The global Bio Herbicides Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Source (Microbial, Biochemical, Others), By Formulation (Granular, Liquid, Others), By Application (Seed treatment, Soil Application, Foliar, Post-harvest).

The market for bio herbicides is witnessing significant growth, driven by the increasing demand for eco-friendly and sustainable weed management solutions in agriculture, forestry, and non-crop settings. Key trends shaping the future of the industry include advancements in microbial technology, biochemistry, and formulation techniques, enabling the development of herbicidal agents derived from natural sources such as plant extracts, microbial metabolites, and genetically modified organisms. Manufacturers are focusing on innovating bio herbicide formulations with selective and broad-spectrum weed control capabilities, as well as enhanced efficacy, safety, and environmental compatibility compared to synthetic chemical herbicides. Additionally, there is a growing emphasis on integrated weed management (IWM) approaches and resistance management strategies, driving the adoption of bio herbicides as part of sustainable agriculture practices that reduce reliance on synthetic chemicals, minimize pesticide residues, and preserve soil health and biodiversity. Moreover, advancements in biotechnology, genetic engineering, and bioinformatics are driving market innovation, enabling the development of next-generation bio herbicides with novel modes of action, improved target specificity, and reduced off-target effects. Overall, the future of the bio herbicides industry lies in continuous research and development efforts to address emerging weed control challenges, optimize product performance, and promote adoption of sustainable weed management practices in global agriculture and land stewardship.

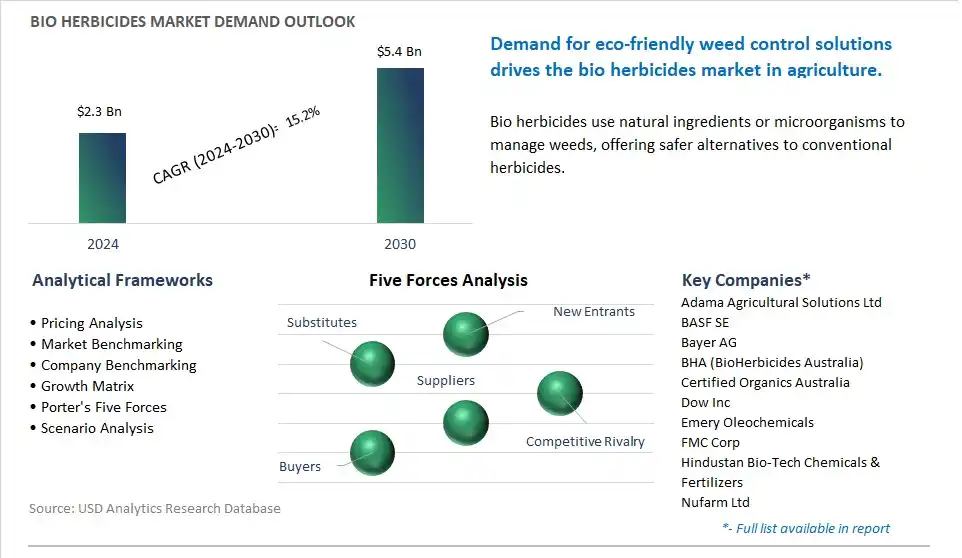

The market report analyses the leading companies in the industry including Adama Agricultural Solutions Ltd, BASF SE, Bayer AG, BHA (BioHerbicides Australia), Certified Organics Australia, Dow Inc, Emery Oleochemicals, FMC Corp, Hindustan Bio-Tech Chemicals & Fertilizers, Nufarm Ltd, Syngenta AG.

In the Bio Herbicides market, a prominent trend is the increasing demand for organic and sustainable agriculture practices. As consumers become more health-conscious and environmentally aware, there's a growing preference for organic food products produced without synthetic chemicals or pesticides. Bio herbicides, derived from natural sources such as microbes, plant extracts, or biochemicals, offer an eco-friendly alternative to traditional herbicides, as they target weeds selectively while minimizing harm to beneficial organisms and ecosystems. This trend is driven by factors such as regulatory support for organic farming, consumer demand for pesticide-free produce, and the adoption of sustainable agriculture practices by farmers worldwide, contributing to a rising market demand for bio herbicides as part of integrated weed management strategies.

A significant driver in the Bio Herbicides market is the increasing concerns over weed resistance and environmental impact associated with conventional herbicides. With the widespread use of chemical herbicides leading to the development of herbicide-resistant weed strains and environmental contamination, there's a pressing need for alternative weed control solutions that are effective, sustainable, and environmentally friendly. Bio herbicides offer a promising solution by leveraging natural mechanisms to control weed growth without causing harm to non-target organisms or leaving harmful residues in soil and water. This driver is fueled by the need for sustainable weed management practices, regulatory restrictions on chemical herbicides, and growing awareness of the long-term environmental consequences of conventional weed control methods, driving demand for bio herbicides as a safer and more sustainable alternative.

A promising opportunity within the Bio Herbicides market lies in innovation in bio herbicide formulations and delivery systems. While bio herbicides offer numerous advantages in terms of safety and environmental impact, there are challenges related to efficacy, stability, and application methods that need to be addressed to fully realize their potential. Opportunities exist in developing novel bio herbicide formulations that improve targeting, adhesion, and persistence on target weeds, as well as innovative delivery systems such as encapsulation, microencapsulation, or nanoformulations that enhance bioavailability and efficacy while minimizing off-target effects. By investing in research and development to overcome these challenges and commercialize advanced bio herbicide solutions, companies can capitalize on this opportunity to expand their product portfolio, address unmet needs in the weed control market, and capture market share in the growing bio herbicides segment.

The largest segment in the Bio-Herbicides Market is the Microbial source segment. microbial-based herbicides utilize naturally occurring microorganisms such as bacteria, fungi, and viruses to control weed growth and manage weed populations effectively. These microorganisms target specific weed species or biological pathways, providing targeted and selective weed control while minimizing harm to non-target organisms and the environment. Additionally, microbial-based herbicides offer potential advantages over chemical herbicides, including lower environmental impact, reduced risk of herbicide resistance development, and compatibility with sustainable agriculture practices such as organic farming. Further, microbial-based herbicides are generally considered safer for humans, animals, and beneficial insects compared to synthetic chemicals, making them suitable for use in sensitive environments such as residential areas, parks, and water bodies. Furthermore, advancements in biotechnology and microbial strain development have led to the discovery and commercialization of novel microbial-based herbicides with improved efficacy, stability, and application methods, further driving the growth of the Microbial source segment in the Bio-Herbicides Market. Over the forecast period, the combination of effective weed control, environmental sustainability, and safety positions the Microbial source segment as the largest in the Bio-Herbicides Market.

The fastest-growing segment in the Bio-Herbicides Market is the Liquid formulation segment. liquid formulations offer potential advantages over granular formulations in terms of ease of application, coverage, and efficacy. Liquid bio-herbicides can be easily mixed with water and applied using conventional spraying equipment, allowing for uniform coverage and targeted application to weed-infested areas. Additionally, liquid formulations are more versatile and adaptable to different application methods and cropping systems, including foliar spraying, soil drenching, and pre-emergence treatments, providing flexibility for weed management practices. Further, liquid bio-herbicides are often formulated with adjuvants and surfactants to enhance herbicide uptake, absorption, and translocation within the plant, maximizing weed control efficacy. Furthermore, liquid formulations offer better compatibility with tank-mixing of multiple herbicides or other crop protection products, allowing for integrated weed management strategies and improved weed resistance management. Additionally, technological advancements in liquid formulation development, such as microencapsulation and nanotechnology, have led to the development of more stable and efficient liquid bio-herbicides with extended shelf life and improved performance. Over the forecast period, the combination of ease of application, versatility, and technological innovations positions the Liquid formulation segment as the fastest-growing in the Bio-Herbicides Market.

The fastest-growing segment in the Bio-Herbicides Market is the Foliar application segment. foliar application of bio-herbicides involves spraying the herbicide directly onto the leaves of target weeds, allowing for rapid uptake and translocation of the active ingredients within the plant tissue. This method of application offers potential advantages, including efficient and targeted weed control, reduced herbicide runoff and soil contamination, and minimal impact on non-target organisms and the environment. Additionally, foliar application is particularly effective for controlling perennial weeds or weeds with extensive leaf surface area, as it ensures direct contact between the herbicide and the weed foliage, leading to optimal herbicidal activity. Further, foliar application allows for flexibility in timing, as bio-herbicides can be applied at any stage of weed growth, from emergence to flowering, depending on the weed species and crop tolerance. Furthermore, technological advancements in spray equipment and formulation development have led to the development of more efficient and user-friendly foliar bio-herbicides, enhancing their efficacy and applicability in various cropping systems. Over the forecast period, the combination of efficacy, environmental sustainability, and technological innovation positions the Foliar application segment as the fastest-growing in the Bio-Herbicides Market.

By Source

Microbial

Biochemical

Others

By Formulation

Granular

Liquid

Others

By Application

Seed treatment

Soil Application

Foliar

Post-harvest

Regions Included

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Adama Agricultural Solutions Ltd

BASF SE

Bayer AG

BHA (BioHerbicides Australia)

Certified Organics Australia

Dow Inc

Emery Oleochemicals

FMC Corp

Hindustan Bio-Tech Chemicals & Fertilizers

Nufarm Ltd

Syngenta AG

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Bio Herbicides Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Bio Herbicides Market Size Outlook, $ Million, 2021 to 2030

3.2 Bio Herbicides Market Outlook by Type, $ Million, 2021 to 2030

3.3 Bio Herbicides Market Outlook by Product, $ Million, 2021 to 2030

3.4 Bio Herbicides Market Outlook by Application, $ Million, 2021 to 2030

3.5 Bio Herbicides Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Bio Herbicides Industry

4.2 Key Market Trends in Bio Herbicides Industry

4.3 Potential Opportunities in Bio Herbicides Industry

4.4 Key Challenges in Bio Herbicides Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Bio Herbicides Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Bio Herbicides Market Outlook by Segments

7.1 Bio Herbicides Market Outlook by Segments, $ Million, 2021- 2030

By Source

Microbial

Biochemical

Others

By Formulation

Granular

Liquid

Others

By Application

Seed treatment

Soil Application

Foliar

Post-harvest

8 North America Bio Herbicides Market Analysis and Outlook To 2030

8.1 Introduction to North America Bio Herbicides Markets in 2024

8.2 North America Bio Herbicides Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Bio Herbicides Market size Outlook by Segments, 2021-2030

By Source

Microbial

Biochemical

Others

By Formulation

Granular

Liquid

Others

By Application

Seed treatment

Soil Application

Foliar

Post-harvest

9 Europe Bio Herbicides Market Analysis and Outlook To 2030

9.1 Introduction to Europe Bio Herbicides Markets in 2024

9.2 Europe Bio Herbicides Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Bio Herbicides Market Size Outlook by Segments, 2021-2030

By Source

Microbial

Biochemical

Others

By Formulation

Granular

Liquid

Others

By Application

Seed treatment

Soil Application

Foliar

Post-harvest

10 Asia Pacific Bio Herbicides Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Bio Herbicides Markets in 2024

10.2 Asia Pacific Bio Herbicides Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Bio Herbicides Market size Outlook by Segments, 2021-2030

By Source

Microbial

Biochemical

Others

By Formulation

Granular

Liquid

Others

By Application

Seed treatment

Soil Application

Foliar

Post-harvest

11 South America Bio Herbicides Market Analysis and Outlook To 2030

11.1 Introduction to South America Bio Herbicides Markets in 2024

11.2 South America Bio Herbicides Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Bio Herbicides Market size Outlook by Segments, 2021-2030

By Source

Microbial

Biochemical

Others

By Formulation

Granular

Liquid

Others

By Application

Seed treatment

Soil Application

Foliar

Post-harvest

12 Middle East and Africa Bio Herbicides Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Bio Herbicides Markets in 2024

12.2 Middle East and Africa Bio Herbicides Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Bio Herbicides Market size Outlook by Segments, 2021-2030

By Source

Microbial

Biochemical

Others

By Formulation

Granular

Liquid

Others

By Application

Seed treatment

Soil Application

Foliar

Post-harvest

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Adama Agricultural Solutions Ltd

BASF SE

Bayer AG

BHA (BioHerbicides Australia)

Certified Organics Australia

Dow Inc

Emery Oleochemicals

FMC Corp

Hindustan Bio-Tech Chemicals & Fertilizers

Nufarm Ltd

Syngenta AG

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Source

Microbial

Biochemical

Others

By Formulation

Granular

Liquid

Others

By Application

Seed treatment

Soil Application

Foliar

Post-harvest

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Bio Herbicides is forecast to reach $5.4 Billion in 2030 from $2.3 Billion in 2024, registering a CAGR of 15.2%

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Adama Agricultural Solutions Ltd, BASF SE, Bayer AG, BHA (BioHerbicides Australia), Certified Organics Australia, Dow Inc, Emery Oleochemicals, FMC Corp, Hindustan Bio-Tech Chemicals & Fertilizers, Nufarm Ltd, Syngenta AG

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume