The global Cesium Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By End-User (Pharmaceutical, Oil and Gas, Others), By Product (Cesium Chloride, Cesium Iodide, Cesium Hydroxide, Others).

The cesium market is witnessing growth driven by its diverse applications in industries such as electronics, telecommunications, healthcare, and energy. Key trends shaping the future of the industry include innovations in cesium production methods, purification techniques, and application technologies to meet stringent quality standards and customer specifications. Advanced cesium products offer high purity, stability, and precise atomic properties, making them valuable in various high-tech applications. Moreover, the integration of cesium into atomic clocks, frequency standards, and telecommunications equipment provides critical timing and synchronization capabilities for global navigation systems, satellite communications, and wireless networks. Additionally, the growing demand for cesium-based catalysts, scintillation detectors, and radiation therapy sources drives market expansion, as cesium compounds exhibit unique chemical and physical properties suitable for specialized applications in chemistry, physics, and medicine. As industries continue to innovate and advance technology in areas such as telecommunications, healthcare, and energy, the cesium market is poised for continued growth and innovation as a key enabler of cutting-edge technologies and scientific advancements.

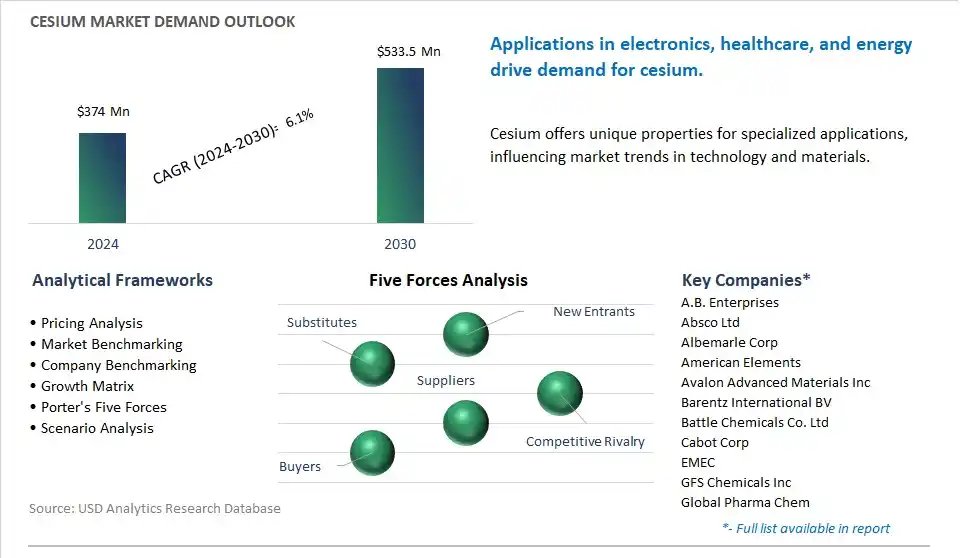

The market report analyses the leading companies in the industry including A.B. Enterprises, Absco Ltd, Albemarle Corp, American Elements, Avalon Advanced Materials Inc, Barentz International BV, Battle Chemicals Co. Ltd, Cabot Corp, EMEC, GFS Chemicals Inc, Global Pharma Chem, Island Pyrochemical Industries Corp, Materion Corp, Merck KGaA, Microsemi Corp, Power Metals Corp, ProChem Inc, Schlumberger Ltd, Thermo Fisher Scientific Inc.

The most prominent trend in the cesium market is the growing demand for cesium-based technologies, driven by their increasing use in various high-tech applications such as atomic clocks, satellite navigation systems, and telecommunications equipment. Cesium's unique properties, including its high electrical conductivity, low work function, and precise atomic resonance, make it ideal for applications requiring accurate timekeeping, frequency control, and signal synchronization. As industries such as aerospace, defense, telecommunications, and scientific research continue to advance and innovate, there's a rising demand for cesium and cesium-based products to support the development and deployment of cutting-edge technologies. This trend is fueled by the expanding use of cesium in emerging fields such as quantum computing, quantum sensing, and precision measurement systems, driving market growth and creating opportunities for innovation and collaboration in the cesium industry.

A key driver in the cesium market is the expansion of global telecommunications infrastructure, driven by increasing demand for high-speed data transmission, wireless connectivity, and internet-enabled devices worldwide. Cesium-based atomic clocks, which provide highly accurate timing signals and frequency references, are essential components in satellite navigation systems, cellular networks, and telecommunications infrastructure, ensuring precise synchronization and coordination of data transmission across multiple devices and networks. As telecommunications companies invest in upgrading and expanding their networks to meet growing bandwidth requirements and support emerging technologies such as 5G, IoT (Internet of Things), and autonomous vehicles, there's a growing demand for cesium and cesium-based devices to enhance network reliability, performance, and scalability. This driver is motivating telecommunications equipment manufacturers, network operators, and satellite providers to procure cesium-based technologies, driving market demand and creating opportunities for growth and innovation in the cesium industry.

The cesium market presents a significant opportunity for expansion into emerging quantum technologies, driven by advancements in quantum computing, quantum communication, and quantum sensing applications. Cesium atoms, with their stable atomic structure and precise hyperfine transition frequencies, are utilized in research laboratories and experimental facilities worldwide for quantum experiments, atomic clocks, and quantum information processing. With the growing interest and investment in quantum technologies for solving complex computational problems, encrypting secure communications, and improving sensing and imaging capabilities, there's a rising demand for cesium and cesium-based devices as key components in quantum systems and devices. Manufacturers can capitalize on this opportunity by developing specialized cesium-based products tailored to the unique requirements of quantum technology applications, collaborating with research institutions and technology partners, and exploring new markets and applications for cesium in the emerging field of quantum technology. By expanding into quantum technologies, cesium suppliers can diversify their product portfolio, tap into new market segments, and drive innovation and growth in the cesium industry.

The largest segment in the Cesium Market is the Oil and Gas end-user segment. This dominance can be attributed to diverse factors. The cesium is used in the oil and gas industry as a key component in cesium formate brine, which is a high-density drilling fluid commonly used in oil and gas exploration and production operations. Cesium formate brine is utilized in drilling operations to control wellbore pressure, prevent blowouts, stabilize formations, and enhance drilling efficiency in challenging drilling environments such as deepwater, high-pressure, and high-temperature reservoirs. Additionally, cesium formate brine offers diverse advantages over conventional drilling fluids, including higher density, lower toxicity, better stability at extreme temperatures, and compatibility with sensitive formations. In addition, the growing demand for energy and the increasing complexity of oil and gas reservoirs drive the adoption of cesium formate brine as a premium drilling fluid solution to overcome technical challenges and maximize hydrocarbon recovery. Further, advancements in drilling technology and increasing investments in offshore and unconventional oil and gas exploration further bolster the demand for cesium in the oil and gas industry. As the oil and gas industry continues to expand globally and explore new frontiers, the Oil and Gas end-user segment is expected to maintain its dominance in the Cesium Market.

The fastest-growing segment in the Cesium Market is the Cesium Chloride segment. This growth can be attributed to diverse factors. The cesium chloride (CsCl) is one of the most commonly used cesium compounds due to its high purity, stability, and versatile applications across various industries. CsCl is widely used in research laboratories, particularly in the field of molecular biology, as a density gradient medium for the separation and purification of nucleic acids such as DNA and RNA. Additionally, CsCl is utilized in analytical chemistry techniques such as atomic absorption spectroscopy and mass spectrometry as a calibration standard and carrier solution. In addition, CsCl finds applications in the production of optical materials, including scintillation crystals for radiation detection, photocathodes for photomultiplier tubes, and optical filters for infrared spectroscopy. Further, the increasing demand for cesium-based catalysts and chemicals in the chemical industry drives the adoption of CsCl as a precursor in the synthesis of cesium compounds such as cesium iodide (CsI) and cesium hydroxide (CsOH). As industries continue to innovate and develop new applications for cesium compounds in electronics, healthcare, and materials science, the Cesium Chloride segment is expected to experience rapid growth in the Cesium Market.

By End-User

Pharmaceutical

Oil and Gas

Others

By Product

Cesium Chloride

Cesium Iodide

Cesium Hydroxide

Others

Regions Included

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

A.B. Enterprises

Absco Ltd

Albemarle Corp

American Elements

Avalon Advanced Materials Inc

Barentz International BV

Battle Chemicals Co. Ltd

Cabot Corp

EMEC

GFS Chemicals Inc

Global Pharma Chem

Island Pyrochemical Industries Corp

Materion Corp

Merck KGaA

Microsemi Corp

Power Metals Corp

ProChem Inc

Schlumberger Ltd

Thermo Fisher Scientific Inc

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Cesium Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Cesium Market Size Outlook, $ Million, 2021 to 2030

3.2 Cesium Market Outlook by Type, $ Million, 2021 to 2030

3.3 Cesium Market Outlook by Product, $ Million, 2021 to 2030

3.4 Cesium Market Outlook by Application, $ Million, 2021 to 2030

3.5 Cesium Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Cesium Industry

4.2 Key Market Trends in Cesium Industry

4.3 Potential Opportunities in Cesium Industry

4.4 Key Challenges in Cesium Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Cesium Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Cesium Market Outlook by Segments

7.1 Cesium Market Outlook by Segments, $ Million, 2021- 2030

By End-User

Pharmaceutical

Oil and Gas

Others

By Product

Cesium Chloride

Cesium Iodide

Cesium Hydroxide

Others

8 North America Cesium Market Analysis and Outlook To 2030

8.1 Introduction to North America Cesium Markets in 2024

8.2 North America Cesium Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Cesium Market size Outlook by Segments, 2021-2030

By End-User

Pharmaceutical

Oil and Gas

Others

By Product

Cesium Chloride

Cesium Iodide

Cesium Hydroxide

Others

9 Europe Cesium Market Analysis and Outlook To 2030

9.1 Introduction to Europe Cesium Markets in 2024

9.2 Europe Cesium Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Cesium Market Size Outlook by Segments, 2021-2030

By End-User

Pharmaceutical

Oil and Gas

Others

By Product

Cesium Chloride

Cesium Iodide

Cesium Hydroxide

Others

10 Asia Pacific Cesium Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Cesium Markets in 2024

10.2 Asia Pacific Cesium Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Cesium Market size Outlook by Segments, 2021-2030

By End-User

Pharmaceutical

Oil and Gas

Others

By Product

Cesium Chloride

Cesium Iodide

Cesium Hydroxide

Others

11 South America Cesium Market Analysis and Outlook To 2030

11.1 Introduction to South America Cesium Markets in 2024

11.2 South America Cesium Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Cesium Market size Outlook by Segments, 2021-2030

By End-User

Pharmaceutical

Oil and Gas

Others

By Product

Cesium Chloride

Cesium Iodide

Cesium Hydroxide

Others

12 Middle East and Africa Cesium Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Cesium Markets in 2024

12.2 Middle East and Africa Cesium Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Cesium Market size Outlook by Segments, 2021-2030

By End-User

Pharmaceutical

Oil and Gas

Others

By Product

Cesium Chloride

Cesium Iodide

Cesium Hydroxide

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

A.B. Enterprises

Absco Ltd

Albemarle Corp

American Elements

Avalon Advanced Materials Inc

Barentz International BV

Battle Chemicals Co. Ltd

Cabot Corp

EMEC

GFS Chemicals Inc

Global Pharma Chem

Island Pyrochemical Industries Corp

Materion Corp

Merck KGaA

Microsemi Corp

Power Metals Corp

ProChem Inc

Schlumberger Ltd

Thermo Fisher Scientific Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By End-User

Pharmaceutical

Oil and Gas

Others

By Product

Cesium Chloride

Cesium Iodide

Cesium Hydroxide

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Cesium is forecast to reach $533.5 Million in 2030 from $374 Million in 2024, registering a CAGR of 6.1%

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

A.B. Enterprises, Absco Ltd, Albemarle Corp, American Elements, Avalon Advanced Materials Inc, Barentz International BV, Battle Chemicals Co. Ltd, Cabot Corp, EMEC, GFS Chemicals Inc, Global Pharma Chem, Island Pyrochemical Industries Corp, Materion Corp, Merck KGaA, Microsemi Corp, Power Metals Corp, ProChem Inc, Schlumberger Ltd, Thermo Fisher Scientific Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume