The global Bio polyamide Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Product (PA-6, PA-66, Specialty Polyamides), By Application (Fiber, Engineering Plastics), By End-User (Textile, Automotive, Film & Coating, Consumer Goods, Industrial, Electrical & Electronics, Others).

The bio polyamide market is witnessing significant growth driven by increasing demand for sustainable and high-performance engineering plastics in various industries such as automotive, electronics, and consumer goods. Key trends shaping the future of the industry include the growing adoption of bio-based polyamides derived from renewable feedstocks such as castor oil, biomass, and bio-waste, offering reduced environmental impact and lower carbon footprint compared to traditional polyamides. Moreover, there's a rising emphasis on bio polyamide's superior mechanical properties, thermal stability, and chemical resistance, making it suitable for demanding applications such as automotive components, electrical connectors, and industrial machinery parts. Additionally, advancements in bio polyamide synthesis, compounding technology, and recycling processes are driving innovation and market expansion, enabling manufacturers to offer bio-based polyamide resins with improved performance, processability, and sustainability in the global bio polyamide market.

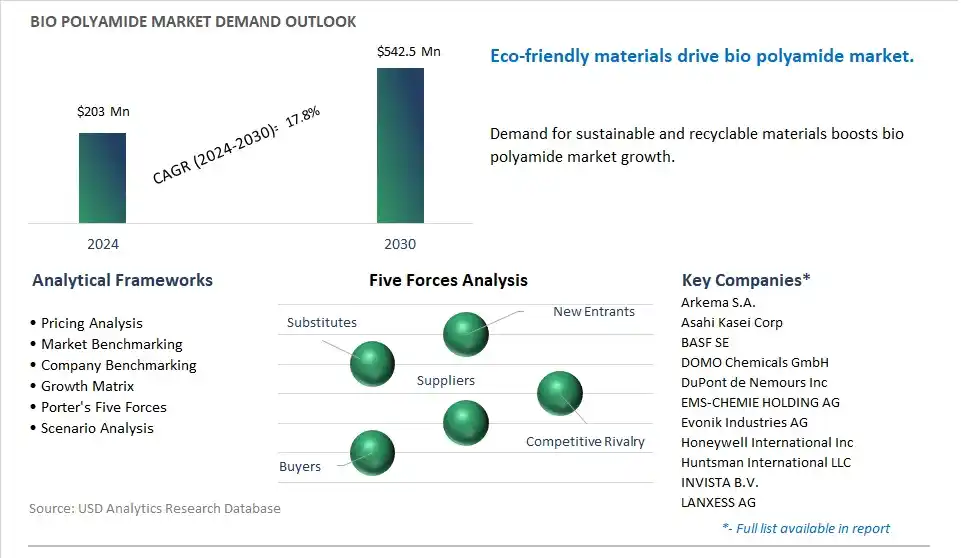

The market report analyses the leading companies in the industry including Arkema S.A., Asahi Kasei Corp, BASF SE, DOMO Chemicals GmbH, DuPont de Nemours Inc, EMS-CHEMIE HOLDING AG, Evonik Industries AG, Honeywell International Inc, Huntsman International LLC, INVISTA B.V., LANXESS AG, Lealea Enterprise Co. Ltd, Quadrant AG, Radici Partecipazioni S.p.A., Royal DSM N.V., Solvay SA, Toray Industries Inc, UBE Corp Europe S.A., Zhejiang Jingu Co. Ltd.

A prominent trend in the bio polyamide market is the increasing demand for sustainable materials in automotive and industrial applications. Bio polyamides, derived from renewable sources such as castor oil or bio-based monomers, offer comparable performance to conventional polyamides while providing environmental benefits such as reduced carbon footprint and lower dependency on fossil fuels. With growing concerns about climate change and the need for sustainable solutions, automotive manufacturers and industrial companies are seeking bio-based alternatives to traditional materials for components such as engine covers, air intake manifolds, and structural parts. This trend is driven by regulatory pressures, consumer preferences for eco-friendly products, and corporate sustainability goals, shaping market dynamics and driving adoption of bio polyamides in diverse end-use sectors.

A primary driver fueling the bio polyamide market is sustainability initiatives and circular economy principles adopted by governments, industries, and consumers. With increasing awareness of environmental issues and resource depletion, there is a growing emphasis on transitioning towards a circular economy model that promotes resource efficiency, waste reduction, and material recycling. Bio polyamides play a key role in this transition by offering a renewable and biodegradable alternative to conventional polyamides, contributing to the development of closed-loop supply chains and sustainable manufacturing practices. Moreover, regulatory frameworks promoting the use of bio-based and recyclable materials in various applications are driving the adoption of bio polyamides as a sustainable solution for reducing environmental impact and promoting circularity in the plastics industry.

An opportunity within the bio polyamide market lies in innovation in advanced applications and performance characteristics to expand market penetration and address evolving customer needs. While bio polyamides have been primarily used in automotive and industrial sectors, there is potential to explore new applications and end-use markets where bio-based materials can offer unique advantages. Industries such as consumer goods, electronics, and sporting goods present opportunities for bio polyamides to replace traditional plastics and contribute to sustainability goals. Moreover, there is potential to develop bio polyamide formulations with enhanced properties such as mechanical strength, heat resistance, and chemical resistance to meet the demanding requirements of advanced applications. By investing in research and development of innovative bio polyamide materials and collaborating with downstream partners, companies can unlock new growth opportunities, differentiate their products, and position themselves as leaders in the sustainable materials market.

The PA-6 (Polyamide 6) segment is the largest segment in the Bio-polyamide Market for diverse compelling reasons. The PA-6 is one of the most widely used types of polyamides due to its excellent mechanical properties, including high strength, toughness, and abrasion resistance. These properties make PA-6 suitable for a wide range of applications across various industries, including automotive, consumer goods, electrical and electronics, and industrial manufacturing. Additionally, PA-6 offers good chemical resistance and thermal stability, further enhancing its versatility and applicability in demanding environments. In addition, the production of bio-based PA-6, derived from renewable sources such as castor oil or bio-based monomers, aligns with the growing global emphasis on sustainability and reducing dependence on fossil fuels. As a result, bio-based PA-6 offers a more environmentally friendly alternative to conventional petroleum-based PA-6, driving its adoption in various end-use applications. Further, the widespread availability and cost-effectiveness of PA-6 compared to specialty polyamides make it a preferred choice for manufacturers seeking high-performance materials at competitive prices. Over the forecast period, the combination of excellent properties, broad applicability, and sustainability benefits positions the PA-6 segment as the largest in the Bio-polyamide Market.

The engineering plastics segment is the fastest-growing segment in the Bio-polyamide Market for diverse key reasons. The engineering plastics, including polyamides, are widely used in various industries such as automotive, electrical and electronics, aerospace, and consumer goods due to their excellent mechanical properties, including high strength, heat resistance, and chemical resistance. As industries increasingly seek sustainable alternatives to conventional petroleum-based engineering plastics, bio-based polyamides offer a compelling solution. Bio-polyamides derived from renewable sources such as castor oil or bio-based monomers offer similar performance characteristics to their petroleum-based counterparts while reducing reliance on fossil fuels and lowering carbon footprints. Additionally, the demand for bio-based engineering plastics is driven by stringent environmental regulations, consumer preferences for eco-friendly products, and corporate sustainability initiatives. In addition, advancements in bio-plastics technology and processing techniques have improved the performance and processability of bio-polyamides, further driving their adoption in engineering applications. As a result, the engineering plastics segment is experiencing rapid growth in the Bio-polyamide Market as industries increasingly transition towards sustainable and environmentally friendly materials.

The automotive segment is the fastest-growing segment in the Bio-polyamide Market for diverse compelling reasons. The there is a growing trend towards lightweighting in the automotive industry to improve fuel efficiency and reduce emissions. Bio-polyamides offer a sustainable alternative to conventional petroleum-based materials for various automotive applications such as engine components, interior parts, exterior trims, and structural components. Additionally, bio-polyamides possess excellent mechanical properties, including high strength, impact resistance, and thermal stability, making them suitable for demanding automotive applications. In addition, the automotive industry's increasing focus on sustainability and environmental responsibility drives the adoption of bio-based materials in vehicle manufacturing. Bio-polyamides derived from renewable sources such as castor oil or bio-based monomers offer a lower carbon footprint and contribute to reducing dependence on fossil fuels. Further, stringent emissions regulations and consumer demand for eco-friendly vehicles further accelerate the adoption of bio-polyamides in the automotive sector. As a result, the automotive segment is experiencing rapid growth in the Bio-polyamide Market as automotive manufacturers seek sustainable materials to meet industry trends and regulatory requirements.

By Product

PA-6

PA-66

Specialty Polyamides

By Application

Fiber

Engineering Plastics

By End-User

Textile

Automotive

Film & Coating

Consumer Goods

Industrial

Electrical & Electronics

Others

Regions Included

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Arkema S.A.

Asahi Kasei Corp

BASF SE

DOMO Chemicals GmbH

DuPont de Nemours Inc

EMS-CHEMIE HOLDING AG

Evonik Industries AG

Honeywell International Inc

Huntsman International LLC

INVISTA B.V.

LANXESS AG

Lealea Enterprise Co. Ltd

Quadrant AG

Radici Partecipazioni S.p.A.

Royal DSM N.V.

Solvay SA

Toray Industries Inc

UBE Corp Europe S.A.

Zhejiang Jingu Co. Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Bio polyamide Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Bio polyamide Market Size Outlook, $ Million, 2021 to 2030

3.2 Bio polyamide Market Outlook by Type, $ Million, 2021 to 2030

3.3 Bio polyamide Market Outlook by Product, $ Million, 2021 to 2030

3.4 Bio polyamide Market Outlook by Application, $ Million, 2021 to 2030

3.5 Bio polyamide Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Bio polyamide Industry

4.2 Key Market Trends in Bio polyamide Industry

4.3 Potential Opportunities in Bio polyamide Industry

4.4 Key Challenges in Bio polyamide Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Bio polyamide Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Bio polyamide Market Outlook by Segments

7.1 Bio polyamide Market Outlook by Segments, $ Million, 2021- 2030

By Product

PA-6

PA-66

Specialty Polyamides

By Application

Fiber

Engineering Plastics

By End-User

Textile

Automotive

Film & Coating

Consumer Goods

Industrial

Electrical & Electronics

Others

8 North America Bio polyamide Market Analysis and Outlook To 2030

8.1 Introduction to North America Bio polyamide Markets in 2024

8.2 North America Bio polyamide Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Bio polyamide Market size Outlook by Segments, 2021-2030

By Product

PA-6

PA-66

Specialty Polyamides

By Application

Fiber

Engineering Plastics

By End-User

Textile

Automotive

Film & Coating

Consumer Goods

Industrial

Electrical & Electronics

Others

9 Europe Bio polyamide Market Analysis and Outlook To 2030

9.1 Introduction to Europe Bio polyamide Markets in 2024

9.2 Europe Bio polyamide Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Bio polyamide Market Size Outlook by Segments, 2021-2030

By Product

PA-6

PA-66

Specialty Polyamides

By Application

Fiber

Engineering Plastics

By End-User

Textile

Automotive

Film & Coating

Consumer Goods

Industrial

Electrical & Electronics

Others

10 Asia Pacific Bio polyamide Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Bio polyamide Markets in 2024

10.2 Asia Pacific Bio polyamide Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Bio polyamide Market size Outlook by Segments, 2021-2030

By Product

PA-6

PA-66

Specialty Polyamides

By Application

Fiber

Engineering Plastics

By End-User

Textile

Automotive

Film & Coating

Consumer Goods

Industrial

Electrical & Electronics

Others

11 South America Bio polyamide Market Analysis and Outlook To 2030

11.1 Introduction to South America Bio polyamide Markets in 2024

11.2 South America Bio polyamide Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Bio polyamide Market size Outlook by Segments, 2021-2030

By Product

PA-6

PA-66

Specialty Polyamides

By Application

Fiber

Engineering Plastics

By End-User

Textile

Automotive

Film & Coating

Consumer Goods

Industrial

Electrical & Electronics

Others

12 Middle East and Africa Bio polyamide Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Bio polyamide Markets in 2024

12.2 Middle East and Africa Bio polyamide Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Bio polyamide Market size Outlook by Segments, 2021-2030

By Product

PA-6

PA-66

Specialty Polyamides

By Application

Fiber

Engineering Plastics

By End-User

Textile

Automotive

Film & Coating

Consumer Goods

Industrial

Electrical & Electronics

Others

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Arkema S.A.

Asahi Kasei Corp

BASF SE

DOMO Chemicals GmbH

DuPont de Nemours Inc

EMS-CHEMIE HOLDING AG

Evonik Industries AG

Honeywell International Inc

Huntsman International LLC

INVISTA B.V.

LANXESS AG

Lealea Enterprise Co. Ltd

Quadrant AG

Radici Partecipazioni S.p.A.

Royal DSM N.V.

Solvay SA

Toray Industries Inc

UBE Corp Europe S.A.

Zhejiang Jingu Co. Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Product

PA-6

PA-66

Specialty Polyamides

By Application

Fiber

Engineering Plastics

By End-User

Textile

Automotive

Film & Coating

Consumer Goods

Industrial

Electrical & Electronics

Others

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Bio polyamide is forecast to reach $542.5 Million in 2030 from $203 Million in 2024, registering a CAGR of 17.8%

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Arkema S.A., Asahi Kasei Corp, BASF SE, DOMO Chemicals GmbH, DuPont de Nemours Inc, EMS-CHEMIE HOLDING AG, Evonik Industries AG, Honeywell International Inc, Huntsman International LLC, INVISTA B.V., LANXESS AG, Lealea Enterprise Co. Ltd, Quadrant AG, Radici Partecipazioni S.p.A., Royal DSM N.V., Solvay SA, Toray Industries Inc, UBE Corp Europe S.A., Zhejiang Jingu Co. Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume