The global Chemical Sensors Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Electrochemical, Optical, Catalytic Bead, Others), By End-User (Industrial, Healthcare, Environmental Monitoring, Defense, Oil and Gas, Homeland Security).

The market for chemical sensors is advancing detection and monitoring capabilities across industries, with key trends focused on miniaturization, sensitivity, and integration with digital technologies. Chemical sensors are essential devices used for detecting and quantifying the presence of specific chemicals or analytes in various environments, such as air, water, soil, and industrial processes. Key trends include advancements in sensor materials and technologies, such as nanomaterials, microfluidics, and selective coatings, to enhance sensitivity, selectivity, and response time. Additionally, developments in sensor design, including wearable devices, portable instruments, and wireless connectivity, enable real-time monitoring and remote data transmission for continuous environmental and process surveillance. Moreover, the integration of artificial intelligence and machine learning algorithms enhances sensor performance, enabling predictive analytics and early warning systems for potential hazards or contaminants. As industries prioritize safety, quality control, and environmental compliance, the demand for chemical sensors with advanced capabilities and seamless integration into IoT platforms is expected to grow, driving further innovation and market adoption in this critical sector of sensing and monitoring technologies.

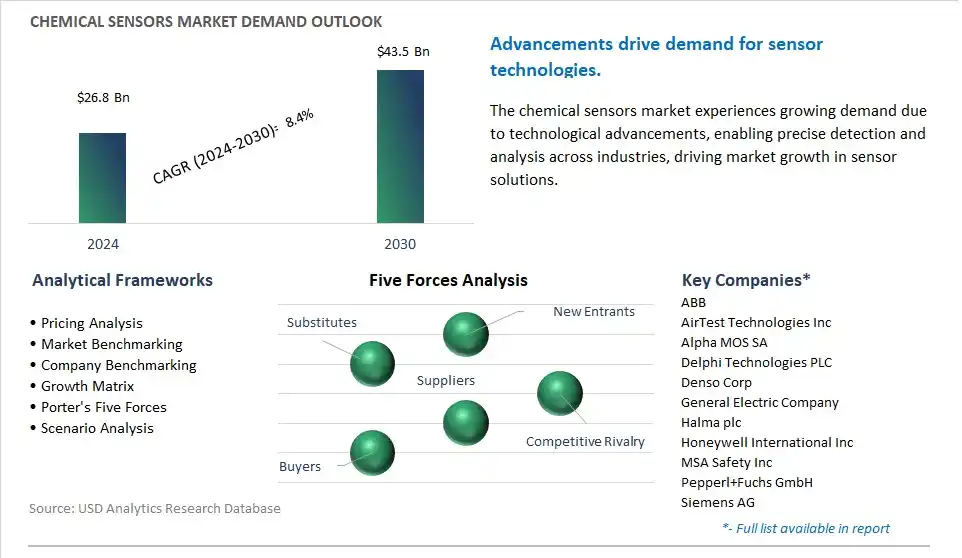

The market report analyses the leading companies in the industry including ABB, AirTest Technologies Inc, Alpha MOS SA, Delphi Technologies PLC, Denso Corp, General Electric Company, Halma plc, Honeywell International Inc, MSA Safety Inc, Pepperl+Fuchs GmbH, Siemens AG, Smiths Detection Inc, Yokogawa Electric Corp .

A prominent trend in the market for chemical sensors is the advancements in IoT (Internet of Things) and smart technology integration. With the rise of Industry 4.0 and the Internet of Things, there is an increasing demand for chemical sensors that can seamlessly integrate with smart devices, networks, and data analytics platforms. Chemical sensors equipped with IoT capabilities allow for real-time monitoring, remote data access, and predictive analytics, enabling industries such as environmental monitoring, healthcare, agriculture, and industrial manufacturing to optimize processes, improve efficiency, and enhance decision-making. This is driven by the need for actionable insights, proactive maintenance, and automation in various sectors, driving the adoption of chemical sensors as essential components of IoT-enabled systems and solutions worldwide.

A significant driver fueling the demand for chemical sensors is the growing focus on environmental monitoring and pollution control. With increasing concerns about air and water quality, industrial emissions, and chemical contamination, there is a rising need for reliable and accurate sensors to detect and measure various pollutants and hazardous substances in the environment. Chemical sensors play a crucial role in monitoring air and water quality, detecting toxic gases, and identifying contaminants in soil and water sources. This driver is further supported by regulatory mandates for environmental protection, public health concerns, and corporate initiatives for sustainability and corporate social responsibility, driving the adoption of chemical sensors as key tools for environmental monitoring and pollution control efforts globally.

An opportunity within the market for chemical sensors lies in the expansion into wearable and personalized healthcare devices. While industrial and environmental monitoring remain primary applications for chemical sensors, there is potential for growth in the healthcare sector, particularly in wearable health monitoring devices and personalized medicine applications. Chemical sensors can be integrated into wearable devices such as smartwatches, fitness trackers, and medical patches to monitor vital signs, detect biomarkers, and track health parameters in real time. Additionally, there is opportunity to develop personalized healthcare solutions that utilize chemical sensors to monitor individuals' exposure to environmental pollutants, allergens, and toxins, enabling personalized recommendations and interventions for improved health outcomes. By capitalizing on this opportunity and collaborating with healthcare technology providers, manufacturers of chemical sensors can diversify their product offerings, penetrate new markets, and drive growth in the dynamic healthcare sensor industry.

The largest segment in the Chemical Sensors market is Electrochemical Sensors. These sensors are widely used due to their ability to detect a wide range of analytes, including gases, liquids, and solids, by measuring electrical changes. They are commonly employed in various applications such as environmental monitoring, industrial process control, automotive emissions detection, and healthcare diagnostics. The robustness, sensitivity, and selectivity of electrochemical sensors make them a preferred choice in many industries, driving their dominance in the chemical sensors market.

The fastest growing segment in the Chemical Sensors market is Environmental Monitoring. With increasing concerns about air and water quality, environmental monitoring has become a critical application for chemical sensors. These sensors are deployed in various environmental monitoring systems to detect pollutants, gases, and other contaminants in the air, water, and soil. The growing emphasis on sustainability, coupled with stringent environmental regulations, is driving the demand for advanced chemical sensors for environmental monitoring purposes. Industries, regulatory bodies, and research institutions are investing significantly in these sensors to ensure environmental safety and compliance, thereby fueling the growth of this segment.

By Product

Electrochemical

Optical

Catalytic Bead

Others

By End-User

Industrial

Healthcare

Environmental Monitoring

Defense

Oil and Gas

Homeland Security

Regions Included

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

ABB

AirTest Technologies Inc

Alpha MOS SA

Delphi Technologies PLC

Denso Corp

General Electric Company

Halma plc

Honeywell International Inc

MSA Safety Inc

Pepperl+Fuchs GmbH

Siemens AG

Smiths Detection Inc

Yokogawa Electric Corp

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Chemical Sensors Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Chemical Sensors Market Size Outlook, $ Million, 2021 to 2030

3.2 Chemical Sensors Market Outlook by Type, $ Million, 2021 to 2030

3.3 Chemical Sensors Market Outlook by Product, $ Million, 2021 to 2030

3.4 Chemical Sensors Market Outlook by Application, $ Million, 2021 to 2030

3.5 Chemical Sensors Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Chemical Sensors Industry

4.2 Key Market Trends in Chemical Sensors Industry

4.3 Potential Opportunities in Chemical Sensors Industry

4.4 Key Challenges in Chemical Sensors Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Chemical Sensors Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Chemical Sensors Market Outlook by Segments

7.1 Chemical Sensors Market Outlook by Segments, $ Million, 2021- 2030

By Product

Electrochemical

Optical

Catalytic Bead

Others

By End-User

Industrial

Healthcare

Environmental Monitoring

Defense

Oil and Gas

Homeland Security

8 North America Chemical Sensors Market Analysis and Outlook To 2030

8.1 Introduction to North America Chemical Sensors Markets in 2024

8.2 North America Chemical Sensors Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Chemical Sensors Market size Outlook by Segments, 2021-2030

By Product

Electrochemical

Optical

Catalytic Bead

Others

By End-User

Industrial

Healthcare

Environmental Monitoring

Defense

Oil and Gas

Homeland Security

9 Europe Chemical Sensors Market Analysis and Outlook To 2030

9.1 Introduction to Europe Chemical Sensors Markets in 2024

9.2 Europe Chemical Sensors Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Chemical Sensors Market Size Outlook by Segments, 2021-2030

By Product

Electrochemical

Optical

Catalytic Bead

Others

By End-User

Industrial

Healthcare

Environmental Monitoring

Defense

Oil and Gas

Homeland Security

10 Asia Pacific Chemical Sensors Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Chemical Sensors Markets in 2024

10.2 Asia Pacific Chemical Sensors Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Chemical Sensors Market size Outlook by Segments, 2021-2030

By Product

Electrochemical

Optical

Catalytic Bead

Others

By End-User

Industrial

Healthcare

Environmental Monitoring

Defense

Oil and Gas

Homeland Security

11 South America Chemical Sensors Market Analysis and Outlook To 2030

11.1 Introduction to South America Chemical Sensors Markets in 2024

11.2 South America Chemical Sensors Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Chemical Sensors Market size Outlook by Segments, 2021-2030

By Product

Electrochemical

Optical

Catalytic Bead

Others

By End-User

Industrial

Healthcare

Environmental Monitoring

Defense

Oil and Gas

Homeland Security

12 Middle East and Africa Chemical Sensors Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Chemical Sensors Markets in 2024

12.2 Middle East and Africa Chemical Sensors Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Chemical Sensors Market size Outlook by Segments, 2021-2030

By Product

Electrochemical

Optical

Catalytic Bead

Others

By End-User

Industrial

Healthcare

Environmental Monitoring

Defense

Oil and Gas

Homeland Security

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

ABB

AirTest Technologies Inc

Alpha MOS SA

Delphi Technologies PLC

Denso Corp

General Electric Company

Halma plc

Honeywell International Inc

MSA Safety Inc

Pepperl+Fuchs GmbH

Siemens AG

Smiths Detection Inc

Yokogawa Electric Corp

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Electrochemical

Optical

Catalytic Bead

Others

By End-User

Industrial

Healthcare

Environmental Monitoring

Defense

Oil and Gas

Homeland Security

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Chemical Sensors is forecast to reach $43.5 Billion in 2030 from $26.8 Billion in 2024, registering a CAGR of 8.4%

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

ABB, AirTest Technologies Inc, Alpha MOS SA, Delphi Technologies PLC, Denso Corp, General Electric Company, Halma plc, Honeywell International Inc, MSA Safety Inc, Pepperl+Fuchs GmbH, Siemens AG, Smiths Detection Inc, Yokogawa Electric Corp

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume