The global Automotive Starter Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Type (Electric, Pneumatic, Hydraulic), By Component (Starter Motor, Magnetic Switch, Battery, Heavy-Gauge Cables, Brush, Others), By Engine (Diesel, Gasoline), By Application (Passenger Vehicles, Light Commercial Vehicles, Heavy Commercial Vehicles), By Sales Channel (OEM, Aftermarket).

The automotive starter market is experiencing notable growth in 2024, driven by the increasing demand for reliable, efficient, and compact starting solutions in internal combustion engine (ICE) and hybrid vehicles. Starters are electromechanical devices responsible for initiating the engine's crankshaft rotation to commence combustion and powertrain operation. With advancements in starter motor technology, including integrated starter-generators (ISGs), stop-start systems, and direct-drive starters, automakers are improving fuel efficiency, reducing emissions, and enhancing cold-start performance. Moreover, the transition towards electrified powertrains, including mild hybrids, plug-in hybrids (PHEVs), and electric vehicles (EVs), is driving innovation in starter design and integration, paving the way for seamless engine start-stop functionality, regenerative braking, and energy recuperation capabilities.

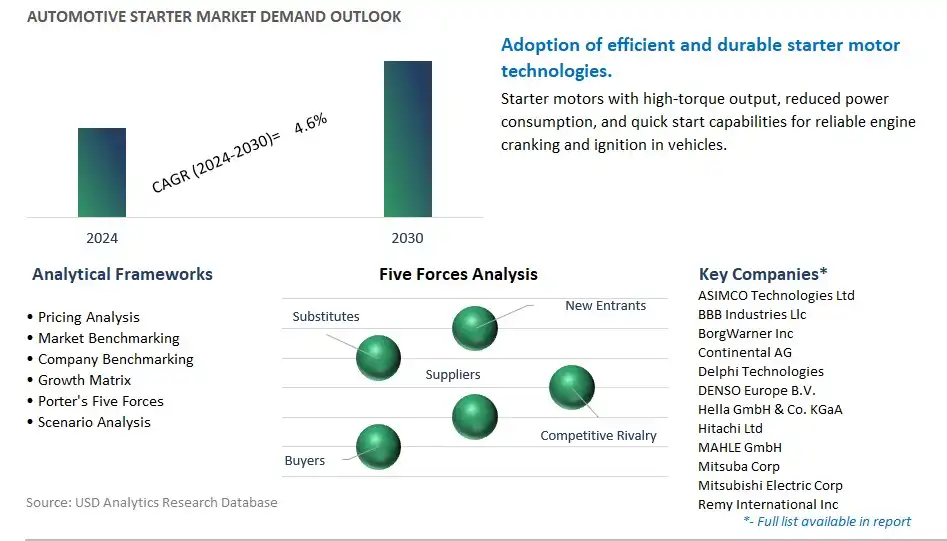

The global Automotive Starter market is highly competitive with a large number of companies focusing on niche market segments. Amidst intense competitive conditions, Automotive Starter Companies are investing in new product launches and strengthening distribution channels. Key companies operating in the Automotive Starter Market Industry include- ASIMCO Technologies Ltd, BBB Industries Llc, BorgWarner Inc, Continental AG, Delphi Technologies, DENSO Europe B.V., Hella GmbH & Co. KGaA, Hitachi Ltd, MAHLE GmbH, Mitsuba Corp, Mitsubishi Electric Corp, Remy International Inc, Valeo SA.

The Automotive Starter Market is experiencing a notable trend marked by the transition towards electric starters, driven by the growing electrification of vehicles. As automotive manufacturers seek to reduce emissions, improve fuel efficiency, and meet regulatory standards, there's an increasing shift away from traditional combustion engine starters towards electric starter systems. This trend is propelled by advancements in battery technology, electric motor design, and power electronics, enabling the development of more efficient and reliable electric starters capable of providing instant torque for engine cranking. Moreover, the rise of hybrid and electric vehicles further accelerates the adoption of electric starters, as they play a vital role in initiating the propulsion systems of these alternative powertrain vehicles, thus reshaping the landscape of the automotive starter market.

A key driver propelling the Automotive Starter Market is the automotive industry's emphasis on enhancing engine efficiency, reliability, and performance. With consumers demanding vehicles that deliver optimal fuel economy, reduced emissions, and smooth starting experiences, automakers prioritize the integration of high-quality starter systems that ensure consistent and reliable engine ignition under various operating conditions. This driver is reinforced by the need to comply with stringent emission regulations and meet customer expectations for seamless engine operation, especially in harsh environments or extreme weather conditions. Additionally, the increasing complexity of modern vehicle systems, including start-stop technology and idle reduction strategies, drives the demand for advanced starter solutions capable of supporting these functionalities while maintaining durability and longevity, thus fueling market growth.

An attractive opportunity within the Automotive Starter Market lies in the integration of start-stop systems to enhance fuel efficiency and reduce emissions in conventional internal combustion engine vehicles. By incorporating start-stop functionality into starter systems, automakers can automatically shut off the engine when the vehicle comes to a stop, such as at traffic lights or in heavy traffic, and restart it quickly and smoothly when the driver resumes acceleration. This opportunity is particularly relevant as governments worldwide implement stricter regulations to curb greenhouse gas emissions and combat climate change, prompting automakers to adopt innovative technologies that improve vehicle efficiency and environmental sustainability. Moreover, the integration of start-stop systems presents avenues for aftermarket retrofitting and service opportunities, allowing vehicle owners to upgrade their existing vehicles with fuel-saving features, thus expanding the addressable market for automotive starter solutions.

By Type

Electric

-Gear Reduction

-Inertia Starter

-Folo-Thru Drive

-Moveable Pole Shoe

Pneumatic

Hydraulic

By Component

Starter Motor

Magnetic Switch

Battery

Heavy-Gauge Cables

Brush

Others

By Engine

Diesel

Gasoline

By Application

Passenger Vehicles

Light Commercial Vehicles

Heavy Commercial Vehicles

By Sales Channel

Original Equipment Manufacturer (OEM)

AftermarketGeographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa

ASIMCO Technologies Ltd

BBB Industries Llc

BorgWarner Inc

Continental AG

Delphi Technologies

DENSO Europe B.V.

Hella GmbH & Co. KGaA

Hitachi Ltd

MAHLE GmbH

Mitsuba Corp

Mitsubishi Electric Corp

Remy International Inc

Valeo SA

*- List not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Automotive Starter Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Automotive Starter Market Size Outlook, $ Million, 2021 to 2030

3.2 Automotive Starter Market Outlook by Type, $ Million, 2021 to 2030

3.3 Automotive Starter Market Outlook by Product, $ Million, 2021 to 2030

3.4 Automotive Starter Market Outlook by Application, $ Million, 2021 to 2030

3.5 Automotive Starter Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Automotive Starter Industry

4.2 Key Market Trends in Automotive Starter Industry

4.3 Potential Opportunities in Automotive Starter Industry

4.4 Key Challenges in Automotive Starter Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Automotive Starter Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Automotive Starter Market Outlook by Segments

7.1 Automotive Starter Market Outlook by Segments, $ Million, 2021- 2030

By Type

Electric

-Gear Reduction

-Inertia Starter

-Folo-Thru Drive

-Moveable Pole Shoe

Pneumatic

Hydraulic

By Component

Starter Motor

Magnetic Switch

Battery

Heavy-Gauge Cables

Brush

Others

By Engine

Diesel

Gasoline

By Application

Passenger Vehicles

Light Commercial Vehicles

Heavy Commercial Vehicles

By Sales Channel

Original Equipment Manufacturer (OEM)

Aftermarket

8 North America Automotive Starter Market Analysis and Outlook To 2030

8.1 Introduction to North America Automotive Starter Markets in 2024

8.2 North America Automotive Starter Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Automotive Starter Market size Outlook by Segments, 2021-2030

By Type

Electric

-Gear Reduction

-Inertia Starter

-Folo-Thru Drive

-Moveable Pole Shoe

Pneumatic

Hydraulic

By Component

Starter Motor

Magnetic Switch

Battery

Heavy-Gauge Cables

Brush

Others

By Engine

Diesel

Gasoline

By Application

Passenger Vehicles

Light Commercial Vehicles

Heavy Commercial Vehicles

By Sales Channel

Original Equipment Manufacturer (OEM)

Aftermarket

9 Europe Automotive Starter Market Analysis and Outlook To 2030

9.1 Introduction to Europe Automotive Starter Markets in 2024

9.2 Europe Automotive Starter Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Automotive Starter Market Size Outlook by Segments, 2021-2030

By Type

Electric

-Gear Reduction

-Inertia Starter

-Folo-Thru Drive

-Moveable Pole Shoe

Pneumatic

Hydraulic

By Component

Starter Motor

Magnetic Switch

Battery

Heavy-Gauge Cables

Brush

Others

By Engine

Diesel

Gasoline

By Application

Passenger Vehicles

Light Commercial Vehicles

Heavy Commercial Vehicles

By Sales Channel

Original Equipment Manufacturer (OEM)

Aftermarket

10 Asia Pacific Automotive Starter Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Automotive Starter Markets in 2024

10.2 Asia Pacific Automotive Starter Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Automotive Starter Market size Outlook by Segments, 2021-2030

By Type

Electric

-Gear Reduction

-Inertia Starter

-Folo-Thru Drive

-Moveable Pole Shoe

Pneumatic

Hydraulic

By Component

Starter Motor

Magnetic Switch

Battery

Heavy-Gauge Cables

Brush

Others

By Engine

Diesel

Gasoline

By Application

Passenger Vehicles

Light Commercial Vehicles

Heavy Commercial Vehicles

By Sales Channel

Original Equipment Manufacturer (OEM)

Aftermarket

11 South America Automotive Starter Market Analysis and Outlook To 2030

11.1 Introduction to South America Automotive Starter Markets in 2024

11.2 South America Automotive Starter Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Automotive Starter Market size Outlook by Segments, 2021-2030

By Type

Electric

-Gear Reduction

-Inertia Starter

-Folo-Thru Drive

-Moveable Pole Shoe

Pneumatic

Hydraulic

By Component

Starter Motor

Magnetic Switch

Battery

Heavy-Gauge Cables

Brush

Others

By Engine

Diesel

Gasoline

By Application

Passenger Vehicles

Light Commercial Vehicles

Heavy Commercial Vehicles

By Sales Channel

Original Equipment Manufacturer (OEM)

Aftermarket

12 Middle East and Africa Automotive Starter Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Automotive Starter Markets in 2024

12.2 Middle East and Africa Automotive Starter Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Automotive Starter Market size Outlook by Segments, 2021-2030

By Type

Electric

-Gear Reduction

-Inertia Starter

-Folo-Thru Drive

-Moveable Pole Shoe

Pneumatic

Hydraulic

By Component

Starter Motor

Magnetic Switch

Battery

Heavy-Gauge Cables

Brush

Others

By Engine

Diesel

Gasoline

By Application

Passenger Vehicles

Light Commercial Vehicles

Heavy Commercial Vehicles

By Sales Channel

Original Equipment Manufacturer (OEM)

Aftermarket

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

ASIMCO Technologies Ltd

BBB Industries Llc

BorgWarner Inc

Continental AG

Delphi Technologies

DENSO Europe B.V.

Hella GmbH & Co. KGaA

Hitachi Ltd

MAHLE GmbH

Mitsuba Corp

Mitsubishi Electric Corp

Remy International Inc

Valeo SA

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Electric

-Gear Reduction

-Inertia Starter

-Folo-Thru Drive

-Moveable Pole Shoe

Pneumatic

Hydraulic

By Component

Starter Motor

Magnetic Switch

Battery

Heavy-Gauge Cables

Brush

Others

By Engine

Diesel

Gasoline

By Application

Passenger Vehicles

Light Commercial Vehicles

Heavy Commercial Vehicles

By Sales Channel

Original Equipment Manufacturer (OEM)

Aftermarket

The global Automotive Starter Market is one of the lucrative growth markets, poised to register a 4.6% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

ASIMCO Technologies Ltd, BBB Industries Llc, BorgWarner Inc, Continental AG, Delphi Technologies, DENSO Europe B.V., Hella GmbH & Co. KGaA, Hitachi Ltd, MAHLE GmbH, Mitsuba Corp, Mitsubishi Electric Corp, Remy International Inc, Valeo SA

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume