The global Brake Pads Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Type (Non-asbestos Organic Brake Pads, Low Metallic NAO Brake Pads, Semi Metallic Brake Pads, Ceramic Brake Pads), By Position (Front, Front & Rear), By Material (Semi-Metallic, Non-Asbestos Organic, Low-Metallic NAO, Ceramic), By Vehicle (PCV, LCV, HCV, Two-wheelers), By Application (Vehicles OEM Industry, Vehicles Aftermarket Industry), By Sales Channel (OEM, Aftermarket).

The brake pads market in 2024 continues to be a crucial segment of the automotive industry, providing essential components for braking systems in vehicles of all types, including passenger cars, commercial trucks, and motorcycles. Brake pads are friction materials that press against brake discs or drums to generate stopping force and slow down or stop the vehicle. With an ongoing emphasis on vehicle safety, performance, and sustainability, the demand for high-quality brake pads remains strong. Manufacturers in this market focus on developing pads that offer excellent stopping power, heat resistance, and durability while meeting stringent regulatory requirements and industry standards. Additionally, as vehicles evolve with advancements in technology, including electrification and automation, brake pads integrate features such as low-dust formulations, regenerative braking compatibility, and predictive maintenance capabilities to enhance performance and longevity. With a continued emphasis on reliability, performance, and innovation, the brake pads market plays a crucial role in ensuring the safety and efficiency of vehicles worldwide.

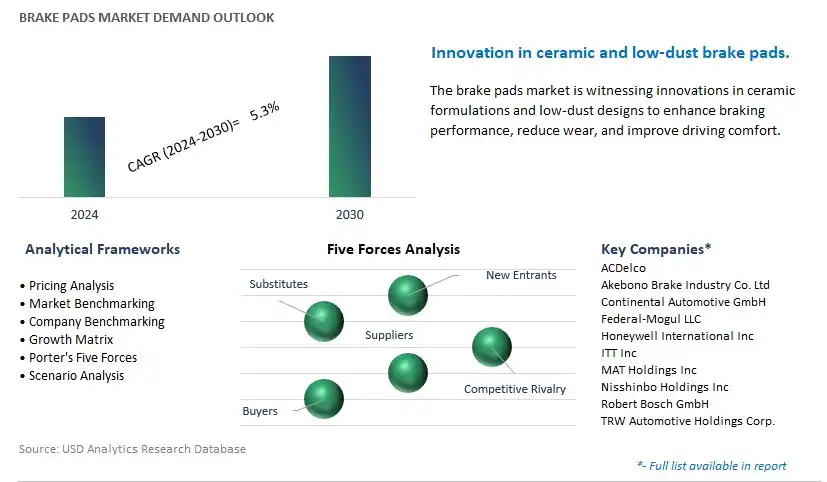

The global Brake Pads market is highly competitive with a large number of companies focusing on niche market segments. Amidst intense competitive conditions, Brake Pads Companies are investing in new product launches and strengthening distribution channels. Key companies operating in the Brake Pads Market Industry include- ACDelco, Akebono Brake Industry Co. Ltd, Continental Automotive GmbH, Federal-Mogul LLC, Honeywell International Inc, ITT Inc, MAT Holdings Inc, Nisshinbo Holdings Inc, Robert Bosch GmbH, TRW Automotive Holdings Corp..

A prominent trend in the Brake Pads market is the shift towards environmentally friendly materials. With increasing concerns about sustainability and environmental impact, there's a growing demand for brake pads made from eco-friendly materials such as ceramic, organic compounds, or low-copper formulations. Manufacturers are responding to this trend by developing brake pads that offer comparable or superior performance to traditional materials while reducing harmful emissions and minimizing environmental footprint. This trend reflects a broader industry focus on sustainability and green technologies, driving market growth and opportunities for brake pad manufacturers to offer innovative solutions that meet the evolving needs of environmentally conscious consumers and regulatory requirements.

The primary drivers propelling the growth of the Brake Pads market are stringent safety regulations and vehicle safety standards. With an increasing focus on vehicle safety and occupant protection, governments and regulatory bodies worldwide have implemented strict standards and requirements for automotive braking systems, including brake pads. These regulations mandate the use of high-quality materials, precise manufacturing processes, and rigorous testing procedures to ensure brake pads meet specified performance criteria for stopping distance, fade resistance, and noise levels. Additionally, the rise of advanced driver assistance systems (ADAS) and autonomous driving technologies further emphasizes the importance of reliable braking systems in ensuring vehicle safety. As automakers strive to comply with regulatory requirements and meet consumer expectations for safe and reliable vehicles, the demand for high-quality brake pads is expected to continue growing, presenting opportunities for manufacturers to supply compliant and innovative products to the automotive industry.

An Market Opportunity ripe for exploration within the Brake Pads market is the development of advanced friction materials and manufacturing techniques. With continuous advancements in material science, engineering, and manufacturing technology, there's significant potential to improve the performance, efficiency, and sustainability of brake pads. Manufacturers can capitalize on this Market Opportunity by researching and developing innovative friction materials with enhanced heat dissipation, wear resistance, and friction stability, resulting in quieter, smoother, and more efficient braking performance. Additionally, there's potential to optimize manufacturing processes, such as molding techniques, bonding methods, and surface treatments, to enhance product consistency, quality control, and production efficiency. By investing in the development of advanced friction materials and manufacturing techniques, brake pad manufacturers can differentiate their products, meet evolving customer demands for high-performance braking solutions, and maintain a competitive edge in the dynamic automotive market.

By Type

Non-asbestos Organic Brake Pads

Low Metallic NAO Brake Pads

Semi Metallic Brake Pads

Ceramic Brake Pads

By Position

Front

Front & Rear

By Material

Semi-Metallic

Non-Asbestos Organic

Low-Metallic NAO

Ceramic

By Vehicle

PCV

LCV

HCV

Two-wheelers

By Application

Vehicles OEM Industry

Vehicles Aftermarket Industry

By Sales Channel

OEM

AftermarketGeographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa

ACDelco

Akebono Brake Industry Co. Ltd

Continental Automotive GmbH

Federal-Mogul LLC

Honeywell International Inc

ITT Inc

MAT Holdings Inc

Nisshinbo Holdings Inc

Robert Bosch GmbH

TRW Automotive Holdings Corp.

*- List not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Brake Pads Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Brake Pads Market Size Outlook, $ Million, 2021 to 2030

3.2 Brake Pads Market Outlook by Type, $ Million, 2021 to 2030

3.3 Brake Pads Market Outlook by Product, $ Million, 2021 to 2030

3.4 Brake Pads Market Outlook by Application, $ Million, 2021 to 2030

3.5 Brake Pads Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Brake Pads Industry

4.2 Key Market Trends in Brake Pads Industry

4.3 Potential Opportunities in Brake Pads Industry

4.4 Key Challenges in Brake Pads Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Brake Pads Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Brake Pads Market Outlook by Segments

7.1 Brake Pads Market Outlook by Segments, $ Million, 2021- 2030

By Type

Non-asbestos Organic Brake Pads

Low Metallic NAO Brake Pads

Semi Metallic Brake Pads

Ceramic Brake Pads

By Position

Front

Front & Rear

By Material

Semi-Metallic

Non-Asbestos Organic

Low-Metallic NAO

Ceramic

By Vehicle

PCV

LCV

HCV

Two-wheelers

By Application

Vehicles OEM Industry

Vehicles Aftermarket Industry

By Sales Channel

OEM

Aftermarket

8 North America Brake Pads Market Analysis and Outlook To 2030

8.1 Introduction to North America Brake Pads Markets in 2024

8.2 North America Brake Pads Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Brake Pads Market size Outlook by Segments, 2021-2030

By Type

Non-asbestos Organic Brake Pads

Low Metallic NAO Brake Pads

Semi Metallic Brake Pads

Ceramic Brake Pads

By Position

Front

Front & Rear

By Material

Semi-Metallic

Non-Asbestos Organic

Low-Metallic NAO

Ceramic

By Vehicle

PCV

LCV

HCV

Two-wheelers

By Application

Vehicles OEM Industry

Vehicles Aftermarket Industry

By Sales Channel

OEM

Aftermarket

9 Europe Brake Pads Market Analysis and Outlook To 2030

9.1 Introduction to Europe Brake Pads Markets in 2024

9.2 Europe Brake Pads Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Brake Pads Market Size Outlook by Segments, 2021-2030

By Type

Non-asbestos Organic Brake Pads

Low Metallic NAO Brake Pads

Semi Metallic Brake Pads

Ceramic Brake Pads

By Position

Front

Front & Rear

By Material

Semi-Metallic

Non-Asbestos Organic

Low-Metallic NAO

Ceramic

By Vehicle

PCV

LCV

HCV

Two-wheelers

By Application

Vehicles OEM Industry

Vehicles Aftermarket Industry

By Sales Channel

OEM

Aftermarket

10 Asia Pacific Brake Pads Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Brake Pads Markets in 2024

10.2 Asia Pacific Brake Pads Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Brake Pads Market size Outlook by Segments, 2021-2030

By Type

Non-asbestos Organic Brake Pads

Low Metallic NAO Brake Pads

Semi Metallic Brake Pads

Ceramic Brake Pads

By Position

Front

Front & Rear

By Material

Semi-Metallic

Non-Asbestos Organic

Low-Metallic NAO

Ceramic

By Vehicle

PCV

LCV

HCV

Two-wheelers

By Application

Vehicles OEM Industry

Vehicles Aftermarket Industry

By Sales Channel

OEM

Aftermarket

11 South America Brake Pads Market Analysis and Outlook To 2030

11.1 Introduction to South America Brake Pads Markets in 2024

11.2 South America Brake Pads Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Brake Pads Market size Outlook by Segments, 2021-2030

By Type

Non-asbestos Organic Brake Pads

Low Metallic NAO Brake Pads

Semi Metallic Brake Pads

Ceramic Brake Pads

By Position

Front

Front & Rear

By Material

Semi-Metallic

Non-Asbestos Organic

Low-Metallic NAO

Ceramic

By Vehicle

PCV

LCV

HCV

Two-wheelers

By Application

Vehicles OEM Industry

Vehicles Aftermarket Industry

By Sales Channel

OEM

Aftermarket

12 Middle East and Africa Brake Pads Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Brake Pads Markets in 2024

12.2 Middle East and Africa Brake Pads Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Brake Pads Market size Outlook by Segments, 2021-2030

By Type

Non-asbestos Organic Brake Pads

Low Metallic NAO Brake Pads

Semi Metallic Brake Pads

Ceramic Brake Pads

By Position

Front

Front & Rear

By Material

Semi-Metallic

Non-Asbestos Organic

Low-Metallic NAO

Ceramic

By Vehicle

PCV

LCV

HCV

Two-wheelers

By Application

Vehicles OEM Industry

Vehicles Aftermarket Industry

By Sales Channel

OEM

Aftermarket

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

ACDelco

Akebono Brake Industry Co. Ltd

Continental Automotive GmbH

Federal-Mogul LLC

Honeywell International Inc

ITT Inc

MAT Holdings Inc

Nisshinbo Holdings Inc

Robert Bosch GmbH

TRW Automotive Holdings Corp.

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Non-asbestos Organic Brake Pads

Low Metallic NAO Brake Pads

Semi Metallic Brake Pads

Ceramic Brake Pads

By Position

Front

Front & Rear

By Material

Semi-Metallic

Non-Asbestos Organic

Low-Metallic NAO

Ceramic

By Vehicle

PCV

LCV

HCV

Two-wheelers

By Application

Vehicles OEM Industry

Vehicles Aftermarket Industry

By Sales Channel

OEM

Aftermarket

The global Brake Pads Market is one of the lucrative growth markets, poised to register a 5.3% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

ACDelco, Akebono Brake Industry Co. Ltd, Continental Automotive GmbH, Federal-Mogul LLC, Honeywell International Inc, ITT Inc, MAT Holdings Inc, Nisshinbo Holdings Inc, Robert Bosch GmbH, TRW Automotive Holdings Corp.

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume