The CAD CAM Dental Milling Machine Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Axis Type (4-axis machines, 5-axis machines), By Size (Benchtop, Tabletop, Standalone).

CAD/CAM (Computer-Aided Design/Computer-Aided Manufacturing) technology continues to play a major role in the dental milling industry by enabling the creation of highly accurate dental prosthetics, restorations, and orthodontic appliances. Amidst robust growth opportunities, the industry is witnessing rapid growth in new product launches, increasing R&D investments, and market consolidation trends.

Leading manufacturing companies are focusing multiple machine operations, remote operations, customer focus, auto calibration, high precision and tolerances in product development. A significant portion of existing and new entrants continue to invest in technological advancements including development of remote platforms, small footprint, products equipped with diverse user-friendly features, and others.

Globally, an estimated 2 billion people suffer from caries of permanent teeth and 514 million children suffer from caries of primary teeth according to the WHO. Further, efforts to improve access to dental care, patient awareness, and ease of accessibility drive the demand for CAD/CAM based milling machines and accessories.

The American Dental Association (ADA) reports that over 60% of dental practices in the United States have adopted CAD/CAM systems. This high adoption rate reflects the growing recognition of the benefits of digital technology in improving the accuracy and efficiency of dental procedures. Similarly, the European Commission has noted that Europe represents one of the largest markets for CAD/CAM dental systems due to the region's strong emphasis on advanced healthcare and dental technologies. The European dental market is driven by a high rate of technology adoption and the presence of numerous key players.

Key companies are continually innovating to enhance the capabilities of their machines, integrating advanced features such as automated material handling, improved software interfaces, and enhanced milling accuracy. The market is also seeing increased adoption of digital workflows, where the integration of CAD/CAM systems with 3D imaging technologies and digital scanners streamlines the process from diagnosis to restoration.

Amidst intense competitive conditions, pricing plays a major role in business penetration. Potential cost advantages of CAD/CAM tools enable quick adoption across healthcare settings. In addition, CAD/CAM systems can reduce the time to create a crown from several weeks to a single visit, enhancing patient satisfaction and operational efficiency.

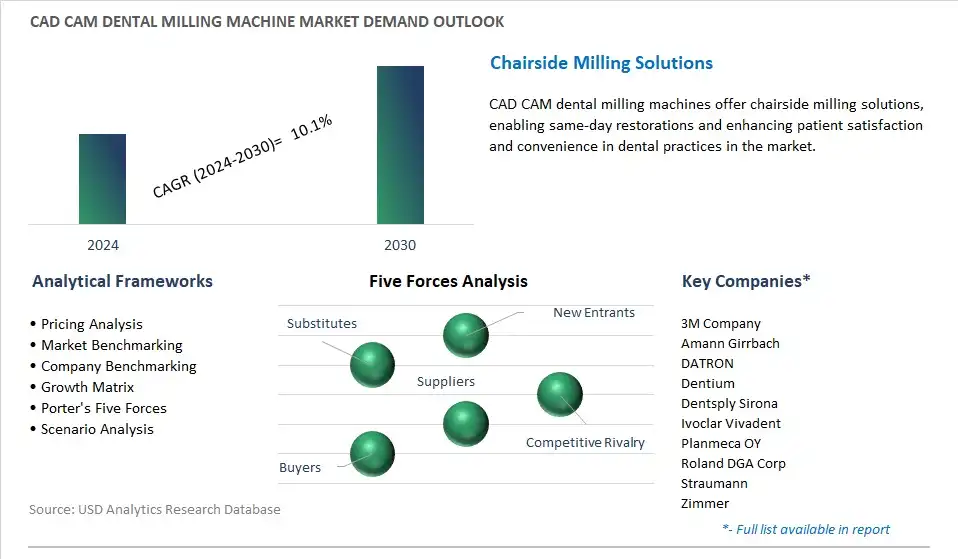

Over the forecast period, the CAD/CAM dental milling machine market is poised for continued expansion, fueled by ongoing technological advancements, rising demand for high-quality dental restorations, and the increasing preference for digital solutions in dental practices. We anticipate the market to register a 10.1% CAGR over the forecast period to 2032.

Computer-aided design/computer-aided manufacturing (CAD/CAM) dental milling machines are advanced dental equipment used for fabricating dental restorations such as crowns, bridges, and veneers with high precision and efficiency. The CAD/CAM dental milling machine market in 2024 caters to the needs of dental laboratories and clinics seeking automation and digital workflows to streamline restorative dentistry processes and deliver custom-made dental prosthetics to patients. Market growth is driven by factors such as the increasing prevalence of dental diseases, the shift towards digital dentistry, and advancements in CAD/CAM technology enabling same-day restorations. Collaboration between dental technology companies, prosthodontists, and dental technicians fosters innovation in CAD/CAM dental milling machines, supporting improved patient outcomes and satisfaction in restorative dental care.

A notable trend in the CAD CAM Dental Milling Machine market is the rising adoption of digital dentistry practices. Dentists and dental laboratories are increasingly embracing CAD/CAM technology to streamline workflows, improve precision, and enhance patient outcomes. This trend is driven by the benefits of digitalization, including faster turnaround times, greater customization options, and improved efficiency in fabricating dental restorations.

A key driver for the CAD CAM Dental Milling Machine market is the growing demand for restorative dentistry procedures worldwide. As the aging population expands and dental health awareness increases, there is a rising need for dental restorations such as crowns, bridges, and dental implants. CAD/CAM milling machines enable dental professionals to produce high-quality restorations with superior accuracy and aesthetics, meeting the escalating demand for dental prosthetics.

One potential opportunity in the CAD CAM Dental Milling Machine market lies in the integration of artificial intelligence (AI) and automation technologies into milling systems. By incorporating AI algorithms and automation features, manufacturers can enhance machine efficiency, optimize material usage, and reduce production errors. This advancement can lead to increased productivity, reduced labor costs, and improved consistency in dental restoration manufacturing, presenting an opportunity for market expansion and innovation.

By Axis

By Size

By Technology

Geographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

In 2023, Dentsply Sirona launched the Primescan Connect intraoral scanner and the CEREC Primemill milling machine, which are designed to integrate seamlessly, providing high precision and faster processing times.

Roland DG introduced the DWX-52DCi dental milling machine with an advanced auto-disk changer. This model features improved milling precision and a more intuitive user interface, making it easier for dental laboratories to manage high volumes of production.

VITA Zahnfabrik recently released the VITA VIONIC CAD/CAM system, which includes a new generation of milling machines designed to work with a broader range of dental materials and enhance the accuracy of prosthetic production.

Straumann completed its acquisition of Neodent, a major implant company, in 2023

In 2024, Align Technology acquired Dental Monitoring, a company specializing in AI-powered remote monitoring solutions. This acquisition is expected to bolster Align's CAD/CAM technology offerings by integrating advanced AI and digital monitoring into their systems.

Medit Corp introduced integrations with various CAD/CAM systems in 2024. These integrations are designed to streamline the workflow between digital scanning and milling processes, improving the overall efficiency of dental practices and laboratories.

Amann Girrbach expanded its manufacturing facilities in 2023 to meet the increasing demand for its CAD/CAM solutions. 3Shape also opened a new innovation center in Europe in 2023, focusing on the development of next-generation CAD/CAM technologies and digital workflow solutions. This expansion is part of 3Shape’s strategy to strengthen its R&D capabilities and accelerate product innovation.

TABLE OF CONTENTS

1 Introduction to 2024 CAD CAM Dental Milling Machine Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global CAD CAM Dental Milling Machine Market Size Outlook, $ Million, 2021 to 2030

3.2 CAD CAM Dental Milling Machine Market Outlook By Type, $ Million, 2021 to 2030

3.3 CAD CAM Dental Milling Machine Market Outlook By Product, $ Million, 2021 to 2030

3.4 CAD CAM Dental Milling Machine Market Outlook By Application, $ Million, 2021 to 2030

3.5 CAD CAM Dental Milling Machine Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of CAD CAM Dental Milling Machine Market Industry

4.2 Key Market Trends in CAD CAM Dental Milling Machine Market Industry

4.3 Potential Opportunities in CAD CAM Dental Milling Machine Market Industry

4.4 Key Challenges in CAD CAM Dental Milling Machine Market Industry

5 Market Factor Analysis

5.1 Competitive Landscape

5.1.1 Global CAD CAM Dental Milling Machine Market Share by Company (%), 2023

5.1.2 Product Offerings by Company

5.2 Porter’s Five Forces Analysis

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global CAD CAM Dental Milling Machine Market Outlook By Segments

7.1 CAD CAM Dental Milling Machine Market Outlook by Segments

By Axis Type

4-axis machines

5-axis machines

By Size

Benchtop

Tabletop

Standalone

8 North America CAD CAM Dental Milling Machine Market Analysis And Outlook To 2030

8.1 Introduction to North America CAD CAM Dental Milling Machine Markets in 2024

8.2 North America CAD CAM Dental Milling Machine Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America CAD CAM Dental Milling Machine Market size Outlook by Segments, 2021-2030

By Axis Type

4-axis machines

5-axis machines

By Size

Benchtop

Tabletop

Standalone

9 Europe CAD CAM Dental Milling Machine Market Analysis And Outlook To 2030

9.1 Introduction to Europe CAD CAM Dental Milling Machine Markets in 2024

9.2 Europe CAD CAM Dental Milling Machine Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe CAD CAM Dental Milling Machine Market Size Outlook By Segments, 2021-2030

By Axis Type

4-axis machines

5-axis machines

By Size

Benchtop

Tabletop

Standalone

10 Asia Pacific CAD CAM Dental Milling Machine Market Analysis And Outlook To 2030

10.1 Introduction to Asia Pacific CAD CAM Dental Milling Machine Markets in 2024

10.2 Asia Pacific CAD CAM Dental Milling Machine Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific CAD CAM Dental Milling Machine Market size Outlook by Segments, 2021-2030

By Axis Type

4-axis machines

5-axis machines

By Size

Benchtop

Tabletop

Standalone

11 South America CAD CAM Dental Milling Machine Market Analysis And Outlook To 2030

11.1 Introduction to South America CAD CAM Dental Milling Machine Markets in 2024

11.2 South America CAD CAM Dental Milling Machine Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America CAD CAM Dental Milling Machine Market size Outlook by Segments, 2021-2030

By Axis Type

4-axis machines

5-axis machines

By Size

Benchtop

Tabletop

Standalone

12 Middle East And Africa CAD CAM Dental Milling Machine Market Analysis And Outlook To 2030

12.1 Introduction to Middle East and Africa CAD CAM Dental Milling Machine Markets in 2024

12.2 Middle East and Africa CAD CAM Dental Milling Machine Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa CAD CAM Dental Milling Machine Market size Outlook by Segments, 2021-2030

By Axis Type

4-axis machines

5-axis machines

By Size

Benchtop

Tabletop

Standalone

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

3M Company

Amann Girrbach

DATRON

Dentium

Dentsply Sirona

Ivoclar Vivadent

Planmeca OY

Roland DGA Corp

Straumann

Zimmer

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Axis

By Size

By Technology

Geographical Analysis

The global CAD CAM Dental Milling Machine Market is one of the lucrative growth markets, poised to register a 10.1% growth (CAGR) between 2024 and 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

3M Company, Amann Girrbach, DATRON, Dentium, Dentsply Sirona, Ivoclar Vivadent, Planmeca OY, Roland DGA Corp, Straumann, Zimmer

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume