The global Commercial Flooring Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Ceramics, Vitrified, Carpet, Vinyl, LVT, Linoleum & Rubber, Wood & Laminate, Natural Stone, Others), By Application (Commercial Buildings, Public Buildings, Education, Others).

The commercial flooring market is experiencing steady growth driven by the expansion of commercial real estate, renovation projects, and changing workplace trends. Key trends shaping the future of the industry include the increasing demand for durable, sustainable, and aesthetically pleasing flooring solutions that meet the diverse needs of commercial spaces such as offices, retail stores, healthcare facilities, and hospitality venues. As businesses prioritize employee well-being, brand image, and sustainability goals, there's a growing need for commercial flooring materials that offer comfort, safety, and environmental responsibility. Moreover, advancements in flooring technology such as luxury vinyl tiles (LVT), carpet tiles, and engineered hardwood are providing versatile options that combine durability, design flexibility, and ease of maintenance, driving market expansion. Additionally, the rising adoption of modular flooring systems, eco-friendly materials, and digital printing technologies for customized designs and patterns is fueling demand for innovative flooring solutions in the commercial sector. Furthermore, the integration of smart flooring technologies such as integrated sensors, LED lighting, and wireless connectivity is enhancing functionality and user experience while enabling data-driven insights into space utilization, occupancy patterns, and environmental conditions, driving innovation and market growth in the commercial flooring industry.

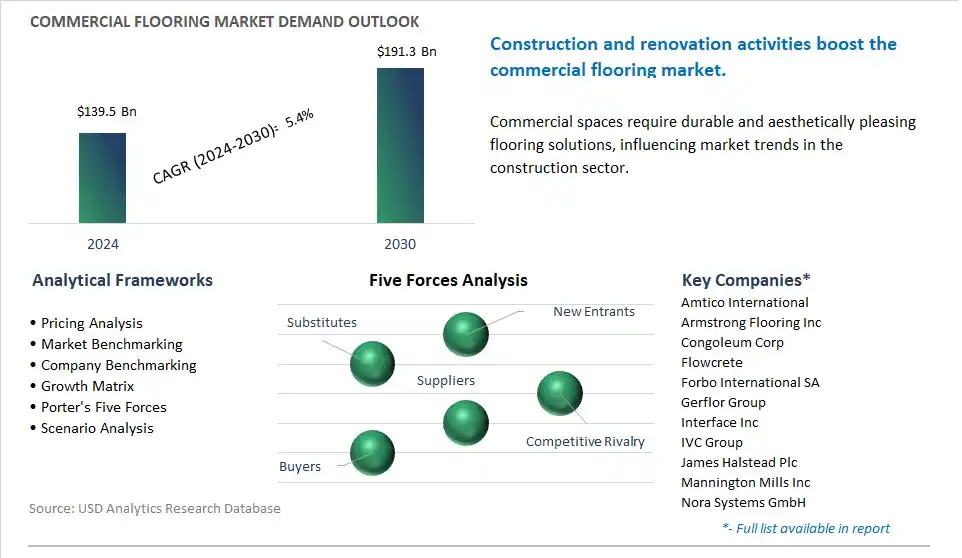

The market report analyses the leading companies in the industry including Amtico International, Armstrong Flooring Inc, Congoleum Corp, Flowcrete, Forbo International SA, Gerflor Group, Interface Inc, IVC Group, James Halstead Plc, Mannington Mills Inc, Nora Systems GmbH, NOX Corp, Tkflor, Toli Flooring Co. Ltd.

One prominent trend in the commercial flooring market is the shift towards sustainable and eco-friendly flooring solutions. With increasing awareness of environmental issues and the desire to reduce carbon footprint, there is a growing demand for flooring materials that are manufactured using sustainable practices, recycled materials, and low-emission adhesives. Commercial buildings, including offices, retail spaces, and hospitality establishments, are seeking flooring options that contribute to green building certifications such as LEED (Leadership in Energy and Environmental Design) and WELL Building Standard. Sustainable flooring materials such as bamboo, cork, linoleum, and recycled rubber are gaining popularity due to their durability, aesthetics, and environmental benefits. This trend is driven by regulatory mandates, corporate sustainability initiatives, and consumer preferences for environmentally responsible products, shaping the commercial flooring market towards more sustainable choices.

A primary driver shaping the commercial flooring market is the ongoing renovation and retrofitting projects in commercial spaces. As businesses seek to modernize their facilities, improve aesthetics, and enhance functionality, there is a significant demand for flooring solutions that offer durability, ease of maintenance, and design flexibility. Renovation projects in office buildings, retail stores, healthcare facilities, and educational institutions drive the need for flooring materials that can withstand high foot traffic, resist stains and spills, and accommodate evolving design trends. Additionally, the growing trend towards open-concept workspaces, collaborative environments, and wellness-focused designs influences the choice of flooring materials that promote employee productivity, comfort, and well-being. The renovation and retrofitting market, fueled by changing workplace dynamics and evolving consumer preferences, presents lucrative opportunities for commercial flooring suppliers to provide innovative and tailored solutions to meet the diverse needs of businesses and organizations.

An opportunity within the commercial flooring market lies in the integration of smart and connected technologies into flooring products. As the commercial real estate industry embraces digitalization and smart building solutions, there is growing interest in flooring systems that offer additional functionalities beyond basic flooring requirements. Smart flooring technologies such as sensor-embedded floors, integrated LED lighting, and wireless communication capabilities can provide valuable data insights on occupancy, foot traffic patterns, indoor air quality, and energy usage, enabling building managers to optimize space utilization, improve operational efficiency, and enhance occupant experience. Additionally, smart flooring solutions can support emerging trends such as contactless access control, wayfinding navigation, and environmental monitoring, contributing to the creation of smarter, safer, and more sustainable built environments. By investing in research and development to innovate smart flooring technologies and collaborating with building automation and technology providers, commercial flooring manufacturers can capitalize on the growing demand for intelligent and connected flooring solutions, driving innovation and differentiation in the market.

Among the delineated segments based on product, Vinyl is the largest segment in the Commercial Flooring Market, driven by diverse pivotal factors. The dominance of Vinyl in the market is driven by vinyl flooring offers a combination of versatility, durability, and cost-effectiveness that makes it a preferred choice for commercial applications across various industries. Vinyl flooring is available in a wide range of designs, colors, and textures, allowing for customization to suit diverse aesthetic preferences and interior design themes. Additionally, vinyl flooring is highly resistant to moisture, stains, scratches, and heavy foot traffic, making it ideal for commercial spaces such as offices, retail stores, healthcare facilities, educational institutions, and hospitality venues. In addition, advancements in vinyl flooring technology, including the development of luxury vinyl tile (LVT) and rigid core vinyl plank flooring, enhance the performance, appearance, and ease of installation of vinyl products, further driving their popularity in the commercial sector. Further, vinyl flooring is relatively easy to maintain and clean, requiring minimal upkeep and providing long-term cost savings for commercial property owners and facility managers. As commercial property owners, architects, and designers prioritize practicality, durability, and aesthetics in flooring solutions, Vinyl maintains its lead in the Commercial Flooring Market, reflecting its unmatched combination of performance, design versatility, and value for commercial applications.

Among the delineated segments based on application, Public Buildings emerge as the fastest-growing segment in the Commercial Flooring Market, driven by diverse compelling factors. The rapid growth of the Public Buildings segment can be attributed to diverse key trends and developments in urbanization, infrastructure investment, and public facility development. The there is a growing focus on the construction and renovation of public buildings such as government offices, healthcare facilities, transportation hubs, recreational centers, and cultural institutions to meet the evolving needs of urban populations and enhance community services. Public buildings require durable, low-maintenance flooring solutions that can withstand high foot traffic, frequent use, and stringent hygiene requirements while maintaining aesthetic appeal and safety standards. Additionally, the increasing adoption of sustainable building practices and green building certifications drives the demand for environmentally friendly flooring materials and installation techniques in public building projects. Further, advancements in commercial flooring technology, including the development of modular flooring systems, acoustic underlays, and slip-resistant coatings, enhance the performance, comfort, and safety of flooring solutions for public buildings, further driving their adoption by architects, designers, and facility managers. In addition, the globalization of design trends, digital printing capabilities, and customization options enable public building owners to create unique and engaging interior environments that reflect their brand identity, mission, and values. As governments, municipalities, and public agencies prioritize infrastructure modernization and community development initiatives, the Public Buildings segment experiences rapid growth in the Commercial Flooring Market, reflecting its pivotal role in creating functional, inviting, and sustainable public spaces that enrich the quality of life for residents and visitors alike.

By Product

Ceramics

Vitrified

Carpet

Vinyl

LVT

Linoleum & Rubber

Wood & Laminate

Natural Stone

Others

By Application

Commercial Buildings

Public Buildings

Education

Others

Regions Included

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Amtico International

Armstrong Flooring Inc

Congoleum Corp

Flowcrete

Forbo International SA

Gerflor Group

Interface Inc

IVC Group

James Halstead Plc

Mannington Mills Inc

Nora Systems GmbH

NOX Corp

Tkflor

Toli Flooring Co. Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Commercial Flooring Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Commercial Flooring Market Size Outlook, $ Million, 2021 to 2030

3.2 Commercial Flooring Market Outlook by Type, $ Million, 2021 to 2030

3.3 Commercial Flooring Market Outlook by Product, $ Million, 2021 to 2030

3.4 Commercial Flooring Market Outlook by Application, $ Million, 2021 to 2030

3.5 Commercial Flooring Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Commercial Flooring Industry

4.2 Key Market Trends in Commercial Flooring Industry

4.3 Potential Opportunities in Commercial Flooring Industry

4.4 Key Challenges in Commercial Flooring Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Commercial Flooring Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Commercial Flooring Market Outlook by Segments

7.1 Commercial Flooring Market Outlook by Segments, $ Million, 2021- 2030

By Product

Ceramics

Vitrified

Carpet

Vinyl

LVT

Linoleum & Rubber

Wood & Laminate

Natural Stone

Others

By Application

Commercial Buildings

Public Buildings

Education

Others

8 North America Commercial Flooring Market Analysis and Outlook To 2030

8.1 Introduction to North America Commercial Flooring Markets in 2024

8.2 North America Commercial Flooring Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Commercial Flooring Market size Outlook by Segments, 2021-2030

By Product

Ceramics

Vitrified

Carpet

Vinyl

LVT

Linoleum & Rubber

Wood & Laminate

Natural Stone

Others

By Application

Commercial Buildings

Public Buildings

Education

Others

9 Europe Commercial Flooring Market Analysis and Outlook To 2030

9.1 Introduction to Europe Commercial Flooring Markets in 2024

9.2 Europe Commercial Flooring Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Commercial Flooring Market Size Outlook by Segments, 2021-2030

By Product

Ceramics

Vitrified

Carpet

Vinyl

LVT

Linoleum & Rubber

Wood & Laminate

Natural Stone

Others

By Application

Commercial Buildings

Public Buildings

Education

Others

10 Asia Pacific Commercial Flooring Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Commercial Flooring Markets in 2024

10.2 Asia Pacific Commercial Flooring Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Commercial Flooring Market size Outlook by Segments, 2021-2030

By Product

Ceramics

Vitrified

Carpet

Vinyl

LVT

Linoleum & Rubber

Wood & Laminate

Natural Stone

Others

By Application

Commercial Buildings

Public Buildings

Education

Others

11 South America Commercial Flooring Market Analysis and Outlook To 2030

11.1 Introduction to South America Commercial Flooring Markets in 2024

11.2 South America Commercial Flooring Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Commercial Flooring Market size Outlook by Segments, 2021-2030

By Product

Ceramics

Vitrified

Carpet

Vinyl

LVT

Linoleum & Rubber

Wood & Laminate

Natural Stone

Others

By Application

Commercial Buildings

Public Buildings

Education

Others

12 Middle East and Africa Commercial Flooring Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Commercial Flooring Markets in 2024

12.2 Middle East and Africa Commercial Flooring Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Commercial Flooring Market size Outlook by Segments, 2021-2030

By Product

Ceramics

Vitrified

Carpet

Vinyl

LVT

Linoleum & Rubber

Wood & Laminate

Natural Stone

Others

By Application

Commercial Buildings

Public Buildings

Education

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Amtico International

Armstrong Flooring Inc

Congoleum Corp

Flowcrete

Forbo International SA

Gerflor Group

Interface Inc

IVC Group

James Halstead Plc

Mannington Mills Inc

Nora Systems GmbH

NOX Corp

Tkflor

Toli Flooring Co. Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Ceramics

Vitrified

Carpet

Vinyl

LVT

Linoleum & Rubber

Wood & Laminate

Natural Stone

Others

By Application

Commercial Buildings

Public Buildings

Education

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Commercial Flooring is forecast to reach $191.3 Billion in 2030 from $139.5 Billion in 2024, registering a CAGR of 5.4%

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Amtico International, Armstrong Flooring Inc, Congoleum Corp, Flowcrete, Forbo International SA, Gerflor Group, Interface Inc, IVC Group, James Halstead Plc, Mannington Mills Inc, Nora Systems GmbH, NOX Corp, Tkflor, Toli Flooring Co. Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume