The global Ceramic Binders Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Cement, Alumina, Phosphate, Silica, Others), By Chemistry (Organic, Inorganic), By Application (Traditional Ceramics, Advanced Ceramics, Abrasives, Others).

Ceramic binders are specialized materials used to bind ceramic powders together during the forming and firing processes in 2024. These binders play a crucial role in ceramic manufacturing by imparting green strength to ceramic bodies, facilitating shaping and handling, and promoting densification and sintering during firing. Ceramic binders can be organic or inorganic and are typically added to ceramic formulations in liquid form before shaping or molding. Upon drying and firing, the binders decompose or burn out, leaving behind a dense ceramic structure. Common types of ceramic binders include organic binders such as cellulose ethers, polyvinyl alcohols (PVA), and acrylic polymers, as well as inorganic binders such as colloidal silica, sodium silicate, and alumina-based binders. The selection of a suitable binder depends on factors such as the desired green strength, rheological properties, and firing conditions of the ceramic product. Ceramic binders are essential components in the production of various ceramic products, including tiles, bricks, sanitaryware, and technical ceramics, where they contribute to achieving desired properties and performance characteristics.

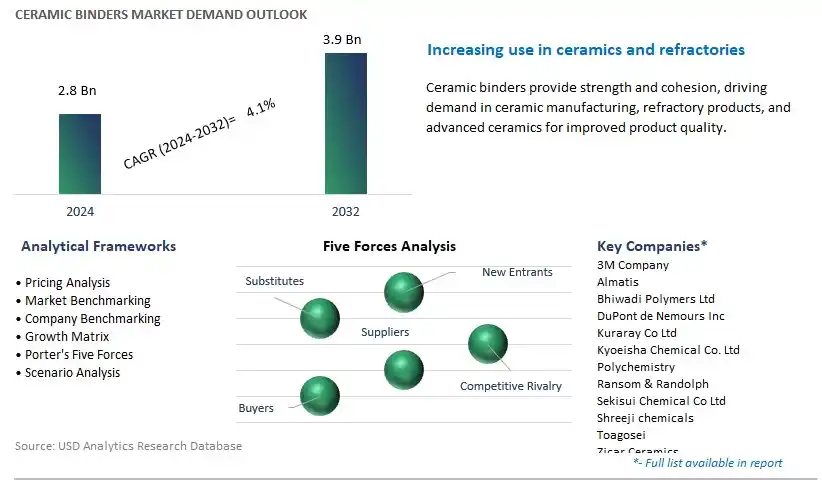

The market report analyses the leading companies in the industry including 3M Company, Almatis, Bhiwadi Polymers Ltd, DuPont de Nemours Inc, Kuraray Co Ltd, Kyoeisha Chemical Co. Ltd, Polychemistry, Ransom & Randolph, Sekisui Chemical Co Ltd, Shreeji chemicals, Toagosei, Zicar Ceramics, and others.

A prominent trend in the Ceramic Binders Market is the growing adoption of advanced ceramics in the electronics industry. As the demand for high-performance electronic components such as capacitors, insulators, and semiconductors rises, manufacturers increasingly use ceramic binders to enhance the properties and performance of these advanced ceramics, driving the market's growth.

The primary driver for the Ceramic Binders Market is the growth in construction and infrastructure development. Ceramic binders are essential in producing construction materials like tiles, bricks, and sanitary ware due to their binding properties and ability to improve material strength and durability. With rapid urbanization and infrastructure projects worldwide, the demand for ceramic binders is set to increase significantly.

A significant opportunity in the Ceramic Binders Market lies in developing eco-friendly and high-performance binders. As environmental regulations become stricter and sustainability becomes a priority, there is a growing need for binders that are not only effective but also environmentally benign. Innovating in this space can cater to the rising demand for green building materials, opening new avenues for market growth.

Within the Ceramic Binders market, the Cement Type segment is the largest, primarily due to its versatility and established applications across various industries. Cement-based ceramic binders, typically composed of Portland cement and other additives, are widely utilized in the production of ceramic tiles, sanitaryware, bricks, and refractory materials. These binders offer excellent bonding strength, durability, and resistance to high temperatures, making them indispensable in ceramic manufacturing processes. Moreover, cement-based binders exhibit versatility in formulation and can be tailored to meet specific performance requirements for different applications. Additionally, the global construction industry's steady growth and increasing infrastructure development activities further drive the demand for cement-based ceramic binders for applications such as tile adhesives, grouts, and mortars. The extensive utilization and proven performance of cement-based binders in ceramic production solidify the Cement Type segment as the largest in the Ceramic Binders market.

Within the Ceramic Binders market, the Organic Chemistry segment is the fastest-growing segment, propelled by advancements in sustainable binder technologies and increasing environmental consciousness. Organic ceramic binders, derived from natural or synthetic organic compounds, offer potential advantages over traditional inorganic binders, including lower energy consumption during production, reduced environmental impact, and improved health and safety profiles. These binders exhibit excellent adhesion properties, enabling the production of high-quality ceramic products such as tiles, sanitaryware, and refractory materials. Moreover, the rising demand for eco-friendly and sustainable building materials, coupled with stringent environmental regulations, drives the adoption of organic ceramic binders in various industries. Additionally, ongoing research and development efforts aimed at enhancing the performance and versatility of organic binders further contribute to the segment's rapid growth. As industries continue to prioritize sustainability and environmental responsibility, the Organic Chemistry segment is expected to maintain its rapid expansion pace in the Ceramic Binders market.

Within the Ceramic Binders market, the Traditional Ceramics application is the largest segment, primarily due to its extensive utilization in well-established industries such as pottery, tableware, and sanitaryware manufacturing. Traditional ceramics, including earthenware, stoneware, and porcelain, rely heavily on ceramic binders to form cohesive structures during shaping and firing processes. These binders play a critical role in controlling the rheology of ceramic slurries, facilitating shaping and molding operations, and providing strength and cohesion to the finished products. Moreover, the global demand for traditional ceramic products remains significant, driven by factors such as population growth, urbanization, and consumer preferences. Additionally, the increasing adoption of advanced manufacturing techniques and digital technologies in traditional ceramic production further enhances the efficiency and quality of finished products, sustaining the demand for ceramic binders in this segment. As traditional ceramic industries continue to evolve and adapt to changing market dynamics, the Traditional Ceramics application maintains its dominance in the Ceramic Binders market.

By Type

Cement

Alumina

Phosphate

Silica

Others

By Chemistry

Organic

Inorganic

By Application

Traditional Ceramics

Advanced Ceramics

Abrasives

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

3M Company

Almatis

Bhiwadi Polymers Ltd

DuPont de Nemours Inc

Kuraray Co Ltd

Kyoeisha Chemical Co. Ltd

Polychemistry

Ransom & Randolph

Sekisui Chemical Co Ltd

Shreeji chemicals

Toagosei

Zicar Ceramics

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Ceramic Binders Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Ceramic Binders Market Size Outlook, $ Million, 2021 to 2032

3.2 Ceramic Binders Market Outlook by Type, $ Million, 2021 to 2032

3.3 Ceramic Binders Market Outlook by Product, $ Million, 2021 to 2032

3.4 Ceramic Binders Market Outlook by Application, $ Million, 2021 to 2032

3.5 Ceramic Binders Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Ceramic Binders Industry

4.2 Key Market Trends in Ceramic Binders Industry

4.3 Potential Opportunities in Ceramic Binders Industry

4.4 Key Challenges in Ceramic Binders Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Ceramic Binders Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Ceramic Binders Market Outlook by Segments

7.1 Ceramic Binders Market Outlook by Segments, $ Million, 2021- 2032

By Type

Cement

Alumina

Phosphate

Silica

Others

By Chemistry

Organic

Inorganic

By Application

Traditional Ceramics

Advanced Ceramics

Abrasives

Others

8 North America Ceramic Binders Market Analysis and Outlook To 2032

8.1 Introduction to North America Ceramic Binders Markets in 2024

8.2 North America Ceramic Binders Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Ceramic Binders Market size Outlook by Segments, 2021-2032

By Type

Cement

Alumina

Phosphate

Silica

Others

By Chemistry

Organic

Inorganic

By Application

Traditional Ceramics

Advanced Ceramics

Abrasives

Others

9 Europe Ceramic Binders Market Analysis and Outlook To 2032

9.1 Introduction to Europe Ceramic Binders Markets in 2024

9.2 Europe Ceramic Binders Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Ceramic Binders Market Size Outlook by Segments, 2021-2032

By Type

Cement

Alumina

Phosphate

Silica

Others

By Chemistry

Organic

Inorganic

By Application

Traditional Ceramics

Advanced Ceramics

Abrasives

Others

10 Asia Pacific Ceramic Binders Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Ceramic Binders Markets in 2024

10.2 Asia Pacific Ceramic Binders Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Ceramic Binders Market size Outlook by Segments, 2021-2032

By Type

Cement

Alumina

Phosphate

Silica

Others

By Chemistry

Organic

Inorganic

By Application

Traditional Ceramics

Advanced Ceramics

Abrasives

Others

11 South America Ceramic Binders Market Analysis and Outlook To 2032

11.1 Introduction to South America Ceramic Binders Markets in 2024

11.2 South America Ceramic Binders Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Ceramic Binders Market size Outlook by Segments, 2021-2032

By Type

Cement

Alumina

Phosphate

Silica

Others

By Chemistry

Organic

Inorganic

By Application

Traditional Ceramics

Advanced Ceramics

Abrasives

Others

12 Middle East and Africa Ceramic Binders Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Ceramic Binders Markets in 2024

12.2 Middle East and Africa Ceramic Binders Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Ceramic Binders Market size Outlook by Segments, 2021-2032

By Type

Cement

Alumina

Phosphate

Silica

Others

By Chemistry

Organic

Inorganic

By Application

Traditional Ceramics

Advanced Ceramics

Abrasives

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

3M Company

Almatis

Bhiwadi Polymers Ltd

DuPont de Nemours Inc

Kuraray Co Ltd

Kyoeisha Chemical Co. Ltd

Polychemistry

Ransom & Randolph

Sekisui Chemical Co Ltd

Shreeji chemicals

Toagosei

Zicar Ceramics

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Cement

Alumina

Phosphate

Silica

Others

By Chemistry

Organic

Inorganic

By Application

Traditional Ceramics

Advanced Ceramics

Abrasives

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Ceramic Binders Market Size is valued at $2.8 Billion in 2024 and is forecast to register a growth rate (CAGR) of 4.1% to reach $3.9 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

3M Company, Almatis, Bhiwadi Polymers Ltd, DuPont de Nemours Inc, Kuraray Co Ltd, Kyoeisha Chemical Co. Ltd, Polychemistry, Ransom & Randolph, Sekisui Chemical Co Ltd, Shreeji chemicals, Toagosei, Zicar Ceramics

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume