The global Bioethanol Yeast Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (Baker’s, Brewer’s), By Application (Food, Animal Feed, Biofuel, Cleaning & Disinfection, Others).

The market for bioethanol yeast is enhancing efficiency and sustainability in biofuel production by offering specialized strains optimized for ethanol fermentation from renewable feedstocks such as sugarcane, corn, and cellulosic biomass. Key trends shaping the future of this industry include the development of yeast strains with enhanced ethanol tolerance, fermentation rates, and substrate utilization efficiency, enabling higher yields and productivity in bioethanol production processes. Additionally, advancements in strain engineering, metabolic pathway optimization, and fermentation conditions enable the production of bioethanol yeast with tailored characteristics suitable for diverse feedstocks and processing environments, reducing production costs and environmental footprint. Moreover, the adoption of sustainable biofuel mandates, carbon reduction policies, and renewable energy incentives drives market demand for bioethanol yeast, fostering innovation and market expansion in this sector. As industries transition towards renewable energy sources and decarbonization, the demand for bioethanol yeast is expected to continue growing, driving further innovation and development of sustainable biofuel technologies.

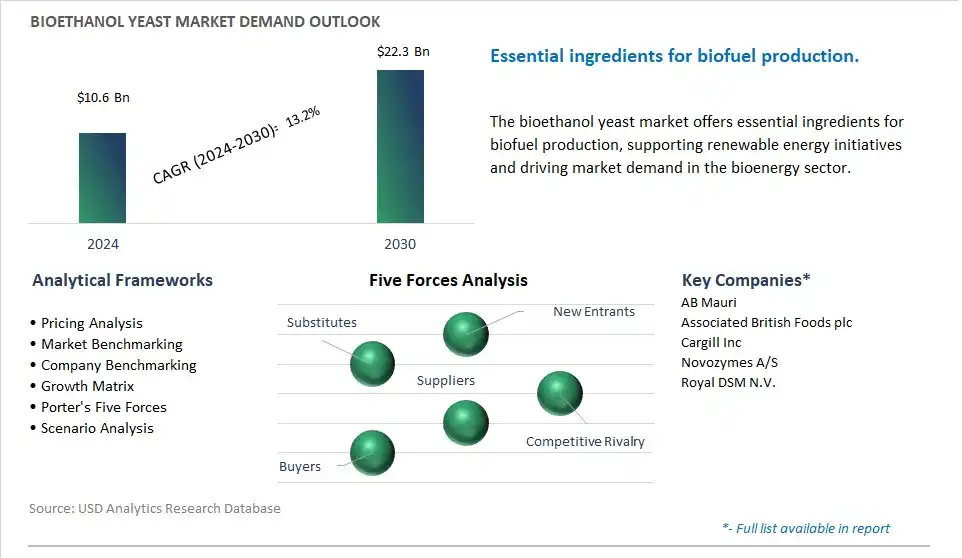

The market report analyses the leading companies in the industry including AB Mauri, Associated British Foods plc, Cargill Inc, Novozymes A/S, Royal DSM N.V..

A prominent trend in the market for bioethanol yeast is the rising demand for renewable energy sources. Bioethanol, produced from renewable biomass sources such as corn, sugarcane, or cellulosic feedstocks, is widely used as a clean-burning fuel additive or biofuel. Yeast plays a critical role in the fermentation process, converting sugars into ethanol. With increasing concerns about climate change and the need to reduce greenhouse gas emissions, there is a growing shift towards bioethanol as a sustainable alternative to fossil fuels. As governments worldwide implement policies to promote renewable energy and reduce dependence on petroleum-based fuels, the demand for bioethanol yeast is expected to rise, driving market growth and innovation in the bioenergy sector.

A key driver behind the demand for bioethanol yeast is government incentives and mandates for renewable fuel production. Many countries have implemented regulations and policies to support the use of biofuels and increase the share of renewable energy in the transportation sector. These policies include renewable fuel standards, blending mandates, tax credits, and subsidies for biofuel producers. Additionally, governments are investing in research and development initiatives to improve biofuel production processes and increase the efficiency of ethanol fermentation. Bioethanol yeast suppliers benefit from these government incentives and mandates, as they drive demand for bioethanol production and create a favorable market environment for renewable energy investments. As regulatory support for biofuels continues to grow, the demand for bioethanol yeast is expected to increase, driving market expansion and investment in the bioenergy industry.

An emerging opportunity in the market for bioethanol yeast lies in innovation in strain development and bioprocessing technologies. As the demand for bioethanol continues to grow, there is a need for yeast strains that are highly efficient, robust, and capable of fermenting a wide range of feedstocks. Opportunities exist to develop genetically engineered yeast strains with enhanced fermentation performance, tolerance to inhibitors, and resistance to stress conditions. Additionally, advancements in bioprocessing technologies such as simultaneous saccharification and fermentation (SSF), consolidated bioprocessing (CBP), and high-cell-density fermentation can improve the efficiency and economics of bioethanol production. By investing in research and development of novel yeast strains and bioprocessing techniques, suppliers of bioethanol yeast can capitalize on new opportunities and drive innovation in the bioenergy sector, positioning themselves for long-term growth and success.

The Market Ecosystem of the bioethanol yeast market begins with the cultivation of crops or sourcing of organic materials including sugarcane and corn, involving companies including Raízen, Tereos, and Green Plains Renewable Energy. For cellulosic feedstocks, optional pre-treatment processes are conducted by companies specializing in biomass pre-treatment technologies including LIG Renewable Fuels. Following this, fermentation media preparation is undertaken by bioethanol producers with specialty companies supplying necessary components. Yeast strain selection and propagation involve established yeast manufacturers including Lesaffre and Lallemand, ensuring the availability of high-performing strains for efficient bioethanol production.

The fermentation process occurs at bioethanol production facilities, followed by downstream processing and purification, which include distillation and dehydration, conducted by bioethanol producers and engineering companies with relevant expertise. Quality control and testing ensure compliance with standards, with bioethanol producers and independent laboratories handling this aspect. Distribution and sales are managed by logistics companies and bioethanol producers, delivering bioethanol to fuel blenders, distributors, and retail stations, facilitating its use in transportation and other applications, with fuel refiners, blenders, and power generation plants as key consumers.

In the Bioethanol Yeast Market, Brewer's Yeast is the largest segment, driven by diverse crucial factors contributing to its dominance. Brewer's yeast, primarily used in the fermentation process of brewing beer, holds a significant share in the bioethanol production sector. This yeast strain is well-suited for ethanol production due to its ability to efficiently ferment sugars into alcohol, contributing to higher ethanol yields. In addition, the brewing industry's robust demand for bioethanol yeast further solidifies Brewer's Yeast as the dominant segment. Its widespread use in beer production, coupled with the growing popularity of craft brewing and the increasing consumption of alcoholic beverages globally, significantly contributes to its market share. Additionally, advancements in fermentation technology and strain optimization have enhanced the performance and productivity of Brewer's Yeast, further cementing its position as the largest segment in the Bioethanol Yeast Market. As the bioethanol industry continues to expand to meet the rising demand for renewable energy sources, Brewer's Yeast is expected to maintain its leading position, driving growth and innovation in the market.

Among the applications in the Bioethanol Yeast Market, the Biofuel segment is the fastest-growing, propelled by diverse key factors contributing to its rapid expansion. With the global shift toward renewable energy sources and the increasing emphasis on reducing greenhouse gas emissions, biofuels, particularly ethanol, have gained significant traction as a viable alternative to fossil fuels. Bioethanol, produced through the fermentation of sugars by yeast, serves as a crucial component in biofuel production. The Biofuel segment experiences rapid growth due to the growing demand for ethanol as a renewable fuel additive, driven by government mandates, environmental regulations, and consumer preferences for cleaner energy sources. Additionally, advancements in biotechnology and fermentation processes have led to improved yields and efficiencies in bioethanol production, further fueling the growth of the Biofuel segment in the Bioethanol Yeast Market. As the world continues to transition toward sustainable energy solutions, the demand for biofuels is expected to surge, driving continued growth and innovation in the Bioethanol Yeast Market.

By Product

Baker’s

Brewer’s

By Application

Food

Animal Feed

Biofuel

Cleaning & Disinfection

Others

AB Mauri

Associated British Foods plc

Cargill Inc

Novozymes A/S

Royal DSM N.V.

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Bioethanol Yeast Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Bioethanol Yeast Market Size Outlook, $ Million, 2021 to 2030

3.2 Bioethanol Yeast Market Outlook by Type, $ Million, 2021 to 2030

3.3 Bioethanol Yeast Market Outlook by Product, $ Million, 2021 to 2030

3.4 Bioethanol Yeast Market Outlook by Application, $ Million, 2021 to 2030

3.5 Bioethanol Yeast Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Bioethanol Yeast Industry

4.2 Key Market Trends in Bioethanol Yeast Industry

4.3 Potential Opportunities in Bioethanol Yeast Industry

4.4 Key Challenges in Bioethanol Yeast Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Bioethanol Yeast Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Bioethanol Yeast Market Outlook by Segments

7.1 Bioethanol Yeast Market Outlook by Segments, $ Million, 2021- 2030

By Product

Baker’s

Brewer’s

By Application

Food

Animal Feed

Biofuel

Cleaning & Disinfection

Others

8 North America Bioethanol Yeast Market Analysis and Outlook To 2030

8.1 Introduction to North America Bioethanol Yeast Markets in 2024

8.2 North America Bioethanol Yeast Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Bioethanol Yeast Market size Outlook by Segments, 2021-2030

By Product

Baker’s

Brewer’s

By Application

Food

Animal Feed

Biofuel

Cleaning & Disinfection

Others

9 Europe Bioethanol Yeast Market Analysis and Outlook To 2030

9.1 Introduction to Europe Bioethanol Yeast Markets in 2024

9.2 Europe Bioethanol Yeast Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Bioethanol Yeast Market Size Outlook by Segments, 2021-2030

By Product

Baker’s

Brewer’s

By Application

Food

Animal Feed

Biofuel

Cleaning & Disinfection

Others

10 Asia Pacific Bioethanol Yeast Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Bioethanol Yeast Markets in 2024

10.2 Asia Pacific Bioethanol Yeast Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Bioethanol Yeast Market size Outlook by Segments, 2021-2030

By Product

Baker’s

Brewer’s

By Application

Food

Animal Feed

Biofuel

Cleaning & Disinfection

Others

11 South America Bioethanol Yeast Market Analysis and Outlook To 2030

11.1 Introduction to South America Bioethanol Yeast Markets in 2024

11.2 South America Bioethanol Yeast Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Bioethanol Yeast Market size Outlook by Segments, 2021-2030

By Product

Baker’s

Brewer’s

By Application

Food

Animal Feed

Biofuel

Cleaning & Disinfection

Others

12 Middle East and Africa Bioethanol Yeast Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Bioethanol Yeast Markets in 2024

12.2 Middle East and Africa Bioethanol Yeast Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Bioethanol Yeast Market size Outlook by Segments, 2021-2030

By Product

Baker’s

Brewer’s

By Application

Food

Animal Feed

Biofuel

Cleaning & Disinfection

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

AB Mauri

Associated British Foods plc

Cargill Inc

Novozymes A/S

Royal DSM N.V.

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

Baker’s

Brewer’s

By Application

Food

Animal Feed

Biofuel

Cleaning & Disinfection

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Bioethanol Yeast is forecast to reach $22.3 Billion in 2030 from $10.6 Billion in 2024, registering a CAGR of 13.2% over the outlook period

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

AB Mauri, Associated British Foods plc, Cargill Inc, Novozymes A/S, Royal DSM N.V.

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume