The global Boom Lifts Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Engine (Electric, Engine-Powered), By Product (Trailer Mounted Booms, Vehicle Mounted Boom, Crawler/Spider Booms, Others), By End-User (Rental, Construction & Building, Mining, Transportation & Logistics,, Landscaping & Orchard Work, Others).

The market for boom lifts is enhancing efficiency and safety in construction and maintenance by providing versatile and maneuverable aerial platforms for working at heights. Key trends shaping the future of this industry include advancements in boom lift designs, such as articulated, telescopic, and hybrid models, offering increased reach, precision control, and operator comfort. Additionally, developments in electric and hybrid power systems contribute to environmental sustainability and reduced emissions, aligning with green construction practices and regulatory requirements. Moreover, the integration of smart technologies, such as sensors, GPS tracking, and remote monitoring, enhances operational efficiency, fleet management, and safety compliance for boom lift users and rental companies. As industries continue to prioritize productivity, worker safety, and environmental responsibility, the demand for boom lifts as essential equipment for elevated work applications is expected to grow, driving further innovation and market expansion in this sector.

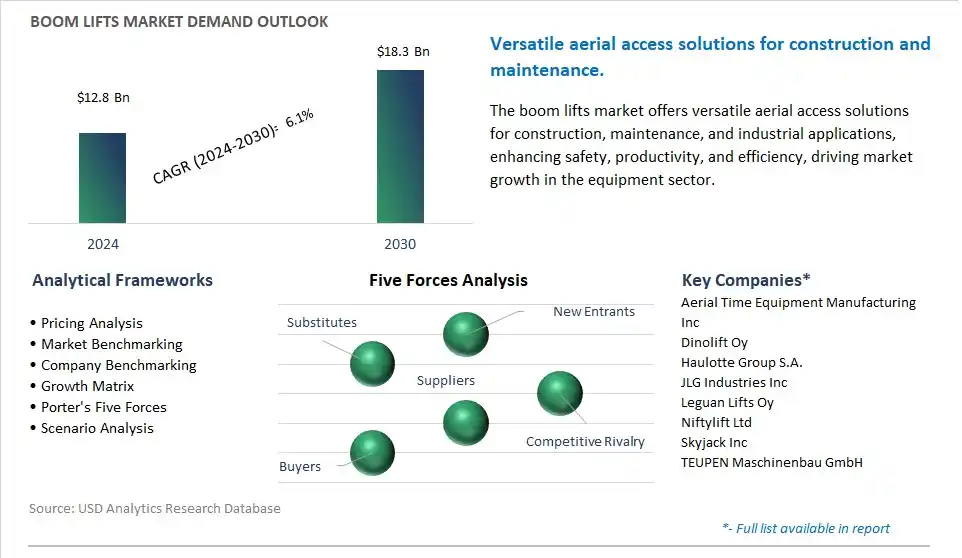

The market report analyses the leading companies in the industry including Aerial Time Equipment Manufacturing Inc, Dinolift Oy, Haulotte Group S.A., JLG Industries Inc, Leguan Lifts Oy, Niftylift Ltd, Skyjack Inc, TEUPEN Maschinenbau GmbH.

A prominent trend in the market for boom lifts is the increased emphasis on safety and efficiency in construction projects. With stricter regulations and heightened awareness of workplace safety, construction companies are prioritizing equipment that enhances worker safety and productivity. Boom lifts, also known as cherry pickers or aerial work platforms, provide elevated access for tasks such as building maintenance, construction, and installation. The trend towards using boom lifts equipped with advanced safety features, such as anti-tip sensors, fall arrest systems, and automatic leveling, reflects the industry's commitment to reducing accidents and improving efficiency on job sites. As safety regulations become more stringent and construction projects require increased precision and speed, the demand for boom lifts with enhanced safety and efficiency features is expected to grow, driving market expansion and innovation in equipment design.

A key driver behind the demand for boom lifts is the growth in construction and infrastructure development worldwide. Boom lifts are essential equipment for accessing elevated work areas in construction projects, industrial maintenance, and facility management. As populations grow, urbanization accelerates, and economies invest in infrastructure projects, there is an increasing demand for construction equipment such as boom lifts to support building construction, renovation, and maintenance activities. Additionally, the expansion of sectors such as telecommunications, energy, and logistics further drives the need for boom lifts for tasks such as installing equipment, maintaining utility lines, and handling goods in warehouses. As construction activity continues to rise globally, fueled by population growth and urbanization trends, the demand for boom lifts is expected to remain strong, driving market growth and investment in lifting equipment.

An emerging opportunity in the market for boom lifts lies in the integration of telematics and Internet of Things (IoT) technologies. Opportunities exist to enhance boom lifts with telematics systems that enable remote monitoring, diagnostics, and predictive maintenance capabilities. Telematics solutions can provide real-time data on equipment usage, location, and performance, allowing rental companies and fleet managers to optimize utilization, schedule maintenance, and improve operational efficiency. Additionally, IoT sensors integrated into boom lifts can provide insights into equipment health, operator behavior, and job site conditions, enabling proactive safety measures and performance optimization. By embracing telematics and IoT technologies, manufacturers of boom lifts can differentiate their products in the market, improve customer satisfaction, and drive innovation in equipment management and maintenance practices, contributing to safer and more efficient construction operations.

The boom lifts market encompasses diverse crucial stages, beginning with raw material suppliers including ArcelorMittal and Nippon Steel, providing high-strength steel for structural components, and hydraulic equipment manufacturers including Bosch Rexroth and Parker Hannifin supplying hydraulic components. Engine manufacturers including Cummins and Caterpillar contribute power sources, while electrical component suppliers including Delphi Technologies and TE Connectivity provide wiring and control systems. Boom lift manufacturing is characterized by the presence of established manufacturers including JLG Industries and Haulotte Group, utilizing processes including welding, machining, and assembly to create boom lifts. Distribution networks connect manufacturers with equipment distributors, rental companies, and end-user customers, facilitating the delivery of boom lifts to various industries.

Rental companies and manufacturers provide essential support services including delivery, operator training, and maintenance to ensure safe and efficient operation of boom lifts. Construction companies and facility maintenance teams rely on these services for both rented and owned equipment, emphasizing the importance of regular maintenance and proper usage for optimal performance and safety in various applications.

In the Boom Lifts Market, the largest segment is engine-powered boom lifts, and this dominance can be attributed to diverse key factors. Engine-powered boom lifts offer higher power and versatility compared to electric models, making them suitable for a wide range of outdoor applications in construction, maintenance, and industrial settings. These lifts are capable of operating on rough terrain and can reach greater heights, making them essential for tasks such as building construction, tree trimming, and exterior maintenance of tall structures. Additionally, engine-powered boom lifts provide longer operating hours and faster cycle times, improving productivity and efficiency on job sites. In addition, the availability of various engine options, including diesel and gasoline, allows users to choose the most suitable lift for their specific needs, further driving the popularity of engine-powered models in the market. Further, advancements in engine technology have led to improved fuel efficiency and reduced emissions, addressing concerns about environmental impact and regulatory compliance. Overall, engine-powered boom lifts emerge as the largest segment in the market due to their versatility, power, and suitability for demanding outdoor applications.

In the Boom Lifts Market, the fastest-growing segment is crawler/spider booms, driven by diverse significant factors. Crawler/spider booms offer unique advantages over traditional boom lift types, making them increasingly favored for a variety of applications. These booms are equipped with tracks or spider legs that provide exceptional stability and maneuverability on uneven or rough terrain, including slopes, gravel, and uneven surfaces. This capability allows crawler/spider booms to access hard-to-reach areas where traditional boom lifts may struggle to operate effectively. Additionally, crawler/spider booms feature compact designs, making them ideal for use in confined spaces such as urban construction sites or indoor facilities like warehouses and factories. In addition, advancements in technology have led to improvements in crawler/spider boom performance, including increased reach, enhanced safety features, and improved efficiency, further driving their adoption in the market. Further, the versatility and adaptability of crawler/spider booms make them suitable for a wide range of industries, including construction, maintenance, and event management, contributing to their rapid growth in the boom lifts market. Overall, crawler/spider booms emerge as the fastest-growing segment due to their unique capabilities, versatility, and suitability for various applications in challenging environments.

In the Boom Lifts Market, the fastest-growing segment is rental, driven by diverse significant factors. The rental segment is experiencing rapid growth due to the increasing trend among businesses and contractors to opt for renting rather than purchasing boom lifts. Renting offers numerous advantages, including cost-effectiveness, flexibility, and access to a wide range of equipment options tailored to specific project needs. Additionally, renting allows businesses to avoid the upfront costs associated with purchasing boom lifts, making it an attractive option for companies with limited capital or short-term projects. In addition, the growing emphasis on operational efficiency and asset utilization drives the demand for rental services, as businesses seek to maximize productivity and minimize downtime by having access to well-maintained and up-to-date equipment. Further, rental companies often provide additional services such as equipment training, maintenance, and support, further enhancing their appeal to customers. Overall, the rental segment is experiencing fast growth in the Boom Lifts Market due to its cost-effectiveness, flexibility, and ability to meet the evolving needs of businesses and contractors in various industries.

By Engine

Electric

Engine-Powered

By Product

Trailer Mounted Booms

Vehicle Mounted Boom

Crawler/Spider Booms

Others

By End-User

Rental

Construction & Building

Mining

Transportation & Logistics,

Landscaping & Orchard Work

Others

Aerial Time Equipment Manufacturing Inc

Dinolift Oy

Haulotte Group S.A.

JLG Industries Inc

Leguan Lifts Oy

Niftylift Ltd

Skyjack Inc

TEUPEN Maschinenbau GmbH

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Boom Lifts Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Boom Lifts Market Size Outlook, $ Million, 2021 to 2030

3.2 Boom Lifts Market Outlook by Type, $ Million, 2021 to 2030

3.3 Boom Lifts Market Outlook by Product, $ Million, 2021 to 2030

3.4 Boom Lifts Market Outlook by Application, $ Million, 2021 to 2030

3.5 Boom Lifts Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Boom Lifts Industry

4.2 Key Market Trends in Boom Lifts Industry

4.3 Potential Opportunities in Boom Lifts Industry

4.4 Key Challenges in Boom Lifts Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Boom Lifts Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Boom Lifts Market Outlook by Segments

7.1 Boom Lifts Market Outlook by Segments, $ Million, 2021- 2030

By Engine

Electric

Engine-Powered

By Product

Trailer Mounted Booms

Vehicle Mounted Boom

Crawler/Spider Booms

Others

By End-User

Rental

Construction & Building

Mining

Transportation & Logistics,

Landscaping & Orchard Work

Others

8 North America Boom Lifts Market Analysis and Outlook To 2030

8.1 Introduction to North America Boom Lifts Markets in 2024

8.2 North America Boom Lifts Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Boom Lifts Market size Outlook by Segments, 2021-2030

By Engine

Electric

Engine-Powered

By Product

Trailer Mounted Booms

Vehicle Mounted Boom

Crawler/Spider Booms

Others

By End-User

Rental

Construction & Building

Mining

Transportation & Logistics,

Landscaping & Orchard Work

Others

9 Europe Boom Lifts Market Analysis and Outlook To 2030

9.1 Introduction to Europe Boom Lifts Markets in 2024

9.2 Europe Boom Lifts Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Boom Lifts Market Size Outlook by Segments, 2021-2030

By Engine

Electric

Engine-Powered

By Product

Trailer Mounted Booms

Vehicle Mounted Boom

Crawler/Spider Booms

Others

By End-User

Rental

Construction & Building

Mining

Transportation & Logistics,

Landscaping & Orchard Work

Others

10 Asia Pacific Boom Lifts Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Boom Lifts Markets in 2024

10.2 Asia Pacific Boom Lifts Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Boom Lifts Market size Outlook by Segments, 2021-2030

By Engine

Electric

Engine-Powered

By Product

Trailer Mounted Booms

Vehicle Mounted Boom

Crawler/Spider Booms

Others

By End-User

Rental

Construction & Building

Mining

Transportation & Logistics,

Landscaping & Orchard Work

Others

11 South America Boom Lifts Market Analysis and Outlook To 2030

11.1 Introduction to South America Boom Lifts Markets in 2024

11.2 South America Boom Lifts Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Boom Lifts Market size Outlook by Segments, 2021-2030

By Engine

Electric

Engine-Powered

By Product

Trailer Mounted Booms

Vehicle Mounted Boom

Crawler/Spider Booms

Others

By End-User

Rental

Construction & Building

Mining

Transportation & Logistics,

Landscaping & Orchard Work

Others

12 Middle East and Africa Boom Lifts Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Boom Lifts Markets in 2024

12.2 Middle East and Africa Boom Lifts Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Boom Lifts Market size Outlook by Segments, 2021-2030

By Engine

Electric

Engine-Powered

By Product

Trailer Mounted Booms

Vehicle Mounted Boom

Crawler/Spider Booms

Others

By End-User

Rental

Construction & Building

Mining

Transportation & Logistics,

Landscaping & Orchard Work

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Aerial Time Equipment Manufacturing Inc

Dinolift Oy

Haulotte Group S.A.

JLG Industries Inc

Leguan Lifts Oy

Niftylift Ltd

Skyjack Inc

TEUPEN Maschinenbau GmbH

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Engine

Electric

Engine-Powered

By Product

Trailer Mounted Booms

Vehicle Mounted Boom

Crawler/Spider Booms

Others

By End-User

Rental

Construction & Building

Mining

Transportation & Logistics,

Landscaping & Orchard Work

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Boom Lifts is forecast to reach $18.3 Billion in 2030 from $12.8 Billion in 2024, registering a CAGR of 6.1% over the outlook period

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Aerial Time Equipment Manufacturing Inc, Dinolift Oy, Haulotte Group S.A., JLG Industries Inc, Leguan Lifts Oy, Niftylift Ltd, Skyjack Inc, TEUPEN Maschinenbau GmbH

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume