The global Bullet Proof Jackets Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Soft Jacket, Hard Jacket), By End-User (Defense, Security & Law Enforcement, Civilians), By Protection Level (II, IIIA & IIIA+, III & III+, IV).

The market for bulletproof jackets is ensuring personal safety and protection by providing reliable and effective body armor solutions for law enforcement, military personnel, security professionals, and civilians facing high-risk environments. Key trends shaping the future of this industry include advancements in ballistic materials, such as aramid fibers, ultra-high-molecular-weight polyethylene (UHMWPE), and ceramic composites, which offer lightweight, flexible, and multi-threat protection against bullets, shrapnel, and stabbing weapons. Additionally, developments in jacket design and construction, including ergonomic fits, modular systems, and trauma reduction features, optimize wearer comfort, mobility, and survivability in critical situations. Moreover, the adoption of innovative technologies, such as nanomaterials, anti-fragmentation layers, and impact sensors, enhances ballistic performance, durability, and user experience in bulletproof jackets. As security threats continue to evolve and expand globally, the demand for advanced bulletproof jackets that combine high-level protection with wearer comfort and mobility is expected to grow, driving further research, development, and market adoption in this crucial segment of personal protective equipment (PPE) industry.

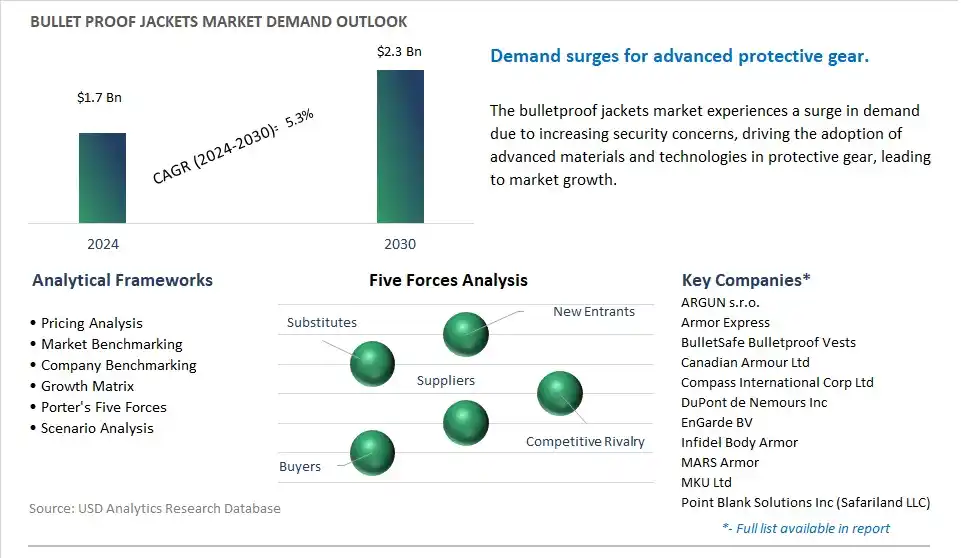

The market report analyses the leading companies in the industry including ARGUN s.r.o., Armor Express, BulletSafe Bulletproof Vests, Canadian Armour Ltd, Compass International Corp Ltd, DuPont de Nemours Inc, EnGarde BV, Infidel Body Armor, MARS Armor, MKU Ltd, Point Blank Solutions Inc (Safariland LLC), Seyntex NV, U.S. Armor Corp, VestGuard UK Ltd.

A prominent trend in the market for bulletproof jackets is the continuous technological advancements in materials used for their construction. Manufacturers are investing in research and development to create lighter, more flexible, and more breathable materials while maintaining high levels of ballistic protection. These advancements allow for the production of bulletproof jackets that are more comfortable to wear for extended periods and provide better mobility for the wearer. Additionally, innovations in materials science are leading to the development of jackets that offer protection against a wider range of threats, including stabbings and blunt force trauma. As technology evolves, the market for bulletproof jackets is expected to see a shift towards more advanced and effective protective solutions, driving market growth and competition among manufacturers.

A key driver behind the demand for bulletproof jackets is the increasing concern about personal safety and security, particularly in high-risk environments such as law enforcement, military operations, and civilian protection. With rising incidences of armed violence, terrorism, and active shooter situations, individuals and organizations are seeking effective means of protection against ballistic threats. Bulletproof jackets provide a crucial layer of defense for frontline personnel and civilians facing dangerous situations, offering peace of mind and confidence in their ability to survive potential threats. As security concerns persist globally and as governments and private entities prioritize safety measures, the demand for bulletproof jackets is expected to remain strong, driving market growth and expansion.

An emerging opportunity in the market for bulletproof jackets lies in the development of lightweight and discreet solutions that offer high levels of protection without sacrificing comfort or style. There is a demand for jackets that can be worn discreetly under everyday clothing or uniforms without attracting attention, particularly in civilian and law enforcement applications where covert protection is essential. Manufacturers aim to capitalize on this opportunity by leveraging advancements in materials and design to create jackets that are thinner, lighter, and more flexible, while still providing effective ballistic resistance. Additionally, there is an opportunity to incorporate features such as moisture-wicking fabrics, adjustable fits, and concealed pockets for improved comfort and functionality. By offering lightweight and discreet bulletproof jackets, suppliers can meet the evolving needs of end-users, differentiate their products in the market, and capture new opportunities in sectors such as personal protection, law enforcement, and private security. Embracing innovation in bulletproof jacket design can drive market growth and competitiveness, contributing to enhanced safety and security for individuals and communities.

The Bullet Proof Jacket market encompasses a multi-stage Market Ecosystem involving the procurement of raw materials, manufacturing processes, and distribution channels to deliver protective gear to end-users. The raw material acquisition comprises ballistic fabrics including Kevlar® by DuPont, ballistic plates, and additional components sourced from various textile and hardware companies. These materials undergo processing, which includes pre-treatment or lamination, handled either in-house by ballistic fabric manufacturers or through dedicated processors. The assembly of raw materials into finished bulletproof jackets is conducted by specialized body armor manufacturers including Point Blank Body Armor, Safariland, and Armor Express, along with defense contractors including BAE Systems and Lockheed Martin, which possess in-house production capabilities.

Following manufacturing, jackets undergo rigorous testing and certification by independent laboratories accredited by organizations including the National Institute of Justice (NIJ) to ensure compliance with protection standards. Distribution to end-users is facilitated through specialized distributors, government procurement agencies, direct sales from manufacturers, and online retailers, catering to military, law enforcement, and civilian markets. Maintenance and aftermarket services are provided by repair specialists for ballistic vests, either offered by manufacturers or independent service providers, ensuring the longevity and effectiveness of bulletproof jackets over time.

In the Bullet Proof Jackets Market, the largest segment is the Soft Jacket segment. Soft bulletproof jackets, also known as soft body armor, are favored for their flexibility, comfort, and lightweight design compared to hard jackets. Soft jackets are made from flexible materials such as Kevlar, Dyneema, or other high-strength synthetic fibers woven together to form a strong, yet pliable, fabric. This flexibility allows wearers to move freely while providing reliable protection against ballistic threats. Soft jackets are commonly worn by law enforcement officers, military personnel, security guards, and civilians in high-risk environments where firearm threats are prevalent. Additionally, soft jackets offer better coverage and are less conspicuous than hard jackets, making them suitable for covert operations and everyday wear. The growing demand for personal protective equipment (PPE) and the increasing incidence of violent crimes and terrorist attacks worldwide contribute to the sustained demand for soft bulletproof jackets. In addition, advancements in materials science and manufacturing processes continue to improve the performance and comfort of soft jackets, further solidifying their position as the largest segment in the Bullet Proof Jackets Market.

In the Bullet Proof Jackets Market, the fastest-growing segment is the Civilians segment. This growth can be attributed to diverse factors driving the increased adoption of bulletproof jackets among civilians. With rising concerns about personal safety and security, especially in regions with high crime rates or ongoing conflicts, civilians are increasingly seeking protective gear to safeguard themselves and their loved ones from potential ballistic threats. Additionally, the growing popularity of recreational shooting sports and outdoor activities has led to a heightened awareness of the need for personal protection against firearm-related accidents or incidents. Further, advancements in bulletproof technology have made protective gear more accessible and affordable for civilian consumers, encouraging greater uptake among individuals who prioritize personal safety. In addition, the evolving nature of modern warfare and the increasing prevalence of asymmetric threats mean that civilians are also at risk of encountering armed violence in various everyday scenarios, further driving the demand for bulletproof jackets. Overall, the Civilians segment is experiencing rapid growth in the Bullet Proof Jackets Market due to heightened security concerns, increased accessibility to protective gear, and a growing recognition of the importance of personal safety in today's uncertain world.

In the Bullet Proof Jackets Market, the fastest-growing segment is the IIIA and IIIA+ protection levels. This growth is driven by diverse factors contributing to the increasing demand for lightweight and flexible body armor offering enhanced protection against a wide range of ballistic threats. IIIA-rated bulletproof jackets are designed to withstand handgun ammunition up to .44 Magnum, providing reliable protection for law enforcement officers, security personnel, and civilians in urban environments where handgun violence is prevalent. The IIIA+ rating indicates an additional level of protection, often incorporating advanced materials and design features to offer increased coverage and resistance against more powerful handgun rounds. The rising incidence of firearm-related incidents and the evolving tactics of armed assailants necessitate the adoption of higher-level protection among law enforcement and security professionals. In addition, civilians seeking personal protection also prioritize body armor with IIIA and IIIA+ ratings for everyday wear, particularly in regions with high crime rates or in occupations where the risk of encountering armed threats is elevated. Additionally, advancements in materials science and manufacturing techniques have led to the development of lighter, more comfortable, and more breathable IIIA-rated bulletproof jackets, further driving their popularity among end-users. Overall, the IIIA and IIIA+ protection level segment experiences rapid growth in the bulletproof jacket market due to the increasing demand for versatile and effective body armor solutions offering enhanced protection against handgun threats.

By Type

Soft Jacket

Hard Jacket

By End-User

Defense

Security & Law Enforcement

Civilians

By Protection Level

II

IIIA & IIIA+

III & III+

IV

ARGUN s.r.o.

Armor Express

BulletSafe Bulletproof Vests

Canadian Armour Ltd

Compass International Corp Ltd

DuPont de Nemours Inc

EnGarde BV

Infidel Body Armor

MARS Armor

MKU Ltd

Point Blank Solutions Inc (Safariland LLC)

Seyntex NV

U.S. Armor Corp

VestGuard UK Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Bullet Proof Jackets Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Bullet Proof Jackets Market Size Outlook, $ Million, 2021 to 2030

3.2 Bullet Proof Jackets Market Outlook by Type, $ Million, 2021 to 2030

3.3 Bullet Proof Jackets Market Outlook by Product, $ Million, 2021 to 2030

3.4 Bullet Proof Jackets Market Outlook by Application, $ Million, 2021 to 2030

3.5 Bullet Proof Jackets Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Bullet Proof Jackets Industry

4.2 Key Market Trends in Bullet Proof Jackets Industry

4.3 Potential Opportunities in Bullet Proof Jackets Industry

4.4 Key Challenges in Bullet Proof Jackets Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Bullet Proof Jackets Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Bullet Proof Jackets Market Outlook by Segments

7.1 Bullet Proof Jackets Market Outlook by Segments, $ Million, 2021- 2030

By Type

Soft Jacket

Hard Jacket

By End-User

Defense

Security & Law Enforcement

Civilians

By Protection Level

II

IIIA & IIIA+

III & III+

IV

8 North America Bullet Proof Jackets Market Analysis and Outlook To 2030

8.1 Introduction to North America Bullet Proof Jackets Markets in 2024

8.2 North America Bullet Proof Jackets Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Bullet Proof Jackets Market size Outlook by Segments, 2021-2030

By Type

Soft Jacket

Hard Jacket

By End-User

Defense

Security & Law Enforcement

Civilians

By Protection Level

II

IIIA & IIIA+

III & III+

IV

9 Europe Bullet Proof Jackets Market Analysis and Outlook To 2030

9.1 Introduction to Europe Bullet Proof Jackets Markets in 2024

9.2 Europe Bullet Proof Jackets Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Bullet Proof Jackets Market Size Outlook by Segments, 2021-2030

By Type

Soft Jacket

Hard Jacket

By End-User

Defense

Security & Law Enforcement

Civilians

By Protection Level

II

IIIA & IIIA+

III & III+

IV

10 Asia Pacific Bullet Proof Jackets Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Bullet Proof Jackets Markets in 2024

10.2 Asia Pacific Bullet Proof Jackets Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Bullet Proof Jackets Market size Outlook by Segments, 2021-2030

By Type

Soft Jacket

Hard Jacket

By End-User

Defense

Security & Law Enforcement

Civilians

By Protection Level

II

IIIA & IIIA+

III & III+

IV

11 South America Bullet Proof Jackets Market Analysis and Outlook To 2030

11.1 Introduction to South America Bullet Proof Jackets Markets in 2024

11.2 South America Bullet Proof Jackets Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Bullet Proof Jackets Market size Outlook by Segments, 2021-2030

By Type

Soft Jacket

Hard Jacket

By End-User

Defense

Security & Law Enforcement

Civilians

By Protection Level

II

IIIA & IIIA+

III & III+

IV

12 Middle East and Africa Bullet Proof Jackets Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Bullet Proof Jackets Markets in 2024

12.2 Middle East and Africa Bullet Proof Jackets Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Bullet Proof Jackets Market size Outlook by Segments, 2021-2030

By Type

Soft Jacket

Hard Jacket

By End-User

Defense

Security & Law Enforcement

Civilians

By Protection Level

II

IIIA & IIIA+

III & III+

IV

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

ARGUN s.r.o.

Armor Express

BulletSafe Bulletproof Vests

Canadian Armour Ltd

Compass International Corp Ltd

DuPont de Nemours Inc

EnGarde BV

Infidel Body Armor

MARS Armor

MKU Ltd

Point Blank Solutions Inc (Safariland LLC)

Seyntex NV

U.S. Armor Corp

VestGuard UK Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Soft Jacket

Hard Jacket

By End-User

Defense

Security & Law Enforcement

Civilians

By Protection Level

II

IIIA & IIIA+

III & III+

IV

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Bullet Proof Jackets is forecast to reach $2.3 Billion in 2030 from $1.7 Billion in 2024, registering a CAGR of 5.3% over the outlook period

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

ARGUN s.r.o., Armor Express, BulletSafe Bulletproof Vests, Canadian Armour Ltd, Compass International Corp Ltd, DuPont de Nemours Inc, EnGarde BV, Infidel Body Armor, MARS Armor, MKU Ltd, Point Blank Solutions Inc (Safariland LLC), Seyntex NV, U.S. Armor Corp, VestGuard UK Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume