The global Car Bumpers Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Type (Front Bumper, Rear Bumper), By Material (Plastic, Metal), By Application (Luxury Car, Executive Car, Economical Car, Sports Utility Vehicle (SUV), Multi Utility Vehicle (MUV)), By Sales Channel (OEM, Aftermarket).

The car bumpers market in 2024 serves as a critical segment of the automotive exterior components industry, providing impact protection and aesthetic enhancements for vehicles. Bumpers play a crucial role in absorbing and dispersing energy during collisions, helping to minimize damage to the vehicle's body and occupants. With the increasing focus on vehicle safety and design aesthetics, the demand for high-quality bumpers continues to grow. Manufacturers in this market focus on developing bumpers that offer durability, impact resistance, and compatibility with advanced driver assistance systems (ADAS). Moreover, as vehicles incorporate lightweight materials and aerodynamic designs, bumpers integrate features such as integrated sensors, pedestrian protection structures, and active grille shutters to enhance safety and fuel efficiency. With a strong emphasis on safety, functionality, and aesthetics, the car bumpers market contributes to the overall protection and visual appeal of vehicles on the road.

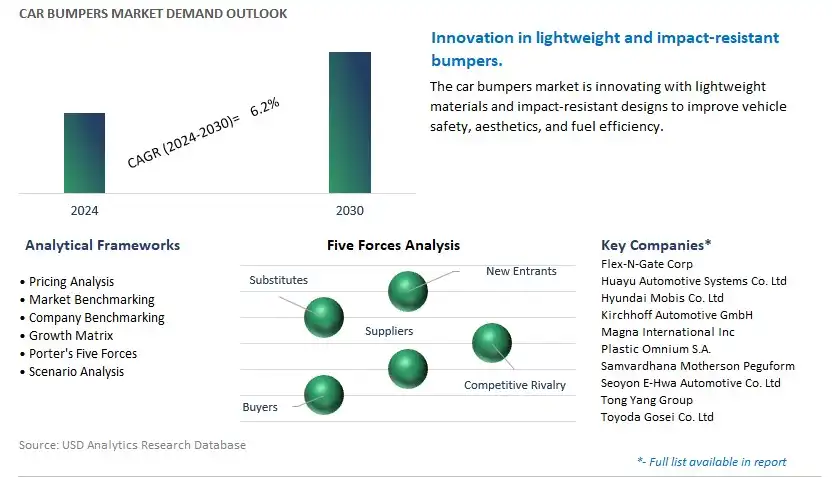

The global Car Bumpers market is highly competitive with a large number of companies focusing on niche market segments. Amidst intense competitive conditions, Car Bumpers Companies are investing in new product launches and strengthening distribution channels. Key companies operating in the Car Bumpers Market Industry include- Flex-N-Gate Corp, Huayu Automotive Systems Co. Ltd, Hyundai Mobis Co. Ltd, Kirchhoff Automotive GmbH, Magna International Inc, Plastic Omnium S.A., Samvardhana Motherson Peguform, Seoyon E-Hwa Automotive Co. Ltd, Tong Yang Group, Toyoda Gosei Co. Ltd.

A prominent trend in the Car Bumpers market is the emphasis on lightweight and high-strength materials. With increasing regulatory pressure to improve fuel efficiency and reduce vehicle emissions, automakers are focusing on lightweighting strategies to enhance vehicle performance and meet stringent efficiency standards. This trend is driving the adoption of advanced materials such as thermoplastics, carbon fiber composites, and reinforced plastics in bumper construction. These materials offer the dual benefits of reduced weight and increased strength, allowing automakers to design bumpers that are both durable and lightweight, thereby contributing to overall vehicle efficiency and safety.

The primary driver propelling the growth of the Car Bumpers market is the increasing vehicle sales and production worldwide. As global economic conditions improve and consumer confidence rises, there's a growing demand for new vehicles across various market segments. Additionally, emerging markets are experiencing rapid urbanization and rising disposable incomes, leading to increased vehicle ownership and demand for automobiles. With each vehicle requiring front and rear bumpers for safety and aesthetic purposes, the growing vehicle sales and production translate into a corresponding increase in demand for car bumpers. This driver underscores the essential role of car bumpers as integral components of vehicle design and safety, driving market growth and opportunities for manufacturers to supply high-quality bumper solutions to automotive OEMs and aftermarket channels.

An Market Opportunity ripe for exploration within the Car Bumpers market is the integration of advanced safety and sensor technologies. With the advancement of automotive safety features such as collision avoidance systems, pedestrian detection, and adaptive cruise control, there's a growing need for bumpers equipped with sensors and smart technologies to enhance vehicle safety and performance. Manufacturers can seize this Market Opportunity by developing bumpers with integrated sensor housings, mounting points, and wiring harnesses to accommodate advanced driver assistance systems (ADAS) and sensor-based safety features. Additionally, there's potential to integrate energy-absorbing materials and crash sensors into bumpers to improve impact resistance and mitigate collision damage. By embracing innovation in safety and sensor technologies, bumper manufacturers can differentiate their products, provide added value to automotive OEMs, and contribute to the advancement of vehicle safety and autonomy.

By Type

Front Bumper

Rear Bumper

By Material

Plastic

-Polyester

-Polypropylene

Metal

-Steel

-Aluminum

By Application

Luxury Car

Executive Car

Economical Car

Sports Utility Vehicle (SUV)

Multi Utility Vehicle (MUV)

By Sales Channel

OEM

AftermarketGeographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa

Flex-N-Gate Corp

Huayu Automotive Systems Co. Ltd

Hyundai Mobis Co. Ltd

Kirchhoff Automotive GmbH

Magna International Inc

Plastic Omnium S.A.

Samvardhana Motherson Peguform

Seoyon E-Hwa Automotive Co. Ltd

Tong Yang Group

Toyoda Gosei Co. Ltd

*- List not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Car Bumpers Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Car Bumpers Market Size Outlook, $ Million, 2021 to 2030

3.2 Car Bumpers Market Outlook by Type, $ Million, 2021 to 2030

3.3 Car Bumpers Market Outlook by Product, $ Million, 2021 to 2030

3.4 Car Bumpers Market Outlook by Application, $ Million, 2021 to 2030

3.5 Car Bumpers Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Car Bumpers Industry

4.2 Key Market Trends in Car Bumpers Industry

4.3 Potential Opportunities in Car Bumpers Industry

4.4 Key Challenges in Car Bumpers Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Car Bumpers Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Car Bumpers Market Outlook by Segments

7.1 Car Bumpers Market Outlook by Segments, $ Million, 2021- 2030

By Type

Front Bumper

Rear Bumper

By Material

Plastic

-Polyester

-Polypropylene

Metal

-Steel

-Aluminum

By Application

Luxury Car

Executive Car

Economical Car

Sports Utility Vehicle (SUV)

Multi Utility Vehicle (MUV)

By Sales Channel

OEM

Aftermarket

8 North America Car Bumpers Market Analysis and Outlook To 2030

8.1 Introduction to North America Car Bumpers Markets in 2024

8.2 North America Car Bumpers Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Car Bumpers Market size Outlook by Segments, 2021-2030

By Type

Front Bumper

Rear Bumper

By Material

Plastic

-Polyester

-Polypropylene

Metal

-Steel

-Aluminum

By Application

Luxury Car

Executive Car

Economical Car

Sports Utility Vehicle (SUV)

Multi Utility Vehicle (MUV)

By Sales Channel

OEM

Aftermarket

9 Europe Car Bumpers Market Analysis and Outlook To 2030

9.1 Introduction to Europe Car Bumpers Markets in 2024

9.2 Europe Car Bumpers Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Car Bumpers Market Size Outlook by Segments, 2021-2030

By Type

Front Bumper

Rear Bumper

By Material

Plastic

-Polyester

-Polypropylene

Metal

-Steel

-Aluminum

By Application

Luxury Car

Executive Car

Economical Car

Sports Utility Vehicle (SUV)

Multi Utility Vehicle (MUV)

By Sales Channel

OEM

Aftermarket

10 Asia Pacific Car Bumpers Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Car Bumpers Markets in 2024

10.2 Asia Pacific Car Bumpers Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Car Bumpers Market size Outlook by Segments, 2021-2030

By Type

Front Bumper

Rear Bumper

By Material

Plastic

-Polyester

-Polypropylene

Metal

-Steel

-Aluminum

By Application

Luxury Car

Executive Car

Economical Car

Sports Utility Vehicle (SUV)

Multi Utility Vehicle (MUV)

By Sales Channel

OEM

Aftermarket

11 South America Car Bumpers Market Analysis and Outlook To 2030

11.1 Introduction to South America Car Bumpers Markets in 2024

11.2 South America Car Bumpers Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Car Bumpers Market size Outlook by Segments, 2021-2030

By Type

Front Bumper

Rear Bumper

By Material

Plastic

-Polyester

-Polypropylene

Metal

-Steel

-Aluminum

By Application

Luxury Car

Executive Car

Economical Car

Sports Utility Vehicle (SUV)

Multi Utility Vehicle (MUV)

By Sales Channel

OEM

Aftermarket

12 Middle East and Africa Car Bumpers Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Car Bumpers Markets in 2024

12.2 Middle East and Africa Car Bumpers Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Car Bumpers Market size Outlook by Segments, 2021-2030

By Type

Front Bumper

Rear Bumper

By Material

Plastic

-Polyester

-Polypropylene

Metal

-Steel

-Aluminum

By Application

Luxury Car

Executive Car

Economical Car

Sports Utility Vehicle (SUV)

Multi Utility Vehicle (MUV)

By Sales Channel

OEM

Aftermarket

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

Flex-N-Gate Corp

Huayu Automotive Systems Co. Ltd

Hyundai Mobis Co. Ltd

Kirchhoff Automotive GmbH

Magna International Inc

Plastic Omnium S.A.

Samvardhana Motherson Peguform

Seoyon E-Hwa Automotive Co. Ltd

Tong Yang Group

Toyoda Gosei Co. Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Front Bumper

Rear Bumper

By Material

Plastic

-Polyester

-Polypropylene

Metal

-Steel

-Aluminum

By Application

Luxury Car

Executive Car

Economical Car

Sports Utility Vehicle (SUV)

Multi Utility Vehicle (MUV)

By Sales Channel

OEM

Aftermarket

The global Car Bumpers Market is one of the lucrative growth markets, poised to register a 6.2% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Flex-N-Gate Corp, Huayu Automotive Systems Co. Ltd, Hyundai Mobis Co. Ltd, Kirchhoff Automotive GmbH, Magna International Inc, Plastic Omnium S.A., Samvardhana Motherson Peguform, Seoyon E-Hwa Automotive Co. Ltd, Tong Yang Group, Toyoda Gosei Co. Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume