The global Cold Chain Logistics Market Comprehensive Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Service (Storage, Transportation, Value-added services), By Application (Food & Beverages, Medical Goods, Chemicals that are sensitive to temperature), By Temperature (Frozen, Chilled)

Cold chain logistics refers to the management and transportation of temperature-sensitive goods, such as perishable food items, pharmaceuticals, and biologics, under controlled temperature conditions in 2024. This specialized logistics sector ensures that products maintain their quality, freshness, and safety throughout the supply chain, from production and storage to distribution and delivery. Cold chain logistics involves the use of refrigerated trucks, warehouses, containers, and monitoring devices to maintain specific temperature ranges required by different products. It also encompasses temperature monitoring, tracking, and documentation to ensure compliance with regulatory standards and customer requirements. With the globalization of supply chains, increasing demand for fresh and frozen foods, and stringent regulations governing product safety and quality, the market for cold chain logistics is expanding. Logistics providers are investing in cold storage infrastructure, technology solutions, and transportation capabilities to meet the growing demand for temperature-controlled transportation and storage services while addressing challenges such as energy efficiency, product traceability, and supply chain visibility.

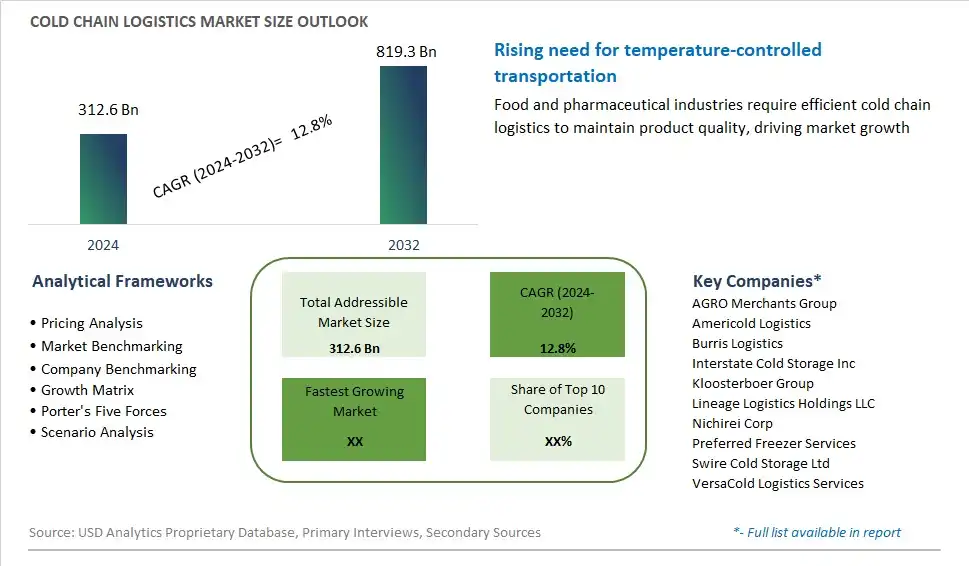

The market report analyses the leading companies in the industry including AGRO Merchants Group, Americold Logistics, Burris Logistics, Interstate Cold Storage Inc, Kloosterboer Group, Lineage Logistics Holdings LLC, Nichirei Corp, Preferred Freezer Services, Swire Cold Storage Ltd, VersaCold Logistics Services, and Others.

The cold chain logistics market is witnessing a prominent trend driven by the increased demand for temperature-controlled supply chain solutions across various industries. With the globalization of trade, advancements in pharmaceuticals, and the growth of the food and beverage sector, there is a rising need to maintain the integrity of temperature-sensitive products throughout the distribution process. Cold chain logistics ensures that perishable goods such as fresh produce, pharmaceuticals, and frozen foods are transported and stored at the optimal temperature range to preserve their quality, safety, and shelf life. This trend is fueled by factors such as stringent regulations, consumer preferences for fresh and high-quality products, and the expansion of e-commerce, which requires efficient cold chain infrastructure to support last-mile delivery of temperature-sensitive goods. As companies prioritize product safety, compliance, and customer satisfaction, the demand for cold chain logistics services continues to grow, driving investment, innovation, and market expansion in the global cold chain industry.

A significant driver of the cold chain logistics market is the rapid growth of the pharmaceutical and healthcare sector, which relies heavily on temperature-controlled logistics to ensure the safe and effective distribution of vaccines, biologics, and pharmaceutical products. The pharmaceutical industry is characterized by the increasing complexity and sensitivity of drug products, with many medications requiring strict temperature control and monitoring throughout the supply chain to maintain efficacy and regulatory compliance. Additionally, the rise of personalized medicine, biopharmaceuticals, and specialty drugs further amplifies the demand for cold chain logistics services, as these products often have specific storage and transportation requirements. The expansion of healthcare infrastructure, advancements in biotechnology, and the global distribution of vaccines and biologics contribute to the growth of the cold chain logistics market, driving the need for specialized temperature-controlled storage, transportation, and distribution solutions to meet the evolving demands of the pharmaceutical and healthcare industries.

An opportunity for the cold chain logistics market lies in the integration of technology and data analytics to enhance visibility, efficiency, and transparency across the cold chain supply chain. By leveraging IoT sensors, RFID tags, temperature monitoring devices, and GPS tracking systems, cold chain logistics providers can collect real-time data on environmental conditions, shipment status, and location, enabling proactive monitoring and management of temperature-sensitive cargo. Advanced analytics and predictive modeling can analyze vast amounts of data to identify potential issues, optimize route planning, and mitigate risks of temperature excursions, ensuring product integrity and regulatory compliance throughout the cold chain journey. Furthermore, blockchain technology offers opportunities to establish immutable records of product provenance, temperature history, and compliance documentation, enhancing traceability and accountability in the cold chain ecosystem. By embracing technological innovations and data-driven solutions, cold chain logistics companies can differentiate themselves, improve operational efficiency, and unlock new opportunities for growth in the dynamic and evolving cold chain logistics market.

The transportation services segment is the largest in the Cold Chain Logistics market due to the critical role it plays in maintaining the integrity of temperature-sensitive goods throughout the supply chain. Cold chain transportation ensures that perishable products such as food, pharmaceuticals, and chemicals are transported under controlled temperature conditions to preserve their quality and safety. This segment encompasses various modes of transportation, including refrigerated trucks, ships, airplanes, and trains, equipped with temperature-controlled containers or compartments. Further, the global demand for fresh and frozen products, coupled with the growth of e-commerce and online grocery delivery services, further drives the need for efficient cold chain transportation solutions. Additionally, stringent regulations and quality standards governing the transportation of perishable goods mandate the use of specialized cold chain logistics services to ensure compliance and minimize the risk of product spoilage or contamination. With its indispensable role in safeguarding product integrity and meeting customer expectations for quality and freshness, the transportation services segment maintains its dominance in the Cold Chain Logistics market.

The medical goods segment is the fastest-growing segment in the Cold Chain Logistics market due to the increasing demand for temperature-sensitive pharmaceuticals, vaccines, biologics, and medical devices. With advancements in healthcare technologies and the development of new biopharmaceutical products, there is a growing need for specialized cold chain logistics services to ensure the safe and effective transport of these sensitive medical goods. Further, the rise in global healthcare expenditure, expansion of pharmaceutical manufacturing capabilities, and the growing emphasis on healthcare access and immunization programs in emerging economies contribute to the increasing demand for cold chain logistics solutions in the medical sector. Additionally, stringent regulatory requirements and quality standards governing the storage and transportation of medical goods necessitate the use of specialized temperature-controlled facilities and transportation vehicles. As a result, the medical goods segment experiences rapid growth, positioning it as a key driver of expansion in the Cold Chain Logistics market.

The frozen segment is the largest in the Cold Chain Logistics market due to its extensive applications across various industries and the increasing demand for frozen food products worldwide. Frozen products, including frozen foods, seafood, meats, fruits, and vegetables, require strict temperature control during storage and transportation to maintain their quality, safety, and nutritional value. This necessitates the use of specialized cold chain logistics services equipped with ultra-low temperature storage facilities and refrigerated transportation vehicles capable of maintaining sub-zero temperatures. Further, the growing popularity of frozen convenience foods, ready-to-eat meals, and frozen desserts, coupled with the expansion of frozen food retail channels such as supermarkets, hypermarkets, and e-commerce platforms, further drives the demand for cold chain logistics solutions in the frozen segment. Additionally, advancements in freezing technologies, packaging solutions, and cold chain infrastructure contribute to the efficiency and reliability of cold chain logistics services for frozen products. With its significant market share and indispensable role in preserving the quality and safety of frozen goods, the frozen segment maintains its dominance in the Cold Chain Logistics market.

By Service

Storage

Transportation

Value-added services

By Application

Food & Beverages

Medical Goods

Chemicals that are sensitive to temperature

By Temperature

Frozen

Chilled

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

AGRO Merchants Group

Americold Logistics

Burris Logistics

Interstate Cold Storage Inc

Kloosterboer Group

Lineage Logistics Holdings LLC

Nichirei Corp

Preferred Freezer Services

Swire Cold Storage Ltd

VersaCold Logistics Services

*- List Not Exhaustive

Chapter 1. TABLE OF CONTENTS

Chapter 2. Introduction to Cold Chain Logistics Market

2.1. Market Overview

2.2. Key Statistics and Report Highlights

2.3. Scope of the Comprehensive Study

2.3.1. Market Definition

2.3.2 Countries and Regions Covered

2.3.3 Research Objective

2.3.4 Units, Currency, and Conversions

2.3.5 Industry Value Chain

2.4. Key Market Segments

2.5. Key Companies

2.6. Study Period

Chapter 3. Strategic Analysis Review

3.1. Cold Chain Logistics Pricing Analysis and Forecast

3.2. Porter’s Five Forces

3.3. Market Ecosystem

3.4. SWOT Analysis

3.5. Regulatory Scenario

3.3. Effects of Inflation, Russia-Ukraine War, moderating economic growth, and other macroeconomic factors

Chapter 4. Competitive Landscape

4.1. Market Share Analysis

4.1.1. Global Cold Chain Logistics Market Share by Company, 2023

4.1.2. Product Offerings of Leading Cold Chain Logistics Companies

4.2. Market Entropy

4.2.1. New Product Launches in the Industry

4.2.2. Mergers, Acquisitions, Joint ventures, and Partnerships

4.3. Key Strategies and Best Practices

Chapter 5. Global Market Projections: Best, Reference, and Low Case Scenarios

5.1. Growth Analysis- Case Scenario Definitions

5.2. Low Growth Case Scenario Forecasts

5.3. Reference Growth Case Scenario Forecasts

5.4. High Growth Case Scenario Forecasts

Chapter 6. Market Dynamics

6.1. Cold Chain Logistics Market Drivers

6.2. Cold Chain Logistics Market Challenges

6.6. Cold Chain Logistics Market Opportunities

6.4. Cold Chain Logistics Market Trends

Chapter 7. Global Cold Chain Logistics Market Outlook Trends

7.1. Global Cold Chain Logistics Revenue (USD Million) and CAGR (%) by Type (2021-2032)

7.2. Global Cold Chain Logistics Revenue (USD Million) and CAGR (%) by Application (2021-2032)

7.3. Global Cold Chain Logistics Revenue (USD Million) and CAGR (%) by Product (2021-2032)

By Service

Storage

Transportation

Value-added services

By Application

Food & Beverages

Medical Goods

Chemicals that are sensitive to temperature

By Temperature

Frozen

Chilled

Chapter 8. Global Cold Chain Logistics Regional Analysis and Outlook

8.1. Global Cold Chain Logistics Revenue (USD Million) By Regions (2021- 2032)

8.2. North America Cold Chain Logistics Revenue (USD Million) by Country (2021-2032)

8.2.1. United States Cold Chain Logistics Regional Analysis and Outlook

8.2.2. Canada Cold Chain Logistics Regional Analysis and Outlook

8.2.3. Mexico Cold Chain Logistics Regional Analysis and Outlook

8.3. Europe Cold Chain Logistics Revenue (USD Million), by Country (2021-2032)

8.3.1. Germany Cold Chain Logistics Regional Analysis and Outlook

8.3.2. France Cold Chain Logistics Regional Analysis and Outlook

8.3.3. United Kingdom Cold Chain Logistics Regional Analysis and Outlook

8.3.4. Spain Cold Chain Logistics Regional Analysis and Outlook

8.3.5. Italy Cold Chain Logistics Regional Analysis and Outlook

8.3.6. Russia Cold Chain Logistics Regional Analysis and Outlook

8.3.7. Rest of Europe Cold Chain Logistics Regional Analysis and Outlook

8.4. Asia Pacific Cold Chain Logistics Revenue (USD Million) by Country (2021-2032)

8.4.1. China Cold Chain Logistics Regional Analysis and Outlook

8.4.2. Japan Cold Chain Logistics Regional Analysis and Outlook

8.4.3. India Cold Chain Logistics Regional Analysis and Outlook

8.4.4. South Korea Cold Chain Logistics Regional Analysis and Outlook

8.4.5. Australia Cold Chain Logistics Regional Analysis and Outlook

8.4.6. South East Asia Cold Chain Logistics Regional Analysis and Outlook

8.4.7. Rest of Asia Pacific Cold Chain Logistics Regional Analysis and Outlook

8.5. South America Cold Chain Logistics Revenue (USD Million), by Country (2021-2032)

8.5.1. Brazil Cold Chain Logistics Regional Analysis and Outlook

8.5.2. Argentina Cold Chain Logistics Regional Analysis and Outlook

8.5.3. Rest of South America Cold Chain Logistics Regional Analysis and Outlook

8.6. Middle East and Africa Cold Chain Logistics Revenue (USD Million) by Country (2021-2032)

8.6.1. Middle East Cold Chain Logistics Regional Analysis and Outlook

8.6.2. Africa Cold Chain Logistics Regional Analysis and Outlook

Chapter 9. North America Cold Chain Logistics Analysis and Outlook

9.1. North America Cold Chain Logistics Revenue (USD Million) by Segments (2021-2032)

9.1.1. North America Cold Chain Logistics Revenue (USD Million) by Type (2021-2032)

9.1.2. North America Cold Chain Logistics Revenue (USD Million) by Application (2021-2032)

9.1.3. North America Cold Chain Logistics Revenue (USD Million) by Product (2021-2032)

By Service

Storage

Transportation

Value-added services

By Application

Food & Beverages

Medical Goods

Chemicals that are sensitive to temperature

By Temperature

Frozen

Chilled

Chapter 10. Europe Cold Chain Logistics Analysis and Outlook

10.1. Europe Cold Chain Logistics Revenue (USD Million), by Segments (USD Million) (2021-2032)

10.1.1. Europe Cold Chain Logistics Revenue (USD Million) by Type (2021-2032)

10.1.2. Europe Cold Chain Logistics Revenue (USD Million) by Application (2021-2032)

10.1.3. Europe Cold Chain Logistics Revenue (USD Million) by Product (2021-2032)

By Service

Storage

Transportation

Value-added services

By Application

Food & Beverages

Medical Goods

Chemicals that are sensitive to temperature

By Temperature

Frozen

Chilled

Chapter 11. Asia Pacific Cold Chain Logistics Analysis and Outlook

11.1. Asia Pacific Cold Chain Logistics Revenue (USD Million), and Revenue (USD Million) by Segments (2021-2032)

11.1.1. Asia Pacific Cold Chain Logistics Revenue (USD Million) by Type (2021-2032)

11.1.2. Asia Pacific Cold Chain Logistics Revenue (USD Million) by Application (2021-2032)

11.1.3. Asia Pacific Cold Chain Logistics Revenue (USD Million) by Product (2021-2032)

By Service

Storage

Transportation

Value-added services

By Application

Food & Beverages

Medical Goods

Chemicals that are sensitive to temperature

By Temperature

Frozen

Chilled

Chapter 12. South America Cold Chain Logistics Analysis and Outlook

12.1. South America Cold Chain Logistics Revenue (USD Million), by Segments (2021-2032)

12.1.1. South America Cold Chain Logistics Revenue (USD Million) by Type (2021-2032)

12.1.2. South America Cold Chain Logistics Revenue (USD Million) by Application (2021-2032)

12.1.3. South America Cold Chain Logistics Revenue (USD Million) by Product (2021-2032)

By Service

Storage

Transportation

Value-added services

By Application

Food & Beverages

Medical Goods

Chemicals that are sensitive to temperature

By Temperature

Frozen

Chilled

Chapter 13. Middle East and Africa Cold Chain Logistics Analysis and Outlook

13.1. Middle East and Africa Cold Chain Logistics Revenue (USD Million), by Segments (2021-2032)

13.1.1. Middle East and Africa Cold Chain Logistics Revenue (USD Million) by Type (2021-2032)

13.1.2. Middle East and Africa Cold Chain Logistics Revenue (USD Million) by Application (2021-2032)

13.1.3. Middle East and Africa Cold Chain Logistics Revenue (USD Million) by Product (2021-2032)

By Service

Storage

Transportation

Value-added services

By Application

Food & Beverages

Medical Goods

Chemicals that are sensitive to temperature

By Temperature

Frozen

Chilled

Chapter 14. Cold Chain Logistics Company Profiles

14.1 Business Overview

14.2 Product Profiles

14.3 SWOT Profiles

14.5 Recent Developments

14.6 Financial Profile

List of Companies

AGRO Merchants Group

Americold Logistics

Burris Logistics

Interstate Cold Storage Inc

Kloosterboer Group

Lineage Logistics Holdings LLC

Nichirei Corp

Preferred Freezer Services

Swire Cold Storage Ltd

VersaCold Logistics Services

15. Methodology and Data Sources

15.1 Customization Offerings

15.2 Subscription Services

15.3 Related Reports

15.4 Publisher Expertise

LIST OF TABLES

Table 1 Market Segmentation Analysis

Table 2 Global Cold Chain Logistics Market Share of Leading Companies, 2023

Table 3 Product Offerings of Leading Companies

Table 4 Low Growth Scenario Forecasts

Table 5 Reference Case Growth Scenario

Table 6 High Growth Case Scenario

Table 7 Global Cold Chain Logistics Revenue (USD Million) And CAGR (%) By Type (2021-2032)

Table 8 Global Cold Chain Logistics Revenue (USD Million) And CAGR (%) By Application (2021-2032)

Table 9 Global Cold Chain Logistics Revenue (USD Million) And CAGR (%) By Product (2021-2032)

Table 10 Global Cold Chain Logistics Market Revenue (USD Million) By Regions (2021-2032)

Table 11 Global Cold Chain Logistics Market Share (%) By Regions (2021-2032)

Table 12 North America Cold Chain Logistics Revenue (USD Million) By Country (2021-2032)

Table 13 Europe Cold Chain Logistics Revenue (USD Million) By Country (2021-2032)

Table 14 Asia Pacific Cold Chain Logistics Revenue (USD Million) By Country (2021-2032)

Table 15 South America Cold Chain Logistics Revenue (USD Million) By Country (2021-2032)

Table 16 Middle East and Africa Cold Chain Logistics Revenue (USD Million) By Region (2021-2032)

Table 17 North America Cold Chain Logistics Revenue (USD Million) By Type (2021-2032)

Table 18 North America Cold Chain Logistics Revenue (USD Million) By Application (2021-2032)

Table 19 North America Cold Chain Logistics Revenue (USD Million) By Product (2021-2032)

Table 20 Europe Cold Chain Logistics Revenue (USD Million) By Type (2021-2032)

Table 21 Europe Cold Chain Logistics Revenue (USD Million) By Application (2021-2032)

Table 22 Europe Cold Chain Logistics Revenue (USD Million) By Product (2021-2032)

Table 23 Asia Pacific Cold Chain Logistics Revenue (USD Million) By Type (2021-2032)

Table 24 Asia Pacific Cold Chain Logistics Revenue (USD Million) By Application (2021-2032)

Table 25 Asia Pacific Cold Chain Logistics Revenue (USD Million) By Product (2021-2032)

Table 26 South America Cold Chain Logistics Revenue (USD Million) By Type (2021-2032)

Table 27 South America Cold Chain Logistics Revenue (USD Million) By Application (2021-2032)

Table 28 South America Cold Chain Logistics Revenue (USD Million) By Product (2021-2032)

Table 29 Middle East and Africa Cold Chain Logistics Revenue (USD Million) By Type (2021-2032)

Table 30 Middle East and Africa Cold Chain Logistics Revenue (USD Million) By Application (2021-2032)

Table 31 Middle East and Africa Cold Chain Logistics Revenue (USD Million) By Product (2021-2032)

LIST OF FIGURES

Figure 1. Market Scope

Figure 2. Pricing Forecasts Per Unit, 2023- 2032

Figure 3. Porter’s Five Forces

Figure 4. Global Cold Chain Logistics Market Revenue (USD Million) By Regions (2021-2032)

Figure 5. Global Cold Chain Logistics Market Share (%) By Regions (2023)

Figure 6. North America Cold Chain Logistics Revenue (USD Million) By Country (2021-2032)

Figure 7. United States Cold Chain Logistics Revenue (USD Million) By Country (2021-2032)

Figure 8. Canada Cold Chain Logistics Revenue (USD Million) By Country (2021-2032)

Figure 9. Mexico Cold Chain Logistics Revenue (USD Million) By Country (2021-2032)

Figure 10. Europe Cold Chain Logistics Revenue (USD Million) By Country (2021-2032)

Figure 11. Germany Cold Chain Logistics Revenue (USD Million) By Country (2021-2032)

Figure 12. France Cold Chain Logistics Revenue (USD Million) By Country (2021-2032)

Figure 13. United Kingdom Cold Chain Logistics Revenue (USD Million) By Country (2021-2032)

Figure 14. Spain Cold Chain Logistics Revenue (USD Million) By Country (2021-2032)

Figure 15. Italy Cold Chain Logistics Revenue (USD Million) By Country (2021-2032)

Figure 16. Russia Cold Chain Logistics Revenue (USD Million) By Country (2021-2032)

Figure 17. Rest of Europe Cold Chain Logistics Revenue (USD Million) By Country (2021-2032)

Figure 11. Asia Pacific Cold Chain Logistics Revenue (USD Million) By Country (2021-2032)

Figure 12. China Cold Chain Logistics Revenue (USD Million) By Country (2021-2032)

Figure 13. Japan Cold Chain Logistics Revenue (USD Million) By Country (2021-2032)

Figure 14. India Cold Chain Logistics Revenue (USD Million) By Country (2021-2032)

Figure 15. South Korea Cold Chain Logistics Revenue (USD Million) By Country (2021-2032)

Figure 16. Australia Cold Chain Logistics Revenue (USD Million) By Country (2021-2032)

Figure 17. South East Asia Cold Chain Logistics Revenue (USD Million) By Country (2021-2032)

Figure 18. South America Cold Chain Logistics Revenue (USD Million) By Country (2021-2032)

Figure 19. Brazil Cold Chain Logistics Revenue (USD Million) By Country (2021-2032)

Figure 20. Argentina Cold Chain Logistics Revenue (USD Million) By Country (2021-2032)

Figure 21. Rest of Asia Pacific Cold Chain Logistics Revenue (USD Million) By Country (2021-2032)

Figure 22. Middle East and Africa Cold Chain Logistics Revenue (USD Million) By Region (2021-2032)

Figure 23. Saudi Arabia Cold Chain Logistics Revenue (USD Million) By Region (2021-2032)

Figure 24. The UAE Cold Chain Logistics Revenue (USD Million) By Region (2021-2032)

Figure 25. Rest of Middle East Cold Chain Logistics Revenue (USD Million) By Region (2021-2032)

Figure 26. South Africa Cold Chain Logistics Revenue (USD Million) By Region (2021-2032)

Figure 27. Africa Cold Chain Logistics Revenue (USD Million) By Region (2021-2032)

Figure 28. North America Cold Chain Logistics Revenue (USD Million) By Type (2021-2032)

Figure 29. North America Cold Chain Logistics Revenue (USD Million) By Application (2021-2032)

Figure 30. North America Cold Chain Logistics Revenue (USD Million) By Product (2021-2032)

Figure 31. Europe Cold Chain Logistics Revenue (USD Million) By Type (2021-2032)

Figure 32. Europe Cold Chain Logistics Revenue (USD Million) By Application (2021-2032)

Figure 33. Europe Cold Chain Logistics Revenue (USD Million) By Product (2021-2032)

Figure 34. Asia Pacific Cold Chain Logistics Revenue (USD Million) By Type (2021-2032)

Figure 35. Asia Pacific Cold Chain Logistics Revenue (USD Million) By Application (2021-2032)

Figure 36. Asia Pacific Cold Chain Logistics Revenue (USD Million) By Product (2021-2032)

Figure 37. South America Cold Chain Logistics Revenue (USD Million) By Type (2021-2032)

Figure 38. South America Cold Chain Logistics Revenue (USD Million) By Application (2021-2032)

Figure 39. South America Cold Chain Logistics Revenue (USD Million) By Product (2021-2032)

Figure 40. Middle East and Africa Cold Chain Logistics Revenue (USD Million) By Type (2021-2032)

Figure 41. Middle East and Africa Cold Chain Logistics Revenue (USD Million) By Application (2021-2032)

Figure 42. Middle East and Africa Cold Chain Logistics Revenue (USD Million) By Product (2021-2032)

By Service

Storage

Transportation

Value-added services

By Application

Food & Beverages

Medical Goods

Chemicals that are sensitive to temperature

By Temperature

Frozen

Chilled

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Cold Chain Logistics Market Size is valued at $312.6 Billion in 2024 and is forecast to register a growth rate (CAGR) of 12.8% to reach $819.3 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

AGRO Merchants Group, Americold Logistics, Burris Logistics, Interstate Cold Storage Inc, Kloosterboer Group, Lineage Logistics Holdings LLC, Nichirei Corp, Preferred Freezer Services, Swire Cold Storage Ltd, VersaCold Logistics Services

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume