The global Biopesticides Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Bioinsecticides, Biofungicides, Bionematicides, Bioherbicides, Others), By Crop (Cereals & Grains, Oil Seeds & Pulses, Fruits & Vegetables, Others), By Source (Microbials, Biochemicals, Beneficial Insects), By Mode Of Application (Seed Treatment, Soil Treatment, Foliar Spray, Others), By Form (Liquid, Dry).

The biopesticides market is experiencing rapid growth driven by increasing concerns over environmental pollution, pesticide resistance, and public health risks associated with synthetic chemical pesticides. Key trends shaping the future of the industry include the growing adoption of bio-based pest control solutions derived from naturally occurring microorganisms, botanical extracts, and biochemicals for managing pests, diseases, and weeds in agriculture, forestry, and public health sectors. Moreover, there's a rising emphasis on biopesticides' eco-friendly nature, target specificity, and low toxicity to non-target organisms, making them suitable for integrated pest management (IPM) programs and organic farming practices. Additionally, there's a growing trend towards the development of novel biopesticide formulations, delivery systems, and application methods to enhance efficacy, stability, and crop compatibility while reducing environmental impact and residue levels. Furthermore, advancements in microbial biotechnology, fermentation processes, and formulation chemistry are driving innovation and market expansion, enabling biopesticide manufacturers to offer a wide range of safe, effective, and sustainable pest management solutions for growers, crop consultants, and pest control operators in the global biopesticides market.

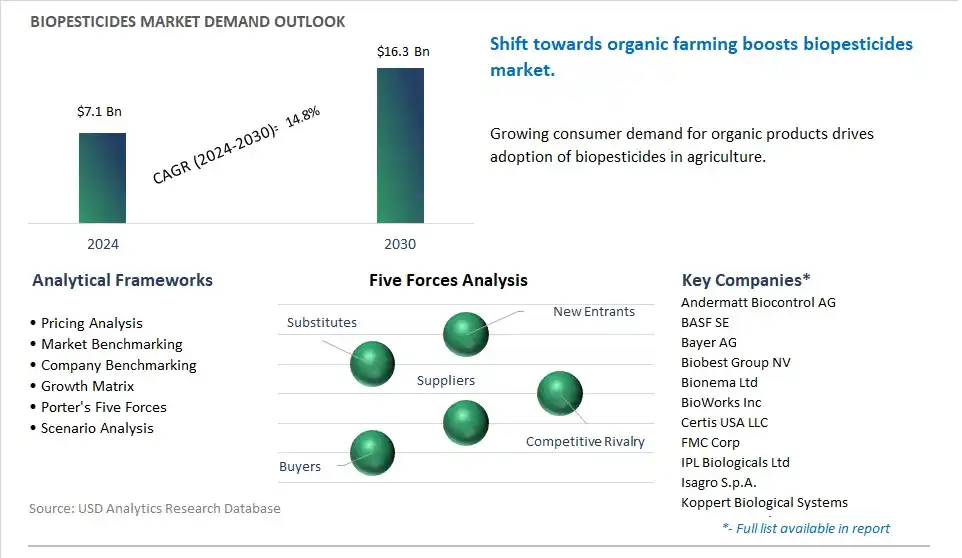

The market report analyses the leading companies in the industry including Andermatt Biocontrol AG, BASF SE, Bayer AG, Biobest Group NV, Bionema Ltd, BioWorks Inc, Certis USA LLC, FMC Corp, IPL Biologicals Ltd, Isagro S.p.A., Koppert Biological Systems, Novozymes A/S, Nufarm Ltd, SOM Phytopharma India Ltd, Stockton Group, Syngenta AG, The Pro Farm Group Inc, UPL Ltd, Valent BioSciences LLC, Vegalab SA.

A prominent trend in the biopesticides market is the increasing adoption of organic farming practices. As consumers become more health-conscious and demand for organic food rises, farmers are shifting towards sustainable and environmentally friendly pest management solutions. Biopesticides, derived from natural sources such as plants, microbes, and minerals, offer an effective alternative to synthetic chemical pesticides, with minimal impact on human health and the environment. With regulatory support and consumer preference for organic produce, the biopesticides market is experiencing significant growth as farmers seek safer and more sustainable pest control options to meet market demand for organic food products.

A primary driver fueling the biopesticides market is regulatory restrictions on synthetic pesticides. Governments and regulatory agencies worldwide are implementing stricter regulations and bans on the use of synthetic chemical pesticides due to concerns about their adverse effects on human health, biodiversity, and the environment. As a result, farmers are turning to biopesticides as an alternative pest control method that meets regulatory requirements while ensuring food safety and environmental sustainability. Additionally, the growing awareness of pesticide residues in food and their impact on public health is driving consumer demand for organic products, further fueling the adoption of biopesticides in agriculture.

An opportunity within the biopesticides market lies in expansion into emerging markets and crop segments to diversify product portfolios and capture untapped market potential. While biopesticides are commonly used in major crops such as fruits, vegetables, and grains, there is potential to explore niche crops and specialty markets where biopesticides can offer unique benefits. Industries such as floriculture, greenhouse vegetables, and specialty crops present opportunities for biopesticides to address specific pest challenges while meeting the growing demand for organic and sustainably produced agricultural products. Moreover, there is potential to expand into emerging markets in Asia-Pacific, Latin America, and Africa, where sustainable agriculture practices are gaining traction, and farmers are seeking effective and environmentally friendly pest management solutions. By investing in research and development, market expansion, and strategic partnerships, companies can seize the opportunity to penetrate new crop segments and emerging markets, thereby driving growth and market leadership in the biopesticides industry.

The Bioinsecticides segment is the largest segment in the Biopesticides Market for diverse compelling reasons. The insects pose significant threats to agricultural crops, causing substantial economic losses due to yield reduction, quality degradation, and post-harvest losses. Bioinsecticides, derived from natural sources such as microorganisms, plants, or biochemicals, offer effective and sustainable solutions for controlling insect pests while minimizing environmental impact. In addition, bioinsecticides exhibit target-specificity, selectively targeting insect pests while preserving beneficial insects, pollinators, and non-target organisms. Additionally, bioinsecticides are compatible with integrated pest management (IPM) strategies, organic farming practices, and conventional crop protection programs, offering versatility in pest control approaches. Further, the growing demand for organic food products, consumer awareness of pesticide residues, and regulatory restrictions on chemical pesticides drive the adoption of bioinsecticides in agriculture. As a result, the Bioinsecticides segment dominates the Biopesticides Market due to its extensive applications, efficacy against insect pests, and alignment with sustainable agriculture practices. Over the forecast period, the Bioinsecticides segment's combination of effectiveness, versatility, and environmental sustainability positions it as the largest segment in the market.

The Fruits & Vegetables segment is the fastest-growing segment in the Biopesticides Market for diverse significant reasons. The fruits and vegetables are highly perishable crops susceptible to a wide range of pests and diseases, necessitating effective pest management solutions. Biopesticides offer a sustainable and environmentally friendly alternative to chemical pesticides for controlling pests and diseases in fruits and vegetables. In addition, consumer demand for safe and pesticide-free produce, coupled with regulatory restrictions on chemical pesticide residues, drives the adoption of biopesticides in fruit and vegetable production. Additionally, the adoption of integrated pest management (IPM) practices and organic farming methods in the fruit and vegetable sector further accelerates the growth of biopesticides. Further, advancements in biopesticide technology, formulation, and application methods enhance efficacy, reliability, and convenience, facilitating broader adoption by fruit and vegetable growers. As a result, the Fruits & Vegetables segment experiences rapid growth in the Biopesticides Market due to increasing market demand, regulatory support, and technological advancements in pest management solutions for fruits and vegetables. Over the forecast period, the Fruits & Vegetables segment's combination of market demand, regulatory drivers, and technological innovations positions it as the fastest-growing segment in the Biopesticides Market.

The Microbials segment is the fastest-growing segment in the Biopesticides Market for diverse compelling reasons. The microbials, including bacteria, fungi, and viruses, offer versatile and effective solutions for controlling pests and diseases in agriculture. These microorganisms produce toxins, enzymes, or metabolites that target specific pests while posing minimal risk to non-target organisms and the environment. In addition, microbials exhibit broad-spectrum activity against a wide range of pests, including insects, fungi, bacteria, and nematodes, making them valuable tools for integrated pest management (IPM) programs. Additionally, advancements in microbial technology, formulation, and delivery methods enhance the efficacy, stability, and shelf life of microbial biopesticides, facilitating their broader adoption by growers. Further, the growing demand for sustainable pest management solutions, regulatory restrictions on chemical pesticides, and consumer preferences for pesticide-free produce drive the market growth of microbial biopesticides. As a result, the Microbials segment experiences rapid growth in the Biopesticides Market due to increasing market demand, technological advancements, and regulatory support for sustainable agriculture practices. Over the forecast period, the Microbials segment's combination of efficacy, versatility, and environmental sustainability positions it as the fastest-growing segment in the Biopesticides Market.

By Type

Bioinsecticides

Biofungicides

Bionematicides

Bioherbicides

Others

By Crop

Cereals & Grains

Oil Seeds & Pulses

Fruits & Vegetables

Others

By Source

Microbials

Biochemicals

Beneficial Insects

By Mode Of Application

Seed Treatment

Soil Treatment

Foliar Spray

Others

By Form

Liquid

Dry

Regions Included

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Andermatt Biocontrol AG

BASF SE

Bayer AG

Biobest Group NV

Bionema Ltd

BioWorks Inc

Certis USA LLC

FMC Corp

IPL Biologicals Ltd

Isagro S.p.A.

Koppert Biological Systems

Novozymes A/S

Nufarm Ltd

SOM Phytopharma India Ltd

Stockton Group

Syngenta AG

The Pro Farm Group Inc

UPL Ltd

Valent BioSciences LLC

Vegalab SA

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Biopesticides Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Biopesticides Market Size Outlook, $ Million, 2021 to 2030

3.2 Biopesticides Market Outlook by Type, $ Million, 2021 to 2030

3.3 Biopesticides Market Outlook by Product, $ Million, 2021 to 2030

3.4 Biopesticides Market Outlook by Application, $ Million, 2021 to 2030

3.5 Biopesticides Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Biopesticides Industry

4.2 Key Market Trends in Biopesticides Industry

4.3 Potential Opportunities in Biopesticides Industry

4.4 Key Challenges in Biopesticides Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Biopesticides Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Biopesticides Market Outlook by Segments

7.1 Biopesticides Market Outlook by Segments, $ Million, 2021- 2030

By Type

Bioinsecticides

Biofungicides

Bionematicides

Bioherbicides

Others

By Crop

Cereals & Grains

Oil Seeds & Pulses

Fruits & Vegetables

Others

By Source

Microbials

Biochemicals

Beneficial Insects

By Mode Of Application

Seed Treatment

Soil Treatment

Foliar Spray

Others

By Form

Liquid

Dry

8 North America Biopesticides Market Analysis and Outlook To 2030

8.1 Introduction to North America Biopesticides Markets in 2024

8.2 North America Biopesticides Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Biopesticides Market size Outlook by Segments, 2021-2030

By Type

Bioinsecticides

Biofungicides

Bionematicides

Bioherbicides

Others

By Crop

Cereals & Grains

Oil Seeds & Pulses

Fruits & Vegetables

Others

By Source

Microbials

Biochemicals

Beneficial Insects

By Mode Of Application

Seed Treatment

Soil Treatment

Foliar Spray

Others

By Form

Liquid

Dry

9 Europe Biopesticides Market Analysis and Outlook To 2030

9.1 Introduction to Europe Biopesticides Markets in 2024

9.2 Europe Biopesticides Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Biopesticides Market Size Outlook by Segments, 2021-2030

By Type

Bioinsecticides

Biofungicides

Bionematicides

Bioherbicides

Others

By Crop

Cereals & Grains

Oil Seeds & Pulses

Fruits & Vegetables

Others

By Source

Microbials

Biochemicals

Beneficial Insects

By Mode Of Application

Seed Treatment

Soil Treatment

Foliar Spray

Others

By Form

Liquid

Dry

10 Asia Pacific Biopesticides Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Biopesticides Markets in 2024

10.2 Asia Pacific Biopesticides Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Biopesticides Market size Outlook by Segments, 2021-2030

By Type

Bioinsecticides

Biofungicides

Bionematicides

Bioherbicides

Others

By Crop

Cereals & Grains

Oil Seeds & Pulses

Fruits & Vegetables

Others

By Source

Microbials

Biochemicals

Beneficial Insects

By Mode Of Application

Seed Treatment

Soil Treatment

Foliar Spray

Others

By Form

Liquid

Dry

11 South America Biopesticides Market Analysis and Outlook To 2030

11.1 Introduction to South America Biopesticides Markets in 2024

11.2 South America Biopesticides Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Biopesticides Market size Outlook by Segments, 2021-2030

By Type

Bioinsecticides

Biofungicides

Bionematicides

Bioherbicides

Others

By Crop

Cereals & Grains

Oil Seeds & Pulses

Fruits & Vegetables

Others

By Source

Microbials

Biochemicals

Beneficial Insects

By Mode Of Application

Seed Treatment

Soil Treatment

Foliar Spray

Others

By Form

Liquid

Dry

12 Middle East and Africa Biopesticides Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Biopesticides Markets in 2024

12.2 Middle East and Africa Biopesticides Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Biopesticides Market size Outlook by Segments, 2021-2030

By Type

Bioinsecticides

Biofungicides

Bionematicides

Bioherbicides

Others

By Crop

Cereals & Grains

Oil Seeds & Pulses

Fruits & Vegetables

Others

By Source

Microbials

Biochemicals

Beneficial Insects

By Mode Of Application

Seed Treatment

Soil Treatment

Foliar Spray

Others

By Form

Liquid

Dry

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Andermatt Biocontrol AG

BASF SE

Bayer AG

Biobest Group NV

Bionema Ltd

BioWorks Inc

Certis USA LLC

FMC Corp

IPL Biologicals Ltd

Isagro S.p.A.

Koppert Biological Systems

Novozymes A/S

Nufarm Ltd

SOM Phytopharma India Ltd

Stockton Group

Syngenta AG

The Pro Farm Group Inc

UPL Ltd

Valent BioSciences LLC

Vegalab SA

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Bioinsecticides

Biofungicides

Bionematicides

Bioherbicides

Others

By Crop

Cereals & Grains

Oil Seeds & Pulses

Fruits & Vegetables

Others

By Source

Microbials

Biochemicals

Beneficial Insects

By Mode Of Application

Seed Treatment

Soil Treatment

Foliar Spray

Others

By Form

Liquid

Dry

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Biopesticides is forecast to reach $16.3 Billion in 2030 from $7.1 Billion in 2024, registering a CAGR of 14.8%

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Andermatt Biocontrol AG, BASF SE, Bayer AG, Biobest Group NV, Bionema Ltd, BioWorks Inc, Certis USA LLC, FMC Corp, IPL Biologicals Ltd, Isagro S.p.A., Koppert Biological Systems, Novozymes A/S, Nufarm Ltd, SOM Phytopharma India Ltd, Stockton Group, Syngenta AG, The Pro Farm Group Inc, UPL Ltd, Valent BioSciences LLC, Vegalab SA

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume