The global Completion Equipment Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Casings, Cementing Materials & Equipment, Perforating Guns, Gravel Packing, Wellheads).

The market for completion equipment is advancing to enhance efficiency and reliability in oil and gas wells, particularly during the final phase of well construction and production. Completion equipment encompasses a wide range of tools and components used to prepare and finish wells for production, including tubing, packers, valves, and control systems. Key trends include advancements in equipment design and materials to withstand harsh downhole conditions, improve sealing integrity, and enhance flow control efficiency. Additionally, developments in intelligent completion systems, such as downhole sensors and remote monitoring technology, enable real-time data acquisition and optimization of well performance. Moreover, the integration of sustainable practices, such as reduced well intervention and extended equipment lifespan, aligns with industry efforts to minimize environmental impact and operational costs. As oil and gas operators seek to maximize production rates and minimize downtime, the demand for advanced completion equipment is expected to grow, driving further innovation and market development in this critical sector of well construction and production technology.

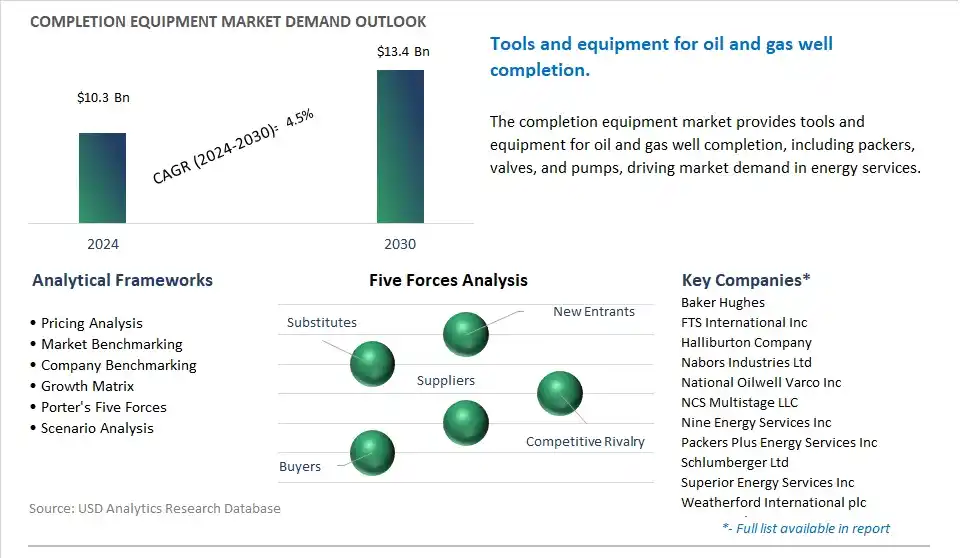

The market report analyses the leading companies in the industry including Baker Hughes, FTS International Inc, Halliburton Company, Nabors Industries Ltd, National Oilwell Varco Inc, NCS Multistage LLC, Nine Energy Services Inc, Packers Plus Energy Services Inc, Schlumberger Ltd, Superior Energy Services Inc, Weatherford International plc, Welltec A/S.

A prominent trend in the market for completion equipment is the increasing focus on enhanced well completion techniques. With the growing complexity of oil and gas reservoirs and the need to maximize production efficiency, there is a rising demand for advanced completion equipment and technologies that can optimize well performance and recovery rates. Operators are increasingly adopting innovative completion techniques such as hydraulic fracturing, multistage fracturing, and intelligent completions to unlock hydrocarbon resources from unconventional reservoirs and improve reservoir connectivity and productivity. This is driven by the pursuit of cost-effective and environmentally sustainable methods to extract oil and gas reserves, leading to a higher demand for completion equipment designed to withstand harsh downhole conditions and deliver superior performance in challenging well environments.

A significant driver fueling the demand for completion equipment is the growth in global oil and gas exploration and production activities. With increasing energy demand, population growth, and industrial development worldwide, there is a continuous need for oil and gas resources to meet energy requirements and drive economic growth. This driver is further supported by advancements in drilling technologies, reservoir characterization techniques, and extraction methods, enabling operators to access previously inaccessible reserves and extend the lifespan of mature fields. As exploration and production activities expand into remote and challenging environments such as deepwater, shale formations, and unconventional reservoirs, the demand for specialized completion equipment such as packers, screens, valves, and intelligent monitoring systems continues to grow, driving innovation and investment in the completion equipment market.

An opportunity within the market for completion equipment lies in the development of next-generation completion technologies. With ongoing advancements in materials science, data analytics, and automation, there is a ripe opportunity to innovate and commercialize new completion equipment solutions that offer improved performance, reliability, and efficiency. Manufacturers aim to capitalize on this opportunity by focusing on the development of intelligent completion systems, downhole sensors, wireless communication tools, and autonomous well control technologies that enhance reservoir management, optimize production operations, and reduce environmental impact. Additionally, there is potential for collaboration with research institutions, technology startups, and industry partners to accelerate the adoption of cutting-edge completion technologies and address evolving challenges in well completion and reservoir management. By investing in research and development and embracing innovation, manufacturers can stay ahead of the curve, differentiate their product offerings, and capture market share in the dynamic and competitive completion equipment market.

In the completion equipment market, the Market Ecosystem begins with design and engineering, where oilfield service giants including Schlumberger, Halliburton Company, and Baker Hughes Company develop equipment tailored to wellbore data and production needs. Independent firms also contribute specialized designs. Raw materials, including steel from mills including ArcelorMittal and specialty alloys from suppliers including Haynes International, are acquired for manufacturing.

Completion equipment manufacturers including Weatherford International plc and NOV Inc. fabricate and assemble the equipment, ensuring quality through rigorous testing, typically in-house or through specialized testing labs. Oilfield service companies handle logistics for delivery to well sites and play a crucial role in installation and well-completion services, ensuring proper deployment and functionality within the wellbore. After-sales services including warranties and maintenance are offered by oilfield service companies to address equipment issues, completing the Market Ecosystem for the completion equipment market, vital for safe and efficient oil and gas production.

The largest segment in the Completion Equipment Market is the "Casings" segment. This dominance is driven by casings play a crucial role in well construction and completion, providing structural support, zonal isolation, and pressure containment throughout the life of the well. Casings are made of steel and are installed inside the wellbore to prevent collapse, fluid migration, and contamination between different geological formations. Additionally, casings serve as conduits for production fluids, allowing for the extraction of oil, gas, or other resources from underground reservoirs. Given the essential functions of casings in ensuring the integrity and productivity of oil and gas wells, they are indispensable components of completion equipment across various types of wells, including exploration, production, and injection wells. Further, advancements in casing design, materials, and manufacturing processes have led to the development of high-performance casings capable of withstanding harsh operating conditions, such as high pressures, temperatures, and corrosive environments. In addition, the increasing demand for oil and gas production, particularly from unconventional shale formations and deepwater reservoirs, drives the need for advanced completion equipment, including casings, to support drilling and completion operations. As a result, the "Casings" segment is the largest segment in the Completion Equipment Market due to its essential role, widespread use, and continuous demand in oil and gas well construction and completion activities.

By Product

Casings

Cementing Materials & Equipment

Perforating Guns

Gravel Packing

Wellheads

Baker Hughes

FTS International Inc

Halliburton Company

Nabors Industries Ltd

National Oilwell Varco Inc

NCS Multistage LLC

Nine Energy Services Inc

Packers Plus Energy Services Inc

Schlumberger Ltd

Superior Energy Services Inc

Weatherford International plc

Welltec A/S

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Completion Equipment Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Completion Equipment Market Size Outlook, $ Million, 2021 to 2030

3.2 Completion Equipment Market Outlook by Type, $ Million, 2021 to 2030

3.3 Completion Equipment Market Outlook by Product, $ Million, 2021 to 2030

3.4 Completion Equipment Market Outlook by Application, $ Million, 2021 to 2030

3.5 Completion Equipment Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Completion Equipment Industry

4.2 Key Market Trends in Completion Equipment Industry

4.3 Potential Opportunities in Completion Equipment Industry

4.4 Key Challenges in Completion Equipment Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Completion Equipment Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Completion Equipment Market Outlook by Segments

7.1 Completion Equipment Market Outlook by Segments, $ Million, 2021- 2030

By Product

Casings

Cementing Materials & Equipment

Perforating Guns

Gravel Packing

Wellheads

8 North America Completion Equipment Market Analysis and Outlook To 2030

8.1 Introduction to North America Completion Equipment Markets in 2024

8.2 North America Completion Equipment Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Completion Equipment Market size Outlook by Segments, 2021-2030

By Product

Casings

Cementing Materials & Equipment

Perforating Guns

Gravel Packing

Wellheads

9 Europe Completion Equipment Market Analysis and Outlook To 2030

9.1 Introduction to Europe Completion Equipment Markets in 2024

9.2 Europe Completion Equipment Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Completion Equipment Market Size Outlook by Segments, 2021-2030

By Product

Casings

Cementing Materials & Equipment

Perforating Guns

Gravel Packing

Wellheads

10 Asia Pacific Completion Equipment Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Completion Equipment Markets in 2024

10.2 Asia Pacific Completion Equipment Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Completion Equipment Market size Outlook by Segments, 2021-2030

By Product

Casings

Cementing Materials & Equipment

Perforating Guns

Gravel Packing

Wellheads

11 South America Completion Equipment Market Analysis and Outlook To 2030

11.1 Introduction to South America Completion Equipment Markets in 2024

11.2 South America Completion Equipment Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Completion Equipment Market size Outlook by Segments, 2021-2030

By Product

Casings

Cementing Materials & Equipment

Perforating Guns

Gravel Packing

Wellheads

12 Middle East and Africa Completion Equipment Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Completion Equipment Markets in 2024

12.2 Middle East and Africa Completion Equipment Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Completion Equipment Market size Outlook by Segments, 2021-2030

By Product

Casings

Cementing Materials & Equipment

Perforating Guns

Gravel Packing

Wellheads

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Baker Hughes

FTS International Inc

Halliburton Company

Nabors Industries Ltd

National Oilwell Varco Inc

NCS Multistage LLC

Nine Energy Services Inc

Packers Plus Energy Services Inc

Schlumberger Ltd

Superior Energy Services Inc

Weatherford International plc

Welltec A/S

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Casings

Cementing Materials & Equipment

Perforating Guns

Gravel Packing

Wellheads

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Completion Equipment is forecast to reach $13.4 Billion in 2030 from $10.3 Billion in 2024, registering a CAGR of 4.5% over the outlook period

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Baker Hughes, FTS International Inc, Halliburton Company, Nabors Industries Ltd, National Oilwell Varco Inc, NCS Multistage LLC, Nine Energy Services Inc, Packers Plus Energy Services Inc, Schlumberger Ltd, Superior Energy Services Inc, Weatherford International plc, Welltec A/S

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume