The global C5 Resin Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Application (Paints and Coatings, Adhesives and Sealants, Printing Inks, Rubber Compounding, Others), By Type (Flake C5 Resin, Powder C5 Resin).

The C5 resin market is witnessing growth driven by its diverse applications in industries such as adhesives, coatings, printing inks, and rubber compounding. Key trends shaping the future of the industry include innovations in C5 resin production methods, polymerization processes, and modification techniques to improve resin compatibility, tackiness, and adhesion properties. Advanced C5 resins offer excellent compatibility with other polymers, solvents, and additives, making them versatile binders and tackifiers for various applications. Moreover, the integration of hydrogenation, functionalization, and reactive extrusion enhances resin performance, stability, and processability, enabling manufacturers to tailor C5 resins to specific formulation requirements and end-use applications. Additionally, the growing demand for pressure-sensitive adhesives, hot melt adhesives, and road marking paints drives market expansion, as C5 resins provide critical functionality and performance enhancements in these applications. As industries seek sustainable and cost-effective solutions for adhesive bonding, coating applications, and specialty formulations, the C5 resin market is poised for continued growth and innovation as a key component of modern materials and manufacturing processes.

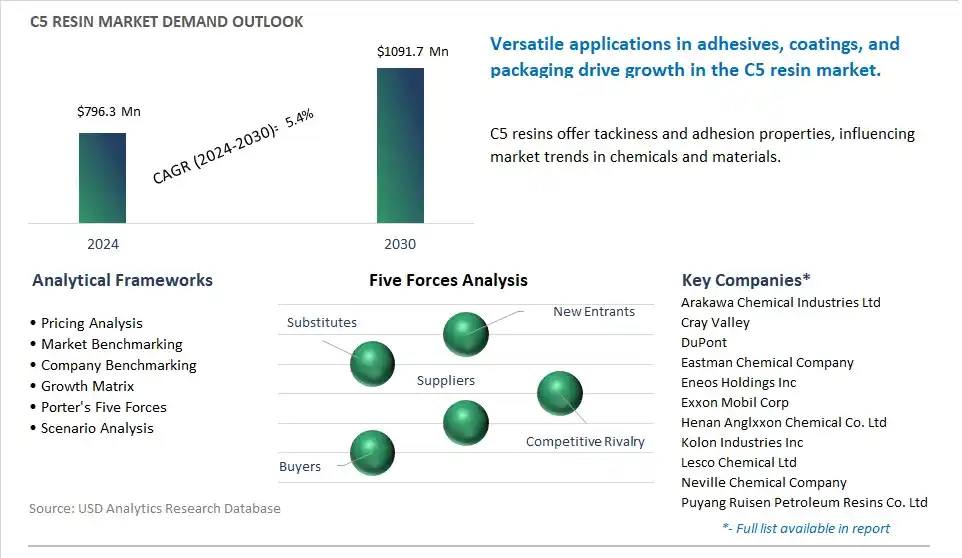

The market report analyses the leading companies in the industry including Arakawa Chemical Industries Ltd, Cray Valley, DuPont, Eastman Chemical Company, Eneos Holdings Inc, Exxon Mobil Corp, Henan Anglxxon Chemical Co. Ltd, Kolon Industries Inc, Lesco Chemical Ltd, Neville Chemical Company, Puyang Ruisen Petroleum Resins Co. Ltd, Seacon Corp, Shanghai Jinsen Hydrocarbon Resins Co. Ltd, Zeon Corp, Zibo Luhua Hongjin New Material Co. Ltd.

The most prominent trend in the C5 resin market is the increasing demand for adhesive applications, driven by growth in construction, automotive, and packaging industries. As manufacturers seek high-performance adhesives with superior bonding strength, flexibility, and durability, there's a rising preference for C5 resins due to their excellent tackifying properties and compatibility with various base polymers. This trend is fueled by the need for advanced adhesive solutions that can withstand harsh operating conditions, such as extreme temperatures and moisture exposure, while offering cost-effective and environmentally friendly alternatives to traditional solvent-based adhesives. Additionally, the shift towards lightweight materials and multi-material assemblies in manufacturing processes further drives the demand for C5 resins as key components in adhesives for bonding diverse substrates.

A key driver in the C5 resin market is the growth in end-use industries such as adhesives, coatings, and rubber compounding, fueled by urbanization, infrastructure development, and technological advancements driving demand for high-performance materials. In the adhesive industry, C5 resins are widely used as tackifiers to improve adhesion, cohesion, and tackiness of adhesive formulations, driving market growth as manufacturers develop innovative adhesive products for diverse applications, including construction, woodworking, automotive, and packaging. Additionally, in the coatings industry, C5 resins are utilized as binders and film-forming agents in paints, varnishes, and sealants, contributing to market expansion as demand for decorative and protective coatings increases in residential, commercial, and industrial sectors. Similarly, in rubber compounding, C5 resins enhance the processability, adhesion, and performance of rubber compounds used in tire manufacturing, automotive components, and industrial applications, driving market demand for C5 resins as essential additives in rubber formulations.

The C5 resin market presents a significant opportunity for expansion into specialty applications beyond traditional adhesive, coating, and rubber industries, driven by the versatility and compatibility of C5 resins with a wide range of polymers and additives. Manufacturers can capitalize on this opportunity by developing specialized C5 resin formulations tailored to the unique requirements of emerging applications such as hot melt adhesives, pressure-sensitive adhesives, ink formulations, and personal care products. For instance, in the packaging industry, C5 resins can be utilized as key components in hot melt adhesives for case and carton sealing applications, offering fast-setting, high-tack adhesion properties suitable for high-speed packaging lines. Similarly, in the personal care industry, C5 resins can be incorporated into cosmetic and personal care formulations such as hair styling products, lipsticks, and skincare creams to enhance texture, stability, and performance. By diversifying into specialty applications, C5 resin manufacturers can tap into new markets, create value-added products, and drive growth and innovation in the C5 resin market.

The largest segment in the C5 Resin Market is the Adhesives and Sealants application segment. This dominance can be attributed to diverse factors. The C5 resins offer excellent tackiness, adhesion, and cohesion properties, making them ideal for formulating adhesives and sealants used in various industries such as construction, automotive, packaging, and woodworking. Additionally, C5 resins provide good compatibility with a wide range of polymers, solvents, and additives, allowing formulators to achieve desired performance characteristics and application requirements. In addition, the versatility of C5 resins enables their use in a wide range of adhesive and sealant formulations, including pressure-sensitive adhesives, hot melt adhesives, solvent-based adhesives, and sealants for bonding substrates such as metals, plastics, wood, and rubber. Further, increasing demand for adhesives and sealants in construction, automotive assembly, packaging, and other end-use industries drives the consumption of C5 resins. As industries continue to prioritize performance, durability, and sustainability in adhesive and sealant formulations, the Adhesives and Sealants application segment is expected to maintain its dominance in the C5 Resin Market.

The fastest-growing segment in the C5 Resin Market is the Flake C5 Resin segment. This growth can be attributed to diverse factors. The Flake C5 resins offer diverse advantages over Powder C5 resins in terms of handling, processing, and formulation flexibility. Flake C5 resins are easier to handle and transport due to their larger particle size and lower dust generation compared to powdered forms. Additionally, Flake C5 resins exhibit better compatibility with other resins, solvents, and additives, allowing formulators to achieve desired performance characteristics in adhesive, coating, and ink formulations. In addition, Flake C5 resins offer improved melt flow properties and heat stability during processing, making them suitable for a wide range of applications such as hot melt adhesives, pressure-sensitive adhesives, and thermoplastic coatings. Further, advancements in flake production technology and resin modification techniques have improved the quality, consistency, and performance of Flake C5 resins, further driving their adoption in various industries. As industries continue to demand high-performance and cost-effective resin solutions for adhesive, coating, and ink applications, the Flake C5 Resin segment is expected to experience rapid growth in the C5 Resin Market.

By Application

Paints and Coatings

Adhesives and Sealants

Printing Inks

Rubber Compounding

Others

By Type

Flake C5 Resin

Powder C5 Resin

Regions Included

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Arakawa Chemical Industries Ltd

Cray Valley

DuPont

Eastman Chemical Company

Eneos Holdings Inc

Exxon Mobil Corp

Henan Anglxxon Chemical Co. Ltd

Kolon Industries Inc

Lesco Chemical Ltd

Neville Chemical Company

Puyang Ruisen Petroleum Resins Co. Ltd

Seacon Corp

Shanghai Jinsen Hydrocarbon Resins Co. Ltd

Zeon Corp

Zibo Luhua Hongjin New Material Co. Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 C5 Resin Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global C5 Resin Market Size Outlook, $ Million, 2021 to 2030

3.2 C5 Resin Market Outlook by Type, $ Million, 2021 to 2030

3.3 C5 Resin Market Outlook by Product, $ Million, 2021 to 2030

3.4 C5 Resin Market Outlook by Application, $ Million, 2021 to 2030

3.5 C5 Resin Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of C5 Resin Industry

4.2 Key Market Trends in C5 Resin Industry

4.3 Potential Opportunities in C5 Resin Industry

4.4 Key Challenges in C5 Resin Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global C5 Resin Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global C5 Resin Market Outlook by Segments

7.1 C5 Resin Market Outlook by Segments, $ Million, 2021- 2030

By Application

Paints and Coatings

Adhesives and Sealants

Printing Inks

Rubber Compounding

Others

By Type

Flake C5 Resin

Powder C5 Resin

8 North America C5 Resin Market Analysis and Outlook To 2030

8.1 Introduction to North America C5 Resin Markets in 2024

8.2 North America C5 Resin Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America C5 Resin Market size Outlook by Segments, 2021-2030

By Application

Paints and Coatings

Adhesives and Sealants

Printing Inks

Rubber Compounding

Others

By Type

Flake C5 Resin

Powder C5 Resin

9 Europe C5 Resin Market Analysis and Outlook To 2030

9.1 Introduction to Europe C5 Resin Markets in 2024

9.2 Europe C5 Resin Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe C5 Resin Market Size Outlook by Segments, 2021-2030

By Application

Paints and Coatings

Adhesives and Sealants

Printing Inks

Rubber Compounding

Others

By Type

Flake C5 Resin

Powder C5 Resin

10 Asia Pacific C5 Resin Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific C5 Resin Markets in 2024

10.2 Asia Pacific C5 Resin Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific C5 Resin Market size Outlook by Segments, 2021-2030

By Application

Paints and Coatings

Adhesives and Sealants

Printing Inks

Rubber Compounding

Others

By Type

Flake C5 Resin

Powder C5 Resin

11 South America C5 Resin Market Analysis and Outlook To 2030

11.1 Introduction to South America C5 Resin Markets in 2024

11.2 South America C5 Resin Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America C5 Resin Market size Outlook by Segments, 2021-2030

By Application

Paints and Coatings

Adhesives and Sealants

Printing Inks

Rubber Compounding

Others

By Type

Flake C5 Resin

Powder C5 Resin

12 Middle East and Africa C5 Resin Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa C5 Resin Markets in 2024

12.2 Middle East and Africa C5 Resin Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa C5 Resin Market size Outlook by Segments, 2021-2030

By Application

Paints and Coatings

Adhesives and Sealants

Printing Inks

Rubber Compounding

Others

By Type

Flake C5 Resin

Powder C5 Resin

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Arakawa Chemical Industries Ltd

Cray Valley

DuPont

Eastman Chemical Company

Eneos Holdings Inc

Exxon Mobil Corp

Henan Anglxxon Chemical Co. Ltd

Kolon Industries Inc

Lesco Chemical Ltd

Neville Chemical Company

Puyang Ruisen Petroleum Resins Co. Ltd

Seacon Corp

Shanghai Jinsen Hydrocarbon Resins Co. Ltd

Zeon Corp

Zibo Luhua Hongjin New Material Co. Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Application

Paints and Coatings

Adhesives and Sealants

Printing Inks

Rubber Compounding

Others

By Type

Flake C5 Resin

Powder C5 Resin

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global C5 Resin is forecast to reach $1091.7 Million in 2030 from $796.3 Million in 2024, registering a CAGR of 5.4%

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Arakawa Chemical Industries Ltd, Cray Valley, DuPont, Eastman Chemical Company, Eneos Holdings Inc, Exxon Mobil Corp, Henan Anglxxon Chemical Co. Ltd, Kolon Industries Inc, Lesco Chemical Ltd, Neville Chemical Company, Puyang Ruisen Petroleum Resins Co. Ltd, Seacon Corp, Shanghai Jinsen Hydrocarbon Resins Co. Ltd, Zeon Corp, Zibo Luhua Hongjin New Material Co. Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume