The global Buildtech Textiles Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Raw Material (Natural, Synthetic), By Product (Woven, Non-Woven, Knitted, Others), By Application (Residential, Non-Residential).

The market for buildtech textiles is revolutionizing construction by providing high-performance fabrics that offer durability, versatility, and functionality in various building applications. Key trends shaping the future of this industry include advancements in textile technology, such as advanced fibers, coatings, and weaving techniques, which enhance fabric strength, weather resistance, and UV stability for use in roofing, insulation, facades, and tensile structures. Additionally, developments in textile manufacturing processes, including digital printing, laser cutting, and heat welding, enable the customization and rapid production of textile components with precise dimensions and complex shapes to meet architectural and design requirements. Moreover, the adoption of sustainable textile materials, such as recycled fibers, bio-based polymers, and eco-friendly finishes, aligns with green building standards and environmental regulations, driving market demand for environmentally responsible buildtech textiles. As architects, engineers, and contractors increasingly recognize the benefits of textiles in construction, such as lightweight, flexible, and energy-efficient solutions, the demand for innovative buildtech textiles is expected to grow, stimulating further research, development, and market adoption in this dynamic segment of the construction materials industry.

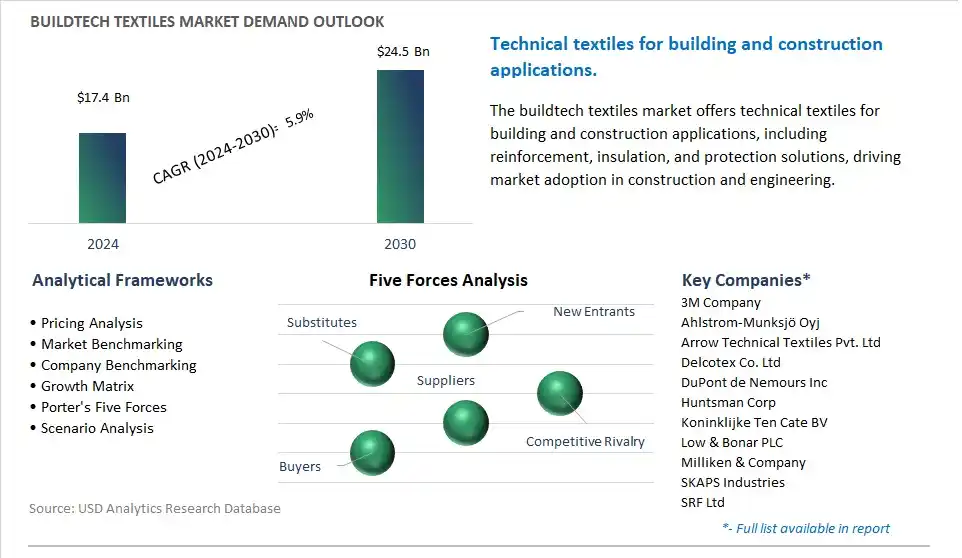

The market report analyses the leading companies in the industry including 3M Company, Ahlstrom-Munksjö Oyj, Arrow Technical Textiles Pvt. Ltd, Delcotex Co. Ltd, DuPont de Nemours Inc, Huntsman Corp, Koninklijke Ten Cate BV, Low & Bonar PLC, Milliken & Company, SKAPS Industries, SRF Ltd, Toray Industries Inc, Toyobo Co. Ltd.

A prominent trend in the market for Buildtech textiles is the integration of smart textiles in construction projects. Smart textiles, embedded with sensors, actuators, and other electronic components, are being increasingly used to enhance building performance, comfort, and safety. These textiles can be incorporated into various applications such as building envelopes, roofing membranes, interior finishes, and protective clothing for construction workers. The integration of smart textiles allows for real-time monitoring of structural integrity, environmental conditions, and energy usage, leading to improved efficiency, sustainability, and occupant well-being. As the construction industry embraces digitalization and smart technologies, the demand for Buildtech textiles with embedded intelligence is expected to grow, driving market expansion and innovation in textile manufacturing and applications.

A key driver behind the demand for Buildtech textiles is the focus on sustainable construction practices. With increasing concerns about environmental impact and energy efficiency in the built environment, there is a shift towards materials that are eco-friendly, energy-efficient, and contribute to green building certifications such as LEED and BREEAM. Buildtech textiles play a crucial role in sustainable construction by offering solutions for thermal insulation, moisture management, air filtration, and daylighting control. Additionally, textiles made from recycled fibers, renewable materials, or biodegradable polymers are gaining traction as alternatives to traditional construction materials. As governments enact stricter regulations on building sustainability and as developers prioritize green building initiatives, the demand for sustainable Buildtech textiles is expected to rise, driving market growth and investment in sustainable textile production technologies.

An emerging opportunity in the market for Buildtech textiles lies in the development of high-performance functional textiles tailored to the specific needs of the construction industry. There is a demand for textiles that offer enhanced properties such as fire resistance, water repellency, UV protection, abrasion resistance, and antimicrobial properties to withstand the harsh conditions of construction sites and building environments. Manufacturers aim to capitalize on this opportunity by investing in research and development of advanced textile coatings, finishes, and treatments that impart these functional properties without compromising on comfort, durability, or breathability. Additionally, there is an opportunity to develop customizable textile solutions that can be adapted to different construction applications and architectural designs. By offering high-performance functional textiles, suppliers can meet the evolving needs of architects, engineers, and contractors, differentiate their products in the market, and capture new opportunities in the growing Buildtech sector. Embracing innovation in functional textiles can drive market growth and competitiveness, contributing to the development of more resilient, efficient, and sustainable buildings and infrastructure.

Buildtech textiles, a specialized subset of technical textiles primarily serving the construction industry, with diverse key segments. Initially, raw materials including synthetic polymers from chemical giants including Dow, DuPont, and BASF, or natural fibers sourced from producers including jute growers, form the foundation. These materials are then transformed into usable yarns or non-woven formats by established textile players including Milliken & Company and Trevira. Further, specialized treatments and finishing processes, provided by companies including Schoeller Textil and Kolon Industries, enhance the base fabrics for construction purposes.

The manufacturing phase involves converting these fabrics into final buildtech products including geotextiles and roofing membranes, handled by diversified building material companies including Saint-Gobain, and specialized manufacturers including TenCate Geosynthetics and Carl Freudenberg Group. Distribution and wholesale networks, including building material distributors and specialist retailers, facilitate the delivery of buildtech textiles to construction companies.

Further, the incorporation, aftermarket maintenance, and potential replacement of buildtech textiles within the building process are managed by general contractors or specialist subcontractors, along with relevant service providers focusing on roofing and waterproofing.

The largest segment in the Buildtech Textiles Market is the Synthetic segment. This is because synthetic fibers offer a wide range of advantages over natural fibers in terms of durability, versatility, and performance. Synthetic fibers such as polyester, nylon, and polypropylene are commonly used in buildtech textiles due to their strength, resistance to wear and tear, and ability to withstand harsh environmental conditions. Additionally, synthetic fibers often provide superior water resistance and moisture management properties, making them ideal for applications in construction and building materials where protection against the elements is crucial. In addition, synthetic fibers can be engineered to meet specific performance requirements, such as flame resistance, UV stability, and antimicrobial properties, further enhancing their suitability for buildtech applications. Overall, the Synthetic segment dominates the Buildtech Textiles Market due to the inherent advantages offered by synthetic fibers in terms of performance, durability, and functionality in construction and building applications.

The fastest-growing segment in the Buildtech Textiles Market is the Non-Woven segment. Non-woven textiles offer diverse advantages over traditional woven and knitted textiles, making them increasingly popular in buildtech applications. Non-woven textiles are manufactured using a process that involves bonding or interlocking fibers together rather than weaving or knitting them. This results in fabrics that are lightweight, durable, and versatile, with properties such as high tensile strength, tear resistance, and flexibility. Non-woven textiles are also highly customizable and can be engineered to meet specific performance requirements, such as waterproofing, filtration, insulation, and sound absorption. In the buildtech sector, non-woven textiles find applications in a wide range of areas including geotextiles for soil stabilization, drainage, and erosion control, as well as in roofing membranes, house wraps, insulation materials, and filtration systems. The growing demand for sustainable and environmentally friendly building materials also contributes to the increasing adoption of non-woven textiles, as they can be made from recycled fibers and are often recyclable themselves. Overall, the Non-Woven segment is experiencing rapid growth in the Buildtech Textiles Market due to its versatility, performance, and suitability for a wide range of construction and building applications.

The fastest-growing segment in the Buildtech Textiles Market is the Non-Residential segment. This growth can be attributed to diverse factors driving the demand for buildtech textiles in non-residential applications. Non-residential construction includes commercial, industrial, institutional, and infrastructure projects such as office buildings, shopping malls, factories, schools, hospitals, and transportation facilities. In non-residential buildings, buildtech textiles find extensive applications in areas such as roofing membranes, façade cladding, insulation materials, interior fabrics, and acoustic panels. The increasing emphasis on sustainability, energy efficiency, and green building practices in non-residential construction drives the adoption of buildtech textiles engineered to provide thermal insulation, moisture management, and sound absorption properties. Additionally, the growing trend toward smart buildings and digitalization in commercial and institutional sectors creates opportunities for buildtech textiles integrated with sensors, photovoltaic cells, and other advanced functionalities. In addition, the rise of infrastructure development projects, including transportation networks, utilities, and public spaces, further boosts the demand for buildtech textiles for applications such as geotextiles, reinforcement fabrics, and erosion control systems. Overall, the Non-Residential segment experiences rapid growth in the Buildtech Textiles Market due to the increasing construction activities in commercial, industrial, and infrastructure sectors, driving the demand for innovative textile solutions to address the evolving needs of non-residential building projects.

By Raw Material

Natural

Synthetic

-HDPE

-PET

-Nylon

-Polyethylene

-Polypropylene

-Others

By Product

Woven

Non-Woven

Knitted

Others

By Application

Residential

Non-Residential

3M Company

Ahlstrom-Munksjö Oyj

Arrow Technical Textiles Pvt. Ltd

Delcotex Co. Ltd

DuPont de Nemours Inc

Huntsman Corp

Koninklijke Ten Cate BV

Low & Bonar PLC

Milliken & Company

SKAPS Industries

SRF Ltd

Toray Industries Inc

Toyobo Co. Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Buildtech Textiles Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Buildtech Textiles Market Size Outlook, $ Million, 2021 to 2030

3.2 Buildtech Textiles Market Outlook by Type, $ Million, 2021 to 2030

3.3 Buildtech Textiles Market Outlook by Product, $ Million, 2021 to 2030

3.4 Buildtech Textiles Market Outlook by Application, $ Million, 2021 to 2030

3.5 Buildtech Textiles Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Buildtech Textiles Industry

4.2 Key Market Trends in Buildtech Textiles Industry

4.3 Potential Opportunities in Buildtech Textiles Industry

4.4 Key Challenges in Buildtech Textiles Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Buildtech Textiles Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Buildtech Textiles Market Outlook by Segments

7.1 Buildtech Textiles Market Outlook by Segments, $ Million, 2021- 2030

By Raw Material

Natural

Synthetic

-HDPE

-PET

-Nylon

-Polyethylene

-Polypropylene

-Others

By Product

Woven

Non-Woven

Knitted

Others

By Application

Residential

Non-Residential

8 North America Buildtech Textiles Market Analysis and Outlook To 2030

8.1 Introduction to North America Buildtech Textiles Markets in 2024

8.2 North America Buildtech Textiles Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Buildtech Textiles Market size Outlook by Segments, 2021-2030

By Raw Material

Natural

Synthetic

-HDPE

-PET

-Nylon

-Polyethylene

-Polypropylene

-Others

By Product

Woven

Non-Woven

Knitted

Others

By Application

Residential

Non-Residential

9 Europe Buildtech Textiles Market Analysis and Outlook To 2030

9.1 Introduction to Europe Buildtech Textiles Markets in 2024

9.2 Europe Buildtech Textiles Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Buildtech Textiles Market Size Outlook by Segments, 2021-2030

By Raw Material

Natural

Synthetic

-HDPE

-PET

-Nylon

-Polyethylene

-Polypropylene

-Others

By Product

Woven

Non-Woven

Knitted

Others

By Application

Residential

Non-Residential

10 Asia Pacific Buildtech Textiles Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Buildtech Textiles Markets in 2024

10.2 Asia Pacific Buildtech Textiles Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Buildtech Textiles Market size Outlook by Segments, 2021-2030

By Raw Material

Natural

Synthetic

-HDPE

-PET

-Nylon

-Polyethylene

-Polypropylene

-Others

By Product

Woven

Non-Woven

Knitted

Others

By Application

Residential

Non-Residential

11 South America Buildtech Textiles Market Analysis and Outlook To 2030

11.1 Introduction to South America Buildtech Textiles Markets in 2024

11.2 South America Buildtech Textiles Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Buildtech Textiles Market size Outlook by Segments, 2021-2030

By Raw Material

Natural

Synthetic

-HDPE

-PET

-Nylon

-Polyethylene

-Polypropylene

-Others

By Product

Woven

Non-Woven

Knitted

Others

By Application

Residential

Non-Residential

12 Middle East and Africa Buildtech Textiles Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Buildtech Textiles Markets in 2024

12.2 Middle East and Africa Buildtech Textiles Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Buildtech Textiles Market size Outlook by Segments, 2021-2030

By Raw Material

Natural

Synthetic

-HDPE

-PET

-Nylon

-Polyethylene

-Polypropylene

-Others

By Product

Woven

Non-Woven

Knitted

Others

By Application

Residential

Non-Residential

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

3M Company

Ahlstrom-Munksjö Oyj

Arrow Technical Textiles Pvt. Ltd

Delcotex Co. Ltd

DuPont de Nemours Inc

Huntsman Corp

Koninklijke Ten Cate BV

Low & Bonar PLC

Milliken & Company

SKAPS Industries

SRF Ltd

Toray Industries Inc

Toyobo Co. Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Raw Material

Natural

Synthetic

-HDPE

-PET

-Nylon

-Polyethylene

-Polypropylene

-Others

By Product

Woven

Non-Woven

Knitted

Others

By Application

Residential

Non-Residential

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Buildtech Textiles is forecast to reach $24.5 Billion in 2030 from $17.4 Billion in 2024, registering a CAGR of 5.9% over the outlook period

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

3M Company, Ahlstrom-Munksjö Oyj, Arrow Technical Textiles Pvt. Ltd, Delcotex Co. Ltd, DuPont de Nemours Inc, Huntsman Corp, Koninklijke Ten Cate BV, Low & Bonar PLC, Milliken & Company, SKAPS Industries, SRF Ltd, Toray Industries Inc, Toyobo Co. Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume