The global Butyraldehyde Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (N-Butanol, 2-Ethylhexanol, Polyvinyl Buthyral, Others), By Application (Paints and Coatings, Pharmaceutical, Agrochemical, Polymer, Others).

Butyraldehyde is an organic compound with a pungent odor and versatile applications in various industries, including chemicals, plastics, pharmaceuticals, and food additives in 2024. Butyraldehyde is primarily used as an intermediate in the production of butanol, a solvent, and plasticizer, through the aldol condensation reaction. Butyraldehyde is also a precursor to other chemicals such as butyric acid, 2-ethylhexanol, and n-butanol, which find applications in the manufacture of polymers, resins, plasticizers, and flavors. In the plastics industry, butyraldehyde is used in the production of polyvinyl butyral (PVB) resin, a key component in safety glass laminates for automotive windshields and architectural glazing. Additionally, butyraldehyde derivatives are employed as flavoring agents in the food and beverage industry, imparting buttery or fruity notes to products such as baked goods, candies, and beverages. With its diverse applications and importance as a chemical intermediate, butyraldehyde plays a critical role in various manufacturing processes and consumer products, contributing to industries ranging from automotive safety to food flavoring.

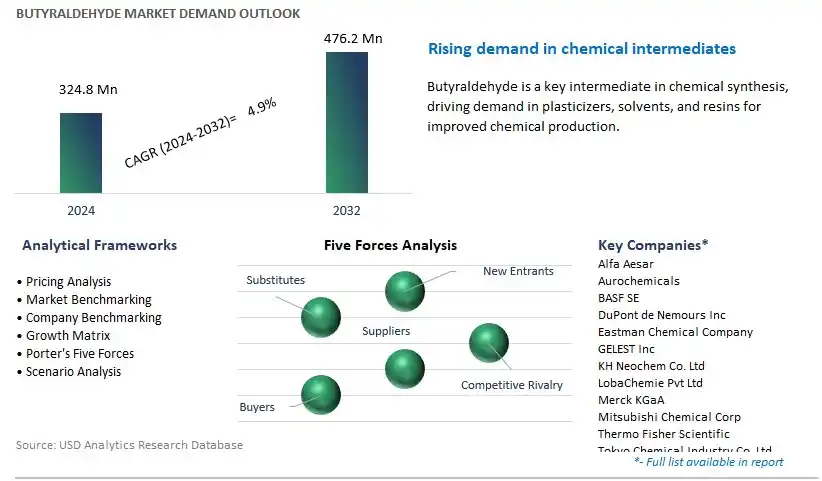

The market report analyses the leading companies in the industry including Alfa Aesar, Aurochemicals, BASF SE, DuPont de Nemours Inc, Eastman Chemical Company, GELEST Inc, KH Neochem Co. Ltd, LobaChemie Pvt Ltd, Merck KGaA, Mitsubishi Chemical Corp, Thermo Fisher Scientific, Tokyo Chemical Industry Co. Ltd, Toronto Research Chemicals, and others.

A prominent trend in the butyraldehyde market is the increasing demand for derivative chemicals derived from butyraldehyde, driven by its versatile applications in various industries such as pharmaceuticals, agrochemicals, flavors, fragrances, and plasticizers. Butyraldehyde serves as a key intermediate in the synthesis of value-added chemicals such as butanol, 2-ethylhexanol, and methyl ethyl ketone (MEK), which are used in the production of coatings, resins, solvents, and other specialty chemicals. This trend is reshaping the market dynamics, with manufacturers focusing on expanding their product portfolios to offer a wide range of butyraldehyde-based derivatives to meet the diverse needs of end-users in different sectors.

The primary driver fueling the growth of the butyraldehyde market is the growth in end-use industries and chemical manufacturing sectors, where butyraldehyde and its derivatives are essential raw materials for various applications. With increasing industrialization, urbanization, and population growth, there is a rising demand for chemicals and materials used in manufacturing processes, driving the consumption of butyraldehyde as a key building block in chemical synthesis. Additionally, advancements in process technologies and production efficiencies further contribute to market growth, enabling manufacturers to meet increasing demand from diverse industries and applications.

An emerging opportunity within the butyraldehyde market lies in the expansion into emerging markets and applications beyond traditional sectors. While butyraldehyde is already widely used in industries such as pharmaceuticals, agrochemicals, and flavors, there is untapped potential in sectors such as renewable energy, bioplastics, and specialty chemicals, where the demand for sustainable and high-performance materials is growing. By investing in research and development initiatives and collaborating with industry partners, manufacturers of butyraldehyde can explore new applications and address evolving customer needs, unlocking opportunities for market expansion, diversification, and revenue growth in emerging markets and industries.

Among the segments outlined in the Butyraldehyde market, the Polyvinyl Butyral (PVB) segment stands out as the largest, owing to its diverse range of applications across various industries. Polyvinyl butyral is widely utilized in the production of safety glass, particularly for automotive and construction purposes, due to its excellent adhesive properties, high transparency, and impact resistance. The automotive sector, in particular, is a significant contributor to the demand for PVB, as laminated safety glass is a standard requirement in modern vehicle manufacturing for windshields and side windows. Moreover, PVB finds applications in architectural glass, where safety and security are paramount. The construction industry's continuous growth, coupled with stringent safety regulations, further propels the demand for PVB in laminated glass production. Additionally, the versatility of PVB extends its usage to sectors like photovoltaics, where it is employed in the encapsulation of solar cells. Given its widespread applications and indispensable role in enhancing safety and performance across multiple industries, the Polyvinyl Butyral segment remains the largest in the Butyraldehyde market.

The Agrochemical segment within the Butyraldehyde market is experiencing rapid growth, primarily propelled by advancements in agriculture and the increasing demand for efficient crop protection solutions. Butyraldehyde serves as a key intermediate in the production of various agrochemicals, including herbicides, insecticides, and fungicides. With the global population steadily rising and arable land becoming scarce, there is a pressing need for innovative agricultural practices to boost crop yields and ensure food security. Agrochemicals formulated with butyraldehyde derivatives play a crucial role in this scenario by providing effective pest and disease control, thereby enhancing crop productivity. Furthermore, the adoption of modern farming techniques, such as precision agriculture and integrated pest management, further drives the demand for agrochemicals, fuelling the growth of the Agrochemical segment in the Butyraldehyde market. As agricultural industries continue to evolve and prioritize sustainability, the demand for innovative agrochemical solutions is expected to surge, sustaining the rapid expansion of this segment.

By Product

N-Butanol

2-Ethylhexanol

Polyvinyl Buthyral

Others

By Application

Paints and Coatings

Pharmaceutical

Agrochemical

Polymer

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Alfa Aesar

Aurochemicals

BASF SE

DuPont de Nemours Inc

Eastman Chemical Company

GELEST Inc

KH Neochem Co. Ltd

LobaChemie Pvt Ltd

Merck KGaA

Mitsubishi Chemical Corp

Thermo Fisher Scientific

Tokyo Chemical Industry Co. Ltd

Toronto Research Chemicals

*- List Not Exhaustive

Global Butyraldehyde Market Size is valued at $324.8 Million in 2024 and is forecast to register a growth rate (CAGR) of 4.9% to reach $476.2 Million by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Alfa Aesar, Aurochemicals, BASF SE, DuPont de Nemours Inc, Eastman Chemical Company, GELEST Inc, KH Neochem Co. Ltd, LobaChemie Pvt Ltd, Merck KGaA, Mitsubishi Chemical Corp, Thermo Fisher Scientific, Tokyo Chemical Industry Co. Ltd, Toronto Research Chemicals

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume