The global Cocoa Powder Market Comprehensive Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Dutch-processed, Natural cocoa powder, Others), By Sales Channel (Direct Sales, Indirect Sales), By End-User (Commercial, Household, Industrial, Others)

In 2024, the Cocoa Powder market is witnessing significant growth, driven by the increasing demand for natural and rich cocoa flavor in various food and beverage applications. Cocoa powder, derived from processed cocoa beans, is used in baking, beverages, dairy products, and confectioneries. The market is supported by the growing trend towards clean-label and minimally processed ingredients. Advances in cocoa processing and powdering technologies are enhancing the quality, flavor, and nutritional content of cocoa powder. The market is also benefiting from the trend towards premium and artisanal products, appealing to consumers seeking high-quality and authentic cocoa flavors.

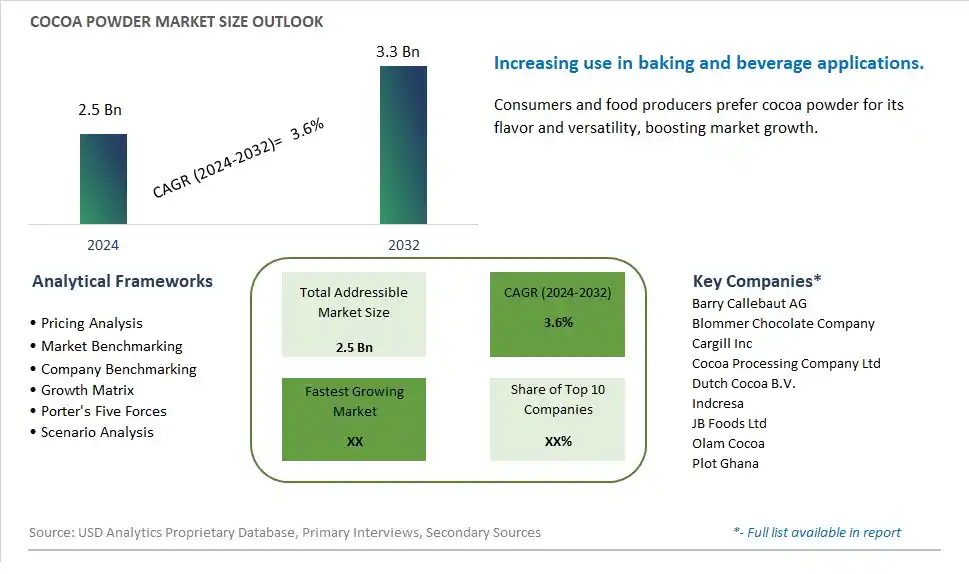

The market report analyses the leading companies in the industry including Barry Callebaut AG, Blommer Chocolate Company, Cargill Inc, Cocoa Processing Company Ltd, Dutch Cocoa B.V., Indcresa, JB Foods Ltd, Olam Cocoa, Plot Ghana, and Others.

A prominent market trend for cocoa powder is the increasing demand among consumers for health-conscious and functional ingredients in the food and beverage industry. With a growing emphasis on wellness and nutrition, there's a rising preference for cocoa powder as a natural and versatile ingredient known for its antioxidant properties, rich flavor, and potential health benefits. Consumers seek products that offer both indulgence and nutritional value, driving the popularity of cocoa powder in various food and beverage applications.

A key driver fueling the market for cocoa powder is the growth in chocolate and cocoa-based products worldwide. As consumer tastes evolve and the chocolate market expands, there's a continuous need for cocoa powder as a primary ingredient in chocolates, baked goods, desserts, beverages, and culinary creations. The market responds to this driver by ensuring a consistent supply of cocoa powder with different cocoa content levels, flavor profiles, and processing techniques to meet the diverse needs of chocolate manufacturers, chefs, and food processors globally.

An opportunity within the cocoa powder market lies in innovation in specialty cocoa powders and applications. Manufacturers can develop specialty cocoa powders with unique flavor notes, textures, and functional properties such as alkalized (dutched) cocoa powders, organic cocoa powders, high-fat cocoa powders, or flavored cocoa powders (e.g., cinnamon, chili, mint). Additionally, exploring new product formulations and applications such as cocoa-infused beverages, protein shakes, energy bars, and plant-based desserts can expand market reach and cater to emerging consumer trends and dietary preferences. By focusing on product innovation, quality assurance, and market diversification, companies can capitalize on the market opportunity presented by cocoa powder and meet the evolving demands of health-conscious consumers and the food industry.

The Natural Cocoa Powder segment emerges as the largest segment in the Cocoa Powder Market. This segment's prominence is driven by several factors contributing to its substantial market share. Natural cocoa powder is produced from cocoa beans that undergo minimal processing, retaining the beans' natural flavors and nutritional properties. It is known for its intense chocolate flavor, dark color, and slightly acidic taste, making it a preferred choice among consumers and manufacturers in various food and beverage applications. Natural cocoa powder is commonly used in baking, confectionery, desserts, beverages, and culinary recipes, where its rich chocolatey aroma and distinct taste enhance the sensory experience of the final products. Further, the growing demand for clean label and natural ingredients in food products has fueled the popularity of natural cocoa powder, as it aligns with consumer preferences for authentic and minimally processed foods. Additionally, the rising interest in homemade baking and gourmet chocolate creations has further driven the demand for natural cocoa powder in the consumer market. With continuous innovation in cocoa processing techniques and the focus on product quality and sustainability, the Natural Cocoa Powder segment of the Cocoa Powder Market is expected to maintain its leadership position and witness steady growth in the coming years.

The Indirect Sales segment is anticipated to be the fastest-growing segment in the Cocoa Powder Market by 2032. This rapid growth can be attributed to several key factors driving the demand for cocoa powder through indirect sales channels. Indirect sales encompass various distribution channels such as wholesalers, distributors, retailers, and e-commerce platforms. These channels play a crucial role in reaching a wider customer base, including businesses and consumers, and expanding the market reach of cocoa powder products. E-commerce platforms, in particular, have witnessed significant growth due to increased digitalization, convenience, and accessibility to a global audience. Consumers' preference for online shopping and the availability of a wide range of cocoa powder products on e-commerce platforms contribute to the growth of indirect sales channels. Further, partnerships with retail chains, supermarkets, specialty stores, and other distribution partners further enhance the visibility and availability of cocoa powder products, driving market expansion. With continuous advancements in distribution networks, marketing strategies, and digital platforms' optimization, the Indirect Sales segment of the Cocoa Powder Market is poised for significant growth and market dominance in the coming years.

The Commercial segment stands out as the largest segment in the Cocoa Powder Market. This segment's prominence is driven by several factors contributing to its substantial market share. Commercial end-users include food and beverage establishments such as bakeries, confectionery manufacturers, restaurants, cafes, hotels, and catering services that utilize cocoa powder as a key ingredient in their products. The widespread usage of cocoa powder in commercial food preparation, baking, confectionery, and beverage production contributes significantly to the demand for cocoa powder in this segment. Further, the growing trend of premium chocolate-based products, gourmet desserts, and specialty beverages in the commercial sector has further boosted the consumption of cocoa powder. Additionally, the expanding foodservice industry, including the rise of coffee shops, artisanal bakeries, and dessert parlors, has created a robust market for cocoa powder among commercial end-users. With continuous product innovation, flavor varieties, and marketing strategies tailored for the commercial food and beverage sector, the Commercial segment of the Cocoa Powder Market is expected to maintain its leadership position and witness steady growth in the coming years.

By Product

Dutch-processed

Natural cocoa powder

Others

By Sales Channel

Direct Sales

Indirect Sales

By End-User

Commercial

Household

Industrial

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Barry Callebaut AG

Blommer Chocolate Company

Cargill Inc

Cocoa Processing Company Ltd

Dutch Cocoa B.V.

Indcresa

JB Foods Ltd

Olam Cocoa

Plot Ghana

*- List Not Exhaustive

Chapter 1. TABLE OF CONTENTS

Chapter 2. Introduction to Cocoa Powder Market

2.1. Market Overview

2.2. Key Statistics and Report Highlights

2.3. Scope of the Comprehensive Study

2.3.1. Market Definition

2.3.2 Countries and Regions Covered

2.3.3 Research Objective

2.3.4 Units, Currency, and Conversions

2.3.5 Industry Value Chain

2.4. Key Market Segments

2.5. Key Companies

2.6. Study Period

Chapter 3. Strategic Analysis Review

3.1. Cocoa Powder Pricing Analysis and Forecast

3.2. Porter’s Five Forces

3.3. Market Ecosystem

3.4. SWOT Analysis

3.5. Regulatory Scenario

3.3. Effects of Inflation, Russia-Ukraine War, moderating economic growth, and other macroeconomic factors

Chapter 4. Competitive Landscape

4.1. Market Share Analysis

4.1.1. Global Cocoa Powder Market Share by Company, 2023

4.1.2. Product Offerings of Leading Cocoa Powder Companies

4.2. Market Entropy

4.2.1. New Product Launches in the Industry

4.2.2. Mergers, Acquisitions, Joint ventures, and Partnerships

4.3. Key Strategies and Best Practices

Chapter 5. Global Market Projections: Best, Reference, and Low Case Scenarios

5.1. Growth Analysis- Case Scenario Definitions

5.2. Low Growth Case Scenario Forecasts

5.3. Reference Growth Case Scenario Forecasts

5.4. High Growth Case Scenario Forecasts

Chapter 6. Market Dynamics

6.1. Cocoa Powder Market Drivers

6.2. Cocoa Powder Market Challenges

6.6. Cocoa Powder Market Opportunities

6.4. Cocoa Powder Market Trends

Chapter 7. Global Cocoa Powder Market Outlook Trends

7.1. Global Cocoa Powder Revenue (USD Million) and CAGR (%) by Type (2021-2032)

7.2. Global Cocoa Powder Revenue (USD Million) and CAGR (%) by Application (2021-2032)

7.3. Global Cocoa Powder Revenue (USD Million) and CAGR (%) by Product (2021-2032)

By Product

Dutch-processed

Natural cocoa powder

Others

By Sales Channel

Direct Sales

Indirect Sales

By End-User

Commercial

Household

Industrial

Others

Chapter 8. Global Cocoa Powder Regional Analysis and Outlook

8.1. Global Cocoa Powder Revenue (USD Million) By Regions (2021- 2032)

8.2. North America Cocoa Powder Revenue (USD Million) by Country (2021-2032)

8.2.1. United States Cocoa Powder Regional Analysis and Outlook

8.2.2. Canada Cocoa Powder Regional Analysis and Outlook

8.2.3. Mexico Cocoa Powder Regional Analysis and Outlook

8.3. Europe Cocoa Powder Revenue (USD Million), by Country (2021-2032)

8.3.1. Germany Cocoa Powder Regional Analysis and Outlook

8.3.2. France Cocoa Powder Regional Analysis and Outlook

8.3.3. United Kingdom Cocoa Powder Regional Analysis and Outlook

8.3.4. Spain Cocoa Powder Regional Analysis and Outlook

8.3.5. Italy Cocoa Powder Regional Analysis and Outlook

8.3.6. Russia Cocoa Powder Regional Analysis and Outlook

8.3.7. Rest of Europe Cocoa Powder Regional Analysis and Outlook

8.4. Asia Pacific Cocoa Powder Revenue (USD Million) by Country (2021-2032)

8.4.1. China Cocoa Powder Regional Analysis and Outlook

8.4.2. Japan Cocoa Powder Regional Analysis and Outlook

8.4.3. India Cocoa Powder Regional Analysis and Outlook

8.4.4. South Korea Cocoa Powder Regional Analysis and Outlook

8.4.5. Australia Cocoa Powder Regional Analysis and Outlook

8.4.6. South East Asia Cocoa Powder Regional Analysis and Outlook

8.4.7. Rest of Asia Pacific Cocoa Powder Regional Analysis and Outlook

8.5. South America Cocoa Powder Revenue (USD Million), by Country (2021-2032)

8.5.1. Brazil Cocoa Powder Regional Analysis and Outlook

8.5.2. Argentina Cocoa Powder Regional Analysis and Outlook

8.5.3. Rest of South America Cocoa Powder Regional Analysis and Outlook

8.6. Middle East and Africa Cocoa Powder Revenue (USD Million) by Country (2021-2032)

8.6.1. Middle East Cocoa Powder Regional Analysis and Outlook

8.6.2. Africa Cocoa Powder Regional Analysis and Outlook

Chapter 9. North America Cocoa Powder Analysis and Outlook

9.1. North America Cocoa Powder Revenue (USD Million) by Segments (2021-2032)

9.1.1. North America Cocoa Powder Revenue (USD Million) by Type (2021-2032)

9.1.2. North America Cocoa Powder Revenue (USD Million) by Application (2021-2032)

9.1.3. North America Cocoa Powder Revenue (USD Million) by Product (2021-2032)

By Product

Dutch-processed

Natural cocoa powder

Others

By Sales Channel

Direct Sales

Indirect Sales

By End-User

Commercial

Household

Industrial

Others

Chapter 10. Europe Cocoa Powder Analysis and Outlook

10.1. Europe Cocoa Powder Revenue (USD Million), by Segments (USD Million) (2021-2032)

10.1.1. Europe Cocoa Powder Revenue (USD Million) by Type (2021-2032)

10.1.2. Europe Cocoa Powder Revenue (USD Million) by Application (2021-2032)

10.1.3. Europe Cocoa Powder Revenue (USD Million) by Product (2021-2032)

By Product

Dutch-processed

Natural cocoa powder

Others

By Sales Channel

Direct Sales

Indirect Sales

By End-User

Commercial

Household

Industrial

Others

Chapter 11. Asia Pacific Cocoa Powder Analysis and Outlook

11.1. Asia Pacific Cocoa Powder Revenue (USD Million), and Revenue (USD Million) by Segments (2021-2032)

11.1.1. Asia Pacific Cocoa Powder Revenue (USD Million) by Type (2021-2032)

11.1.2. Asia Pacific Cocoa Powder Revenue (USD Million) by Application (2021-2032)

11.1.3. Asia Pacific Cocoa Powder Revenue (USD Million) by Product (2021-2032)

By Product

Dutch-processed

Natural cocoa powder

Others

By Sales Channel

Direct Sales

Indirect Sales

By End-User

Commercial

Household

Industrial

Others

Chapter 12. South America Cocoa Powder Analysis and Outlook

12.1. South America Cocoa Powder Revenue (USD Million), by Segments (2021-2032)

12.1.1. South America Cocoa Powder Revenue (USD Million) by Type (2021-2032)

12.1.2. South America Cocoa Powder Revenue (USD Million) by Application (2021-2032)

12.1.3. South America Cocoa Powder Revenue (USD Million) by Product (2021-2032)

By Product

Dutch-processed

Natural cocoa powder

Others

By Sales Channel

Direct Sales

Indirect Sales

By End-User

Commercial

Household

Industrial

Others

Chapter 13. Middle East and Africa Cocoa Powder Analysis and Outlook

13.1. Middle East and Africa Cocoa Powder Revenue (USD Million), by Segments (2021-2032)

13.1.1. Middle East and Africa Cocoa Powder Revenue (USD Million) by Type (2021-2032)

13.1.2. Middle East and Africa Cocoa Powder Revenue (USD Million) by Application (2021-2032)

13.1.3. Middle East and Africa Cocoa Powder Revenue (USD Million) by Product (2021-2032)

By Product

Dutch-processed

Natural cocoa powder

Others

By Sales Channel

Direct Sales

Indirect Sales

By End-User

Commercial

Household

Industrial

Others

Chapter 14. Cocoa Powder Company Profiles

14.1 Business Overview

14.2 Product Profiles

14.3 SWOT Profiles

14.5 Recent Developments

14.6 Financial Profile

List of Companies

Barry Callebaut AG

Blommer Chocolate Company

Cargill Inc

Cocoa Processing Company Ltd

Dutch Cocoa B.V.

Indcresa

JB Foods Ltd

Olam Cocoa

Plot Ghana

15. Methodology and Data Sources

15.1 Customization Offerings

15.2 Subscription Services

15.3 Related Reports

15.4 Publisher Expertise

LIST OF TABLES

Table 1 Market Segmentation Analysis

Table 2 Global Cocoa Powder Market Share of Leading Companies, 2023

Table 3 Product Offerings of Leading Companies

Table 4 Low Growth Scenario Forecasts

Table 5 Reference Case Growth Scenario

Table 6 High Growth Case Scenario

Table 7 Global Cocoa Powder Revenue (USD Million) And CAGR (%) By Type (2021-2032)

Table 8 Global Cocoa Powder Revenue (USD Million) And CAGR (%) By Application (2021-2032)

Table 9 Global Cocoa Powder Revenue (USD Million) And CAGR (%) By Product (2021-2032)

Table 10 Global Cocoa Powder Market Revenue (USD Million) By Regions (2021-2032)

Table 11 Global Cocoa Powder Market Share (%) By Regions (2021-2032)

Table 12 North America Cocoa Powder Revenue (USD Million) By Country (2021-2032)

Table 13 Europe Cocoa Powder Revenue (USD Million) By Country (2021-2032)

Table 14 Asia Pacific Cocoa Powder Revenue (USD Million) By Country (2021-2032)

Table 15 South America Cocoa Powder Revenue (USD Million) By Country (2021-2032)

Table 16 Middle East and Africa Cocoa Powder Revenue (USD Million) By Region (2021-2032)

Table 17 North America Cocoa Powder Revenue (USD Million) By Type (2021-2032)

Table 18 North America Cocoa Powder Revenue (USD Million) By Application (2021-2032)

Table 19 North America Cocoa Powder Revenue (USD Million) By Product (2021-2032)

Table 20 Europe Cocoa Powder Revenue (USD Million) By Type (2021-2032)

Table 21 Europe Cocoa Powder Revenue (USD Million) By Application (2021-2032)

Table 22 Europe Cocoa Powder Revenue (USD Million) By Product (2021-2032)

Table 23 Asia Pacific Cocoa Powder Revenue (USD Million) By Type (2021-2032)

Table 24 Asia Pacific Cocoa Powder Revenue (USD Million) By Application (2021-2032)

Table 25 Asia Pacific Cocoa Powder Revenue (USD Million) By Product (2021-2032)

Table 26 South America Cocoa Powder Revenue (USD Million) By Type (2021-2032)

Table 27 South America Cocoa Powder Revenue (USD Million) By Application (2021-2032)

Table 28 South America Cocoa Powder Revenue (USD Million) By Product (2021-2032)

Table 29 Middle East and Africa Cocoa Powder Revenue (USD Million) By Type (2021-2032)

Table 30 Middle East and Africa Cocoa Powder Revenue (USD Million) By Application (2021-2032)

Table 31 Middle East and Africa Cocoa Powder Revenue (USD Million) By Product (2021-2032)

LIST OF FIGURES

Figure 1. Market Scope

Figure 2. Pricing Forecasts Per Unit, 2023- 2032

Figure 3. Porter’s Five Forces

Figure 4. Global Cocoa Powder Market Revenue (USD Million) By Regions (2021-2032)

Figure 5. Global Cocoa Powder Market Share (%) By Regions (2023)

Figure 6. North America Cocoa Powder Revenue (USD Million) By Country (2021-2032)

Figure 7. United States Cocoa Powder Revenue (USD Million) By Country (2021-2032)

Figure 8. Canada Cocoa Powder Revenue (USD Million) By Country (2021-2032)

Figure 9. Mexico Cocoa Powder Revenue (USD Million) By Country (2021-2032)

Figure 10. Europe Cocoa Powder Revenue (USD Million) By Country (2021-2032)

Figure 11. Germany Cocoa Powder Revenue (USD Million) By Country (2021-2032)

Figure 12. France Cocoa Powder Revenue (USD Million) By Country (2021-2032)

Figure 13. United Kingdom Cocoa Powder Revenue (USD Million) By Country (2021-2032)

Figure 14. Spain Cocoa Powder Revenue (USD Million) By Country (2021-2032)

Figure 15. Italy Cocoa Powder Revenue (USD Million) By Country (2021-2032)

Figure 16. Russia Cocoa Powder Revenue (USD Million) By Country (2021-2032)

Figure 17. Rest of Europe Cocoa Powder Revenue (USD Million) By Country (2021-2032)

Figure 11. Asia Pacific Cocoa Powder Revenue (USD Million) By Country (2021-2032)

Figure 12. China Cocoa Powder Revenue (USD Million) By Country (2021-2032)

Figure 13. Japan Cocoa Powder Revenue (USD Million) By Country (2021-2032)

Figure 14. India Cocoa Powder Revenue (USD Million) By Country (2021-2032)

Figure 15. South Korea Cocoa Powder Revenue (USD Million) By Country (2021-2032)

Figure 16. Australia Cocoa Powder Revenue (USD Million) By Country (2021-2032)

Figure 17. South East Asia Cocoa Powder Revenue (USD Million) By Country (2021-2032)

Figure 18. South America Cocoa Powder Revenue (USD Million) By Country (2021-2032)

Figure 19. Brazil Cocoa Powder Revenue (USD Million) By Country (2021-2032)

Figure 20. Argentina Cocoa Powder Revenue (USD Million) By Country (2021-2032)

Figure 21. Rest of Asia Pacific Cocoa Powder Revenue (USD Million) By Country (2021-2032)

Figure 22. Middle East and Africa Cocoa Powder Revenue (USD Million) By Region (2021-2032)

Figure 23. Saudi Arabia Cocoa Powder Revenue (USD Million) By Region (2021-2032)

Figure 24. The UAE Cocoa Powder Revenue (USD Million) By Region (2021-2032)

Figure 25. Rest of Middle East Cocoa Powder Revenue (USD Million) By Region (2021-2032)

Figure 26. South Africa Cocoa Powder Revenue (USD Million) By Region (2021-2032)

Figure 27. Africa Cocoa Powder Revenue (USD Million) By Region (2021-2032)

Figure 28. North America Cocoa Powder Revenue (USD Million) By Type (2021-2032)

Figure 29. North America Cocoa Powder Revenue (USD Million) By Application (2021-2032)

Figure 30. North America Cocoa Powder Revenue (USD Million) By Product (2021-2032)

Figure 31. Europe Cocoa Powder Revenue (USD Million) By Type (2021-2032)

Figure 32. Europe Cocoa Powder Revenue (USD Million) By Application (2021-2032)

Figure 33. Europe Cocoa Powder Revenue (USD Million) By Product (2021-2032)

Figure 34. Asia Pacific Cocoa Powder Revenue (USD Million) By Type (2021-2032)

Figure 35. Asia Pacific Cocoa Powder Revenue (USD Million) By Application (2021-2032)

Figure 36. Asia Pacific Cocoa Powder Revenue (USD Million) By Product (2021-2032)

Figure 37. South America Cocoa Powder Revenue (USD Million) By Type (2021-2032)

Figure 38. South America Cocoa Powder Revenue (USD Million) By Application (2021-2032)

Figure 39. South America Cocoa Powder Revenue (USD Million) By Product (2021-2032)

Figure 40. Middle East and Africa Cocoa Powder Revenue (USD Million) By Type (2021-2032)

Figure 41. Middle East and Africa Cocoa Powder Revenue (USD Million) By Application (2021-2032)

Figure 42. Middle East and Africa Cocoa Powder Revenue (USD Million) By Product (2021-2032)

By Product

Dutch-processed

Natural cocoa powder

Others

By Sales Channel

Direct Sales

Indirect Sales

By End-User

Commercial

Household

Industrial

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Cocoa Powder Market Size is valued at $2.5 Billion in 2024 and is forecast to register a growth rate (CAGR) of 3.6% to reach $3.3 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Barry Callebaut AG, Blommer Chocolate Company, Cargill Inc, Cocoa Processing Company Ltd, Dutch Cocoa B.V., Indcresa, JB Foods Ltd, Olam Cocoa, Plot Ghana

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume