The global Automotive Windshield Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Position (Front, Rear), By Glass, Tempered, Laminated), By Vehicle (Light Commercial Vehicle (LCV), Heavy Commercial Vehicle (HCV), Passenger Cars, Others), By End-User (OEM, Aftermarket).

The automotive windshield market in 2024 reflects a critical component of vehicle safety, visibility, and structural integrity, witnessing steady growth driven by advancements in materials, manufacturing processes, and vehicle design. Windshields, also known as windscreens, serve as a protective barrier against environmental elements, debris, and road hazards while providing structural support to the vehicle's roof. With the increasing focus on lightweighting, aerodynamics, and advanced driver assistance systems (ADAS), automakers are adopting laminated glass, acoustic interlayers, and hydrophobic coatings to enhance windshield performance and passenger safety. Moreover, the integration of heads-up displays (HUDs), augmented reality (AR) overlays, and sensor arrays is transforming automotive windshields into multifunctional components that contribute to vehicle connectivity, navigation, and autonomous driving capabilities.

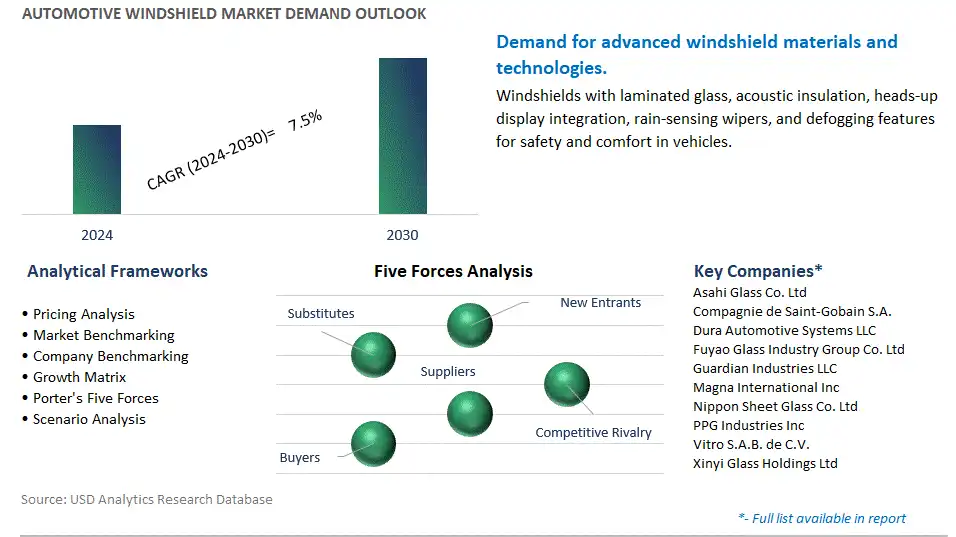

The global Automotive Windshield market is highly competitive with a large number of companies focusing on niche market segments. Amidst intense competitive conditions, Automotive Windshield Companies are investing in new product launches and strengthening distribution channels. Key companies operating in the Automotive Windshield Market Industry include- Asahi Glass Co. Ltd, Compagnie de Saint-Gobain S.A., Dura Automotive Systems LLC, Fuyao Glass Industry Group Co. Ltd, Guardian Industries LLC, Magna International Inc, Nippon Sheet Glass Co. Ltd, PPG Industries Inc, Vitro S.A.B. de C.V., Xinyi Glass Holdings Ltd.

A significant trend in the automotive windshield market is the integration of advanced driver assistance systems (ADAS) sensors. As vehicles become more technologically advanced and safety-conscious, there's a growing demand for windshields equipped with sensors for features such as lane departure warning, automatic emergency braking, and adaptive cruise control. Windshields with integrated ADAS sensors help improve the accuracy and reliability of these safety systems by providing a clear and unobstructed view of the road ahead. Additionally, the integration of sensors directly into the windshield reduces the need for external sensor mounts, leading to a more streamlined and aesthetically pleasing vehicle design. This trend reflects the automotive industry's commitment to enhancing vehicle safety and incorporating cutting-edge technology into vehicle components.

The primary driver in the automotive windshield market is the increasing focus on vehicle safety and regulatory compliance. Governments worldwide are implementing stricter safety regulations and standards to reduce the number of accidents and improve occupant protection. Windshields play a crucial role in vehicle safety by providing structural integrity, preventing ejection during a collision, and acting as a barrier against road debris and environmental hazards. Automakers are therefore prioritizing the use of high-quality, impact-resistant materials and advanced manufacturing techniques to ensure that windshields meet stringent safety requirements. Additionally, advancements in windshield technology, such as laminated glass and tempered glass, further enhance vehicle safety and contribute to regulatory compliance. This driver underscores the importance of windshield safety in the automotive industry and drives market growth in the automotive windshield segment.

An emerging opportunity in the automotive windshield market lies in the development of smart windshields with integrated technology. Smart windshields go beyond traditional functionality to offer additional features such as heads-up displays (HUDs), augmented reality (AR) overlays, and interactive touchscreens. These advanced windshields provide drivers with real-time information such as navigation directions, vehicle diagnostics, and traffic updates, enhancing situational awareness and reducing driver distraction. Moreover, smart windshields can be equipped with built-in sensors for rain detection, light sensing, and temperature monitoring, enabling automated control of windshield wipers, defrosters, and tinting. By developing innovative smart windshield solutions, manufacturers can capitalize on the growing demand for connected and intelligent vehicles and create new revenue streams in the automotive market.

By Position

Front

Rear

By Glass

Tempered

Laminated

By Vehicle

Light Commercial Vehicle (LCV)

Heavy Commercial Vehicle (HCV)

Passenger Cars

Others

By End-User

Original Equipment Manufacturer (OEM)

AftermarketGeographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa

Asahi Glass Co. Ltd

Compagnie de Saint-Gobain S.A.

Dura Automotive Systems LLC

Fuyao Glass Industry Group Co. Ltd

Guardian Industries LLC

Magna International Inc

Nippon Sheet Glass Co. Ltd

PPG Industries Inc

Vitro S.A.B. de C.V.

Xinyi Glass Holdings Ltd

*- List not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Automotive Windshield Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Automotive Windshield Market Size Outlook, $ Million, 2021 to 2030

3.2 Automotive Windshield Market Outlook by Type, $ Million, 2021 to 2030

3.3 Automotive Windshield Market Outlook by Product, $ Million, 2021 to 2030

3.4 Automotive Windshield Market Outlook by Application, $ Million, 2021 to 2030

3.5 Automotive Windshield Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Automotive Windshield Industry

4.2 Key Market Trends in Automotive Windshield Industry

4.3 Potential Opportunities in Automotive Windshield Industry

4.4 Key Challenges in Automotive Windshield Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Automotive Windshield Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Automotive Windshield Market Outlook by Segments

7.1 Automotive Windshield Market Outlook by Segments, $ Million, 2021- 2030

By Position

Front

Rear

By Glass

Tempered

Laminated

By Vehicle

Light Commercial Vehicle (LCV)

Heavy Commercial Vehicle (HCV)

Passenger Cars

Others

By End-User

Original Equipment Manufacturer (OEM)

Aftermarket

8 North America Automotive Windshield Market Analysis and Outlook To 2030

8.1 Introduction to North America Automotive Windshield Markets in 2024

8.2 North America Automotive Windshield Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Automotive Windshield Market size Outlook by Segments, 2021-2030

By Position

Front

Rear

By Glass

Tempered

Laminated

By Vehicle

Light Commercial Vehicle (LCV)

Heavy Commercial Vehicle (HCV)

Passenger Cars

Others

By End-User

Original Equipment Manufacturer (OEM)

Aftermarket

9 Europe Automotive Windshield Market Analysis and Outlook To 2030

9.1 Introduction to Europe Automotive Windshield Markets in 2024

9.2 Europe Automotive Windshield Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Automotive Windshield Market Size Outlook by Segments, 2021-2030

By Position

Front

Rear

By Glass

Tempered

Laminated

By Vehicle

Light Commercial Vehicle (LCV)

Heavy Commercial Vehicle (HCV)

Passenger Cars

Others

By End-User

Original Equipment Manufacturer (OEM)

Aftermarket

10 Asia Pacific Automotive Windshield Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Automotive Windshield Markets in 2024

10.2 Asia Pacific Automotive Windshield Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Automotive Windshield Market size Outlook by Segments, 2021-2030

By Position

Front

Rear

By Glass

Tempered

Laminated

By Vehicle

Light Commercial Vehicle (LCV)

Heavy Commercial Vehicle (HCV)

Passenger Cars

Others

By End-User

Original Equipment Manufacturer (OEM)

Aftermarket

11 South America Automotive Windshield Market Analysis and Outlook To 2030

11.1 Introduction to South America Automotive Windshield Markets in 2024

11.2 South America Automotive Windshield Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Automotive Windshield Market size Outlook by Segments, 2021-2030

By Position

Front

Rear

By Glass

Tempered

Laminated

By Vehicle

Light Commercial Vehicle (LCV)

Heavy Commercial Vehicle (HCV)

Passenger Cars

Others

By End-User

Original Equipment Manufacturer (OEM)

Aftermarket

12 Middle East and Africa Automotive Windshield Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Automotive Windshield Markets in 2024

12.2 Middle East and Africa Automotive Windshield Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Automotive Windshield Market size Outlook by Segments, 2021-2030

By Position

Front

Rear

By Glass

Tempered

Laminated

By Vehicle

Light Commercial Vehicle (LCV)

Heavy Commercial Vehicle (HCV)

Passenger Cars

Others

By End-User

Original Equipment Manufacturer (OEM)

Aftermarket

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

Asahi Glass Co. Ltd

Compagnie de Saint-Gobain S.A.

Dura Automotive Systems LLC

Fuyao Glass Industry Group Co. Ltd

Guardian Industries LLC

Magna International Inc

Nippon Sheet Glass Co. Ltd

PPG Industries Inc

Vitro S.A.B. de C.V.

Xinyi Glass Holdings Ltd

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Position

Front

Rear

By Glass

Tempered

Laminated

By Vehicle

Light Commercial Vehicle (LCV)

Heavy Commercial Vehicle (HCV)

Passenger Cars

Others

By End-User

Original Equipment Manufacturer (OEM)

Aftermarket

The global Automotive Windshield Market is one of the lucrative growth markets, poised to register a 7.5% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

Asahi Glass Co. Ltd, Compagnie de Saint-Gobain S.A., Dura Automotive Systems LLC, Fuyao Glass Industry Group Co. Ltd, Guardian Industries LLC, Magna International Inc, Nippon Sheet Glass Co. Ltd, PPG Industries Inc, Vitro S.A.B. de C.V., Xinyi Glass Holdings Ltd

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume