The global Brake Fluids Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Petroleum, Non-petroleum), By Product (DOT 3, DOT 4, DOT 5, DOT 5.1), By Application (Light Commercial Vehicles, Passenger Cars, Others).

Brake fluids are specialized hydraulic fluids used in automotive brake systems to transmit force from the brake pedal to the brake pads or shoes, enabling effective braking in 2024. These fluids must meet stringent performance requirements, including high boiling points, low viscosity at low temperatures, corrosion resistance, and compatibility with rubber seals and components. Brake fluids are typically glycol-based or silicone-based, with glycol-based fluids being more common in automotive applications due to their superior performance characteristics. Glycol-based brake fluids, such as DOT 3, DOT 4, and DOT 5.1, are hygroscopic and absorb moisture from the atmosphere over time, necessitating regular replacement to maintain brake system performance and prevent corrosion. Silicone-based brake fluids, such as DOT 5, are non-hygroscopic and offer higher temperature stability but are less commonly used due to compatibility issues with certain brake system components. Proper selection and maintenance of brake fluids are essential for ensuring safe and reliable brake operation, as degraded or contaminated brake fluid can lead to brake system failure and compromise vehicle safety.

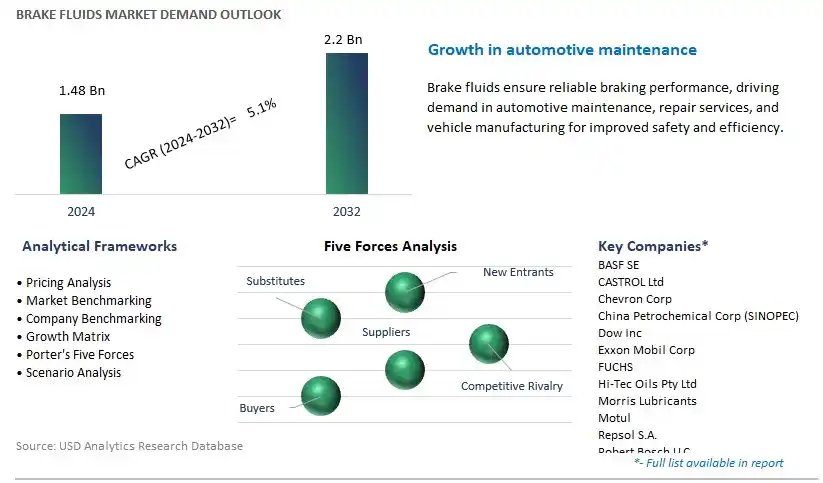

The market report analyses the leading companies in the industry including BASF SE, CASTROL Ltd, Chevron Corp, China Petrochemical Corp (SINOPEC), Dow Inc, Exxon Mobil Corp, FUCHS, Hi-Tec Oils Pty Ltd, Morris Lubricants, Motul, Repsol S.A., Robert Bosch LLC, TotalEnergies SE, Valvoline Inc, and others.

A prominent trend in the brake fluids market is the increasing emphasis on vehicle safety and performance, driven by regulatory mandates, technological advancements, and consumer demand for reliable braking systems. With the automotive industry focusing on enhancing vehicle safety features and performance capabilities, there is a growing need for high-quality brake fluids that can withstand extreme temperatures, provide consistent braking performance, and ensure reliable operation under various driving conditions. This trend is reshaping the brake fluids market, with manufacturers developing advanced formulations that meet stringent performance standards and regulatory requirements, driving innovation and market growth in the automotive sector.

The primary driver fueling the growth of the brake fluids market is the growth in automotive production and vehicle ownership worldwide, particularly in emerging economies experiencing rapid urbanization and industrialization. As the global automotive industry continues to expand, driven by rising disposable incomes, urbanization, and infrastructure development, the demand for brake fluids is expected to increase proportionally, driven by the need for regular maintenance and replacement of brake systems in vehicles. Additionally, stringent safety regulations and vehicle inspection requirements further contribute to market demand, as manufacturers and vehicle owners prioritize the maintenance of braking systems to ensure safe and reliable operation on the road.

An emerging opportunity within the brake fluids market lies in the development of high-performance and environmentally friendly formulations that meet evolving industry requirements and sustainability goals. With increasing awareness of environmental issues and regulatory pressures to reduce emissions and hazardous chemicals, there is a growing demand for brake fluids that are not only effective in performance but also eco-friendly and biodegradable. Manufacturers can capitalize on this opportunity by investing in research and development initiatives to innovate new formulations using renewable and bio-based ingredients, while maintaining or enhancing performance characteristics such as boiling point, viscosity, and corrosion resistance. By offering sustainable and high-performance brake fluids, manufacturers can differentiate themselves in the market, meet customer expectations, and contribute to a greener automotive industry ecosystem.

The non-petroleum segment is the largest in the Brake Fluids Market by type. This segment's dominance is primarily due to the superior performance and environmental benefits offered by synthetic, non-petroleum-based brake fluids. Non-petroleum brake fluids, such as glycol-ether and silicone-based fluids, exhibit higher boiling points and better stability under extreme temperatures compared to their petroleum counterparts. These properties are crucial for ensuring reliable brake performance and safety, particularly in high-performance and heavy-duty vehicles that operate under severe conditions. Moreover, non-petroleum brake fluids are less prone to absorb moisture, which enhances their longevity and effectiveness. The shift towards more environmentally friendly and sustainable automotive components is also driving the preference for non-petroleum brake fluids, as they tend to be less harmful to the environment and comply with stringent regulatory standards. The growing adoption of electric and hybrid vehicles, which often require advanced braking systems, further fuels the demand for non-petroleum brake fluids. These factors collectively contribute to the non-petroleum segment's leading position in the brake fluids market.

The DOT 5.1 segment is the fastest-growing in the Brake Fluids Market by product. This rapid growth is driven by the superior performance characteristics of DOT 5.1 brake fluids, which meet the increasing demands of modern braking systems. DOT 5.1 brake fluids have a higher boiling point compared to DOT 3 and DOT 4 fluids, making them particularly suitable for high-performance and heavy-duty applications where braking systems are subjected to extreme temperatures and stress. The enhanced thermal stability and lower viscosity at low temperatures ensure consistent and reliable braking performance, which is crucial for advanced safety features in contemporary vehicles. As automotive manufacturers continue to integrate advanced driver-assistance systems (ADAS) and other high-performance features, the demand for reliable and robust brake fluids like DOT 5.1 increases. Additionally, the growing adoption of electric and hybrid vehicles, which often require more efficient and durable braking systems, further propels the demand for DOT 5.1 brake fluids. The trend towards improved vehicle safety and performance standards globally reinforces the rapid adoption and growth of the DOT 5.1 segment in the brake fluids market.

The passenger cars segment is the largest in the Brake Fluids Market by application. The large revenue share is attributed to the sheer volume of passenger cars in operation globally, which far exceeds the number of light commercial vehicles and other types of vehicles. Passenger cars, ranging from compact models to luxury sedans and SUVs, require regular maintenance, including brake fluid replacement, to ensure safety and optimal performance. The continuous growth of the automotive industry, particularly in emerging economies, has led to a significant increase in the production and sales of passenger cars. This expansion directly translates to a higher demand for brake fluids. Additionally, advancements in automotive technology, including the integration of sophisticated braking systems and driver-assistance features, necessitate the use of high-quality brake fluids to maintain efficiency and reliability. The emphasis on vehicle safety and performance standards globally also drives the frequent use of brake fluids in passenger cars. As more consumers prioritize vehicle safety and manufacturers innovate with advanced braking technologies, the passenger cars segment will continue to be the largest and a crucial driver of the brake fluids market.

By Type

Petroleum

Non-petroleum

By Product

DOT 3

DOT 4

DOT 5

DOT 5.1

By Application

Light Commercial Vehicles

Passenger Cars

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

BASF SE

CASTROL Ltd

Chevron Corp

China Petrochemical Corp (SINOPEC)

Dow Inc

Exxon Mobil Corp

FUCHS

Hi-Tec Oils Pty Ltd

Morris Lubricants

Motul

Repsol S.A.

Robert Bosch LLC

TotalEnergies SE

Valvoline Inc

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Brake Fluids Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Brake Fluids Market Size Outlook, $ Million, 2021 to 2032

3.2 Brake Fluids Market Outlook by Type, $ Million, 2021 to 2032

3.3 Brake Fluids Market Outlook by Product, $ Million, 2021 to 2032

3.4 Brake Fluids Market Outlook by Application, $ Million, 2021 to 2032

3.5 Brake Fluids Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Brake Fluids Industry

4.2 Key Market Trends in Brake Fluids Industry

4.3 Potential Opportunities in Brake Fluids Industry

4.4 Key Challenges in Brake Fluids Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Brake Fluids Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Brake Fluids Market Outlook by Segments

7.1 Brake Fluids Market Outlook by Segments, $ Million, 2021- 2032

By Type

Petroleum

Non-petroleum

By Product

DOT 3

DOT 4

DOT 5

DOT 5.1

By Application

Light Commercial Vehicles

Passenger Cars

Others

8 North America Brake Fluids Market Analysis and Outlook To 2032

8.1 Introduction to North America Brake Fluids Markets in 2024

8.2 North America Brake Fluids Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Brake Fluids Market size Outlook by Segments, 2021-2032

By Type

Petroleum

Non-petroleum

By Product

DOT 3

DOT 4

DOT 5

DOT 5.1

By Application

Light Commercial Vehicles

Passenger Cars

Others

9 Europe Brake Fluids Market Analysis and Outlook To 2032

9.1 Introduction to Europe Brake Fluids Markets in 2024

9.2 Europe Brake Fluids Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Brake Fluids Market Size Outlook by Segments, 2021-2032

By Type

Petroleum

Non-petroleum

By Product

DOT 3

DOT 4

DOT 5

DOT 5.1

By Application

Light Commercial Vehicles

Passenger Cars

Others

10 Asia Pacific Brake Fluids Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Brake Fluids Markets in 2024

10.2 Asia Pacific Brake Fluids Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Brake Fluids Market size Outlook by Segments, 2021-2032

By Type

Petroleum

Non-petroleum

By Product

DOT 3

DOT 4

DOT 5

DOT 5.1

By Application

Light Commercial Vehicles

Passenger Cars

Others

11 South America Brake Fluids Market Analysis and Outlook To 2032

11.1 Introduction to South America Brake Fluids Markets in 2024

11.2 South America Brake Fluids Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Brake Fluids Market size Outlook by Segments, 2021-2032

By Type

Petroleum

Non-petroleum

By Product

DOT 3

DOT 4

DOT 5

DOT 5.1

By Application

Light Commercial Vehicles

Passenger Cars

Others

12 Middle East and Africa Brake Fluids Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Brake Fluids Markets in 2024

12.2 Middle East and Africa Brake Fluids Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Brake Fluids Market size Outlook by Segments, 2021-2032

By Type

Petroleum

Non-petroleum

By Product

DOT 3

DOT 4

DOT 5

DOT 5.1

By Application

Light Commercial Vehicles

Passenger Cars

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

BASF SE

CASTROL Ltd

Chevron Corp

China Petrochemical Corp (SINOPEC)

Dow Inc

Exxon Mobil Corp

FUCHS

Hi-Tec Oils Pty Ltd

Morris Lubricants

Motul

Repsol S.A.

Robert Bosch LLC

TotalEnergies SE

Valvoline Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Petroleum

Non-petroleum

By Product

DOT 3

DOT 4

DOT 5

DOT 5.1

By Application

Light Commercial Vehicles

Passenger Cars

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Brake Fluids Market Size is valued at $1.48 Billion in 2024 and is forecast to register a growth rate (CAGR) of 5.1% to reach $2.2 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

BASF SE, CASTROL Ltd, Chevron Corp, China Petrochemical Corp (SINOPEC), Dow Inc, Exxon Mobil Corp, FUCHS, Hi-Tec Oils Pty Ltd, Morris Lubricants, Motul, Repsol S.A., Robert Bosch LLC, TotalEnergies SE, Valvoline Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume