The global Calcium Silicate Insulation Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Temperature (High Temperature, Mid Temperature), By End-User (Metals, Industrial, Power Generation, Petrochemical, Transport, Others).

Calcium silicate insulation is a type of thermal insulation material composed of calcium silicate hydrate, a compound formed from calcium oxide, silica, and water. This insulation material offers high thermal resistance, fire resistance, moisture resistance, and durability, making it suitable for a wide range of high-temperature and fire-resistant applications. The market for calcium silicate insulation is driven by the demand for energy-efficient, fire-safe, and sustainable insulation solutions in industries such as petrochemicals, power generation, metallurgy, cement manufacturing, and building construction. Calcium silicate insulation is used to insulate pipes, vessels, boilers, furnaces, and building structures to reduce heat transfer, prevent condensation, and protect against fire hazards. Further, advancements in calcium silicate insulation formulations, manufacturing processes, and installation techniques are driving innovation and market growth. As industries seek to improve safety, reduce energy consumption, and comply with regulatory requirements, calcium silicate insulation s to be a preferred choice for thermal insulation applications requiring high-performance and reliability.

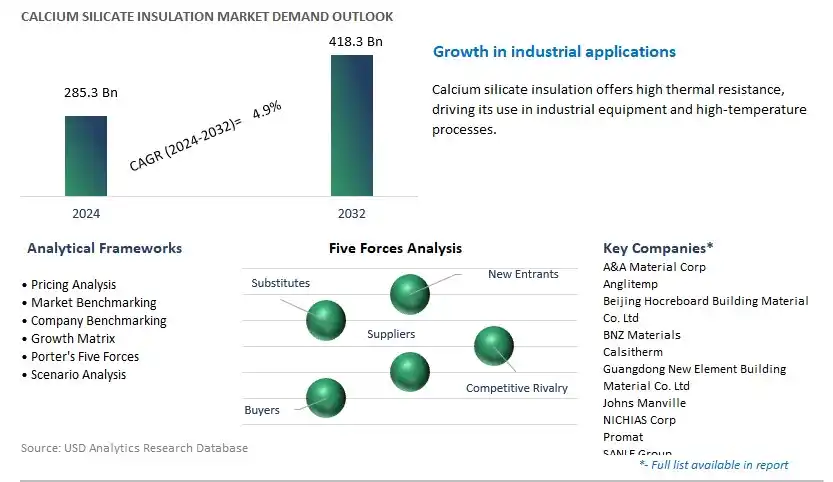

The market report analyses the leading companies in the industry including A&A Material Corp, Anglitemp, Beijing Hocreboard Building Material Co. Ltd, BNZ Materials, Calsitherm, Guangdong New Element Building Material Co. Ltd, Johns Manville, NICHIAS Corp, Promat, SANLE Group, Skamol, Taisyou International Business Co. Ltd, and others.

A prominent market trend for Calcium Silicate Insulation is the growing emphasis on fire safety and thermal performance in building construction and industrial applications, driven by stringent regulations, safety standards, and energy efficiency goals. As concerns about fire protection and energy conservation continue to rise, there is an increasing demand for insulation materials that offer superior fire resistance, thermal conductivity, and durability. This trend reflects a broader industry shift towards sustainable building practices, resilient infrastructure, and enhanced occupant safety, influencing the adoption of calcium silicate insulation in various construction projects, including residential, commercial, and industrial buildings, as well as in high-temperature industrial processes.

A key market driver for Calcium Silicate Insulation is the expansion of construction and industrial activities driven by urbanization, infrastructure development, and industrialization in emerging economies and urban centers worldwide. As populations grow, urban areas expand, and industrial sectors diversify, there is a continuous need for insulation materials that provide reliable thermal insulation, moisture resistance, and mechanical strength in a wide range of applications, including HVAC systems, piping, equipment, and structural components. Additionally, advancements in construction techniques, energy-efficient building designs, and industrial processes create opportunities for the adoption of calcium silicate insulation solutions that meet the evolving needs and challenges of modern construction and industrial projects.

An attractive opportunity in the Calcium Silicate Insulation market lies in innovation in advanced insulation solutions tailored to specific application requirements, performance criteria, and environmental conditions. Opportunities exist to develop calcium silicate insulation products with enhanced properties such as higher thermal resistance, lower density, improved moisture resistance, and ease of installation. Collaboration with architects, engineers, contractors, and insulation specialists can facilitate the development of customized solutions that address the unique needs and challenges of different sectors and projects. By leveraging their expertise, technology, and market insights, insulation manufacturers can unlock new opportunities for market growth and differentiation in the dynamic and competitive insulation materials industry.

The "High Temperature" segment is the largest within the Calcium Silicate Insulation market. High temperature calcium silicate insulation products are widely used in industrial applications where thermal stability and fire resistance are paramount. These insulations are designed to withstand extreme temperatures typically encountered in industrial processes such as petrochemical refining, power generation, metallurgy, and cement manufacturing. High temperature calcium silicate insulation offers excellent thermal insulation properties, low thermal conductivity, and resistance to thermal shock, making it ideal for insulating equipment, piping, furnaces, boilers, and other high-temperature environments. Moreover, the increasing emphasis on energy efficiency, safety, and regulatory compliance in industrial facilities drives the demand for high-quality insulation materials capable of withstanding harsh operating conditions. With its superior performance attributes and widespread application in critical industrial processes, the "High Temperature" segment stands as the largest within the Calcium Silicate Insulation market, reflecting its essential role in ensuring operational reliability and safety in high-temperature applications.

The "Petrochemical" segment is the fastest-growing within the Calcium Silicate Insulation market. Petrochemical facilities, including refineries, chemical plants, and gas processing plants, require robust insulation solutions to maintain process efficiency, safety, and regulatory compliance. Calcium silicate insulation products are particularly well-suited for petrochemical applications due to their excellent thermal insulation properties, fire resistance, and chemical inertness. These insulations effectively mitigate heat transfer, reduce energy consumption, and protect equipment and piping from corrosion, thermal shock, and fire hazards. With the global demand for petrochemical products continuing to rise and the expansion of petrochemical infrastructure worldwide, the need for high-performance insulation materials in petrochemical facilities is escalating. Additionally, stringent safety and environmental regulations in the petrochemical industry drive the adoption of reliable insulation solutions capable of withstanding aggressive operating conditions. As a result, the "Petrochemical" segment experiences significant growth within the Calcium Silicate Insulation market, reflecting its critical role in supporting the safety, efficiency, and sustainability of petrochemical operations.

By Temperature

High Temperature

Mid Temperature

By End-User

Metals

Industrial

Power Generation

Petrochemical

Transport

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

A&A Material Corp

Anglitemp

Beijing Hocreboard Building Material Co. Ltd

BNZ Materials

Calsitherm

Guangdong New Element Building Material Co. Ltd

Johns Manville

NICHIAS Corp

Promat

SANLE Group

Skamol

Taisyou International Business Co. Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Calcium Silicate Insulation Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Calcium Silicate Insulation Market Size Outlook, $ Million, 2021 to 2032

3.2 Calcium Silicate Insulation Market Outlook by Type, $ Million, 2021 to 2032

3.3 Calcium Silicate Insulation Market Outlook by Product, $ Million, 2021 to 2032

3.4 Calcium Silicate Insulation Market Outlook by Application, $ Million, 2021 to 2032

3.5 Calcium Silicate Insulation Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Calcium Silicate Insulation Industry

4.2 Key Market Trends in Calcium Silicate Insulation Industry

4.3 Potential Opportunities in Calcium Silicate Insulation Industry

4.4 Key Challenges in Calcium Silicate Insulation Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Calcium Silicate Insulation Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Calcium Silicate Insulation Market Outlook by Segments

7.1 Calcium Silicate Insulation Market Outlook by Segments, $ Million, 2021- 2032

By Temperature

High Temperature

Mid Temperature

By End-User

Metals

Industrial

Power Generation

Petrochemical

Transport

Others

8 North America Calcium Silicate Insulation Market Analysis and Outlook To 2032

8.1 Introduction to North America Calcium Silicate Insulation Markets in 2024

8.2 North America Calcium Silicate Insulation Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Calcium Silicate Insulation Market size Outlook by Segments, 2021-2032

By Temperature

High Temperature

Mid Temperature

By End-User

Metals

Industrial

Power Generation

Petrochemical

Transport

Others

9 Europe Calcium Silicate Insulation Market Analysis and Outlook To 2032

9.1 Introduction to Europe Calcium Silicate Insulation Markets in 2024

9.2 Europe Calcium Silicate Insulation Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Calcium Silicate Insulation Market Size Outlook by Segments, 2021-2032

By Temperature

High Temperature

Mid Temperature

By End-User

Metals

Industrial

Power Generation

Petrochemical

Transport

Others

10 Asia Pacific Calcium Silicate Insulation Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Calcium Silicate Insulation Markets in 2024

10.2 Asia Pacific Calcium Silicate Insulation Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Calcium Silicate Insulation Market size Outlook by Segments, 2021-2032

By Temperature

High Temperature

Mid Temperature

By End-User

Metals

Industrial

Power Generation

Petrochemical

Transport

Others

11 South America Calcium Silicate Insulation Market Analysis and Outlook To 2032

11.1 Introduction to South America Calcium Silicate Insulation Markets in 2024

11.2 South America Calcium Silicate Insulation Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Calcium Silicate Insulation Market size Outlook by Segments, 2021-2032

By Temperature

High Temperature

Mid Temperature

By End-User

Metals

Industrial

Power Generation

Petrochemical

Transport

Others

12 Middle East and Africa Calcium Silicate Insulation Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Calcium Silicate Insulation Markets in 2024

12.2 Middle East and Africa Calcium Silicate Insulation Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Calcium Silicate Insulation Market size Outlook by Segments, 2021-2032

By Temperature

High Temperature

Mid Temperature

By End-User

Metals

Industrial

Power Generation

Petrochemical

Transport

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

A&A Material Corp

Anglitemp

Beijing Hocreboard Building Material Co. Ltd

BNZ Materials

Calsitherm

Guangdong New Element Building Material Co. Ltd

Johns Manville

NICHIAS Corp

Promat

SANLE Group

Skamol

Taisyou International Business Co. Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Temperature

High Temperature

Mid Temperature

By End-User

Metals

Industrial

Power Generation

Petrochemical

Transport

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Calcium Silicate Insulation Market Size is valued at $285.3 Million in 2024 and is forecast to register a growth rate (CAGR) of 4.9% to reach $418.3 Million by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

A&A Material Corp, Anglitemp, Beijing Hocreboard Building Material Co. Ltd, BNZ Materials, Calsitherm, Guangdong New Element Building Material Co. Ltd, Johns Manville, NICHIAS Corp, Promat, SANLE Group, Skamol, Taisyou International Business Co. Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume