The global Breakfast Cereals Market Comprehensive Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Hot Cereals, Ready-to-Eat), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, E-commerce, Others)

The breakfast cereal market in 2024 continues to evolve, shaped by changing consumer lifestyles, dietary preferences, and innovation in product development. Breakfast cereals remain a popular choice for consumers seeking convenient, nutritious, and versatile breakfast options. With hectic schedules and on-the-go lifestyles becoming the norm, there's a growing demand for breakfast cereals that offer quick preparation, portability, and satiety. Manufacturers are responding to these trends by introducing a diverse range of breakfast cereals tailored to meet various dietary needs and taste preferences, including gluten-free, high-protein, and organic options. Moreover, with increasing emphasis on health and wellness, there's a rising interest in fortified cereals enriched with vitamins, minerals, and functional ingredients such as fiber and antioxidants. As breakfast cereals continue to adapt to changing consumer demands and preferences, the market remains dynamic and competitive, driving innovation and growth.

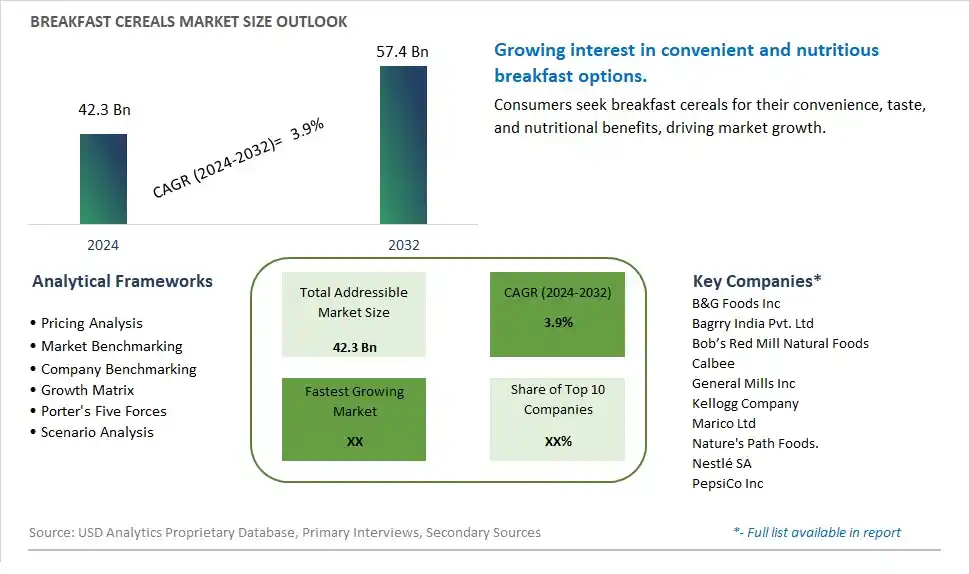

The market report analyses the leading companies in the industry including B&G Foods Inc, Bagrry India Pvt. Ltd, Bob’s Red Mill Natural Foods, Calbee, General Mills Inc, Kellogg Company, Marico Ltd, Nature's Path Foods., Nestlé SA, PepsiCo Inc, and Others.

The most prominent market trend in the breakfast cereal industry is the diversification and innovation of cereal offerings. With changing consumer preferences and lifestyles, breakfast cereals are evolving to cater to a broader range of tastes, dietary needs, and health considerations. This trend includes the introduction of new flavors, ingredients, and formulations to appeal to diverse consumer demographics, including gluten-free, vegan, and high-protein options. Additionally, there is a growing emphasis on functional ingredients, such as whole grains, nuts, seeds, and superfoods, to enhance the nutritional profile and health benefits of breakfast cereals, reflecting consumers' increasing interest in health and wellness.

The primary market driver for breakfast cereals is the convenience they offer to consumers with busy lifestyles. As more people juggle work, family, and other commitments, there is a growing demand for quick and easy breakfast solutions that require minimal preparation. Breakfast cereals provide a convenient and time-saving option for individuals seeking a nutritious morning meal that can be enjoyed on the go or at home. Furthermore, the portability and shelf-stability of breakfast cereals make them a practical choice for households looking for hassle-free breakfast options, driving their popularity in both developed and emerging markets.

An opportunity for the breakfast cereal market lies in targeting health-conscious consumers with functional and customizable cereal options. With an increasing focus on wellness and nutrition, there is a demand for breakfast cereals that not only taste good but also deliver added health benefits. Manufacturers can capitalize on this opportunity by incorporating functional ingredients such as probiotics, prebiotics, antioxidants, and vitamins into their cereal formulations to address specific health concerns and meet evolving consumer needs. Moreover, offering customizable options, such as build-your-own cereal kits or personalized cereal blends, allows consumers to tailor their breakfast experience according to their dietary preferences, taste preferences, and nutritional goals, fostering brand loyalty and differentiation in a competitive market landscape.

Ready-to-eat cereals emerge as the largest segment in the breakfast cereals market due to their convenience, versatility, and widespread consumer appeal. Ready-to-eat cereals offer busy individuals and families a quick and convenient breakfast option that requires minimal preparation, making them ideal for hectic mornings. These cereals come in a variety of flavors, textures, and nutritional profiles, catering to diverse tastes and dietary preferences. Further, ready-to-eat cereals are often fortified with essential vitamins and minerals, offering a convenient way for consumers to meet their daily nutritional needs. The popularity of ready-to-eat cereals is further bolstered by aggressive marketing campaigns, innovative product formulations, and strategic partnerships with celebrities and influencers. As consumers continue to prioritize convenience and healthy eating habits, the ready-to-eat cereals segment is expected to maintain its dominance in the breakfast cereals market.

E-commerce is the fastest-growing segment in the breakfast cereals market, driven by shifting consumer shopping habits, convenience, and the increasing prevalence of online grocery shopping. With the rise of digital platforms and the convenience of doorstep delivery, more consumers are turning to e-commerce channels to purchase their breakfast cereals. Online retailers offer a wide selection of cereals, including niche and specialty products, catering to diverse consumer preferences. Further, the COVID-19 pandemic accelerated the adoption of e-commerce as consumers sought safe and contactless shopping options. The convenience of browsing and purchasing breakfast cereals from the comfort of home, coupled with the ability to access a broader range of products and avail of discounts and promotions, fuels the rapid growth of the e-commerce segment in the breakfast cereals market. As online grocery shopping continues to gain traction, the e-commerce segment is poised to maintain its momentum and further expand its share in the market.

By Product

Hot Cereals

Ready-to-Eat

By Distribution Channel

Supermarkets/Hypermarkets

Convenience Stores

E-commerce

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

B&G Foods Inc

Bagrry India Pvt. Ltd

Bob’s Red Mill Natural Foods

Calbee

General Mills Inc

Kellogg Company

Marico Ltd

Nature's Path Foods.

Nestlé SA

PepsiCo Inc

*- List Not Exhaustive

Chapter 1. TABLE OF CONTENTS

Chapter 2. Introduction to Breakfast Cereals Market

2.1. Market Overview

2.2. Key Statistics and Report Highlights

2.3. Scope of the Comprehensive Study

2.3.1. Market Definition

2.3.2 Countries and Regions Covered

2.3.3 Research Objective

2.3.4 Units, Currency, and Conversions

2.3.5 Industry Value Chain

2.4. Key Market Segments

2.5. Key Companies

2.6. Study Period

Chapter 3. Strategic Analysis Review

3.1. Breakfast Cereals Pricing Analysis and Forecast

3.2. Porter’s Five Forces

3.3. Market Ecosystem

3.4. SWOT Analysis

3.5. Regulatory Scenario

3.3. Effects of Inflation, Russia-Ukraine War, moderating economic growth, and other macroeconomic factors

Chapter 4. Competitive Landscape

4.1. Market Share Analysis

4.1.1. Global Breakfast Cereals Market Share by Company, 2023

4.1.2. Product Offerings of Leading Breakfast Cereals Companies

4.2. Market Entropy

4.2.1. New Product Launches in the Industry

4.2.2. Mergers, Acquisitions, Joint ventures, and Partnerships

4.3. Key Strategies and Best Practices

Chapter 5. Global Market Projections: Best, Reference, and Low Case Scenarios

5.1. Growth Analysis- Case Scenario Definitions

5.2. Low Growth Case Scenario Forecasts

5.3. Reference Growth Case Scenario Forecasts

5.4. High Growth Case Scenario Forecasts

Chapter 6. Market Dynamics

6.1. Breakfast Cereals Market Drivers

6.2. Breakfast Cereals Market Challenges

6.6. Breakfast Cereals Market Opportunities

6.4. Breakfast Cereals Market Trends

Chapter 7. Global Breakfast Cereals Market Outlook Trends

7.1. Global Breakfast Cereals Revenue (USD Million) and CAGR (%) by Type (2021-2032)

7.2. Global Breakfast Cereals Revenue (USD Million) and CAGR (%) by Application (2021-2032)

7.3. Global Breakfast Cereals Revenue (USD Million) and CAGR (%) by Product (2021-2032)

By Product

Hot Cereals

Ready-to-Eat

By Distribution Channel

Supermarkets/Hypermarkets

Convenience Stores

E-commerce

Others

Chapter 8. Global Breakfast Cereals Regional Analysis and Outlook

8.1. Global Breakfast Cereals Revenue (USD Million) By Regions (2021- 2032)

8.2. North America Breakfast Cereals Revenue (USD Million) by Country (2021-2032)

8.2.1. United States Breakfast Cereals Regional Analysis and Outlook

8.2.2. Canada Breakfast Cereals Regional Analysis and Outlook

8.2.3. Mexico Breakfast Cereals Regional Analysis and Outlook

8.3. Europe Breakfast Cereals Revenue (USD Million), by Country (2021-2032)

8.3.1. Germany Breakfast Cereals Regional Analysis and Outlook

8.3.2. France Breakfast Cereals Regional Analysis and Outlook

8.3.3. United Kingdom Breakfast Cereals Regional Analysis and Outlook

8.3.4. Spain Breakfast Cereals Regional Analysis and Outlook

8.3.5. Italy Breakfast Cereals Regional Analysis and Outlook

8.3.6. Russia Breakfast Cereals Regional Analysis and Outlook

8.3.7. Rest of Europe Breakfast Cereals Regional Analysis and Outlook

8.4. Asia Pacific Breakfast Cereals Revenue (USD Million) by Country (2021-2032)

8.4.1. China Breakfast Cereals Regional Analysis and Outlook

8.4.2. Japan Breakfast Cereals Regional Analysis and Outlook

8.4.3. India Breakfast Cereals Regional Analysis and Outlook

8.4.4. South Korea Breakfast Cereals Regional Analysis and Outlook

8.4.5. Australia Breakfast Cereals Regional Analysis and Outlook

8.4.6. South East Asia Breakfast Cereals Regional Analysis and Outlook

8.4.7. Rest of Asia Pacific Breakfast Cereals Regional Analysis and Outlook

8.5. South America Breakfast Cereals Revenue (USD Million), by Country (2021-2032)

8.5.1. Brazil Breakfast Cereals Regional Analysis and Outlook

8.5.2. Argentina Breakfast Cereals Regional Analysis and Outlook

8.5.3. Rest of South America Breakfast Cereals Regional Analysis and Outlook

8.6. Middle East and Africa Breakfast Cereals Revenue (USD Million) by Country (2021-2032)

8.6.1. Middle East Breakfast Cereals Regional Analysis and Outlook

8.6.2. Africa Breakfast Cereals Regional Analysis and Outlook

Chapter 9. North America Breakfast Cereals Analysis and Outlook

9.1. North America Breakfast Cereals Revenue (USD Million) by Segments (2021-2032)

9.1.1. North America Breakfast Cereals Revenue (USD Million) by Type (2021-2032)

9.1.2. North America Breakfast Cereals Revenue (USD Million) by Application (2021-2032)

9.1.3. North America Breakfast Cereals Revenue (USD Million) by Product (2021-2032)

By Product

Hot Cereals

Ready-to-Eat

By Distribution Channel

Supermarkets/Hypermarkets

Convenience Stores

E-commerce

Others

Chapter 10. Europe Breakfast Cereals Analysis and Outlook

10.1. Europe Breakfast Cereals Revenue (USD Million), by Segments (USD Million) (2021-2032)

10.1.1. Europe Breakfast Cereals Revenue (USD Million) by Type (2021-2032)

10.1.2. Europe Breakfast Cereals Revenue (USD Million) by Application (2021-2032)

10.1.3. Europe Breakfast Cereals Revenue (USD Million) by Product (2021-2032)

By Product

Hot Cereals

Ready-to-Eat

By Distribution Channel

Supermarkets/Hypermarkets

Convenience Stores

E-commerce

Others

Chapter 11. Asia Pacific Breakfast Cereals Analysis and Outlook

11.1. Asia Pacific Breakfast Cereals Revenue (USD Million), and Revenue (USD Million) by Segments (2021-2032)

11.1.1. Asia Pacific Breakfast Cereals Revenue (USD Million) by Type (2021-2032)

11.1.2. Asia Pacific Breakfast Cereals Revenue (USD Million) by Application (2021-2032)

11.1.3. Asia Pacific Breakfast Cereals Revenue (USD Million) by Product (2021-2032)

By Product

Hot Cereals

Ready-to-Eat

By Distribution Channel

Supermarkets/Hypermarkets

Convenience Stores

E-commerce

Others

Chapter 12. South America Breakfast Cereals Analysis and Outlook

12.1. South America Breakfast Cereals Revenue (USD Million), by Segments (2021-2032)

12.1.1. South America Breakfast Cereals Revenue (USD Million) by Type (2021-2032)

12.1.2. South America Breakfast Cereals Revenue (USD Million) by Application (2021-2032)

12.1.3. South America Breakfast Cereals Revenue (USD Million) by Product (2021-2032)

By Product

Hot Cereals

Ready-to-Eat

By Distribution Channel

Supermarkets/Hypermarkets

Convenience Stores

E-commerce

Others

Chapter 13. Middle East and Africa Breakfast Cereals Analysis and Outlook

13.1. Middle East and Africa Breakfast Cereals Revenue (USD Million), by Segments (2021-2032)

13.1.1. Middle East and Africa Breakfast Cereals Revenue (USD Million) by Type (2021-2032)

13.1.2. Middle East and Africa Breakfast Cereals Revenue (USD Million) by Application (2021-2032)

13.1.3. Middle East and Africa Breakfast Cereals Revenue (USD Million) by Product (2021-2032)

By Product

Hot Cereals

Ready-to-Eat

By Distribution Channel

Supermarkets/Hypermarkets

Convenience Stores

E-commerce

Others

Chapter 14. Breakfast Cereals Company Profiles

14.1 Business Overview

14.2 Product Profiles

14.3 SWOT Profiles

14.5 Recent Developments

14.6 Financial Profile

List of Companies

B&G Foods Inc

Bagrry India Pvt. Ltd

Bob’s Red Mill Natural Foods

Calbee

General Mills Inc

Kellogg Company

Marico Ltd

Nature's Path Foods.

Nestlé SA

PepsiCo Inc

15. Methodology and Data Sources

15.1 Customization Offerings

15.2 Subscription Services

15.3 Related Reports

15.4 Publisher Expertise

LIST OF TABLES

Table 1 Market Segmentation Analysis

Table 2 Global Breakfast Cereals Market Share of Leading Companies, 2023

Table 3 Product Offerings of Leading Companies

Table 4 Low Growth Scenario Forecasts

Table 5 Reference Case Growth Scenario

Table 6 High Growth Case Scenario

Table 7 Global Breakfast Cereals Revenue (USD Million) And CAGR (%) By Type (2021-2032)

Table 8 Global Breakfast Cereals Revenue (USD Million) And CAGR (%) By Application (2021-2032)

Table 9 Global Breakfast Cereals Revenue (USD Million) And CAGR (%) By Product (2021-2032)

Table 10 Global Breakfast Cereals Market Revenue (USD Million) By Regions (2021-2032)

Table 11 Global Breakfast Cereals Market Share (%) By Regions (2021-2032)

Table 12 North America Breakfast Cereals Revenue (USD Million) By Country (2021-2032)

Table 13 Europe Breakfast Cereals Revenue (USD Million) By Country (2021-2032)

Table 14 Asia Pacific Breakfast Cereals Revenue (USD Million) By Country (2021-2032)

Table 15 South America Breakfast Cereals Revenue (USD Million) By Country (2021-2032)

Table 16 Middle East and Africa Breakfast Cereals Revenue (USD Million) By Region (2021-2032)

Table 17 North America Breakfast Cereals Revenue (USD Million) By Type (2021-2032)

Table 18 North America Breakfast Cereals Revenue (USD Million) By Application (2021-2032)

Table 19 North America Breakfast Cereals Revenue (USD Million) By Product (2021-2032)

Table 20 Europe Breakfast Cereals Revenue (USD Million) By Type (2021-2032)

Table 21 Europe Breakfast Cereals Revenue (USD Million) By Application (2021-2032)

Table 22 Europe Breakfast Cereals Revenue (USD Million) By Product (2021-2032)

Table 23 Asia Pacific Breakfast Cereals Revenue (USD Million) By Type (2021-2032)

Table 24 Asia Pacific Breakfast Cereals Revenue (USD Million) By Application (2021-2032)

Table 25 Asia Pacific Breakfast Cereals Revenue (USD Million) By Product (2021-2032)

Table 26 South America Breakfast Cereals Revenue (USD Million) By Type (2021-2032)

Table 27 South America Breakfast Cereals Revenue (USD Million) By Application (2021-2032)

Table 28 South America Breakfast Cereals Revenue (USD Million) By Product (2021-2032)

Table 29 Middle East and Africa Breakfast Cereals Revenue (USD Million) By Type (2021-2032)

Table 30 Middle East and Africa Breakfast Cereals Revenue (USD Million) By Application (2021-2032)

Table 31 Middle East and Africa Breakfast Cereals Revenue (USD Million) By Product (2021-2032)

LIST OF FIGURES

Figure 1. Market Scope

Figure 2. Pricing Forecasts Per Unit, 2023- 2032

Figure 3. Porter’s Five Forces

Figure 4. Global Breakfast Cereals Market Revenue (USD Million) By Regions (2021-2032)

Figure 5. Global Breakfast Cereals Market Share (%) By Regions (2023)

Figure 6. North America Breakfast Cereals Revenue (USD Million) By Country (2021-2032)

Figure 7. United States Breakfast Cereals Revenue (USD Million) By Country (2021-2032)

Figure 8. Canada Breakfast Cereals Revenue (USD Million) By Country (2021-2032)

Figure 9. Mexico Breakfast Cereals Revenue (USD Million) By Country (2021-2032)

Figure 10. Europe Breakfast Cereals Revenue (USD Million) By Country (2021-2032)

Figure 11. Germany Breakfast Cereals Revenue (USD Million) By Country (2021-2032)

Figure 12. France Breakfast Cereals Revenue (USD Million) By Country (2021-2032)

Figure 13. United Kingdom Breakfast Cereals Revenue (USD Million) By Country (2021-2032)

Figure 14. Spain Breakfast Cereals Revenue (USD Million) By Country (2021-2032)

Figure 15. Italy Breakfast Cereals Revenue (USD Million) By Country (2021-2032)

Figure 16. Russia Breakfast Cereals Revenue (USD Million) By Country (2021-2032)

Figure 17. Rest of Europe Breakfast Cereals Revenue (USD Million) By Country (2021-2032)

Figure 11. Asia Pacific Breakfast Cereals Revenue (USD Million) By Country (2021-2032)

Figure 12. China Breakfast Cereals Revenue (USD Million) By Country (2021-2032)

Figure 13. Japan Breakfast Cereals Revenue (USD Million) By Country (2021-2032)

Figure 14. India Breakfast Cereals Revenue (USD Million) By Country (2021-2032)

Figure 15. South Korea Breakfast Cereals Revenue (USD Million) By Country (2021-2032)

Figure 16. Australia Breakfast Cereals Revenue (USD Million) By Country (2021-2032)

Figure 17. South East Asia Breakfast Cereals Revenue (USD Million) By Country (2021-2032)

Figure 18. South America Breakfast Cereals Revenue (USD Million) By Country (2021-2032)

Figure 19. Brazil Breakfast Cereals Revenue (USD Million) By Country (2021-2032)

Figure 20. Argentina Breakfast Cereals Revenue (USD Million) By Country (2021-2032)

Figure 21. Rest of Asia Pacific Breakfast Cereals Revenue (USD Million) By Country (2021-2032)

Figure 22. Middle East and Africa Breakfast Cereals Revenue (USD Million) By Region (2021-2032)

Figure 23. Saudi Arabia Breakfast Cereals Revenue (USD Million) By Region (2021-2032)

Figure 24. The UAE Breakfast Cereals Revenue (USD Million) By Region (2021-2032)

Figure 25. Rest of Middle East Breakfast Cereals Revenue (USD Million) By Region (2021-2032)

Figure 26. South Africa Breakfast Cereals Revenue (USD Million) By Region (2021-2032)

Figure 27. Africa Breakfast Cereals Revenue (USD Million) By Region (2021-2032)

Figure 28. North America Breakfast Cereals Revenue (USD Million) By Type (2021-2032)

Figure 29. North America Breakfast Cereals Revenue (USD Million) By Application (2021-2032)

Figure 30. North America Breakfast Cereals Revenue (USD Million) By Product (2021-2032)

Figure 31. Europe Breakfast Cereals Revenue (USD Million) By Type (2021-2032)

Figure 32. Europe Breakfast Cereals Revenue (USD Million) By Application (2021-2032)

Figure 33. Europe Breakfast Cereals Revenue (USD Million) By Product (2021-2032)

Figure 34. Asia Pacific Breakfast Cereals Revenue (USD Million) By Type (2021-2032)

Figure 35. Asia Pacific Breakfast Cereals Revenue (USD Million) By Application (2021-2032)

Figure 36. Asia Pacific Breakfast Cereals Revenue (USD Million) By Product (2021-2032)

Figure 37. South America Breakfast Cereals Revenue (USD Million) By Type (2021-2032)

Figure 38. South America Breakfast Cereals Revenue (USD Million) By Application (2021-2032)

Figure 39. South America Breakfast Cereals Revenue (USD Million) By Product (2021-2032)

Figure 40. Middle East and Africa Breakfast Cereals Revenue (USD Million) By Type (2021-2032)

Figure 41. Middle East and Africa Breakfast Cereals Revenue (USD Million) By Application (2021-2032)

Figure 42. Middle East and Africa Breakfast Cereals Revenue (USD Million) By Product (2021-2032)

By Product

Hot Cereals

Ready-to-Eat

By Distribution Channel

Supermarkets/Hypermarkets

Convenience Stores

E-commerce

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Breakfast Cereals Market Size is valued at $42.3 Billion in 2024 and is forecast to register a growth rate (CAGR) of 3.9% to reach $57.4 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

B&G Foods Inc, Bagrry India Pvt. Ltd, Bob’s Red Mill Natural Foods, Calbee, General Mills Inc, Kellogg Company, Marico Ltd, Nature's Path Foods., Nestlé SA, PepsiCo Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume