The global Aviation Lubricants Market Study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments -By Type (Engine Oil, Hydraulic Fluid, Special Lubricants and Additives, Grease), By Technology (Synthetic, Mineral-based), By End-User (OEM, Aftermarket), By Application (Engine, Hydraulic Systems, Landing Gear, Airframe, Others), By Platform (Commercial Aviation, Military Aviation, Business & General Aviation).

The aviation lubricants market is experiencing growth driven by the increasing demand for high-performance lubricants to ensure safe and efficient operation of aircraft engines, components, and systems. Key trends shaping the future of the industry include innovations in lubricant formulations, additive technologies, and synthetic base oils to meet the rigorous requirements of modern aviation applications. Advanced aviation lubricants offer exceptional lubricity, thermal stability, and oxidation resistance, providing critical protection against wear, friction, and corrosion in high-temperature and high-pressure operating conditions. Moreover, the integration of lubricant condition monitoring, predictive maintenance, and data analytics enables proactive maintenance strategies, optimizing equipment performance, and minimizing downtime in aviation operations. Additionally, the growing trend towards fuel-efficient engines, reduced emissions, and extended maintenance intervals drives market demand for eco-friendly lubricants with lower environmental impact and regulatory compliance. As aircraft manufacturers and operators prioritize reliability, safety, and operational efficiency, the aviation lubricants market is poised for continued growth and innovation as a key contributor to the reliability and performance of aviation systems and equipment.

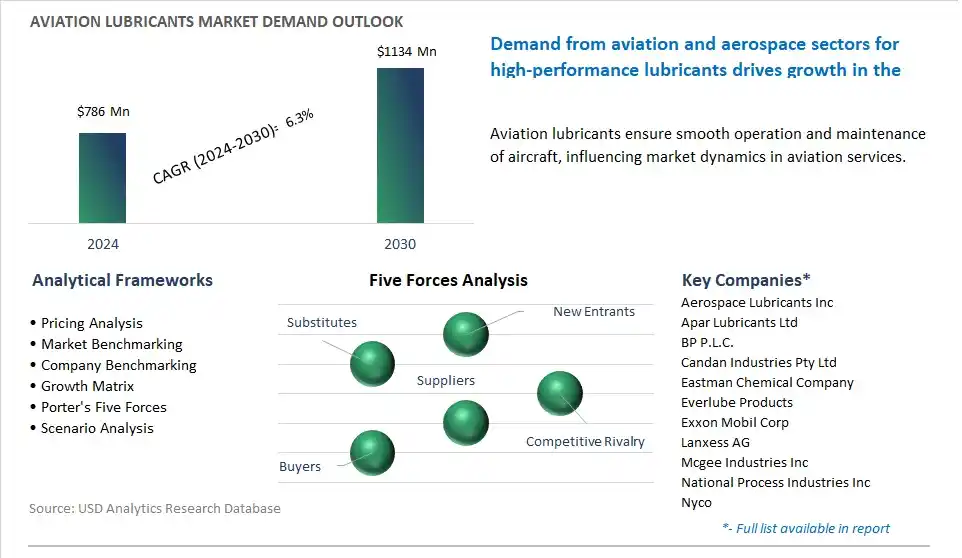

The market report analyses the leading companies in the industry including Aerospace Lubricants Inc, Apar Lubricants Ltd, BP P.L.C., Candan Industries Pty Ltd, Eastman Chemical Company, Everlube Products, Exxon Mobil Corp, Lanxess AG, Mcgee Industries Inc, National Process Industries Inc, Nyco, Nye Lubricants Inc, Phillips 66, PJSC Lukoil, ROCOL, Royal Dutch Shell Plc , The Chemours Company, Tiodize Co. Inc, Totalenergies Company, Whitmore Manufacturing Llc .

A prominent trend in the aviation lubricants market is the adoption of advanced synthetic lubricants. With increasing demands for fuel efficiency, engine performance, and durability in the aviation industry, there is a growing shift towards synthetic lubricants that offer superior properties compared to conventional mineral-based lubricants. Synthetic lubricants, formulated with high-quality base oils and advanced additives, provide enhanced lubrication, wear protection, and thermal stability, contributing to improved engine efficiency, reduced maintenance costs, and extended component life. This trend reflects a broader industry focus on optimizing aircraft performance, reliability, and safety through the use of advanced lubrication technologies, driving the demand for synthetic aviation lubricants in commercial and military aviation applications.

A key driver for the aviation lubricants market is the growth in air passenger traffic and fleet expansion. The aviation industry is experiencing steady growth driven by factors such as increasing disposable income, rising tourism, and expanding global trade. As airlines expand their fleets and introduce new aircraft models to meet growing demand for air travel, there is a parallel demand for lubricants to support engine, gearbox, and hydraulic systems in commercial and military aircraft. The continuous operation of aircraft engines and components under demanding conditions necessitates the use of high-performance lubricants that can withstand extreme temperatures, pressures, and operating environments. The expansion of air passenger traffic and fleet size drives the demand for aviation lubricants as essential maintenance fluids, creating opportunities for lubricant manufacturers and suppliers to serve the needs of the aviation sector worldwide.

An opportunity within the aviation lubricants market lies in the development of bio-based and environmentally friendly lubricants. With increasing concerns over environmental sustainability and regulatory pressures to reduce emissions and carbon footprint, there is a growing interest in bio-based lubricants derived from renewable sources such as vegetable oils, esters, and synthetic hydrocarbons. Bio-based lubricants offer advantages such as biodegradability, low toxicity, and reduced environmental impact compared to conventional petroleum-based lubricants. In addition to meeting regulatory requirements, bio-based lubricants align with the aviation industry's sustainability goals and corporate responsibility initiatives. By investing in research and development of bio-based lubricants tailored for aviation applications, lubricant manufacturers can capitalize on the growing demand for environmentally friendly solutions and position themselves as leaders in sustainable aviation lubrication.

The engine oil segment is the largest in the Aviation Lubricants Market due to diverse key factors. Engine oil is essential for the proper functioning and maintenance of aircraft engines, providing lubrication, cooling, and corrosion protection to critical engine components. As aircraft engines operate under extreme conditions of temperature, pressure, and speed, they require high-performance lubricants capable of withstanding these demanding environments while ensuring optimal engine performance and longevity. Engine oils for aviation applications are specifically formulated to meet stringent industry standards and regulatory requirements, including those set by organizations such as the Federal Aviation Administration (FAA) and the European Aviation Safety Agency (EASA). These lubricants offer excellent thermal stability, oxidation resistance, and wear protection, ensuring smooth operation and reduced friction within the engine. In addition, engine oil plays a crucial role in maintaining fuel efficiency and reducing emissions by minimizing frictional losses and optimizing engine combustion processes. Additionally, with the increasing global air traffic and fleet expansion, there is a growing demand for high-quality engine oils to support aircraft maintenance and operations worldwide. As a result, the engine oil segment dominates the Aviation Lubricants Market, driven by the critical role of lubricants in ensuring the safety, reliability, and performance of aircraft engines.

The synthetic segment is the fastest-growing in the Aviation Lubricants Market due to diverse compelling reasons. Synthetic lubricants offer superior performance characteristics compared to their mineral-based counterparts, making them increasingly preferred for aviation applications. Synthetic lubricants are engineered from carefully selected base oils and advanced additives to deliver exceptional thermal stability, oxidation resistance, and wear protection under extreme operating conditions encountered in aircraft engines and components. These lubricants exhibit consistent viscosity properties across a wide temperature range, ensuring reliable lubrication and component protection in both high-temperature and low-temperature environments. In addition, synthetic lubricants offer extended drain intervals and reduced maintenance requirements compared to mineral-based oils, resulting in lower operating costs and downtime for aircraft operators. Additionally, synthetic lubricants contribute to improved fuel efficiency and reduced emissions by minimizing frictional losses and optimizing engine performance. With the aviation industry increasingly focusing on sustainability, synthetic lubricants align with environmental goals by offering enhanced efficiency and reduced environmental impact. Further, technological advancements and innovations in synthetic lubricant formulations continue to drive performance improvements, expanding their applicability across various aircraft types and operating conditions. As a result, the synthetic segment is experiencing rapid growth in the Aviation Lubricants Market, driven by the demand for high-performance lubrication solutions that enhance aircraft reliability, efficiency, and environmental sustainability.

By Type

Engine Oil

Hydraulic Fluid

Special Lubricants and Additives

Grease

By Technology

Synthetic

Mineral-based

By End-User

OEM

Aftermarket

By Application

Engine

Hydraulic Systems

Landing Gear

Airframe

Others

By Platform

Commercial Aviation

Military Aviation

Business & General Aviation

Regions Included

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Aerospace Lubricants Inc

Apar Lubricants Ltd

BP P.L.C.

Candan Industries Pty Ltd

Eastman Chemical Company

Everlube Products

Exxon Mobil Corp

Lanxess AG

Mcgee Industries Inc

National Process Industries Inc

Nyco

Nye Lubricants Inc

Phillips 66

PJSC Lukoil

ROCOL

Royal Dutch Shell Plc

The Chemours Company

Tiodize Co. Inc

Totalenergies Company

Whitmore Manufacturing Llc

*- List Not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Aviation Lubricants Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Covered

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Aviation Lubricants Market Size Outlook, $ Million, 2021 to 2030

3.2 Aviation Lubricants Market Outlook by Type, $ Million, 2021 to 2030

3.3 Aviation Lubricants Market Outlook by Product, $ Million, 2021 to 2030

3.4 Aviation Lubricants Market Outlook by Application, $ Million, 2021 to 2030

3.5 Aviation Lubricants Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Aviation Lubricants Industry

4.2 Key Market Trends in Aviation Lubricants Industry

4.3 Potential Opportunities in Aviation Lubricants Industry

4.4 Key Challenges in Aviation Lubricants Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Aviation Lubricants Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Aviation Lubricants Market Outlook by Segments

7.1 Aviation Lubricants Market Outlook by Segments, $ Million, 2021- 2030

By Type

Engine Oil

Hydraulic Fluid

Special Lubricants and Additives

Grease

By Technology

Synthetic

Mineral-based

By End-User

OEM

Aftermarket

By Application

Engine

Hydraulic Systems

Landing Gear

Airframe

Others

By Platform

Commercial Aviation

Military Aviation

Business & General Aviation

8 North America Aviation Lubricants Market Analysis and Outlook To 2030

8.1 Introduction to North America Aviation Lubricants Markets in 2024

8.2 North America Aviation Lubricants Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Aviation Lubricants Market size Outlook by Segments, 2021-2030

By Type

Engine Oil

Hydraulic Fluid

Special Lubricants and Additives

Grease

By Technology

Synthetic

Mineral-based

By End-User

OEM

Aftermarket

By Application

Engine

Hydraulic Systems

Landing Gear

Airframe

Others

By Platform

Commercial Aviation

Military Aviation

Business & General Aviation

9 Europe Aviation Lubricants Market Analysis and Outlook To 2030

9.1 Introduction to Europe Aviation Lubricants Markets in 2024

9.2 Europe Aviation Lubricants Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Aviation Lubricants Market Size Outlook by Segments, 2021-2030

By Type

Engine Oil

Hydraulic Fluid

Special Lubricants and Additives

Grease

By Technology

Synthetic

Mineral-based

By End-User

OEM

Aftermarket

By Application

Engine

Hydraulic Systems

Landing Gear

Airframe

Others

By Platform

Commercial Aviation

Military Aviation

Business & General Aviation

10 Asia Pacific Aviation Lubricants Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Aviation Lubricants Markets in 2024

10.2 Asia Pacific Aviation Lubricants Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Aviation Lubricants Market size Outlook by Segments, 2021-2030

By Type

Engine Oil

Hydraulic Fluid

Special Lubricants and Additives

Grease

By Technology

Synthetic

Mineral-based

By End-User

OEM

Aftermarket

By Application

Engine

Hydraulic Systems

Landing Gear

Airframe

Others

By Platform

Commercial Aviation

Military Aviation

Business & General Aviation

11 South America Aviation Lubricants Market Analysis and Outlook To 2030

11.1 Introduction to South America Aviation Lubricants Markets in 2024

11.2 South America Aviation Lubricants Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Aviation Lubricants Market size Outlook by Segments, 2021-2030

By Type

Engine Oil

Hydraulic Fluid

Special Lubricants and Additives

Grease

By Technology

Synthetic

Mineral-based

By End-User

OEM

Aftermarket

By Application

Engine

Hydraulic Systems

Landing Gear

Airframe

Others

By Platform

Commercial Aviation

Military Aviation

Business & General Aviation

12 Middle East and Africa Aviation Lubricants Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Aviation Lubricants Markets in 2024

12.2 Middle East and Africa Aviation Lubricants Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Aviation Lubricants Market size Outlook by Segments, 2021-2030

By Type

Engine Oil

Hydraulic Fluid

Special Lubricants and Additives

Grease

By Technology

Synthetic

Mineral-based

By End-User

OEM

Aftermarket

By Application

Engine

Hydraulic Systems

Landing Gear

Airframe

Others

By Platform

Commercial Aviation

Military Aviation

Business & General Aviation

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

Aerospace Lubricants Inc

Apar Lubricants Ltd

BP P.L.C.

Candan Industries Pty Ltd

Eastman Chemical Company

Everlube Products

Exxon Mobil Corp

Lanxess AG

Mcgee Industries Inc

National Process Industries Inc

Nyco

Nye Lubricants Inc

Phillips 66

PJSC Lukoil

ROCOL

Royal Dutch Shell Plc

The Chemours Company

Tiodize Co. Inc

Totalenergies Company

Whitmore Manufacturing Llc

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Engine Oil

Hydraulic Fluid

Special Lubricants and Additives

Grease

By Technology

Synthetic

Mineral-based

By End-User

OEM

Aftermarket

By Application

Engine

Hydraulic Systems

Landing Gear

Airframe

Others

By Platform

Commercial Aviation

Military Aviation

Business & General Aviation

Countries Analyzed

North America (US, Canada, Mexico)

Europe (Germany, UK, France, Spain, Italy, Russia, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Australia, South East Asia, Rest of Asia)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa)

Global Aviation Lubricants is forecast to reach $1134 Million in 2030 from $786 Million in 2024, registering a CAGR of 6.3%

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Aerospace Lubricants Inc, Apar Lubricants Ltd, BP P.L.C., Candan Industries Pty Ltd, Eastman Chemical Company, Everlube Products, Exxon Mobil Corp, Lanxess AG, Mcgee Industries Inc, National Process Industries Inc, Nyco, Nye Lubricants Inc, Phillips 66, PJSC Lukoil, ROCOL, Royal Dutch Shell Plc , The Chemours Company, Tiodize Co. Inc, Totalenergies Company, Whitmore Manufacturing Llc

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: Revenue (USD); Volume