiangsu Jingxue Insulation Technology Co. Ltd, Kingspan Group, Metecno, Owens Corning, PFB Corp, Rautaruukki Corp, Tata Steel, Zamil Steel Pre-Engineered Buildings Company Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume