The global Citronella Oil Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Java, Ceylon), By Application (Food & Beverages, Cosmetics, Aromatherapy, Pharmaceuticals, Others), By Nature (Conventional, Organic).

The market for citronella oil is experiencing a surge in demand due to increasing consumer preference for natural insect repellents amidst growing concerns about chemical exposure and environmental impact. Citronella oil, derived from the leaves of the citronella plant, is widely used in various products such as candles, sprays, and lotions for its effective mosquito-repelling properties. Key trends include advancements in extraction techniques to enhance oil purity and potency, as well as innovations in product formulations for convenient and long-lasting insect protection. Additionally, the rising popularity of outdoor activities and the expansion of tropical disease vectors are driving the demand for citronella oil-based repellents in both residential and commercial markets. Moreover, with the growing trend towards eco-friendly and sustainable products, citronella oil presents a natural alternative to synthetic insecticides, further propelling market growth. As consumers continue to prioritize health and environmental consciousness, the citronella oil market is expected to witness continued expansion and innovation in the development of natural insect repellent solutions.

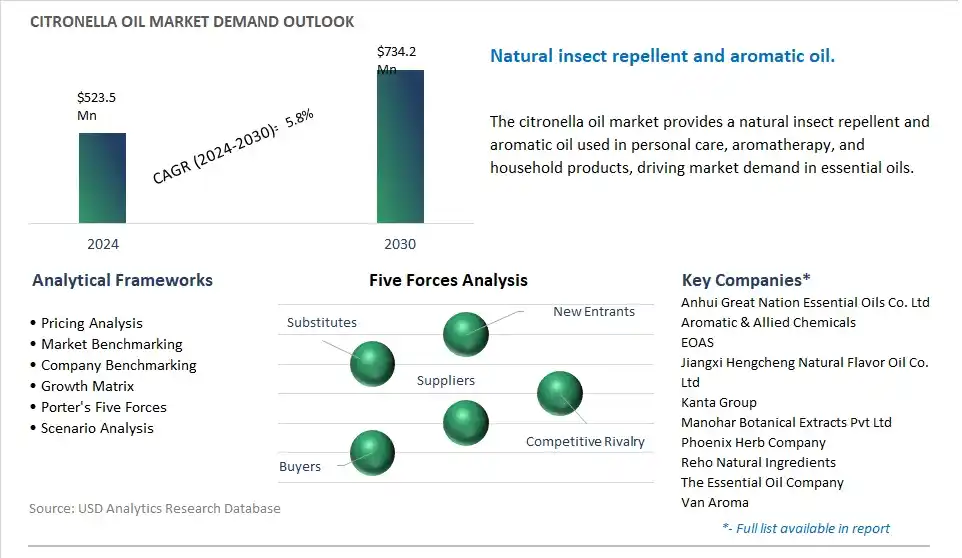

The market report analyses the leading companies in the industry including Anhui Great Nation Essential Oils Co. Ltd, Aromatic & Allied Chemicals, EOAS, Jiangxi Hengcheng Natural Flavor Oil Co. Ltd, Kanta Group, Manohar Botanical Extracts Pvt Ltd, Phoenix Herb Company, Reho Natural Ingredients, The Essential Oil Company, Van Aroma.

A prominent trend in the market for citronella oil is the increasing demand for natural and organic insect repellents. With growing concerns about the health and environmental impacts of synthetic chemicals used in insect repellent products, there is a rising preference among consumers for natural alternatives derived from botanical sources. Citronella oil, known for its insect-repelling properties and pleasant scent, is experiencing higher demand as a key ingredient in natural insect repellent formulations. This is driven by changing consumer preferences towards eco-friendly and chemical-free products, as well as increasing awareness of the potential health risks associated with synthetic insecticides. The demand for citronella oil is expected to continue growing as consumers seek safe and effective solutions for protecting themselves from mosquitoes and other insects.

A significant driver fueling the demand for citronella oil is the rise in mosquito-borne diseases and concerns about vector control. With the global spread of diseases such as malaria, dengue fever, Zika virus, and West Nile virus, there is an urgent need for effective measures to prevent mosquito bites and reduce the spread of these diseases. Citronella oil, with its natural insect-repelling properties, is widely used in mosquito repellent products such as candles, lotions, sprays, and diffusers. This driver is further supported by public health initiatives, government campaigns for vector control, and the increasing prevalence of mosquito-borne illnesses in tropical and subtropical regions. The demand for citronella oil as a key ingredient in mosquito repellents is expected to remain strong as efforts to combat mosquito-borne diseases continue worldwide.

An opportunity within the market for citronella oil lies in expansion into personal care and aromatherapy products. While citronella oil is primarily known for its insect-repelling properties, it also offers various health and wellness benefits when used in personal care and aromatherapy applications. Manufacturers are investing in opportunities to develop skincare products such as lotions, soaps, and shampoos that harness the skin-soothing and antimicrobial properties of citronella oil. Additionally, there is opportunity to create aromatherapy products such as candles, diffuser oils, and massage blends that promote relaxation, stress relief, and mood enhancement. By capitalizing on this opportunity and diversifying product offerings, manufacturers of citronella oil can tap into new markets, attract a broader customer base, and drive growth in the competitive essential oils industry.

The largest segment in the Citronella Oil market is Java Citronella Oil. Java Citronella Oil is renowned for its high quality and robust properties, making it a preferred choice for various applications such as insect repellents, aromatherapy, and flavoring agents. It is extracted from a specific species of citronella grass native to Java, Indonesia, known for its potent insect-repelling properties due to the presence of citronellal and geraniol compounds. The demand for Java Citronella Oil is particularly high in the personal care and household products sectors due to its effectiveness in repelling mosquitoes and other insects naturally.

The fastest-growing segment in the Citronella Oil market is Aromatherapy. Citronella Oil is increasingly being utilized in aromatherapy due to its refreshing and calming properties. As more people seek natural remedies and holistic wellness practices, the demand for Citronella Oil in aromatherapy applications has surged. It is known for its ability to promote relaxation, relieve stress, and uplift mood, making it a popular choice among consumers looking for natural and therapeutic solutions. The use of Citronella Oil in aromatherapy products such as essential oil blends, diffusers, and massage oils is driving the growth of this segment in the market.

The largest segment in the Citronella Oil market is Conventional Citronella Oil. Conventional Citronella Oil refers to oil produced from citronella plants that are grown using traditional agricultural practices, which include the use of synthetic fertilizers and pesticides. This segment accounts for the majority of Citronella Oil production and consumption globally. However, there is a growing demand for Organic Citronella Oil due to increasing consumer preference for organic and natural products. Organic Citronella Oil is derived from citronella plants that are cultivated without the use of synthetic chemicals, pesticides, or genetically modified organisms (GMOs). While the organic segment is expanding, conventional Citronella Oil remains the largest segment in terms of market share and volume.

By Type

Java

Ceylon

By Application

Food & Beverages

Cosmetics

Aromatherapy

Pharmaceuticals

Others

By Nature

Conventional

Organic

Regions Included

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Anhui Great Nation Essential Oils Co. Ltd

Aromatic & Allied Chemicals

EOAS

Jiangxi Hengcheng Natural Flavor Oil Co. Ltd

Kanta Group

Manohar Botanical Extracts Pvt Ltd

Phoenix Herb Company

Reho Natural Ingredients

The Essential Oil Company

Van Aroma

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Citronella Oil Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Citronella Oil Market Size Outlook, $ Million, 2021 to 2030

3.2 Citronella Oil Market Outlook by Type, $ Million, 2021 to 2030

3.3 Citronella Oil Market Outlook by Product, $ Million, 2021 to 2030

3.4 Citronella Oil Market Outlook by Application, $ Million, 2021 to 2030

3.5 Citronella Oil Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Citronella Oil Industry

4.2 Key Market Trends in Citronella Oil Industry

4.3 Potential Opportunities in Citronella Oil Industry

4.4 Key Challenges in Citronella Oil Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Citronella Oil Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Citronella Oil Market Outlook by Segments

7.1 Citronella Oil Market Outlook by Segments, $ Million, 2021- 2030

By Type

Java

Ceylon

By Application

Food & Beverages

Cosmetics

Aromatherapy

Pharmaceuticals

Others

By Nature

Conventional

Organic

8 North America Citronella Oil Market Analysis and Outlook To 2030

8.1 Introduction to North America Citronella Oil Markets in 2024

8.2 North America Citronella Oil Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Citronella Oil Market size Outlook by Segments, 2021-2030

By Type

Java

Ceylon

By Application

Food & Beverages

Cosmetics

Aromatherapy

Pharmaceuticals

Others

By Nature

Conventional

Organic

9 Europe Citronella Oil Market Analysis and Outlook To 2030

9.1 Introduction to Europe Citronella Oil Markets in 2024

9.2 Europe Citronella Oil Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Citronella Oil Market Size Outlook by Segments, 2021-2030

By Type

Java

Ceylon

By Application

Food & Beverages

Cosmetics

Aromatherapy

Pharmaceuticals

Others

By Nature

Conventional

Organic

10 Asia Pacific Citronella Oil Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Citronella Oil Markets in 2024

10.2 Asia Pacific Citronella Oil Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Citronella Oil Market size Outlook by Segments, 2021-2030

By Type

Java

Ceylon

By Application

Food & Beverages

Cosmetics

Aromatherapy

Pharmaceuticals

Others

By Nature

Conventional

Organic

11 South America Citronella Oil Market Analysis and Outlook To 2030

11.1 Introduction to South America Citronella Oil Markets in 2024

11.2 South America Citronella Oil Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Citronella Oil Market size Outlook by Segments, 2021-2030

By Type

Java

Ceylon

By Application

Food & Beverages

Cosmetics

Aromatherapy

Pharmaceuticals

Others

By Nature

Conventional

Organic

12 Middle East and Africa Citronella Oil Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Citronella Oil Markets in 2024

12.2 Middle East and Africa Citronella Oil Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Citronella Oil Market size Outlook by Segments, 2021-2030

By Type

Java

Ceylon

By Application

Food & Beverages

Cosmetics

Aromatherapy

Pharmaceuticals

Others

By Nature

Conventional

Organic

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Anhui Great Nation Essential Oils Co. Ltd

Aromatic & Allied Chemicals

EOAS

Jiangxi Hengcheng Natural Flavor Oil Co. Ltd

Kanta Group

Manohar Botanical Extracts Pvt Ltd

Phoenix Herb Company

Reho Natural Ingredients

The Essential Oil Company

Van Aroma

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Java

Ceylon

By Application

Food & Beverages

Cosmetics

Aromatherapy

Pharmaceuticals

Others

By Nature

Conventional

Organic

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Citronella Oil is forecast to reach $734.2 Million in 2030 from $523.5 Million in 2024, registering a CAGR of 5.8%

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Anhui Great Nation Essential Oils Co. Ltd, Aromatic & Allied Chemicals, EOAS, Jiangxi Hengcheng Natural Flavor Oil Co. Ltd, Kanta Group, Manohar Botanical Extracts Pvt Ltd, Phoenix Herb Company, Reho Natural Ingredients, The Essential Oil Company, Van Aroma

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume