The global Blue Hydrogen Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Technology (Steam Methane Reforming Technology, Gas Partial Oxidation, Auto Thermal Reforming), By Transportation Mode (Pipeline, Cryogenic Liquid Tankers), By Application (Chemicals, Refinery, Power Generation, Others).

Blue hydrogen is a form of hydrogen produced from natural gas or methane through steam methane reforming (SMR) or autothermal reforming (ATR) processes coupled with carbon capture and storage (CCS) technology in 2024. Unlike gray hydrogen, which is produced without carbon capture and emits carbon dioxide as a byproduct, blue hydrogen production captures and stores the resulting carbon dioxide, reducing greenhouse gas emissions. Blue hydrogen is considered a transitional fuel towards a low-carbon economy, offering a cleaner alternative to conventional fossil fuels while leveraging existing infrastructure and technology. Blue hydrogen can be used as a feedstock for industrial processes, power generation, transportation, and fuel cell applications, where it can replace fossil fuels and reduce carbon emissions. With growing interest in decarbonization and renewable energy sources, blue hydrogen is gaining attention as a viable solution for reducing carbon emissions from sectors such as industry, heating, and transportation, and supporting the transition towards a more sustainable and environmentally friendly energy system.

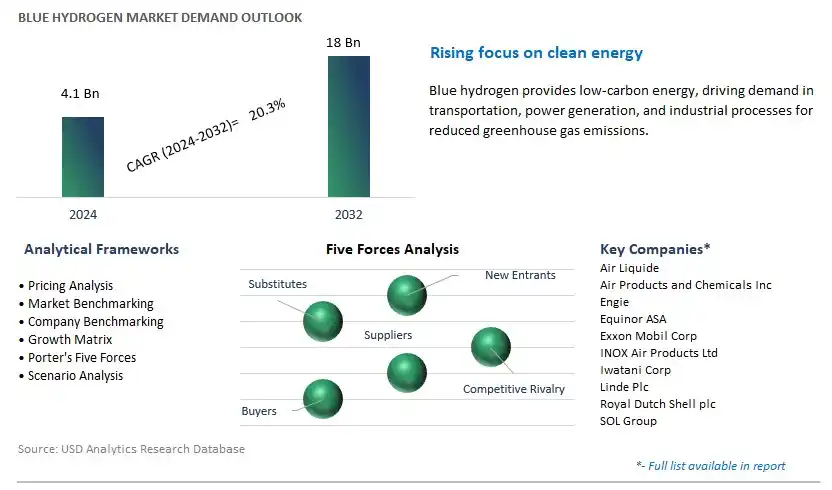

The market report analyses the leading companies in the industry including Air Liquide, Air Products and Chemicals Inc, Engie, Equinor ASA, Exxon Mobil Corp, INOX Air Products Ltd, Iwatani Corp, Linde Plc, Royal Dutch Shell plc, SOL Group, and others.

A prominent trend in the blue hydrogen market is the shift towards low-carbon energy solutions, driven by increasing awareness of climate change and the need to reduce greenhouse gas emissions. Blue hydrogen, produced from natural gas with carbon capture and storage (CCS) technology, offers a lower carbon footprint compared to traditional grey hydrogen, which is produced from natural gas without CCS. This trend is reshaping the energy landscape, with governments, industries, and consumers increasingly recognizing the importance of transitioning to cleaner energy sources to mitigate climate change and achieve sustainability goals. As a result, the demand for blue hydrogen as a clean and versatile energy carrier is expected to grow, driving market expansion and investment in hydrogen production and infrastructure.

The primary driver fueling the growth of the blue hydrogen market is decarbonization initiatives and regulatory support promoting the adoption of low-carbon energy technologies. Governments worldwide are implementing policies, incentives, and carbon pricing mechanisms to encourage the use of hydrogen as a clean energy vector and accelerate the transition to a low-carbon economy. Additionally, industry partnerships and collaborations are driving investment in blue hydrogen projects, with companies seeking to reduce their carbon footprint, enhance energy security, and comply with regulatory mandates. As decarbonization efforts intensify and hydrogen gains momentum as a key enabler of clean energy transition, the demand for blue hydrogen is expected to increase, creating opportunities for market growth and innovation in hydrogen production and utilization technologies.

An emerging opportunity within the blue hydrogen market lies in the integration with carbon capture and utilization (CCU) technologies to further enhance environmental sustainability and resource efficiency. While blue hydrogen production already involves capturing and storing CO2 emissions from the hydrogen production process, there is potential to utilize captured CO2 for beneficial purposes such as enhanced oil recovery, carbon-neutral fuels, and chemical feedstock production. By leveraging synergies between blue hydrogen production and CCU technologies, stakeholders can maximize the value of captured CO2 while minimizing environmental impact, creating a closed-loop carbon cycle that contributes to climate mitigation efforts. By investing in research and development initiatives and collaborating with industry partners, manufacturers of blue hydrogen can unlock opportunities to optimize their production processes, reduce costs, and enhance the overall sustainability of the hydrogen value chain, driving innovation and competitiveness in the global hydrogen market.

Steam Methane Reforming (SMR) Technology is the largest segment in the Blue Hydrogen Market by technology. SMR technology dominates the market due to its established efficiency, cost-effectiveness, and widespread adoption in hydrogen production. In the SMR process, methane from natural gas reacts with steam under high temperature and pressure in the presence of a catalyst to produce hydrogen and carbon dioxide. This method is particularly favored because it leverages the existing natural gas infrastructure, making it a more accessible and economical option compared to other technologies. Additionally, the integration of carbon capture and storage (CCS) with SMR allows for the significant reduction of carbon emissions, aligning with global efforts to minimize greenhouse gas outputs and promote cleaner energy solutions. The scalability of SMR technology also contributes to its leading position, as it can be adapted for both large-scale industrial applications and smaller, distributed hydrogen production units. Continuous advancements in SMR technology, including improved catalysts and more efficient carbon capture systems, further reinforce its dominance in the blue hydrogen market.

The pipeline segment is the fastest-growing in the Blue Hydrogen Market by transportation mode. This rapid growth is primarily driven by the increasing investments in infrastructure to support the transition to a hydrogen-based economy. Pipelines are considered the most efficient and cost-effective method for transporting large volumes of hydrogen over long distances, making them crucial for scaling up hydrogen production and distribution. The existing natural gas pipeline networks can often be repurposed or upgraded for hydrogen transport, which significantly reduces initial investment costs and accelerates deployment. Furthermore, pipelines offer a continuous and reliable supply of hydrogen to various end-users, including industrial facilities, power plants, and refuelling stations for hydrogen-powered vehicles. As countries and companies commit to ambitious carbon reduction goals, the demand for hydrogen as a clean energy source is surging, necessitating robust pipeline infrastructure. Technological advancements in pipeline materials and monitoring systems also enhance safety and efficiency, making pipelines a preferred option for hydrogen transportation. This convergence of factors contributes to the pipeline segment's status as the fastest-growing mode of transportation in the blue hydrogen market.

The chemicals segment is the largest in the Blue Hydrogen Market by application. The large revenue share is driven by the extensive use of hydrogen as a critical feedstock in the production of various chemicals, including ammonia and methanol. Hydrogen is essential in ammonia synthesis for fertilizers, which are vital for global agriculture, and in methanol production, which serves as a building block for numerous chemical products and industrial applications. The chemical industry's reliance on hydrogen is amplified by the sector's massive scale and the consistent demand for chemical products worldwide. Additionally, the transition to blue hydrogen, which incorporates carbon capture and storage (CCS) technologies, is particularly attractive to the chemical industry as it helps reduce the carbon footprint associated with hydrogen production, aligning with global sustainability and decarbonization goals. The scalability of hydrogen usage in chemical manufacturing processes and the integration of hydrogen into existing infrastructure further bolster the segment's leading position. As the push for greener and more sustainable industrial practices intensifies, the adoption of blue hydrogen in the chemicals sector continues to grow, reinforcing its status as the largest application segment in the market.

By Technology

Steam Methane Reforming Technology

Gas Partial Oxidation

Auto Thermal Reforming

By Transportation Mode

Pipeline

Cryogenic Liquid Tankers

By Application

Chemicals

Refinery

Power Generation

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Air Liquide

Air Products and Chemicals Inc

Engie

Equinor ASA

Exxon Mobil Corp

INOX Air Products Ltd

Iwatani Corp

Linde Plc

Royal Dutch Shell plc

SOL Group

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Blue Hydrogen Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Blue Hydrogen Market Size Outlook, $ Million, 2021 to 2032

3.2 Blue Hydrogen Market Outlook by Type, $ Million, 2021 to 2032

3.3 Blue Hydrogen Market Outlook by Product, $ Million, 2021 to 2032

3.4 Blue Hydrogen Market Outlook by Application, $ Million, 2021 to 2032

3.5 Blue Hydrogen Market Outlook by Key Countries, $ Million, 2021 to 2032

4 Market Dynamics

4.1 Key Driving Forces of Blue Hydrogen Industry

4.2 Key Market Trends in Blue Hydrogen Industry

4.3 Potential Opportunities in Blue Hydrogen Industry

4.4 Key Challenges in Blue Hydrogen Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Blue Hydrogen Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Blue Hydrogen Market Outlook by Segments

7.1 Blue Hydrogen Market Outlook by Segments, $ Million, 2021- 2032

By Technology

Steam Methane Reforming Technology

Gas Partial Oxidation

Auto Thermal Reforming

By Transportation Mode

Pipeline

Cryogenic Liquid Tankers

By Application

Chemicals

Refinery

Power Generation

Others

8 North America Blue Hydrogen Market Analysis and Outlook To 2032

8.1 Introduction to North America Blue Hydrogen Markets in 2024

8.2 North America Blue Hydrogen Market Size Outlook by Country, 2021-2032

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Blue Hydrogen Market size Outlook by Segments, 2021-2032

By Technology

Steam Methane Reforming Technology

Gas Partial Oxidation

Auto Thermal Reforming

By Transportation Mode

Pipeline

Cryogenic Liquid Tankers

By Application

Chemicals

Refinery

Power Generation

Others

9 Europe Blue Hydrogen Market Analysis and Outlook To 2032

9.1 Introduction to Europe Blue Hydrogen Markets in 2024

9.2 Europe Blue Hydrogen Market Size Outlook by Country, 2021-2032

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Blue Hydrogen Market Size Outlook by Segments, 2021-2032

By Technology

Steam Methane Reforming Technology

Gas Partial Oxidation

Auto Thermal Reforming

By Transportation Mode

Pipeline

Cryogenic Liquid Tankers

By Application

Chemicals

Refinery

Power Generation

Others

10 Asia Pacific Blue Hydrogen Market Analysis and Outlook To 2032

10.1 Introduction to Asia Pacific Blue Hydrogen Markets in 2024

10.2 Asia Pacific Blue Hydrogen Market Size Outlook by Country, 2021-2032

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Blue Hydrogen Market size Outlook by Segments, 2021-2032

By Technology

Steam Methane Reforming Technology

Gas Partial Oxidation

Auto Thermal Reforming

By Transportation Mode

Pipeline

Cryogenic Liquid Tankers

By Application

Chemicals

Refinery

Power Generation

Others

11 South America Blue Hydrogen Market Analysis and Outlook To 2032

11.1 Introduction to South America Blue Hydrogen Markets in 2024

11.2 South America Blue Hydrogen Market Size Outlook by Country, 2021-2032

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Blue Hydrogen Market size Outlook by Segments, 2021-2032

By Technology

Steam Methane Reforming Technology

Gas Partial Oxidation

Auto Thermal Reforming

By Transportation Mode

Pipeline

Cryogenic Liquid Tankers

By Application

Chemicals

Refinery

Power Generation

Others

12 Middle East and Africa Blue Hydrogen Market Analysis and Outlook To 2032

12.1 Introduction to Middle East and Africa Blue Hydrogen Markets in 2024

12.2 Middle East and Africa Blue Hydrogen Market Size Outlook by Country, 2021-2032

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Blue Hydrogen Market size Outlook by Segments, 2021-2032

By Technology

Steam Methane Reforming Technology

Gas Partial Oxidation

Auto Thermal Reforming

By Transportation Mode

Pipeline

Cryogenic Liquid Tankers

By Application

Chemicals

Refinery

Power Generation

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Air Liquide

Air Products and Chemicals Inc

Engie

Equinor ASA

Exxon Mobil Corp

INOX Air Products Ltd

Iwatani Corp

Linde Plc

Royal Dutch Shell plc

SOL Group

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Technology

Steam Methane Reforming Technology

Gas Partial Oxidation

Auto Thermal Reforming

By Transportation Mode

Pipeline

Cryogenic Liquid Tankers

By Application

Chemicals

Refinery

Power Generation

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Blue Hydrogen Market Size is valued at $4.1 Billion in 2024 and is forecast to register a growth rate (CAGR) of 20.3% to reach $18 Billion by 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Air Liquide, Air Products and Chemicals Inc, Engie, Equinor ASA, Exxon Mobil Corp, INOX Air Products Ltd, Iwatani Corp, Linde Plc, Royal Dutch Shell plc, SOL Group

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2032; Currency: Revenue (USD); Volume