The global Automotive Tie Rod Assembly Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Type (Steering Tie Rod Assembly, Straight Tie Rod Assembly), By Application (Passenger Cars, LCVs, M&HCVs), By Sales Channel (OEMs, Aftermarket).

The Automotive Tie Rod Assembly Market involves the manufacturing and distribution of components that connect the steering rack to the steering knuckle in vehicles, transmitting steering input from the steering wheel to the wheels for steering control. Tie rod assemblies play a critical role in maintaining steering precision, alignment, and stability, ensuring safe and predictable handling of vehicles. With the automotive industry's increasing emphasis on safety, performance, and durability, the demand for high-quality tie rod assemblies continues to rise. Manufacturers in this market focus on developing tie rod assemblies with robust materials, precision engineering, and corrosion-resistant coatings to meet the rigorous demands of modern vehicles and driving conditions. Moreover, advancements in tie rod assembly technology, including sealed and greased designs, improved sealing mechanisms, and integrated wear indicators, drive innovation, enabling enhanced reliability, longevity, and maintenance intervals. Additionally, as vehicle designs evolve to incorporate more electrification and autonomous features, the Automotive Tie Rod Assembly Market presents opportunities for further innovation and integration to ensure optimal steering performance, comfort, and safety in vehicles.

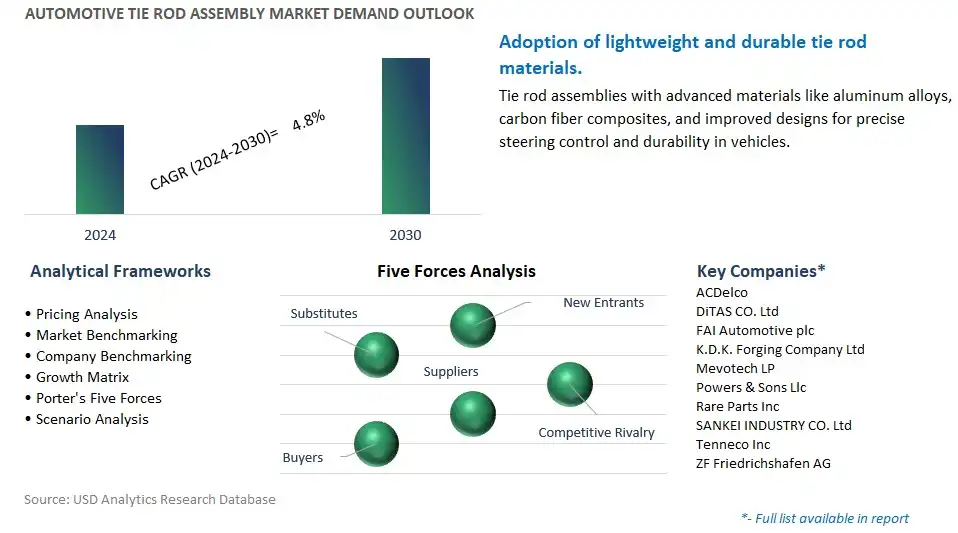

The global Automotive Tie Rod Assembly market is highly competitive with a large number of companies focusing on niche market segments. Amidst intense competitive conditions, Automotive Tie Rod Assembly Companies are investing in new product launches and strengthening distribution channels. Key companies operating in the Automotive Tie Rod Assembly Market Industry include- ACDelco, DiTAS CO. Ltd, FAI Automotive plc, K.D.K. Forging Company Ltd, Mevotech LP, Powers & Sons Llc, Rare Parts Inc, SANKEI INDUSTRY CO. Ltd, Tenneco Inc, ZF Friedrichshafen AG.

A prominent trend in the automotive tie rod assembly market is the increasing emphasis on vehicle safety standards. As road safety regulations become more stringent worldwide, automakers are prioritizing the integration of advanced safety features into their vehicles. Tie rod assemblies play a crucial role in steering and suspension systems, directly impacting vehicle stability and handling. Consequently, there is a growing demand for tie rod assemblies that meet or exceed stringent safety standards, including crashworthiness requirements, to enhance overall vehicle safety performance.

A significant driver shaping the automotive tie rod assembly market is the growing demand for lighter and more fuel-efficient vehicles. With increasing concerns about environmental sustainability and fuel economy, automakers are focusing on reducing vehicle weight to improve fuel efficiency and lower emissions. Lightweight materials such as aluminum and high-strength steel are being increasingly used in automotive components, including tie rod assemblies, to achieve weight reduction without compromising structural integrity. This driver is fueling the demand for innovative tie rod assembly designs and materials that offer both lightweight construction and robust performance, thereby driving market growth.

An emerging opportunity in the automotive tie rod assembly market is the expansion into electric and autonomous vehicle segments. The shift towards electric vehicles (EVs) and autonomous vehicles (AVs) is reshaping the automotive industry, presenting new opportunities for component manufacturers. EVs and AVs require specialized tie rod assemblies designed to meet the unique performance requirements of electric drivetrains and autonomous driving systems. By developing tie rod assemblies optimized for EVs and AVs, manufacturers can capitalize on the growing demand for components tailored to these rapidly evolving vehicle segments, thereby expanding their market presence and revenue opportunities.

By Type

Steering Tie Rod Assembly

Straight Tie Rod Assembly

By Application

Passenger Cars

LCVs

M&HCVs

By Sales Channel

OEMs

AftermarketGeographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa

ACDelco

DiTAS CO. Ltd

FAI Automotive plc

K.D.K. Forging Company Ltd

Mevotech LP

Powers & Sons Llc

Rare Parts Inc

SANKEI INDUSTRY CO. Ltd

Tenneco Inc

ZF Friedrichshafen AG

*- List not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Automotive Tie Rod Assembly Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Automotive Tie Rod Assembly Market Size Outlook, $ Million, 2021 to 2030

3.2 Automotive Tie Rod Assembly Market Outlook by Type, $ Million, 2021 to 2030

3.3 Automotive Tie Rod Assembly Market Outlook by Product, $ Million, 2021 to 2030

3.4 Automotive Tie Rod Assembly Market Outlook by Application, $ Million, 2021 to 2030

3.5 Automotive Tie Rod Assembly Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Automotive Tie Rod Assembly Industry

4.2 Key Market Trends in Automotive Tie Rod Assembly Industry

4.3 Potential Opportunities in Automotive Tie Rod Assembly Industry

4.4 Key Challenges in Automotive Tie Rod Assembly Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Automotive Tie Rod Assembly Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Automotive Tie Rod Assembly Market Outlook by Segments

7.1 Automotive Tie Rod Assembly Market Outlook by Segments, $ Million, 2021- 2030

By Type

Steering Tie Rod Assembly

Straight Tie Rod Assembly

By Application

Passenger Cars

LCVs

M&HCVs

By Sales Channel

OEMs

Aftermarket

8 North America Automotive Tie Rod Assembly Market Analysis and Outlook To 2030

8.1 Introduction to North America Automotive Tie Rod Assembly Markets in 2024

8.2 North America Automotive Tie Rod Assembly Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Automotive Tie Rod Assembly Market size Outlook by Segments, 2021-2030

By Type

Steering Tie Rod Assembly

Straight Tie Rod Assembly

By Application

Passenger Cars

LCVs

M&HCVs

By Sales Channel

OEMs

Aftermarket

9 Europe Automotive Tie Rod Assembly Market Analysis and Outlook To 2030

9.1 Introduction to Europe Automotive Tie Rod Assembly Markets in 2024

9.2 Europe Automotive Tie Rod Assembly Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Automotive Tie Rod Assembly Market Size Outlook by Segments, 2021-2030

By Type

Steering Tie Rod Assembly

Straight Tie Rod Assembly

By Application

Passenger Cars

LCVs

M&HCVs

By Sales Channel

OEMs

Aftermarket

10 Asia Pacific Automotive Tie Rod Assembly Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Automotive Tie Rod Assembly Markets in 2024

10.2 Asia Pacific Automotive Tie Rod Assembly Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Automotive Tie Rod Assembly Market size Outlook by Segments, 2021-2030

By Type

Steering Tie Rod Assembly

Straight Tie Rod Assembly

By Application

Passenger Cars

LCVs

M&HCVs

By Sales Channel

OEMs

Aftermarket

11 South America Automotive Tie Rod Assembly Market Analysis and Outlook To 2030

11.1 Introduction to South America Automotive Tie Rod Assembly Markets in 2024

11.2 South America Automotive Tie Rod Assembly Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Automotive Tie Rod Assembly Market size Outlook by Segments, 2021-2030

By Type

Steering Tie Rod Assembly

Straight Tie Rod Assembly

By Application

Passenger Cars

LCVs

M&HCVs

By Sales Channel

OEMs

Aftermarket

12 Middle East and Africa Automotive Tie Rod Assembly Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Automotive Tie Rod Assembly Markets in 2024

12.2 Middle East and Africa Automotive Tie Rod Assembly Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Automotive Tie Rod Assembly Market size Outlook by Segments, 2021-2030

By Type

Steering Tie Rod Assembly

Straight Tie Rod Assembly

By Application

Passenger Cars

LCVs

M&HCVs

By Sales Channel

OEMs

Aftermarket

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

ACDelco

DiTAS CO. Ltd

FAI Automotive plc

K.D.K. Forging Company Ltd

Mevotech LP

Powers & Sons Llc

Rare Parts Inc

SANKEI INDUSTRY CO. Ltd

Tenneco Inc

ZF Friedrichshafen AG

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Steering Tie Rod Assembly

Straight Tie Rod Assembly

By Application

Passenger Cars

LCVs

M&HCVs

By Sales Channel

OEMs

Aftermarket

The global Automotive Tie Rod Assembly Market is one of the lucrative growth markets, poised to register a 4.8% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

ACDelco, DiTAS CO. Ltd, FAI Automotive plc, K.D.K. Forging Company Ltd, Mevotech LP, Powers & Sons Llc, Rare Parts Inc, SANKEI INDUSTRY CO. Ltd, Tenneco Inc, ZF Friedrichshafen AG

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume