The Biologics Contract Manufacturing Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Product (MABs, Recombinant Protein, Others), By Indication (Oncology, Immunological Disorders, Cardiovascular Disorders, Hematological Disorders, Others).

The Biologics Contract Manufacturing market in 2024 experiences rapid expansion driven by the increasing outsourcing trend among biopharmaceutical companies seeking cost-effective and scalable solutions for biologics production. Contract manufacturing organizations (CMOs) offer specialized expertise, state-of-the-art facilities, and flexible manufacturing platforms to support the development and commercialization of biologic drugs. With the growing complexity of biologic molecules and regulatory requirements, outsourcing manufacturing processes enables companies to focus on core competencies, accelerate time-to-market, and mitigate capital-intensive investments. Collaborative partnerships between biopharma firms and CMOs foster innovation, technology transfer, and supply chain resilience, positioning contract manufacturing as a strategic enabler for the biologics industry's growth and global market penetration.

A prominent trend in the Biologics Contract Manufacturing market is the increasing outsourcing of biologic manufacturing by pharmaceutical and biotechnology companies. As the demand for biologic therapies continues to grow, companies are facing pressure to accelerate development timelines, reduce costs, and enhance manufacturing flexibility. Outsourcing biologic manufacturing to contract development and manufacturing organizations (CDMOs) offers several advantages, including access to specialized expertise, state-of-the-art manufacturing facilities, and scalability to meet fluctuating demand. Additionally, CDMOs can help mitigate risks associated with capital investment, regulatory compliance, and technology transfer, thereby enabling sponsors to focus on core competencies such as research, development, and commercialization.

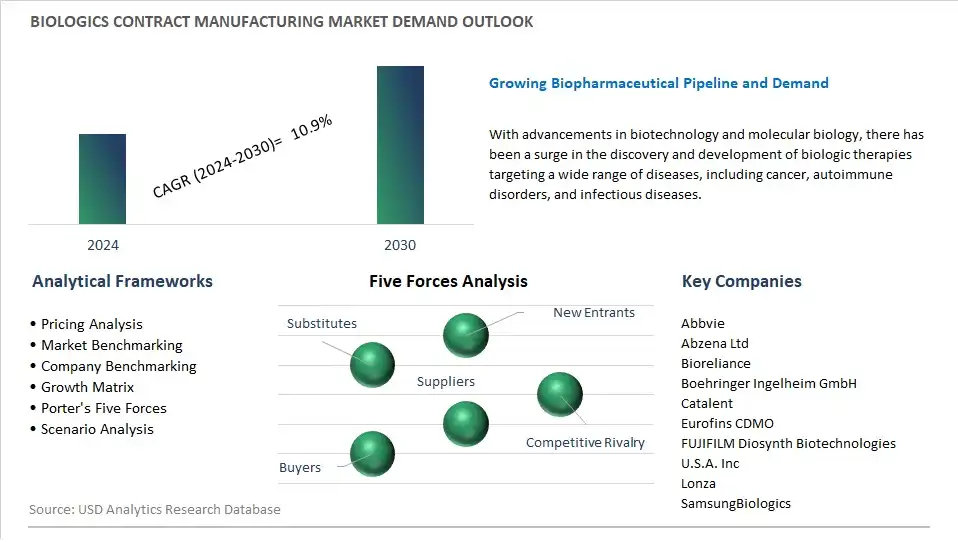

The primary driver for the Biologics Contract Manufacturing market is the growing biopharmaceutical pipeline and demand for biologic drugs. With advancements in biotechnology and molecular biology, there has been a surge in the discovery and development of biologic therapies targeting a wide range of diseases, including cancer, autoimmune disorders, and infectious diseases. This expanding pipeline, coupled with the increasing prevalence of chronic and complex diseases, is driving the demand for biologic manufacturing services. Biopharmaceutical companies are increasingly relying on CDMOs to provide expertise in process development, manufacturing scale-up, and regulatory compliance, enabling them to bring innovative biologic drugs to market efficiently and cost-effectively.

An opportunity in the Biologics Contract Manufacturing market lies in expanding operations into emerging markets and offering services for novel modalities. As the demand for biologic therapies continues to rise globally, there is growing interest in accessing manufacturing capabilities in emerging markets such as Asia-Pacific and Latin America. These regions offer cost advantages, a skilled workforce, and strategic geographic locations, making them attractive destinations for biologics manufacturing. Additionally, there is a shift towards the development of novel modalities such as cell and gene therapies, mRNA-based vaccines, and gene editing technologies, which require specialized manufacturing expertise. By investing in capabilities for these emerging modalities and establishing a presence in key geographic markets, CDMOs can capitalize on the evolving needs of biopharmaceutical sponsors and position themselves for long-term growth and success in the dynamic Biologics Contract Manufacturing market.

By Product

MABs

Recombinant Protein

Others

By Indication

Oncology

Immunological Disorders

Cardiovascular Disorders

Hematological Disorders

Others

Geographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Abbvie

Abzena Ltd

Bioreliance

Boehringer Ingelheim GmbH

Catalent

Eurofins CDMO

FUJIFILM Diosynth Biotechnologies U.S.A. Inc

Lonza

SamsungBiologics

Thermo Fischer (Patheon)

Wuxi Biologics

• Deepen your industry insights and navigate uncertainties for strategy formulation, CAPEX, and Operational decisions

• Gain access to detailed insights on the Biologics Contract Manufacturing Market, encompassing current market size, growth trends, and forecasts till 2030.

• Access detailed competitor analysis, enabling competitive advantage through a thorough understanding of market players, strategies, and potential differentiation opportunities

• Stay ahead of the curve with insights on technological advancements, innovations, and upcoming trends

• Identify lucrative investment avenues and expansion opportunities within the Biologics Contract Manufacturing Market industry, guided by robust, data-backed analysis.

• Understand regional and global markets through country-wise analysis, regional market potential, regulatory nuances, and dynamics

• Execute strategies with confidence and speed through information, analytics, and insights on the industry value chain

• Corporate leaders, strategists, financial experts, shareholders, asset managers, and governmental representatives can make long-term planning scenarios and build an integrated and timely understanding of market dynamics

• Benefit from tailored solutions and expert consultation based on report insights, providing personalized strategies aligned with specific business needs.

TABLE OF CONTENTS

1 Introduction to 2024 Biologics Contract Manufacturing Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Biologics Contract Manufacturing Market Size Outlook, $ Million, 2021 to 2030

3.2 Biologics Contract Manufacturing Market Outlook by Type, $ Million, 2021 to 2030

3.3 Biologics Contract Manufacturing Market Outlook by Product, $ Million, 2021 to 2030

3.4 Biologics Contract Manufacturing Market Outlook by Application, $ Million, 2021 to 2030

3.5 Biologics Contract Manufacturing Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Biologics Contract Manufacturing Market Industry

4.2 Key Market Trends in Biologics Contract Manufacturing Market Industry

4.3 Potential Opportunities in Biologics Contract Manufacturing Market Industry

4.4 Key Challenges in Biologics Contract Manufacturing Market Industry

5 Market Factor Analysis

5.1 Competitive Landscape

5.1.1 Global Biologics Contract Manufacturing Market Share by Company (%), 2023

5.1.2 Product Offerings by Company

5.2 Porter’s Five Forces Analysis

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Biologics Contract Manufacturing Market Outlook By Segments

7.1 Biologics Contract Manufacturing Market Outlook by Segments

By Product

MABs

Recombinant Protein

Others

By Indication

Oncology

Immunological Disorders

Cardiovascular Disorders

Hematological Disorders

Others

8 North America Biologics Contract Manufacturing Market Analysis And Outlook To 2030

8.1 Introduction to North America Biologics Contract Manufacturing Markets in 2024

8.2 North America Biologics Contract Manufacturing Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Biologics Contract Manufacturing Market size Outlook by Segments, 2021-2030

By Product

MABs

Recombinant Protein

Others

By Indication

Oncology

Immunological Disorders

Cardiovascular Disorders

Hematological Disorders

Others

9 Europe Biologics Contract Manufacturing Market Analysis And Outlook To 2030

9.1 Introduction to Europe Biologics Contract Manufacturing Markets in 2024

9.2 Europe Biologics Contract Manufacturing Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Biologics Contract Manufacturing Market Size Outlook By Segments, 2021-2030

By Product

MABs

Recombinant Protein

Others

By Indication

Oncology

Immunological Disorders

Cardiovascular Disorders

Hematological Disorders

Others

10 Asia Pacific Biologics Contract Manufacturing Market Analysis And Outlook To 2030

10.1 Introduction to Asia Pacific Biologics Contract Manufacturing Markets in 2024

10.2 Asia Pacific Biologics Contract Manufacturing Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Biologics Contract Manufacturing Market size Outlook by Segments, 2021-2030

By Product

MABs

Recombinant Protein

Others

By Indication

Oncology

Immunological Disorders

Cardiovascular Disorders

Hematological Disorders

Others

11 South America Biologics Contract Manufacturing Market Analysis And Outlook To 2030

11.1 Introduction to South America Biologics Contract Manufacturing Markets in 2024

11.2 South America Biologics Contract Manufacturing Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Biologics Contract Manufacturing Market size Outlook by Segments, 2021-2030

By Product

MABs

Recombinant Protein

Others

By Indication

Oncology

Immunological Disorders

Cardiovascular Disorders

Hematological Disorders

Others

12 Middle East And Africa Biologics Contract Manufacturing Market Analysis And Outlook To 2030

12.1 Introduction to Middle East and Africa Biologics Contract Manufacturing Markets in 2024

12.2 Middle East and Africa Biologics Contract Manufacturing Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Biologics Contract Manufacturing Market size Outlook by Segments, 2021-2030

By Product

MABs

Recombinant Protein

Others

By Indication

Oncology

Immunological Disorders

Cardiovascular Disorders

Hematological Disorders

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

Abbvie

Abzena Ltd

Bioreliance

Boehringer Ingelheim GmbH

Catalent

Eurofins CDMO

FUJIFILM Diosynth Biotechnologies U.S.A. Inc

Lonza

SamsungBiologics

Thermo Fischer (Patheon)

Wuxi Biologics

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

MABs

Recombinant Protein

Others

By Indication

Oncology

Immunological Disorders

Cardiovascular Disorders

Hematological Disorders

Others

The global Biologics Contract Manufacturing Market is one of the lucrative growth markets, poised to register a 10.9% growth (CAGR) between 2024 and 2032.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Abbvie, Abzena Ltd, Bioreliance, Boehringer Ingelheim GmbH, Catalent, Eurofins CDMO, FUJIFILM Diosynth Biotechnologies U.S.A. Inc, Lonza, SamsungBiologics, Thermo Fischer (Patheon), Wuxi Biologics

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume