The global Automotive Stabilizer Bar Market study analyzes and forecasts the market size across 6 regions and 24 countries for diverse segments including By Type (Hollow and Solid Stabilizer Bar, Tubular Stabilizer Bar, Splined Stabilizer Bar), By Material (Cast Iron, Steel, Aluminium, Carbon Fibre Reinforced Plastic), By Vehicle (Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle), By Sales Channel (OEM, Aftermarket).

The automotive stabilizer bar market in 2024 showcases steady growth, driven by the pursuit of enhanced vehicle handling, stability, and ride comfort. Stabilizer bars, also known as anti-roll bars or sway bars, play a crucial role in reducing body roll and improving cornering stability by connecting the suspension components of a vehicle. With the increasing adoption of electric power steering (EPS) systems and advanced chassis control technologies, automakers are optimizing stabilizer bar designs, materials, and attachment points to achieve optimal handling characteristics while maintaining ride comfort. Moreover, the trend towards modular vehicle platforms and lightweighting initiatives is driving innovation in stabilizer bar construction, including hollow bars, composite materials, and integrated active suspension systems, to meet the evolving demands of modern vehicle architectures and consumer preferences.

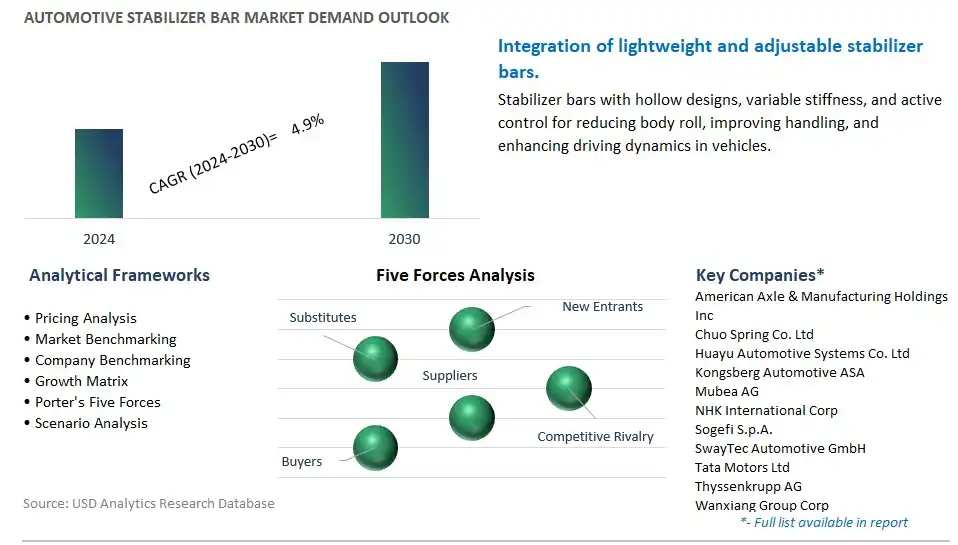

The global Automotive Stabilizer Bar market is highly competitive with a large number of companies focusing on niche market segments. Amidst intense competitive conditions, Automotive Stabilizer Bar Companies are investing in new product launches and strengthening distribution channels. Key companies operating in the Automotive Stabilizer Bar Market Industry include- American Axle & Manufacturing Holdings Inc, Chuo Spring Co. Ltd, Huayu Automotive Systems Co. Ltd, Kongsberg Automotive ASA, Mubea AG, NHK International Corp, Sogefi S.p.A., SwayTec Automotive GmbH, Tata Motors Ltd, Thyssenkrupp AG, Wanxiang Group Corp, ZF Friedrichshafen AG.

The Automotive Stabilizer Bar Market is witnessing a significant trend driven by the increasing demand for lightweight and high-performance materials in vehicle components. As automakers strive to improve fuel efficiency, handling, and overall vehicle dynamics, there's a growing preference for advanced materials such as advanced high-strength steel, aluminum alloys, and composite materials in stabilizer bar construction. This trend is reinforced by stringent regulatory requirements aimed at reducing vehicle emissions and enhancing safety standards, prompting manufacturers to innovate and optimize stabilizer bar designs to meet performance targets while minimizing weight and environmental impact. Consequently, the market is experiencing a shift towards next-generation materials and manufacturing processes that offer superior strength-to-weight ratios and corrosion resistance, thereby driving the adoption of innovative stabilizer bar solutions in modern automobiles.

A key driver propelling the Automotive Stabilizer Bar Market is the automotive industry's heightened focus on vehicle safety and stability. With an increasing emphasis on crashworthiness and active safety systems to mitigate the risk of accidents and enhance occupant protection, stabilizer bars play a crucial role in improving vehicle stability, reducing body roll, and enhancing overall handling characteristics. This driver is further accentuated by consumer demand for vehicles equipped with advanced safety features and enhanced driving dynamics, driving automakers to prioritize the integration of robust suspension systems and chassis components like stabilizer bars into their vehicle platforms. Additionally, regulatory mandates mandating the inclusion of stability control systems in new vehicles contribute to the sustained demand for stabilizer bars, thereby fueling market growth.

An attractive opportunity within the Automotive Stabilizer Bar Market lies in the integration of advanced suspension technologies to further enhance vehicle performance and ride quality. By combining stabilizer bars with electronically controlled damping systems, adaptive air suspensions, and active roll control mechanisms, automakers can offer customers a superior driving experience characterized by enhanced comfort, agility, and road holding capabilities. This opportunity is particularly relevant in the context of electric and autonomous vehicles, where precise control over vehicle dynamics is essential for optimizing energy efficiency and ensuring passenger comfort. Moreover, the integration of advanced suspension technologies presents avenues for differentiation and value-added offerings in a competitive automotive market landscape, enabling manufacturers to cater to evolving consumer preferences and stay ahead of technological advancements.

By Type

Hollow and Solid Stabilizer Bar

Tubular Stabilizer Bar

Splined Stabilizer Bar

By Material

Cast Iron

Steel

Aluminum

Carbon Fibre Reinforced Plastic

By Vehicle

Passenger Car

Light Commercial Vehicle

Heavy Commercial Vehicle

By Sales Channel

OEM

AftermarketGeographical Analysis

North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa

American Axle & Manufacturing Holdings Inc

Chuo Spring Co. Ltd

Huayu Automotive Systems Co. Ltd

Kongsberg Automotive ASA

Mubea AG

NHK International Corp

Sogefi S.p.A.

SwayTec Automotive GmbH

Tata Motors Ltd

Thyssenkrupp AG

Wanxiang Group Corp

ZF Friedrichshafen AG

*- List not Exhaustive

TABLE OF CONTENTS

1 Introduction to 2024 Automotive Stabilizer Bar Market

1.1 Market Overview

1.2 Quick Facts

1.3 Scope/Objective of the Study

1.4 Market Definition

1.5 Countries and Regions Analyzed

1.6 Units, Currency, and Conversions

1.7 Industry Value Chain

2 Research Methodology

2.1 Market Size Estimation

2.2 Sources and Research Methodology

2.3 Data Triangulation

2.4 Assumptions and Limitations

3 Executive Summary

3.1 Global Automotive Stabilizer Bar Market Size Outlook, $ Million, 2021 to 2030

3.2 Automotive Stabilizer Bar Market Outlook by Type, $ Million, 2021 to 2030

3.3 Automotive Stabilizer Bar Market Outlook by Product, $ Million, 2021 to 2030

3.4 Automotive Stabilizer Bar Market Outlook by Application, $ Million, 2021 to 2030

3.5 Automotive Stabilizer Bar Market Outlook by Key Countries, $ Million, 2021 to 2030

4 Market Dynamics

4.1 Key Driving Forces of Automotive Stabilizer Bar Industry

4.2 Key Market Trends in Automotive Stabilizer Bar Industry

4.3 Potential Opportunities in Automotive Stabilizer Bar Industry

4.4 Key Challenges in Automotive Stabilizer Bar Industry

5 Market Factor Analysis

5.1 Value Chain Analysis

5.2 Competitive Landscape

5.2.1 Global Automotive Stabilizer Bar Market Share by Company (%), 2023

5.2.2 Product Offerings by Company

5.3 Porter’s Five Forces Analysis

5.4 Pricing Analysis and Outlook

6 Growth Outlook Across Scenarios

6.1 Growth Analysis-Case Scenario Definitions

6.2 Low Growth Scenario Forecasts

6.3 Reference Growth Scenario Forecasts

6.4 High Growth Scenario Forecasts

7 Global Automotive Stabilizer Bar Market Outlook by Segments

7.1 Automotive Stabilizer Bar Market Outlook by Segments, $ Million, 2021- 2030

By Type

Hollow and Solid Stabilizer Bar

Tubular Stabilizer Bar

Splined Stabilizer Bar

By Material

Cast Iron

Steel

Aluminum

Carbon Fibre Reinforced Plastic

By Vehicle

Passenger Car

Light Commercial Vehicle

Heavy Commercial Vehicle

By Sales Channel

OEM

Aftermarket

8 North America Automotive Stabilizer Bar Market Analysis and Outlook To 2030

8.1 Introduction to North America Automotive Stabilizer Bar Markets in 2024

8.2 North America Automotive Stabilizer Bar Market Size Outlook by Country, 2021-2030

8.2.1 United States

8.2.2 Canada

8.2.3 Mexico

8.3 North America Automotive Stabilizer Bar Market size Outlook by Segments, 2021-2030

By Type

Hollow and Solid Stabilizer Bar

Tubular Stabilizer Bar

Splined Stabilizer Bar

By Material

Cast Iron

Steel

Aluminum

Carbon Fibre Reinforced Plastic

By Vehicle

Passenger Car

Light Commercial Vehicle

Heavy Commercial Vehicle

By Sales Channel

OEM

Aftermarket

9 Europe Automotive Stabilizer Bar Market Analysis and Outlook To 2030

9.1 Introduction to Europe Automotive Stabilizer Bar Markets in 2024

9.2 Europe Automotive Stabilizer Bar Market Size Outlook by Country, 2021-2030

9.2.1 Germany

9.2.2 France

9.2.3 Spain

9.2.4 United Kingdom

9.2.4 Italy

9.2.5 Russia

9.2.6 Norway

9.2.7 Rest of Europe

9.3 Europe Automotive Stabilizer Bar Market Size Outlook by Segments, 2021-2030

By Type

Hollow and Solid Stabilizer Bar

Tubular Stabilizer Bar

Splined Stabilizer Bar

By Material

Cast Iron

Steel

Aluminum

Carbon Fibre Reinforced Plastic

By Vehicle

Passenger Car

Light Commercial Vehicle

Heavy Commercial Vehicle

By Sales Channel

OEM

Aftermarket

10 Asia Pacific Automotive Stabilizer Bar Market Analysis and Outlook To 2030

10.1 Introduction to Asia Pacific Automotive Stabilizer Bar Markets in 2024

10.2 Asia Pacific Automotive Stabilizer Bar Market Size Outlook by Country, 2021-2030

10.2.1 China

10.2.2 India

10.2.3 Japan

10.2.4 South Korea

10.2.5 Indonesia

10.2.6 Malaysia

10.2.7 Australia

10.2.8 Rest of Asia Pacific

10.3 Asia Pacific Automotive Stabilizer Bar Market size Outlook by Segments, 2021-2030

By Type

Hollow and Solid Stabilizer Bar

Tubular Stabilizer Bar

Splined Stabilizer Bar

By Material

Cast Iron

Steel

Aluminum

Carbon Fibre Reinforced Plastic

By Vehicle

Passenger Car

Light Commercial Vehicle

Heavy Commercial Vehicle

By Sales Channel

OEM

Aftermarket

11 South America Automotive Stabilizer Bar Market Analysis and Outlook To 2030

11.1 Introduction to South America Automotive Stabilizer Bar Markets in 2024

11.2 South America Automotive Stabilizer Bar Market Size Outlook by Country, 2021-2030

11.2.1 Brazil

11.2.2 Argentina

11.2.3 Rest of South America

11.3 South America Automotive Stabilizer Bar Market size Outlook by Segments, 2021-2030

By Type

Hollow and Solid Stabilizer Bar

Tubular Stabilizer Bar

Splined Stabilizer Bar

By Material

Cast Iron

Steel

Aluminum

Carbon Fibre Reinforced Plastic

By Vehicle

Passenger Car

Light Commercial Vehicle

Heavy Commercial Vehicle

By Sales Channel

OEM

Aftermarket

12 Middle East and Africa Automotive Stabilizer Bar Market Analysis and Outlook To 2030

12.1 Introduction to Middle East and Africa Automotive Stabilizer Bar Markets in 2024

12.2 Middle East and Africa Automotive Stabilizer Bar Market Size Outlook by Country, 2021-2030

12.2.1 Saudi Arabia

12.2.2 UAE

12.2.3 Oman

12.2.4 Rest of Middle East

12.2.5 Egypt

12.2.6 Nigeria

12.2.7 South Africa

12.2.8 Rest of Africa

12.3 Middle East and Africa Automotive Stabilizer Bar Market size Outlook by Segments, 2021-2030

By Type

Hollow and Solid Stabilizer Bar

Tubular Stabilizer Bar

Splined Stabilizer Bar

By Material

Cast Iron

Steel

Aluminum

Carbon Fibre Reinforced Plastic

By Vehicle

Passenger Car

Light Commercial Vehicle

Heavy Commercial Vehicle

By Sales Channel

OEM

Aftermarket

13 Company Profiles

13.1 Company Snapshot

13.2 SWOT Profiles

13.3 Products and Services

13.4 Recent Developments

13.5 Financial Profile

List of Companies

American Axle & Manufacturing Holdings Inc

Chuo Spring Co. Ltd

Huayu Automotive Systems Co. Ltd

Kongsberg Automotive ASA

Mubea AG

NHK International Corp

Sogefi S.p.A.

SwayTec Automotive GmbH

Tata Motors Ltd

Thyssenkrupp AG

Wanxiang Group Corp

ZF Friedrichshafen AG

14 Appendix

14.1 Customization Offerings

14.2 Subscription Services

14.3 Related Reports

14.4 Publisher Expertise

By Type

Hollow and Solid Stabilizer Bar

Tubular Stabilizer Bar

Splined Stabilizer Bar

By Material

Cast Iron

Steel

Aluminum

Carbon Fibre Reinforced Plastic

By Vehicle

Passenger Car

Light Commercial Vehicle

Heavy Commercial Vehicle

By Sales Channel

OEM

Aftermarket

The global Automotive Stabilizer Bar Market is one of the lucrative growth markets, poised to register a 4.9% growth (CAGR) between 2024 and 2030.

Emerging Markets across Asia Pacific, Europe, and Americas present robust growth prospects.

American Axle & Manufacturing Holdings Inc, Chuo Spring Co. Ltd, Huayu Automotive Systems Co. Ltd, Kongsberg Automotive ASA, Mubea AG, NHK International Corp, Sogefi S.p.A., SwayTec Automotive GmbH, Tata Motors Ltd, Thyssenkrupp AG, Wanxiang Group Corp, ZF Friedrichshafen AG

Base Year- 2023; Estimated Year- 2024; Historic Period- 2018-2023; Forecast period- 2024 to 2030; Currency: USD; Volume