The global ceramic coatings industry is rapidly growing driven by demand from automobiles, aerospace and defense, power generation and healthcare industries. The industry is characterized by continuous new product launches driven by innovations in nanotechnology and material science. Motorglaze introduced advanced ceramic coatings and eco-friendly car care products in India, AERO developed fluorographene ceramic coating for both painted and non-painted surfaces, IGL Coatings launched graphene reinforced dual system that combines two ceramic coatings, Apex Auto Care introduced self-healing ceramic coating services. CeramTec is expanding its operations in China to cater to the rapidly growing demand in Asia Pacific.

Ceramic coatings are advanced protective layers made from a blend of polymers and silicone dioxide, designed to provide a durable, high-gloss shield for a vehicle’s exterior. These coatings offer superior protection against UV damage, scratches, discoloration, and environmental contaminants while creating a hydrophobic surface that resists rust and corrosion. Stronger and more resilient than traditional auto care products, ceramic coatings last for several years, providing chemical resistance and long-lasting gloss.

Wide range of coating materials including Chrome oxide, Aluminum oxide, Zirconium oxide, and others are marketed for diverse applications. In the industrial segment, ceramic coatings boost mechanical and high-temperature properties of components and equipment performance. End-users across automotive parts, aerospace and defense components, power, and other industries are opting for ceramic coatings. Alumina, alumina magnesia, silicon carbide, hafnia, silicon nitride, boron carbide, and zirconia raw materials are widely used in the manufacturing of ceramic coatings.

Innovations in spray coating technologies, like HVOF and plasma spraying, continue to boost the efficiency and quality of ceramic coatings. Acordingly, companies are investing in new product launches- Flame Spray Technologies (FST) released a new ceramic coating solution tailored for the automotive industry, focusing on improving wear resistance and thermal management in high-performance engines, Bodycote introduced a new series of plasma-sprayed ceramic coatings that offer enhanced durability and protection for aerospace components, particularly in high-temperature and corrosive environments.

Similarly, Zircotec launched a new range of ceramic coatings aimed at the motorsport and automotive markets. These coatings are designed to provide superior heat resistance and thermal management for exhaust systems and other high-temperature components. Companies market potential benefits including extremely high hydrophobicity, high level of protection against dirt, perfect gloss, excellent visual effect, resistance to extremely low and high ph, protection of the paint against uv radiation, protection against road deposits, and others to appeal to wide consumer base.

Ceramic coatings are gaining significant traction in the aerospace industry, driven by their ability to enhance performance and durability under extreme conditions. Ceramic coatings are extensively used in jet engines, particularly on turbine blades and exhaust systems. These components operate at temperatures exceeding 1,000°C (1,832°F), and ceramic coatings help to maintain structural integrity under these extreme conditions. The use of ceramic coatings in protecting these parts can lead to a reduction in operational costs by up to 20%, primarily through decreased downtime and maintenance frequency.

The UN predicts that by 2050 two thirds of the world population will live in cities. Further, according to the International Air Transport Association, the aviation industry generated $996 Billion revenue in 2024 while $936 Billion is recorded as expenses. Of the expenses, 31% is fuel-based expenses and the rest 69% is non-fuel based expenses. The application of advanced ceramic coatings can reduce fuel consumption by 1-2% per flight and can contribute to a reduction in CO2 emissions by up to 10% for newer aircraft models equipped with these technologies.

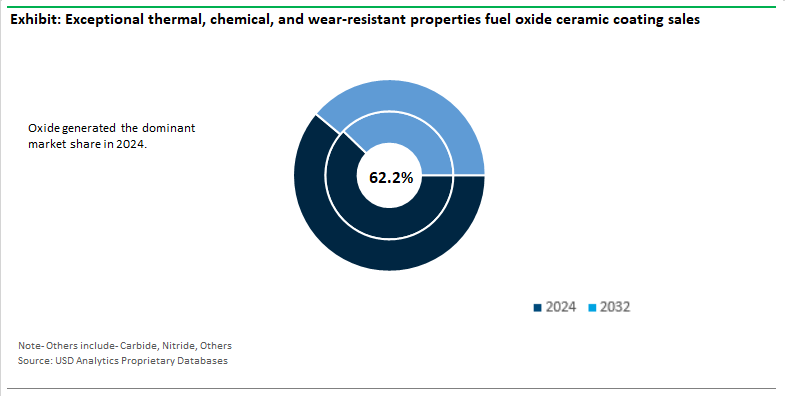

The oxide segment represents the largest market share of 62.2% within the ceramic coatings industry, driven by its extensive applications across various sectors such as aerospace, automotive, electronics, and energy. Oxide ceramic coatings, particularly those made from materials like alumina (Al₂O₃), zirconia (ZrO₂), and titania (TiO₂), are highly valued for their exceptional thermal, chemical, and wear-resistant properties.

Oxide ceramic coatings are renowned for their ability to withstand high temperatures, often exceeding 1,000°C. This makes them indispensable in applications where thermal stability is critical, such as in gas turbines and engine components. In addition, Oxide coatings are chemically inert, providing excellent resistance to corrosion and chemical attacks.

This property is particularly important in harsh environments, such as those found in the chemical processing and energy sectors. The hardness of oxide coatings, particularly alumina, contributes to their superior wear resistance, extending the life of components in high-friction environments. Leading companies including Praxair Surface Technologies (aerospace and industrial sectors), Saint-Gobain (high-performance applications), Oerlikon Metco (thermal barrier coatings), Bodycote (thermal processing services), and others continue to invest in new product launches in oxide based ceramic coatings.

The Thermal Spray Technology segment generated the highest revenue of $8.3 Billion in 2024. Thermal spray technology can be used to apply various types of ceramic coatings, including oxides, carbides, and nitrides, making it highly versatile. The technology can be applied to a wide range of substrates, including metals, plastics, and composites, further broadening its applicability across different sectors.

In addition, Thermal spray coatings are particularly valued for their ability to withstand extreme temperatures, making them ideal for applications such as turbine blades in jet engines and exhaust systems in automotive applications. By extending the lifespan of components and reducing the need for frequent maintenance, thermal spray coatings offer long-term cost savings and allows for rapid coating of large and complex parts, making it a cost-effective solution for large-scale industrial applications. Further, advances in thermal spray technology, such as the development of high-velocity oxygen fuel (HVOF) spraying and plasma spraying, continue to boost the quality and performance of ceramic coatings.

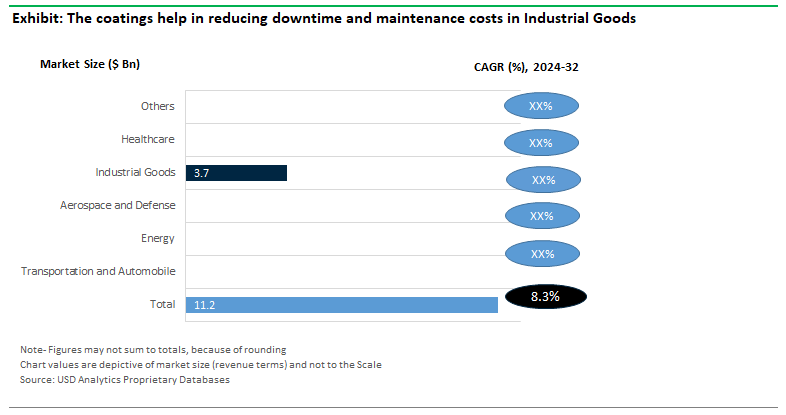

Transportation and Automotive, Energy, Aerospace and Defense, Industrial Goods, Healthcare, and Others are the leading end-users of ceramic coatings. Of these, Industrial Goods held the dominant market share of 32.6% in 2024. Sectors like mining, oil and gas, and chemical processing are major users of ceramic coatings. The coatings help in reducing downtime and maintenance costs, making operations more efficient and cost-effective. Further, in manufacturing sectors like steel and glass production, components exposed to high temperatures require protective coatings to maintain their integrity and performance. Ceramic coatings are widely used in the tooling industry to enhance the hardness and wear resistance of cutting tools, drills, and other precision instruments.

The growth of manufacturing and processing industries, particularly in emerging economies, has significantly increased the demand for high-performance coatings. Regions like Asia-Pacific, where industrialization is rapidly advancing, have seen a surge in demand for ceramic coatings. Countries like China and India are leading this growth, contributing to the substantial revenue share of the industrial goods segment.

In addition to industrial goods, ceramic coatings are increasingly emerging as the most popular choice for automotive paint protection. Further, growing refurbished component manufacturing is strengthening the demand for ceramic coatings, in particular, generation equipment, medical equipment, and other industrial equipment.

Asia-Pacific, particularly countries like China, India, Japan, and South Korea are emerging as global manufacturing hub. The industry generated 40.8% of the global ceramic coating market size. China is the largest market within the region, driven by its massive industrial base and Indian market is expected to witness a CAGR of 9.2% during the forecast period, supported by government initiatives to boost manufacturing and infrastructure development.

Massive investments in infrastructure projects across the region are driving the demand for ceramic coatings, especially in sectors like construction, energy, and transportation. In particular, the region’s automotive industry is increasingly adopting ceramic coatings for various applications, including engine components, exhaust systems, and paint protection, to enhance vehicle performance and longevity. China and India are investing heavily in developing their aerospace capabilities, with numerous projects underway to build and expand aircraft manufacturing facilities. Further, growing focus on sustainable energy solutions, such as wind and solar power, is also contributing to the demand for ceramic coatings.

The ceramic coatings market is fragmented, characterized by the presence of a large number of players, both large multinational corporations and smaller regional and niche companies. While the market is fragmented, there is ongoing consolidation as larger companies acquire smaller or specialized firms to expand their technology portfolios and market reach. APS Materials Inc, Aremco Products Inc, Bodycote, Cetek Cermaic Technologies Ltd, Element 119, Keronite Group Ltd, NanoShine Ltd, Praxair Surface Technologies Inc, Saint-Gobain S.A., Ultramet Inc., and others are the leading companies in the industry.

The Ceramic Coatings industry is characterized by the presence of capital-intensive companies across the industry from raw material procurement to final product distribution.

|

Parameter |

Details |

|

Market Size (2024) |

$11.2 Billion |

|

Market Size (2032) |

$21.2 Billion |

|

Market Growth Rate |

8.3% |

|

Largest Segment- Product |

Oxide-based Ceramic Coatings (62.2%) |

|

Largest Segment- Technology |

Thermal Spray Technology ($8.3 Billion) |

|

Fastest Growing Market- Region |

Asia Pacific (40.8% Market Share) |

|

Largest End-User Industry |

Industrial Goods (32.6% Market Share) |

|

Segments |

Products, Technologies, Applications |

|

Study Period |

2018- 2023 and 2024-2032 |

|

Units |

Revenue (USD) |

|

Qualitative Analysis |

Porter’s Five Forces, SWOT Profile, Market Share, Scenario Forecasts, Market Ecosystem, Company Ranking, Market Dynamics, Industry Benchmarking |

|

Companies |

APS Materials Inc, Aremco Products Inc, Bodycote, Cetek Cermaic Technologies Ltd, Element 119, Keronite Group Ltd, NanoShine Ltd, Praxair Surface Technologies Inc, Saint-Gobain S.A., Ultramet Inc |

|

Countries |

US, Canada, Mexico, Germany, France, Spain, Italy, UK, Russia, China, India, Japan, South Korea, Australia, South East Asia, Brazil, Argentina, Middle East, Africa |

Products

Technologies

Applications

Regions Analyzed

*List not exhaustive

About USD Analytics

Table of Contents

1. Executive Summary

What’s New in 2024?

Top 10 Takeaways from the industry

Potential Opportunities for Industry Stakeholders

Strategic Imperatives

Company Market Positioning

Industry Benchmarking Matrix

2. Research Scope and Methodology

Market Definition

Market Segments

Companies Profiled

Research Methodology

Data Sources

Conversion Rates for USD

Abbreviations

3. Strategic Landscape: Key Insights and Implications

Spotlight: Key Strategies opted by Business Leaders

Competitive Landscape

SWOT Analysis

Porter’s Five Force Analysis

Macro-Environmental Analysis

5. Growth Opportunity Analysis

Trends at a Glance

Market Dynamics

Key Industry Stakeholders

Regulatory Landscape

6. Market Size Outlook to 2032

Global Ceramic Coatings Market Size Forecast, USD Million, 2018- 2032

Scenario Analysis

Pricing Analysis and Outlook

7. Historical Ceramic Coatings Market Size by Segments, 2018- 2023

Key Statistics, 2024

Ceramic Coatings Market Size Outlook by Type, USD Million, 2018-2023

Growth Comparison (y-o-y) across Ceramic Coatings Types, 2018-2023

Ceramic Coatings Market Size Outlook by Application, USD Million, 2018-2023

Growth Comparison (y-o-y) across Ceramic Coatings Applications, 2018-2023

8. Ceramic Coatings Market Size Outlook by Segments, 2024- 2032

Ceramic Coatings Market Size Outlook by Resin, USD Million, 2024-2032

Growth Comparison (y-o-y) across Ceramic Coatings Resins, 2024-2032

Ceramic Coatings Market Size Outlook by Technologies, USD Million, 2024-2032

Growth Comparison (y-o-y) across Ceramic Coatings Technologies, 2024-2032

Ceramic Coatings Market Size Outlook by End-Users, USD Million, 2024-2032

Growth Comparison (y-o-y) across Ceramic Coatings End-Users, 2024-2032

9. Ceramic Coatings Market Size Outlook by Region

North America

Europe

Asia Pacific

South America

Middle East and Africa

10. United States Ceramic Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

United States Ceramic Coatings Market Size Outlook by Type, 2021- 2032

United States Ceramic Coatings Market Size Outlook by Application, 2021- 2032

United States Ceramic Coatings Market Size Outlook by End-User, 2021- 2032

11. Canada Ceramic Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Canada Ceramic Coatings Market Size Outlook by Type, 2021- 2032

Canada Ceramic Coatings Market Size Outlook by Application, 2021- 2032

Canada Ceramic Coatings Market Size Outlook by End-User, 2021- 2032

12. Mexico Ceramic Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Mexico Ceramic Coatings Market Size Outlook by Type, 2021- 2032

Mexico Ceramic Coatings Market Size Outlook by Application, 2021- 2032

Mexico Ceramic Coatings Market Size Outlook by End-User, 2021- 2032

13. Germany Ceramic Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Germany Ceramic Coatings Market Size Outlook by Type, 2021- 2032

Germany Ceramic Coatings Market Size Outlook by Application, 2021- 2032

Germany Ceramic Coatings Market Size Outlook by End-User, 2021- 2032

14. France Ceramic Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

France Ceramic Coatings Market Size Outlook by Type, 2021- 2032

France Ceramic Coatings Market Size Outlook by Application, 2021- 2032

France Ceramic Coatings Market Size Outlook by End-User, 2021- 2032

15. United Kingdom Ceramic Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

United Kingdom Ceramic Coatings Market Size Outlook by Type, 2021- 2032

United Kingdom Ceramic Coatings Market Size Outlook by Application, 2021- 2032

United Kingdom Ceramic Coatings Market Size Outlook by End-User, 2021- 2032

10. Spain Ceramic Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Spain Ceramic Coatings Market Size Outlook by Type, 2021- 2032

Spain Ceramic Coatings Market Size Outlook by Application, 2021- 2032

Spain Ceramic Coatings Market Size Outlook by End-User, 2021- 2032

16. Italy Ceramic Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Italy Ceramic Coatings Market Size Outlook by Type, 2021- 2032

Italy Ceramic Coatings Market Size Outlook by Application, 2021- 2032

Italy Ceramic Coatings Market Size Outlook by End-User, 2021- 2032

17. Benelux Ceramic Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Benelux Ceramic Coatings Market Size Outlook by Type, 2021- 2032

Benelux Ceramic Coatings Market Size Outlook by Application, 2021- 2032

Benelux Ceramic Coatings Market Size Outlook by End-User, 2021- 2032

18. Nordic Ceramic Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Nordic Ceramic Coatings Market Size Outlook by Type, 2021- 2032

Nordic Ceramic Coatings Market Size Outlook by Application, 2021- 2032

Nordic Ceramic Coatings Market Size Outlook by End-User, 2021- 2032

19. Rest of Europe Ceramic Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Europe Ceramic Coatings Market Size Outlook by Type, 2021- 2032

Rest of Europe Ceramic Coatings Market Size Outlook by Application, 2021- 2032

Rest of Europe Ceramic Coatings Market Size Outlook by End-User, 2021- 2032

20. China Ceramic Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

China Ceramic Coatings Market Size Outlook by Type, 2021- 2032

China Ceramic Coatings Market Size Outlook by Application, 2021- 2032

China Ceramic Coatings Market Size Outlook by End-User, 2021- 2032

21. India Ceramic Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

India Ceramic Coatings Market Size Outlook by Type, 2021- 2032

India Ceramic Coatings Market Size Outlook by Application, 2021- 2032

India Ceramic Coatings Market Size Outlook by End-User, 2021- 2032

22. Japan Ceramic Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Japan Ceramic Coatings Market Size Outlook by Type, 2021- 2032

Japan Ceramic Coatings Market Size Outlook by Application, 2021- 2032

Japan Ceramic Coatings Market Size Outlook by End-User, 2021- 2032

23. South Korea Ceramic Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

South Korea Ceramic Coatings Market Size Outlook by Type, 2021- 2032

South Korea Ceramic Coatings Market Size Outlook by Application, 2021- 2032

South Korea Ceramic Coatings Market Size Outlook by End-User, 2021- 2032

24. Australia Ceramic Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Australia Ceramic Coatings Market Size Outlook by Type, 2021- 2032

Australia Ceramic Coatings Market Size Outlook by Application, 2021- 2032

Australia Ceramic Coatings Market Size Outlook by End-User, 2021- 2032

25. South East Asia Ceramic Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

South East Asia Ceramic Coatings Market Size Outlook by Type, 2021- 2032

South East Asia Ceramic Coatings Market Size Outlook by Application, 2021- 2032

South East Asia Ceramic Coatings Market Size Outlook by End-User, 2021- 2032

26. Rest of Asia Pacific Ceramic Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Asia Pacific Ceramic Coatings Market Size Outlook by Type, 2021- 2032

Rest of Asia Pacific Ceramic Coatings Market Size Outlook by Application, 2021- 2032

Rest of Asia Pacific Ceramic Coatings Market Size Outlook by End-User, 2021- 2032

27. Brazil Ceramic Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Brazil Ceramic Coatings Market Size Outlook by Type, 2021- 2032

Brazil Ceramic Coatings Market Size Outlook by Application, 2021- 2032

Brazil Ceramic Coatings Market Size Outlook by End-User, 2021- 2032

28. Argentina Ceramic Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Argentina Ceramic Coatings Market Size Outlook by Type, 2021- 2032

Argentina Ceramic Coatings Market Size Outlook by Application, 2021- 2032

Argentina Ceramic Coatings Market Size Outlook by End-User, 2021- 2032

29. Rest of South America Ceramic Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of South America Ceramic Coatings Market Size Outlook by Type, 2021- 2032

Rest of South America Ceramic Coatings Market Size Outlook by Application, 2021- 2032

Rest of South America Ceramic Coatings Market Size Outlook by End-User, 2021- 2032

30. United Arab Emirates Ceramic Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

United Arab Emirates Ceramic Coatings Market Size Outlook by Type, 2021- 2032

United Arab Emirates Ceramic Coatings Market Size Outlook by Application, 2021- 2032

United Arab Emirates Ceramic Coatings Market Size Outlook by End-User, 2021- 2032

31. Saudi Arabia Ceramic Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Saudi Arabia Ceramic Coatings Market Size Outlook by Type, 2021- 2032

Saudi Arabia Ceramic Coatings Market Size Outlook by Application, 2021- 2032

Saudi Arabia Ceramic Coatings Market Size Outlook by End-User, 2021- 2032

32. Rest of Middle East Ceramic Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Middle East Ceramic Coatings Market Size Outlook by Type, 2021- 2032

Rest of Middle East Ceramic Coatings Market Size Outlook by Application, 2021- 2032

Rest of Middle East Ceramic Coatings Market Size Outlook by End-User, 2021- 2032

33. South Africa Ceramic Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

South Africa Ceramic Coatings Market Size Outlook by Type, 2021- 2032

South Africa Ceramic Coatings Market Size Outlook by Application, 2021- 2032

South Africa Ceramic Coatings Market Size Outlook by End-User, 2021- 2032

34. Rest of Africa Ceramic Coatings Market Analysis and Outlook, 2021- 2032

Key Statistics

Rest of Africa Ceramic Coatings Market Size Outlook by Type, 2021- 2032

Rest of Africa Ceramic Coatings Market Size Outlook by Application, 2021- 2032

Rest of Africa Ceramic Coatings Market Size Outlook by End-User, 2021- 2032

35. Key Companies

Market Share Analysis

Company Benchmarking

Financial Analysis

36. Recent Market Developments

37. Appendix

Looking Ahead

Research Methodology

Legal Disclaimer

Products

Technologies

Applications

Regions Analyzed

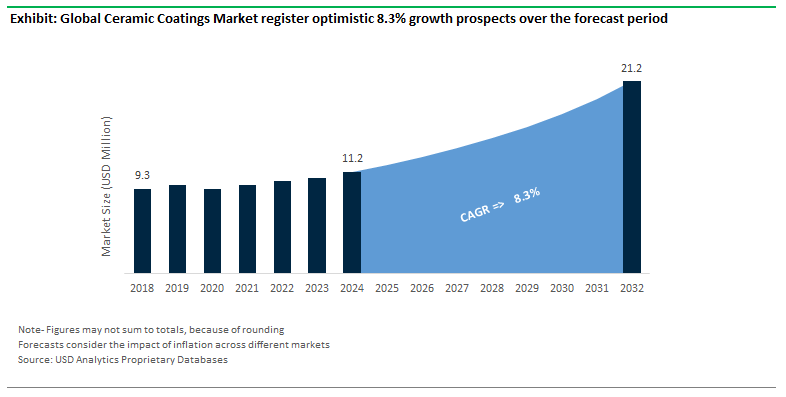

Ceramic Coatings Market Size is estimated to increase at an 8.3% CAGR over the forecast period from $11.2 Billion 2024 to $21.2 Billion in 2032.

Oxide-based Ceramic Coatings (62.2% Market Share), Thermal Spray Technology ($8.3 Billion), Industrial Goods (32.6% Market Share)

APS Materials Inc, Aremco Products Inc, Bodycote, Cetek Cermaic Technologies Ltd, Element 119, Keronite Group Ltd, NanoShine Ltd, Praxair Surface Technologies Inc, Saint-Gobain S.A., Ultramet Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume

Asia Pacific (40.8% Market Share)