The global Carbon Foam Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Graphitic, Non-graphitic), By End-User (Aerospace and Defense, Building and Construction, Automotive, Electrical, Industrial, Others).

Carbon foam is a lightweight and porous material composed primarily of carbon with a cellular structure resembling foam in 2024. This unique material possesses excellent thermal and electrical conductivity, high temperature resistance, and chemical inertness, making it suitable for a wide range of applications in industries such as aerospace, automotive, electronics, and energy storage. Carbon foam is commonly used as a thermal insulator in high-temperature environments, heat sinks in electronic devices, and catalyst supports in chemical processes. Additionally, its high surface area and porous structure make it ideal for applications such as water filtration, electrode materials for batteries and capacitors, and structural components in lightweight composites. With its exceptional properties and versatility, carbon foam s to be a material of interest for researchers and engineers seeking innovative solutions for thermal management, energy storage, and environmental remediation challenges.

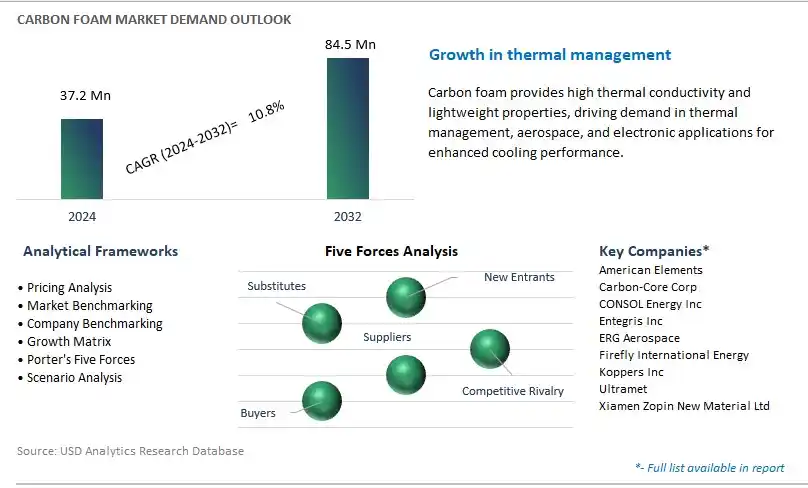

The market report analyses the leading companies in the industry including American Elements, Carbon-Core Corp, CONSOL Energy Inc, Entegris Inc, ERG Aerospace, Firefly International Energy, Koppers Inc, Ultramet, Xiamen Zopin New Material Ltd, and others.

A prominent trend in the carbon foam market is the growing demand for lightweight and high-performance materials across various industries, driven by the need for innovative solutions to address challenges related to energy efficiency, thermal management, and structural integrity. Carbon foam, known for its unique combination of properties including high thermal conductivity, low density, and excellent mechanical strength, is increasingly favored in applications such as thermal insulation, heat sinks, energy storage, and aerospace structures. This trend is reshaping the materials landscape, with manufacturers focusing on developing advanced carbon foam formulations and production processes to meet the evolving needs of industries seeking lightweight, durable, and versatile materials for next-generation applications.

The primary driver fueling the growth of the carbon foam market is the expansion in renewable energy and energy storage sectors, where carbon foam plays a critical role in improving the efficiency and performance of renewable energy systems and energy storage devices. With the increasing adoption of solar, wind, and battery technologies for electricity generation and storage, there is a rising demand for materials that can enhance heat dissipation, thermal management, and electrochemical performance. Carbon foam's high thermal conductivity, lightweight nature, and compatibility with harsh operating conditions make it an ideal material for applications such as heat exchangers, thermal insulation, and electrodes in batteries and fuel cells, driving market growth and innovation in renewable energy and energy storage solutions.

An emerging opportunity within the carbon foam market lies in the exploration of emerging applications in automotive and electronics sectors, leveraging carbon foam's unique properties to enhance vehicle performance, energy efficiency, and electronic device reliability. With the automotive industry focusing on lightweighting, electrification, and thermal management to improve fuel economy and reduce emissions, there is potential for carbon foam to be used in applications such as lightweight structural components, battery enclosures, and thermal management systems in electric vehicles. Similarly, in the electronics sector, carbon foam can find applications as heat sinks, electromagnetic interference (EMI) shields, and substrate materials for high-power electronic devices, offering opportunities for market expansion and collaboration with stakeholders in automotive and electronics industries to address emerging challenges and opportunities. By exploring new applications and markets, manufacturers of carbon foam can capitalize on the growing demand for lightweight and high-performance materials, driving innovation and competitiveness in the global carbon foam market.

In the Carbon Foam market, the Graphitic Type segment is the largest, primarily due to its superior properties and wide-ranging applications across various industries. Graphitic carbon foam, characterized by its high thermal conductivity, excellent mechanical strength, and electrical conductivity, finds extensive utilization in thermal management applications, such as heat sinks, thermal insulation, and thermal energy storage systems. Additionally, its lightweight nature and structural integrity make it suitable for aerospace and automotive applications, where weight reduction is critical for fuel efficiency and performance enhancement. Moreover, graphitic carbon foam's resistance to corrosion and high-temperature environments further expands its utility in industrial settings, including chemical processing, metal casting, and semiconductor manufacturing. The exceptional properties of graphitic carbon foam, coupled with its versatility across diverse industries, solidify its position as the largest segment in the Carbon Foam market.

The Automotive end-user segment within the Carbon Foam market is experiencing rapid growth, propelled by the automotive industry's increasing emphasis on lightweighting initiatives and performance demands. Carbon foam materials offer significant weight reduction benefits while maintaining structural integrity and performance, making them highly desirable for automotive manufacturers striving to enhance fuel efficiency and reduce emissions. Additionally, with the global shift towards electric and hybrid vehicles, lightweight materials like carbon foam play a crucial role in extending driving range and optimizing energy efficiency. Moreover, the automotive sector's growing focus on advanced safety features and enhanced comfort drives the adoption of carbon foam in applications such as impact-absorbing structures and noise insulation. As automotive manufacturers continue to prioritize lightweighting and performance optimization to meet regulatory standards and consumer expectations, the Automotive end-user segment is expected to sustain its rapid growth trajectory within the Carbon Foam market.

By Type

Graphitic

Non-graphitic

By End-User

Aerospace and Defense

Building and Construction

Automotive

Electrical

Industrial

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

American Elements

Carbon-Core Corp

CONSOL Energy Inc

Entegris Inc

ERG Aerospace

Firefly International Energy

Koppers Inc

Ultramet

Xiamen Zopin New Material Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Carbon Foam Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Carbon Foam Market Size Outlook, $ Million, 2021 to 2032

3.2 Carbon Foam Market Outlook by Type, $ Million, 2021 to 2032

3.3 Carbon Foam Market Outlook by Product, $ Million, 2021 to 2032

3.4 Carbon Foam Market Outlook by Application, $ Million, 2021 to 2032

3.5 Carbon Foam Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Carbon Foam Industry

4.2 Key Market Trends in Carbon Foam Industry

4.3 Potential Opportunities in Carbon Foam Industry

4.4 Key Challenges in Carbon Foam Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Carbon Foam Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Carbon Foam Market Outlook by Segments

7.1 Carbon Foam Market Outlook by Segments, $ Million, 2021- 2032

By Type

Graphitic

Non-graphitic

By End-User

Aerospace and Defense

Building and Construction

Automotive

Electrical

Industrial

Others

8 North America Carbon Foam Market Analysis and Outlook To 2032

8.1 Introduction to North America Carbon Foam Markets in 2024

8.2 North America Carbon Foam Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Carbon Foam Market size Outlook by Segments, 2021-2032

By Type

Graphitic

Non-graphitic

By End-User

Aerospace and Defense

Building and Construction

Automotive

Electrical

Industrial

Others

9 Europe Carbon Foam Market Analysis and Outlook To 2032

9.1 Introduction to Europe Carbon Foam Markets in 2024

9.2 Europe Carbon Foam Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Carbon Foam Market Size Outlook by Segments, 2021-2032

By Type

Graphitic

Non-graphitic

By End-User

Aerospace and Defense

Building and Construction

Automotive

Electrical

Industrial

Others

10 Asia Pacific Carbon Foam Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Carbon Foam Markets in 2024

10.2 Asia Pacific Carbon Foam Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Carbon Foam Market size Outlook by Segments, 2021-2032

By Type

Graphitic

Non-graphitic

By End-User

Aerospace and Defense

Building and Construction

Automotive

Electrical

Industrial

Others

11 South America Carbon Foam Market Analysis and Outlook To 2032

11.1 Introduction to South America Carbon Foam Markets in 2024

11.2 South America Carbon Foam Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Carbon Foam Market size Outlook by Segments, 2021-2032

By Type

Graphitic

Non-graphitic

By End-User

Aerospace and Defense

Building and Construction

Automotive

Electrical

Industrial

Others

12 Middle East and Africa Carbon Foam Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Carbon Foam Markets in 2024

12.2 Middle East and Africa Carbon Foam Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Carbon Foam Market size Outlook by Segments, 2021-2032

By Type

Graphitic

Non-graphitic

By End-User

Aerospace and Defense

Building and Construction

Automotive

Electrical

Industrial

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

American Elements

Carbon-Core Corp

CONSOL Energy Inc

Entegris Inc

ERG Aerospace

Firefly International Energy

Koppers Inc

Ultramet

Xiamen Zopin New Material Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Graphitic

Non-graphitic

By End-User

Aerospace and Defense

Building and Construction

Automotive

Electrical

Industrial

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Carbon Foam Market Size is valued at $37.2 Million in 2024 and is forecast to register a growth rate (CAGR) of 10.8% to reach $84.5 Million by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

American Elements, Carbon-Core Corp, CONSOL Energy Inc, Entegris Inc, ERG Aerospace, Firefly International Energy, Koppers Inc, Ultramet, Xiamen Zopin New Material Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume