The global Baby Food Packaging Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Material (Plastic, Paperboard, Metal, Glass), By Packaging (Bottles, Metal Cans, Cartons, Jars, Pouches), By Product (Liquid Milk Formula, Dried Baby Food, Powder Milk Formula, Prepared Baby Food).

The market for baby food packaging is evolving to meet the stringent safety and convenience requirements of infant nutrition products. Key trends shaping the future of this industry include the development of packaging materials and formats that preserve the freshness, nutritional integrity, and sensory qualities of baby food while ensuring safety from contamination and tampering. Advanced packaging solutions such as pouches, jars, and trays with resealable closures, tamper-evident seals, and oxygen barriers help extend shelf life and maintain product quality without the need for preservatives or additives. Additionally, innovations in printing technologies enable the incorporation of informative labels, graphics, and branding elements that enhance product visibility, appeal, and communication with consumers. Moreover, the adoption of sustainable and eco-friendly packaging materials, such as bio-based plastics, recyclable materials, and compostable films, aligns with consumer preferences for environmentally responsible products and packaging. As parents prioritize convenience, safety, and sustainability in baby food choices, the demand for innovative packaging solutions is expected to continue growing, driving further innovation and market expansion in this sector.

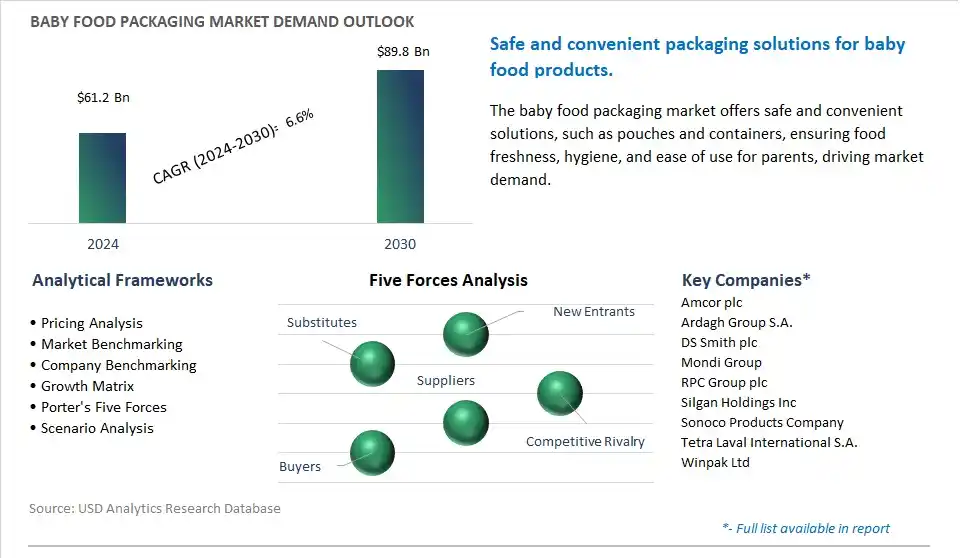

The market report analyses the leading companies in the industry including Amcor plc, Ardagh Group S.A., DS Smith plc, Mondi Group, RPC Group plc, Silgan Holdings Inc, Sonoco Products Company, Tetra Laval International S.A., Winpak Ltd.

A prominent trend in the market for baby food packaging is the increasing demand for sustainable and eco-friendly packaging solutions. As consumers become more environmentally conscious and seek products that align with their values, there is a growing preference for packaging materials that are recyclable, biodegradable, and made from renewable sources. Baby food manufacturers are responding to this by adopting sustainable packaging options, such as compostable pouches, recyclable plastic containers, and paper-based packaging. Additionally, innovations in sustainable packaging technologies, such as bio-based plastics and water-based inks, are driving the development of eco-friendly packaging solutions that meet the unique requirements of baby food products.

A key driver behind the demand for baby food packaging is regulatory compliance and safety standards imposed by government agencies and industry organizations. Baby food packaging must meet strict regulations and guidelines to ensure the safety and quality of products consumed by infants and young children. Regulatory bodies, such as the Food and Drug Administration (FDA) in the United States and the European Food Safety Authority (EFSA) in the European Union, establish requirements for packaging materials, labeling, and hygiene practices to prevent contamination and ensure product integrity. Compliance with these regulations is essential for manufacturers to maintain consumer trust and confidence in the safety of their baby food products. Additionally, advancements in packaging technologies, such as tamper-evident seals and barrier films, help protect baby food from external contaminants and extend shelf life, further driving the adoption of safe and compliant packaging solutions in the baby food market.

An emerging opportunity in the market for baby food packaging lies in innovation in convenience and portability. With changing consumer lifestyles and increasing demand for on-the-go food options, there is a growing need for convenient and portable packaging formats that cater to the needs of busy parents and caregivers. Baby food manufacturers aim to capitalize on this opportunity by introducing innovative packaging designs, such as single-serve pouches, resealable containers, and portion-controlled packs, that offer convenience and ease of use for feeding infants and toddlers both at home and while traveling. Additionally, incorporating features such as ergonomic shapes, easy-open seals, and spill-resistant closures can enhance the user experience and make feeding time more convenient for parents. By focusing on innovation in convenience and portability, manufacturers can meet the evolving needs of modern families and gain a competitive edge in the baby food market.

The baby food packaging market is characterized by a series of interconnected stages involving raw material acquisition, material conversion, printing and decoration, packaging manufacturing, quality control, and testing, distribution and sales, baby food manufacturing and filling, retail, and distribution, and Further, end consumers. Chemical companies including Dow Inc. and LyondellBasell Industries provide essential plastics for barrier films, while metal producers including Alcoa Corporation supply aluminum foil. Glass manufacturers including Corning Incorporated, and printing ink manufacturers including Flint Group play crucial roles in providing packaging materials.

Companies including Tetra Pak, Amcor plc, and Berry Global Group, Inc. are major players in packaging manufacturing, ensuring the production of safe and durable packaging for baby food products. Further, the end consumers, including parents and caregivers, play a pivotal role in selecting baby food products based on various factors, including nutritional content, packaging convenience, and safety features.

The plastic segment is the largest segment in the baby food packaging market due to its versatility, durability, and cost-effectiveness. Plastic materials, such as polyethylene (PE), polypropylene (PP), and polyethylene terephthalate (PET), offer a wide range of packaging options suitable for various baby food products, including pouches, bottles, cups, and containers. Plastic packaging provides excellent barrier properties, protecting baby food products from moisture, oxygen, and contaminants, thereby ensuring product safety and shelf life extension. In addition, plastic packaging is lightweight and unbreakable, making it convenient for parents to handle and transport baby food products. Additionally, plastic packaging allows for innovative designs and customization options, enabling brands to differentiate their products and attract consumers in a competitive market. As the demand for convenient and portable baby food solutions continues to rise, especially in urban areas with busy lifestyles, the plastic segment is expected to maintain its dominance in the baby food packaging market. Further, ongoing advancements in plastic packaging technology, including recyclability and eco-friendly options, further bolster the growth prospects of the plastic segment in the baby food packaging market.

The pouches segment is the fastest-growing segment in the baby food packaging market due to diverse key factors driving its adoption and popularity. Pouch packaging offers numerous advantages over traditional packaging formats, making it increasingly preferred by both consumers and manufacturers. Pouches are lightweight, portable, and convenient, making them ideal for on-the-go consumption, which aligns with the busy lifestyles of modern parents. In addition, pouch packaging provides excellent barrier properties, ensuring the freshness and quality of baby food products while also extending shelf life. The flexible nature of pouches allows for innovative designs, such as spouts and resealable closures, enhancing ease of use and minimizing mess during feeding. Additionally, pouches are space-efficient and require less material for packaging compared to other formats like bottles or jars, leading to reduced transportation costs and environmental benefits. As consumer demand for convenient, portable, and environmentally friendly packaging solutions continues to rise, the pouches segment is expected to witness significant growth in the baby food packaging market. Further, ongoing advancements in pouch packaging technology, including improved recyclability and sustainability features, further contribute to its rapid expansion in the market.

The prepared baby food segment is the fastest-growing segment in the baby food packaging market due to shifting consumer preferences toward convenience and time-saving solutions. Prepared baby food products offer parents a hassle-free feeding option, as they eliminate the need for cooking, blending, and pureeing ingredients at home. With busy lifestyles becoming increasingly common, especially among urban parents, the demand for prepared baby food products has surged significantly. These products come in various forms, including ready-to-eat meals, purees, and snacks, and are often packaged in convenient pouches or jars for easy consumption. Additionally, prepared baby food products are formulated to meet the nutritional needs of infants and toddlers, providing reassurance to parents about the quality and safety of the food they feed their children. As more parents opt for convenient and nutritious feeding solutions without compromising on quality, the prepared baby food segment is poised for rapid growth in the baby food packaging market. In addition, manufacturers continue to innovate by introducing new flavors, textures, and packaging formats to cater to evolving consumer preferences, further driving the expansion of this segment.

By Material

Plastic

Paperboard

Metal

Glass

By Packaging

Bottles

Metal Cans

Cartons

Jars

Pouches

By Product

Liquid Milk Formula

Dried Baby Food

Powder Milk Formula

Prepared Baby Food

Amcor plc

Ardagh Group S.A.

DS Smith plc

Mondi Group

RPC Group plc

Silgan Holdings Inc

Sonoco Products Company

Tetra Laval International S.A.

Winpak Ltd

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Baby Food Packaging Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Baby Food Packaging Market Size Outlook, $ Million, 2021 to 2030

3.2 Baby Food Packaging Market Outlook by Type, $ Million, 2021 to 2030

3.3 Baby Food Packaging Market Outlook by Product, $ Million, 2021 to 2030

3.4 Baby Food Packaging Market Outlook by Application, $ Million, 2021 to 2030

3.5 Baby Food Packaging Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Baby Food Packaging Industry

4.2 Key Market Trends in Baby Food Packaging Industry

4.3 Potential Opportunities in Baby Food Packaging Industry

4.4 Key Challenges in Baby Food Packaging Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Baby Food Packaging Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Baby Food Packaging Market Outlook by Segments

7.1 Baby Food Packaging Market Outlook by Segments, $ Million, 2021- 2030

By Material

Plastic

Paperboard

Metal

Glass

By Packaging

Bottles

Metal Cans

Cartons

Jars

Pouches

By Product

Liquid Milk Formula

Dried Baby Food

Powder Milk Formula

Prepared Baby Food

8 North America Baby Food Packaging Market Analysis and Outlook To 2030

8.1 Introduction to North America Baby Food Packaging Markets in 2024

8.2 North America Baby Food Packaging Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Baby Food Packaging Market size Outlook by Segments, 2021-2030

By Material

Plastic

Paperboard

Metal

Glass

By Packaging

Bottles

Metal Cans

Cartons

Jars

Pouches

By Product

Liquid Milk Formula

Dried Baby Food

Powder Milk Formula

Prepared Baby Food

9 Europe Baby Food Packaging Market Analysis and Outlook To 2030

9.1 Introduction to Europe Baby Food Packaging Markets in 2024

9.2 Europe Baby Food Packaging Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Baby Food Packaging Market Size Outlook by Segments, 2021-2030

By Material

Plastic

Paperboard

Metal

Glass

By Packaging

Bottles

Metal Cans

Cartons

Jars

Pouches

By Product

Liquid Milk Formula

Dried Baby Food

Powder Milk Formula

Prepared Baby Food

10 Asia Pacific Baby Food Packaging Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Baby Food Packaging Markets in 2024

10.2 Asia Pacific Baby Food Packaging Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Baby Food Packaging Market size Outlook by Segments, 2021-2030

By Material

Plastic

Paperboard

Metal

Glass

By Packaging

Bottles

Metal Cans

Cartons

Jars

Pouches

By Product

Liquid Milk Formula

Dried Baby Food

Powder Milk Formula

Prepared Baby Food

11 South America Baby Food Packaging Market Analysis and Outlook To 2030

11.1 Introduction to South America Baby Food Packaging Markets in 2024

11.2 South America Baby Food Packaging Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Baby Food Packaging Market size Outlook by Segments, 2021-2030

By Material

Plastic

Paperboard

Metal

Glass

By Packaging

Bottles

Metal Cans

Cartons

Jars

Pouches

By Product

Liquid Milk Formula

Dried Baby Food

Powder Milk Formula

Prepared Baby Food

12 Middle East and Africa Baby Food Packaging Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Baby Food Packaging Markets in 2024

12.2 Middle East and Africa Baby Food Packaging Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Baby Food Packaging Market size Outlook by Segments, 2021-2030

By Material

Plastic

Paperboard

Metal

Glass

By Packaging

Bottles

Metal Cans

Cartons

Jars

Pouches

By Product

Liquid Milk Formula

Dried Baby Food

Powder Milk Formula

Prepared Baby Food

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Amcor plc

Ardagh Group S.A.

DS Smith plc

Mondi Group

RPC Group plc

Silgan Holdings Inc

Sonoco Products Company

Tetra Laval International S.A.

Winpak Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Material

Plastic

Paperboard

Metal

Glass

By Packaging

Bottles

Metal Cans

Cartons

Jars

Pouches

By Product

Liquid Milk Formula

Dried Baby Food

Powder Milk Formula

Prepared Baby Food

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Baby Food Packaging is forecast to reach $89.8 Billion in 2030 from $61.2 Billion in 2024, registering a CAGR of 6.6% over the outlook period

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Amcor plc, Ardagh Group S.A., DS Smith plc, Mondi Group, RPC Group plc, Silgan Holdings Inc, Sonoco Products Company, Tetra Laval International S.A., Winpak Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume