The global Boom Trucks Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Type (Below 10 Metric Tons, 10 to 20 Metric Tons, 20 to 30 Metric Tons, 30 to 40 Metric Tons, 40 to Metric Tons, Above 50 Metric Tons), By Application (Rental, Construction, Utility, Telecommunication), By Class (Class 4, Class 5, Class 6, Class 7, Class 8).

The boom trucks market in 2024 serves industries requiring versatile lifting and material handling solutions, offering a range of trucks equipped with hydraulic booms for lifting heavy loads to heights and distances unreachable by conventional equipment. Boom trucks, also known as bucket trucks or cherry pickers, find applications in construction, utility maintenance, forestry, telecommunications, and other sectors requiring elevated work platforms. With the increasing demand for infrastructure development, urbanization, and maintenance activities, the need for efficient and flexible lifting solutions continues to grow. Manufacturers in this market focus on developing boom trucks that offer robust construction, precise control, and safety features to ensure reliable performance in demanding work environments. Moreover, as industries adopt advanced technologies such as telematics and remote operation, boom trucks integrate features such as load sensing, stability control, and remote monitoring to enhance productivity and safety for operators. With a strong emphasis on versatility, efficiency, and safety, the boom trucks market enables industries to tackle a wide range of lifting and access challenges, contributing to improved productivity and operational excellence.

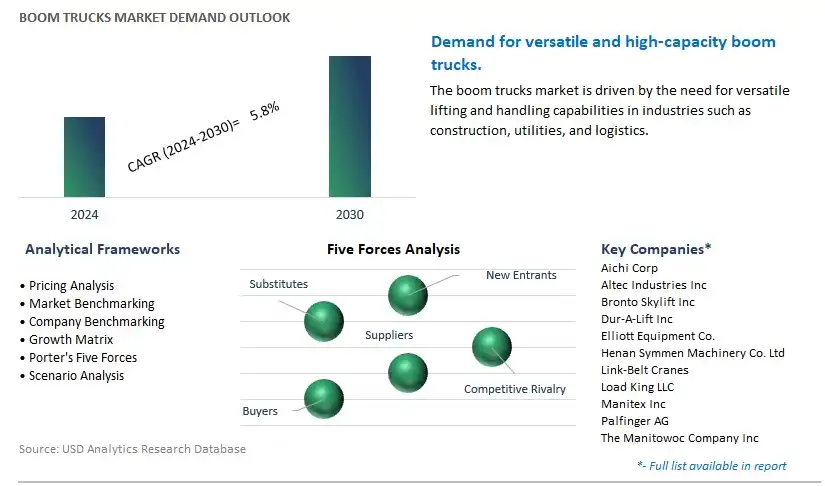

The global Boom Trucks market is highly competitive with a large number of companies focusing on niche market segments. Amidst intense competitive conditions, Boom Trucks Companies are investing in new product launches and strengthening distribution channels. Key companies operating in the Boom Trucks Market Industry include- Aichi Corp, Altec Industries Inc, Bronto Skylift Inc, Dur-A-Lift Inc, Elliott Equipment Co., Henan Symmen Machinery Co. Ltd, Link-Belt Cranes, Load King LLC, Manitex Inc, Palfinger AG, The Manitowoc Company Inc.

A prominent trend in the Boom Trucks market is the adoption of telematics and Internet of Things (IoT) integration. With increasing emphasis on efficiency, safety, and fleet management, there's a growing demand for boom trucks equipped with telematics systems and IoT sensors. These technologies enable remote monitoring of equipment health, real-time tracking of vehicle location and performance, predictive maintenance scheduling, and data-driven decision-making for fleet operators. Manufacturers are responding to this trend by incorporating telematics and IoT capabilities into boom trucks, offering fleet managers greater visibility and control over their assets, optimizing operations, and improving overall productivity. This trend reflects a broader industry shift towards digitization and connectivity in the construction and logistics sectors, driving market growth and opportunities for boom truck manufacturers to provide value-added solutions.

The primary driver propelling the growth of the Boom Trucks market is the expansion of construction and infrastructure projects worldwide. With urbanization, population growth, and economic development driving demand for new buildings, roads, bridges, and utilities, there's an increasing need for versatile and efficient lifting equipment such as boom trucks. These vehicles play a critical role in construction, maintenance, and material handling tasks, offering flexibility, mobility, and reach to access elevated work areas and transport heavy loads. Additionally, the rise of infrastructure investment initiatives, such as government stimulus packages and public-private partnerships, further fuels demand for boom trucks as essential tools for completing projects safely and efficiently. As construction activity continues to grow globally, the market for boom trucks is expected to experience sustained growth, presenting opportunities for manufacturers to expand their customer base and market presence.

An Market Opportunity ripe for exploration within the Boom Trucks market is the development of advanced safety features and operator assistance systems. With a focus on reducing accidents, improving operator efficiency, and enhancing worksite safety, there's a growing demand for boom trucks equipped with advanced safety technologies. Manufacturers can capitalize on this Market Opportunity by integrating features such as collision avoidance systems, blind-spot monitoring, automatic emergency braking, and intelligent load monitoring into boom trucks, helping to prevent accidents and minimize risks during operation. Additionally, there's potential to develop operator assistance systems, such as semi-autonomous controls, remote operation capabilities, and augmented reality interfaces, to improve operator productivity, precision, and situational awareness while operating boom trucks. By investing in research and development of advanced safety features and operator assistance systems, manufacturers can differentiate their products, address customer concerns about safety and efficiency, and maintain a competitive edge in the booming boom truck market.

By Type

Below 10 Metric Tons

10 to 20 Metric Tons

20 to 30 Metric Tons

30 to 40 Metric Tons

40 to Metric Tons

Above 50 Metric Tons

By Application

Rental

Construction

Utility

Telecommunication

By Class

Class 4

Class 5

Class 6

Class 7

Class 8Geographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa

Aichi Corp

Altec Industries Inc

Bronto Skylift Inc

Dur-A-Lift Inc

Elliott Equipment Co.

Henan Symmen Machinery Co. Ltd

Link-Belt Cranes

Load King LLC

Manitex Inc

Palfinger AG

The Manitowoc Company Inc

*- List not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Boom Trucks Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Boom Trucks Market Size Outlook, $ Million, 2021 to 2030

3.2 Boom Trucks Market Outlook by Type, $ Million, 2021 to 2030

3.3 Boom Trucks Market Outlook by Product, $ Million, 2021 to 2030

3.4 Boom Trucks Market Outlook by Application, $ Million, 2021 to 2030

3.5 Boom Trucks Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Boom Trucks Industry

4.2 Key Market Trends in Boom Trucks Industry

4.3 Potential Opportunities in Boom Trucks Industry

4.4 Key Challenges in Boom Trucks Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Boom Trucks Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Boom Trucks Market Outlook by Segments

7.1 Boom Trucks Market Outlook by Segments, $ Million, 2021- 2030

By Type

Below 10 Metric Tons

10 to 20 Metric Tons

20 to 30 Metric Tons

30 to 40 Metric Tons

40 to Metric Tons

Above 50 Metric Tons

By Application

Rental

Construction

Utility

Telecommunication

By Class

Class 4

Class 5

Class 6

Class 7

Class 8

8 North America Boom Trucks Market Analysis and Outlook To 2030

8.1 Introduction to North America Boom Trucks Markets in 2024

8.2 North America Boom Trucks Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Boom Trucks Market size Outlook by Segments, 2021-2030

By Type

Below 10 Metric Tons

10 to 20 Metric Tons

20 to 30 Metric Tons

30 to 40 Metric Tons

40 to Metric Tons

Above 50 Metric Tons

By Application

Rental

Construction

Utility

Telecommunication

By Class

Class 4

Class 5

Class 6

Class 7

Class 8

9 Europe Boom Trucks Market Analysis and Outlook To 2030

9.1 Introduction to Europe Boom Trucks Markets in 2024

9.2 Europe Boom Trucks Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Boom Trucks Market Size Outlook by Segments, 2021-2030

By Type

Below 10 Metric Tons

10 to 20 Metric Tons

20 to 30 Metric Tons

30 to 40 Metric Tons

40 to Metric Tons

Above 50 Metric Tons

By Application

Rental

Construction

Utility

Telecommunication

By Class

Class 4

Class 5

Class 6

Class 7

Class 8

10 Asia Pacific Boom Trucks Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Boom Trucks Markets in 2024

10.2 Asia Pacific Boom Trucks Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Boom Trucks Market size Outlook by Segments, 2021-2030

By Type

Below 10 Metric Tons

10 to 20 Metric Tons

20 to 30 Metric Tons

30 to 40 Metric Tons

40 to Metric Tons

Above 50 Metric Tons

By Application

Rental

Construction

Utility

Telecommunication

By Class

Class 4

Class 5

Class 6

Class 7

Class 8

11 South America Boom Trucks Market Analysis and Outlook To 2030

11.1 Introduction to South America Boom Trucks Markets in 2024

11.2 South America Boom Trucks Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Boom Trucks Market size Outlook by Segments, 2021-2030

By Type

Below 10 Metric Tons

10 to 20 Metric Tons

20 to 30 Metric Tons

30 to 40 Metric Tons

40 to Metric Tons

Above 50 Metric Tons

By Application

Rental

Construction

Utility

Telecommunication

By Class

Class 4

Class 5

Class 6

Class 7

Class 8

12 Middle East and Africa Boom Trucks Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Boom Trucks Markets in 2024

12.2 Middle East and Africa Boom Trucks Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Boom Trucks Market size Outlook by Segments, 2021-2030

By Type

Below 10 Metric Tons

10 to 20 Metric Tons

20 to 30 Metric Tons

30 to 40 Metric Tons

40 to Metric Tons

Above 50 Metric Tons

By Application

Rental

Construction

Utility

Telecommunication

By Class

Class 4

Class 5

Class 6

Class 7

Class 8

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

Aichi Corp

Altec Industries Inc

Bronto Skylift Inc

Dur-A-Lift Inc

Elliott Equipment Co.

Henan Symmen Machinery Co. Ltd

Link-Belt Cranes

Load King LLC

Manitex Inc

Palfinger AG

The Manitowoc Company Inc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Below 10 Metric Tons

10 to 20 Metric Tons

20 to 30 Metric Tons

30 to 40 Metric Tons

40 to Metric Tons

Above 50 Metric Tons

By Application

Rental

Construction

Utility

Telecommunication

By Class

Class 4

Class 5

Class 6

Class 7

Class 8

The global Boom Trucks Market is one of the lucrative growth markets, poised to register a 5.8% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Aichi Corp, Altec Industries Inc, Bronto Skylift Inc, Dur-A-Lift Inc, Elliott Equipment Co., Henan Symmen Machinery Co. Ltd, Link-Belt Cranes, Load King LLC, Manitex Inc, Palfinger AG, The Manitowoc Company Inc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume